Judge Approves Settlement Allowing CVS-Aetna Merger -- WSJ

September 05 2019 - 3:02AM

Dow Jones News

By Brent Kendall

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 5, 2019).

WASHINGTON -- A federal judge on Wednesday approved a Justice

Department settlement that allowed CVS Health Corp.'s nearly $70

billion acquisition of health insurer Aetna Inc., removing a cloud

of uncertainty for the merged company.

U.S. District Judge Richard Leon had spent months questioning

whether the settlement did enough to protect competition and

consumers in health-care markets, raising the possibility that he

might not approve it.

The judge, in a first for a court review of a government merger

settlement, convened hearings to consider live witness testimony

from the deal's critics who said the Justice Department's deal with

the companies was inadequate.

Judge Leon on Wednesday said the critics' testimony ultimately

was unpersuasive. He said the health-care markets at issue in the

case "are not only very competitive today, but are likely to remain

so post-merger."

The settlement "is well within the reaches of the public

interest," the judge concluded.

The Justice Department approved the CVS-Aetna deal nearly a year

ago, requiring CVS to sell off Aetna's Medicare prescription

drug-plan business.

CVS completed the acquisition weeks later and has been moving

forward with the Aetna business ever since. It sold Aetna's

Medicare assets to WellCare Health Plans Inc., as the department

required.

The merger combined the nation's third-largest health insurer

with CVS's sprawling network of pharmacies and its

pharmacy-benefit-management business. The companies argued that

their combination could lower costs and improve health care for

consumers.

"CVS Health and Aetna have been one company since November 2018,

and today's action by the district court makes that 100 percent

clear," a CVS spokesman said. "We remain focused on transforming

the consumer health care experience in America."

An array of parties, including the American Medical Association

and consumer groups, lodged objections to the merger, saying the

deal would have anticompetitive effects throughout the health-care

supply chain, giving CVS an outsize role.

Judge Leon said while the complaints warranted serious

consideration, the evidence wasn't sufficient to reject the

government's settlement with the companies. He rejected critics'

arguments that the merger would harm markets for Medicare

prescription drug plans. He also said CVS is unlikely to use its

strong market position in the management of pharmacy benefits to

disadvantage companies that compete with CVS's newly expanded

health-insurance business.

The AMA expressed disappointment in the ruling. "Despite an

unprecedented review that dragged many details of this merger into

the light, today's decision ultimately fails patients, will likely

raise prices, lower quality, reduce choice, and stifle innovation,"

AMA president Patrice A. Harris said.

Wednesday's ruling will likely come as a relief to the Justice

Department, which has seen repeated difficulties in Judge Leon's

courtroom. The judge, while questioning whether the DOJ did enough

to address the CVS-Aetna merger, last year rejected the

department's bid to block AT&T Inc. from acquiring

entertainment company Time Warner.

Assistant Attorney General Makan Delrahim, the department's

antitrust chief, said the settlement "provides a comprehensive

remedy to the harms the Justice Department identified." Approval of

the settlement "protects seniors and other vulnerable customers,"

he said.

Write to Brent Kendall at brent.kendall@wsj.com

(END) Dow Jones Newswires

September 05, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

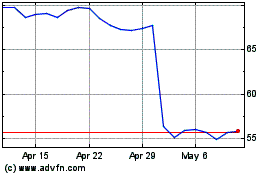

CVS Health (NYSE:CVS)

Historical Stock Chart

From May 2024 to Jun 2024

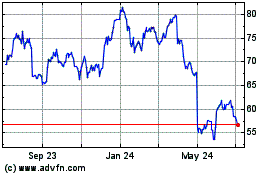

CVS Health (NYSE:CVS)

Historical Stock Chart

From Jun 2023 to Jun 2024