Amended Current Report Filing (8-k/a)

August 06 2015 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________

FORM 8-K/A

________________________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 3, 2015

________________________________________________

Advanced Energy Industries, Inc.

(Exact name of registrant as specified in its charter)

________________________________________________

|

| | | | |

Delaware | | 000-26966 | | 84-0846841 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | | | | |

1625 Sharp Point Drive, Fort Collins, Colorado | | 80525 | |

(Address of principal executive offices) | | (Zip Code) | |

|

| | | |

(970) 221-4670 |

(Registrant's telephone number, including area code) |

| | | |

Not applicable |

(Former name or former address, if changed since last report) |

________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Explanatory Note

On August 3, 2015, Advanced Energy Industries, Inc. issued an earnings release announcing its financial results for the quarter ended June 30, 2015. A copy of the earnings release was furnished with a Current Report on Form 8-K filed on August 3, 2015. This amendment to Advanced Energy’s Form 8-K is being filed solely for the purpose of correcting a mathematical error in the earnings release, as described below.

Item 2.02 Results of Operations and Financial Condition.

The information in this Form 8-K that is furnished under “Item 2.02 Results of Operations and Financial Condition” and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Act of 1934, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

On August 3, 2015, Advanced Energy Industries, Inc. announced its financial results for the quarter ended June 30, 2015. Non-GAAP financial information was included in the press release to assist the reader with understanding how the company’s results would have been reported had it not had the inverter segment during the historical periods presented. The information regarding non-GAAP operating income excluding inverters was misstated due to a mathematical error. The error involved solely the line items “Operating Income (loss) as reported” and “Non-GAAP Operating Income (loss)” for the columns “Amounts related to Inverter” and “Amounts Excluding Inverter” and the corresponding written disclosure under the captions “Results Excluding the Inverter Business” and “Inverters.” Such information, as corrected, is included in exhibit 99.1 hereto, which indicates the corrected numbers in shading. The mathematical error did not impact the GAAP financial statements or third quarter guidance.

Item 9.01 Financial Statements and Exhibits.

|

| | | |

(d) | Exhibits |

| | |

99.1 |

| | Revised “Other Selected Data (Unaudited)” |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | | |

| | /s/ Thomas Liguori |

Date: August 6, 2015 | | Thomas Liguori |

| | Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

| | |

Exhibit Number | | Description |

99.1 | | Revised “Other Selected Data (Unaudited)” |

Exhibit 99.1

Results Excluding the Inverter Business

Excluding the inverter business, sales were $104.6 million in the second quarter of 2015, slightly below the first quarter’s sales of $105.8 million and up 27.9% from $81.8 million in the second quarter of 2014. In line with the company’s served market, sales to semiconductor declined slightly in the quarter from near-record highs, while improvements in some industrial applications also contributed. Non-GAAP operating income for the business excluding inverters was $26.8 million, or 25.6% of sales.

Inverters

Closing out the second quarter 2015, inverter sales were $32.2 million, slightly down from $35.3 million in the first quarter 2015, and down 50.0% from $64.5 million in the second quarter of 2014. Non-GAAP operating income for Inverters was $(211.4) million due to the charges related to the wind down.

. . .

OTHER SELECTED DATA (UNAUDITED)

Based on the decision by the Company to exit the inverter segment in a wind-down of operations commencing effective June 29, 2015 we have ceased allocating corporate overhead to the inverter segment as of that date. These costs include allocated costs which have historically been shared between the inverter segment and the precision power segment but which going forward will burden solely our single reporting segment, the precision power business. For comparability to assist the reader with understanding how our results would have been reported had we not had the inverter segment we have prepared the following Non-GAAP presentation. The following non-GAAP tables present historical comparative periods presented on a consistent basis with this forward looking presentation approach with respect to internal costs. We have eliminated from the historical GAAP segment presentation for inverters the corporate overhead expenses previously allocated to inverters and these costs have been reflected as burdening the Precision Power segment (reflected below in the column "Non-GAAP results excluding inverter amounts").

|

| | | | | | | | | | | | | | | | | | | | | | | |

Reconciliation of Non-GAAP measure - Revenue & operating income excluding certain items | Three months ended June 30, 2015 | | Six months ended June 30, 2015 |

| As reported | | Amounts related to Inverter | | Amounts excluding Inverter | | As reported | | Amounts related to Inverter | | Amounts excluding Inverter |

