Current Report Filing (8-k)

January 15 2015 - 4:14PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 15, 2015

____________________

SPIRIT AIRLINES, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

|

| |

001-35186 (Commission File Number) | 38-1747023 (IRS Employer Identification Number) |

2800 Executive Way

Miramar, Florida 33025

(Address of principal executive offices, including Zip Code)

(954) 447-7920

(Registrant's telephone number, including area code)

____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

[] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

[] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

[] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

[] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

The information in this report furnished pursuant to Item 7.01 shall not be deemed “filed” for the purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. It may only be incorporated by reference in another filing under the Exchange Act or the Securities Act of 1933, as amended (the “Securities Act”), if such subsequent filing specifically references the information furnished pursuant to Item 7.01 of this report.

| |

Item 7.01. | Regulation FD Disclosure. |

On January 15, 2015, the Company provided an update to investors regarding the Company's guidance for the fourth quarter 2014 and full year 2014; a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The guidance provided therein is only an estimate of what the Company believes is realizable as of the date of this investor update. Actual results will vary from the guidance and the variations may be material. The Company undertakes no intent or obligation to publicly update or revise any of these projections, whether as a result of new information, future events or otherwise, except as required by law.

| |

Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

The following is furnished as an exhibit to this report and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act:

|

| | | | | | |

Exhibit No. | Description | | | | | |

99.1 | Investor Update regarding fourth quarter and full year 2014 guidance |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Date: January 15, 2015 | SPIRIT AIRLINES, INC. |

By: /s/ Thomas Canfield

Name: Thomas Canfield

Title: Senior Vice President and General Counsel

EXHIBIT INDEX

|

| | | | | | |

Exhibit No. | Description | | | | | |

99.1 | Investor Update regarding fourth quarter and full year 2014 guidance |

Exhibit 99.1

Investor Update

January 15, 2015

This investor update provides Spirit's guidance for the fourth quarter and full year ending December 31, 2014. All data is based on preliminary estimates.

|

| | | | | | | | | | | | | | | |

Capacity - Available Seat Miles (ASMs) | 1Q14A |

| | 2Q14A |

| | 3Q14A |

| | 4Q14A |

| | FY2014A |

|

Year-over-Year % Change | 21.0 | % | | 17.2 | % | | 14.7 | % | | 18.9 | % | | 17.9 | % |

|

| | | | |

| | 4Q14E |

| | | | |

Operating Margin(1) | Approximately 19.5% |

| | | | |

Operating Expense per ASM (CASM) (cents) | | | |

Adjusted CASM Year-over-Year Change(1) | Down Approx. 9.5% |

| |

Adjusted CASM Ex-fuel Year-over-Year Change(2) | Down Approx. 2.0% |

| |

Average Stage Length (miles) | 983 |

| |

Fuel Expense per Gallon ($) | | | |

Economic fuel cost(3) | $2.56 |

| | | | |

Fuel gallons (thousands) | 52,735 |

| | | | |

Selected Operating Expenses ($Millions) | |

Aircraft rent | $51 |

Depreciation and amortization | $13 |

| | | | |

Total other non-operating expense ($Millions) | $1 |

Total other non-operating income includes a charitable contribution that is specifically creditable against current income tax in the State of Florida, as allowed under state law. |

| | | |

Effective Tax Rate | 37.5% |

| | | | |

Wtd. Average Share Count (Millions) | | | |

| Basic | 72.8 |

| Diluted | 73.3 |

|

| | | | | | |

Capital Expenditures & Other Working Capital Requirements ($Millions) | Full Year 2014E |

| Aircraft purchase commitments for leased aircraft | | $ | 304 |

| |

| | | | |

| Aircraft capital expenditures(4) | | 149 |

| |

| Other capital expenditures(5) | | 38 |

| |

| | | 187 |

| |

| Less: Proceeds from issuance of long term debt | | 148 |

| |

| Less: Proceeds from sale/leaseback transaction | | 7 |

| |

| | | 32 |

| |

| | | | |

| Pre-delivery deposits for flight equipment, net of refunds | | 116 |

| |

| | | | |

| Payments for heavy maintenance events(6) | | 52 |

| |

| Pre-paid maintenance deposits, net of reimbursements | | 32 |

| |

Footnotes

| |

(1) | Excludes special items which may include any unrealized gains and losses arising from mark-to-market adjustments to outstanding fuel derivatives, estimated premium expense to be recognized related to fuel option contracts, loss on disposal of assets, and special charges or credits. Includes economic premium expense related to fuel option contracts in the period the option is benefiting. |

| |

(2) | Excludes all components of fuel expense, loss on disposal of assets, and special items. |

| |

(3) | Includes fuel taxes, into-plane fuel cost, and economic premium expense related to fuel option contracts in the period the option is benefiting. |

| |

(4) | Includes purchase amounts related to four aircraft. Excludes $25 million of aircraft capital expenditures that were funded with pre-delivery deposits paid in prior years held by the manufacturer. |

| |

(5) | Includes the purchase of a spare engine financed under a sale/leaseback transaction after it was delivered. |

| |

(6) | Payments for heavy maintenance events are presented as Long-term deposits and other assets within "Changes in operating assets and liabilities," on the Company's cash flow statement. |