Revenues | $ | 136,791 |

| | $ | 32,181 |

| | $ | 104,610 |

| | $ | 277,909 |

| | $ | 67,460 |

| | $ | 210,449 |

|

| | | | | | | | | | | |

Operating (loss) income as reported | $ | (184,602 | ) | | $ | (211,385 | ) | | $ | 26,783 |

| | $ | (162,745 | ) | | $ | (218,994 | ) | | $ | 56,249 |

|

Adjustments | | | | | | | | | | | |

Restructuring charges | 168,393 |

| | 168,393 |

| | — |

| | 168,393 |

| | 168,393 |

| | — |

|

Acquisition-related costs | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

Stock-based compensation | 853 |

| | 159 |

| | 694 |

| | 1,442 |

| | 260 |

| | 1,182 |

|

Nonrecurring tax items | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

Nonrecurring inventory impairment | 14,994 |

| | 14,994 |

| | — |

| | 14,994 |

| | 14,994 |

| | — |

|

Nonrecurring accounts receivable impairment | 17,661 |

| | 17,661 |

| | — |

| | 17,661 |

| | 17,661 |

| | — |

|

Amortization of intangible assets | 1,894 |

| | 793 |

| | 1,101 |

| | 3,785 |

| | 1,586 |

| | 2,199 |

|

Non-GAAP Operating income (loss) | $ | 19,193 |

| | $ | (9,385 | ) | | $ | 28,578 |

| | $ | 43,530 |

| | $ | (16,100 | ) | | $ | 59,630 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | |

Reconciliation of Non-GAAP measure - Revenue & operating income excluding certain items | Three months ended June 30, 2014 | | Six months ended June 30, 2014 |

| As reported | | Amounts related to Inverter | | Amounts excluding Inverter | | As reported | | Amounts related to Inverter | | Amounts excluding Inverter |

Revenues | $ | 146,285 |

| | $ | 64,453 |

| | $ | 81,832 |

| | $ | 287,233 |

| | $ | 122,529 |

| | $ | 164,704 |

|

| | | | | | | | | | | |

Operating income (loss) as reported | $ | 11,512 |

| | $ | (3,937 | ) | | $ | 15,449 |

| | $ | 28,425 |

| | $ | (8,222 | ) | | $ | 36,647 |

|

Adjustments | | | | | | | | | | | |

Restructuring charges | 244 |

| | 189 |

| | 55 |

| | 244 |

| | 189 |

| | 55 |

|

Acquisition-related costs | 470 |

| | — |

| | 470 |

| | 730 |

| | — |

| | 730 |

|

Stock-based compensation | 1,495 |

| | 280 |

| | 1,215 |

| | 3,259 |

| | 727 |

| | 2,532 |

|

Amortization of intangible assets | 2,226 |

| | 1,115 |

| | 1,111 |

| | 4,101 |

| | 2,225 |

| | 1,876 |

|

Nonrecurring executive severance | 867 |

| | — |

| | 867 |

| | 867 |

| | — |

| | 867 |

|

Non-GAAP Operating income (loss) | $ | 16,814 |

| | $ | (2,353 | ) | | $ | 19,167 |

| | $ | 37,626 |

| | $ | (5,081 | ) | | $ | 42,707 |

|

* * *

This exhibit includes GAAP and non-GAAP income and per-share earnings data. Please note that beginning in 2013, Advanced Energy redefined its non-GAAP measures to exclude restructuring charges, acquisition-related costs, stock based compensation and amortization of intangibles and tax release items. These non-GAAP measures are not in accordance with, or an alternative for, similar measures calculated under generally accepted accounting principles and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. Advanced Energy believes that these non-GAAP measures provide useful information to management and investors regarding financial and business trends relating to its financial condition and results of operations.

Additionally, the company believes that these non-GAAP measures, in combination with its financial results calculated in accordance with GAAP, provide investors with additional perspective. While some of the excluded items may be incurred and reflected in the company’s GAAP financial results in the foreseeable future, the company believes that the items excluded from certain non-GAAP measures do not accurately reflect the underlying performance of its continuing operations for the period in which they are incurred. The use of non-GAAP measures has limitations in that such measures do not reflect all of the amounts associated with the company’s results of operations as determined in accordance with GAAP, and these measures should only be used to evaluate the company’s results of operations in conjunction with the corresponding GAAP measures.

This exhibit should be read in conjunction with Advanced Energy’s Form 8-K regarding this exhibit furnished August 6, 2015 to the Securities and Exchange Commission and Advanced Energy’s Form 8-K regarding results from the quarter ended June 30, 2015 furnished August 3, 2015.

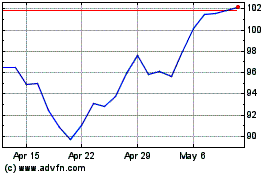

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Aug 2024 to Sep 2024

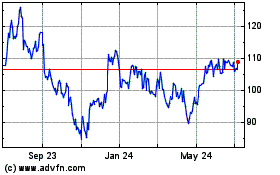

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Sep 2023 to Sep 2024