|

| | | | | | | | | | | | | | | | | | | | |

Spirit Airlines, Inc. |

| | | | | | |

| | | | Aircraft Delivery Schedule (net of Scheduled Retirements) as of December 31, 2014 |

| A319 |

| | A320 CEO |

| | A320 NEO |

| | A321 CEO |

| | A321 NEO |

| | Total |

|

Total Year-end 2013 | 29 |

| | 23 |

| | — |

| | 2 |

| | — |

| | 54 |

|

| | | | | | | | | | | | | | |

| | 1Q14 | | — |

| | 2 |

| | — |

| | — |

| | — |

| | 2 |

|

| | 2Q14 | | — |

| | 1 |

| | — |

| | — |

| | — |

| | 1 |

|

| | 3Q14 | | — |

| | 1 |

| | — |

| | — |

| | — |

| | 1 |

|

| | 4Q14 | | — |

| | 7 |

| | — |

| | — |

| | — |

| | 7 |

|

Total Year-end 2014 | 29 |

| | 34 |

| | — |

| | 2 |

| | — |

| | 65 |

|

| | | | | | | | | | | | | | |

| | 1Q15 | | — |

| | 5 |

| | — |

| | — |

| | — |

| | 5 |

|

| | 2Q15 | | — |

| | 3 |

| | — |

| | — |

| | — |

| | 3 |

|

| | 3Q15 | | — |

| | — |

| | — |

| | 3 |

| | — |

| | 3 |

|

| | 4Q15 | | — |

| | — |

| | 1 |

| | 3 |

| | — |

| | 4 |

|

Total Year-end 2015 | 29 |

| | 42 |

| | 1 |

| | 8 |

| | — |

| | 80 |

|

| | | | | | | | | | | | | | |

| | 2016 | | (3 | ) | | 3 |

| | 4 |

| | 9 |

| | — |

| | 13 |

|

| | 2017 | | (4 | ) | | 7 |

| | — |

| | 8 |

| | — |

| | 11 |

|

| | 2018 | | (5 | ) | | 2 |

| | 6 |

| | 5 |

| | — |

| | 8 |

|

| | 2019 | | (1 | ) | | — |

| | 3 |

| | — |

| | 10 |

| | 12 |

|

| | 2020 | | (7 | ) | | — |

| | 13 |

| | — |

| | — |

| | 6 |

|

| | 2021 | | (4 | ) | | — |

| | 18 |

| | — |

| | — |

| | 14 |

|

Total Year-end 2021 | 5 |

| | 54 |

| | 45 |

| | 30 |

| | 10 |

| | 144 |

|

| | | | | | | | | | | | | |

Notes: | | | | |

Includes aircraft on firm order as well as 5 leased A320neo aircraft. | | | | |

2017 reflects scheduled deliveries of 8 A320ceo and 10 A321ceo aircraft, net of 1 A320ceo and 2 A321ceo lease expirations. |

| | | | | | | | | | | |

Forward-Looking Statements

Statements in this release and certain oral statements made from time to time by representatives of the Company contain various forward-looking statements within the meaning Section 21E of the Securities Exchange Act of 1934, as amended, which represent the Company's expectations or beliefs concerning future events. When used in this release, the words “expects,” “estimates,” “plans,” “anticipates,” “indicates,” “believes,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “targets” and similar expressions are intended to identify forward-looking statements. Similarly, statements that describe the Company's objectives, plans or goals, or actions the Company may take in the future, are forward-looking statements. Forward-looking statements include, without limitation, statements regarding the Company's intentions and expectations regarding the delivery schedule of aircraft on order, guidance and estimates for the fourth quarter and full year 2014 including expectations regarding operating margin, capacity, CASM, CASM ex-fuel, fuel expense, economic fuel cost, expected unrealized mark-to-market gains or losses, capital expenditures and other working capital requirements, aircraft rent, depreciation and amortization, fuel hedges and tax rates. All forward-looking statements in this release are based upon information available to the Company on the date of this release. The Company has no intent, nor undertakes any obligation, to publicly update or revise any of these projections, whether as a result of new information, future events or otherwise, except as required by law. Forward-looking statements are subject to a number of factors that could cause the Company's actual results to differ materially from the Company's expectations, including the competitive environment in the airline industry; the Company's ability to keep costs low; changes in fuel costs; the impact of worldwide economic conditions on customer travel behavior; the Company's ability to generate non-ticket revenues; and government regulation. Additional information concerning these and other factors is contained in the Company's Securities and Exchange Commission filings, including but not limited to the Company's Annual Report on Form 10-K and Quarterly Reports on Form 10-Q.

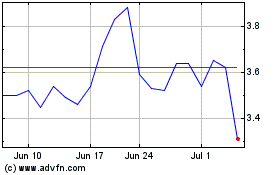

Spirit Airlines (NYSE:SAVE)

Historical Stock Chart

From Aug 2024 to Sep 2024

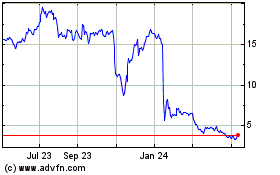

Spirit Airlines (NYSE:SAVE)

Historical Stock Chart

From Sep 2023 to Sep 2024