UMB investment community call today, Monday,

April 29, at 7:30 a.m. (CT) / 8:30 a.m. (ET)

First Quarter 2024 Financial Highlights

- GAAP net income of $110.3 million, or $2.25 per diluted

share.

- Net operating income(i) of $120.7 million, or $2.47 per diluted

share.

- Average loans increased 4.2% on a linked-quarter, annualized

basis, to $23.4 billion.

- Average loans increased $2.1 billion, or 9.8%, as compared to

the first quarter of 2023.

- Average deposits increased 10.4% on a linked-quarter,

annualized basis, to $33.5 billion.

- Net interest income increased 3.9% from the linked

quarter.

- Net interest margin was 2.48%, an increase of two basis points

from the linked quarter.

- Noninterest income increased 22.3% from the first quarter of

2023, equal to 39.9% of total revenue.

- Credit quality remained strong, with net charge-offs of just

0.05% of average loans.

UMB Financial Corporation (Nasdaq: UMBF), a financial services

company, announced net income for the first quarter of 2024 of

$110.3 million, or $2.25 per diluted share, compared to $70.9

million, or $1.45 per diluted share, in the fourth quarter of 2023

(linked quarter) and $92.4 million, or $1.90 per diluted share, in

the first quarter of 2023. The results for the first quarter of

2024 and the fourth quarter of 2023 include pre-tax expense of

$13.0 million and $52.8 million, respectively, for the

industry-wide FDIC special assessment.

Net operating income, a non-GAAP financial measure reconciled

later in this release to net income, the nearest comparable GAAP

measure, was $120.7 million, or $2.47 per diluted share, for the

first quarter of 2024, compared to $112.0 million, or $2.29 per

diluted share, for the linked quarter and $92.8 million, or $1.91

per diluted share, for the first quarter of 2023. Operating

pre-tax, pre-provision income (operating PTPP), a non-GAAP measure

reconciled later in this release to the components of net income

before taxes, the nearest comparable GAAP measure, was $157.5

million, or $3.22 per diluted share, for the first quarter of 2024,

compared to $134.9 million, or $2.76 per diluted share, for the

linked quarter, and $135.4 million, or $2.78 per diluted share, for

the first quarter of 2023. These operating PTPP results represent

increases of 16.7% on a linked-quarter basis and 16.3% compared to

the first quarter of 2023.

“Our 2024 is off to a great start, with strong first quarter

financial results driven by balance sheet and net interest income

growth, net interest margin expansion, double-digit growth in our

fee income revenue, and stable credit metrics,” said Mariner

Kemper, UMB Financial Corporation chairman and chief executive

officer.

“Our performance validates the perspective I shared earlier this

year that the dramatized and highly exaggerated regional bank

crisis from a year ago—and similar frenzy over idiosyncratic

commercial real estate headlines earlier this year—do not apply to

the whole regional banking industry, which remains on strong

footing. As students of history, we believe in gravity and that

what goes up will eventually come down. We run the company based on

this expectation.

“While indications suggest the economy is on reasonably stable

footing, persistently high inflation, an upcoming presidential

election cycle, and a potential 'No Landing' scenario may dictate a

constrictive Federal Reserve monetary policy that could pose

economic challenges.

“In the first quarter of 2024, average loans increased 9.8% to

$23.4 billion, while average deposits increased $2.0 billion or

6.2%, from one year ago. Our financial metrics demonstrate our

borrowers and depository clients remain cautiously optimistic and

selective with their investments. The overall loan portfolio

remains healthy as exemplified by net charge-offs averaging less

than 10 basis points in each of the past seven quarters, and

non-performing loans at a meager eight basis points of total loans.

Also of note for the quarter is that we closed on the purchase of a

co-branded credit card portfolio partnership with Rural King, a

preeminent, family-owned general merchandise store with more than

130 locations in a 13-state footprint.”

(i) A non-GAAP financial measure reconciled later in this

release to net income, the nearest comparable GAAP measure.

First Quarter 2024 earnings discussion

Summary of quarterly financial

results

UMB Financial

Corporation

(unaudited, dollars in thousands, except

per share data)

Q1

Q4

Q1

2024

2023

2023

Net income (GAAP)

$

110,258

$

70,923

$

92,437

Earnings per share - diluted (GAAP)

2.25

1.45

1.90

Operating pre-tax, pre-provision income

(Non-GAAP)(i)

157,451

134,901

135,369

Operating pre-tax, pre-provision earnings

per share - diluted (Non-GAAP)(i)

3.22

2.76

2.78

Operating pre-tax, pre-provision income -

FTE (Non-GAAP)(i)

163,967

141,571

141,924

Operating pre-tax, pre-provision earnings

per share - FTE - diluted (Non-GAAP)(i)

3.35

2.90

2.91

Net operating income (Non-GAAP)(i)

120,712

112,038

92,836

Operating earnings per share - diluted

(Non-GAAP)(i)

2.47

2.29

1.91

GAAP

Return on average assets

1.06

%

0.69

%

0.97

%

Return on average equity

14.11

9.52

13.76

Efficiency ratio

63.44

77.65

63.12

Non-GAAP(i)

Operating return on average assets

1.16

%

1.10

%

0.98

%

Operating return on average equity

15.44

15.04

13.82

Operating efficiency ratio

60.04

63.06

62.98

(i) See reconciliation of Non-GAAP

measures to their nearest comparable GAAP measures later in this

release.

Summary of revenue

UMB Financial

Corporation

(unaudited, dollars in thousands)

Q1

Q4

Q1

CQ vs.

CQ vs.

2024

2023

2023

LQ

PY

Net interest income

$

239,434

$

230,522

$

241,696

$

8,912

$

(2,262

)

Noninterest income:

Trust and securities processing

69,478

66,584

62,359

2,894

7,119

Trading and investment banking

5,462

5,751

5,308

(289

)

154

Service charges on deposit accounts

20,757

21,330

21,159

(573

)

(402

)

Insurance fees and commissions

283

238

274

45

9

Brokerage fees

13,160

13,439

13,676

(279

)

(516

)

Bankcard fees

21,968

18,672

18,172

3,296

3,796

Investment securities gains (losses),

net

9,371

1,014

(5,324

)

8,357

14,695

Other

18,765

13,226

14,576

5,539

4,189

Total noninterest income

$

159,244

$

140,254

$

130,200

$

18,990

$

29,044

Total revenue

$

398,678

$

370,776

$

371,896

$

27,902

$

26,782

Net interest income (FTE)

$

245,950

$

237,192

$

248,251

Net interest margin (FTE)

2.48

%

2.46

%

2.76

%

Total noninterest income as a % of total

revenue

39.9

37.8

35.0

Net interest income

- First quarter 2024 net interest income totaled $239.4 million,

an increase of $8.9 million, or 3.9%, from the linked quarter,

driven primarily by continued growth in average loans and higher

levels of liquidity, $1.4 million in municipal bond hedge gain

amortization, partially offset by higher interest expense.

- Average earning assets increased $1.6 billion, or 4.1%, from

the linked quarter, largely driven by an increase of $931.4 million

in interest-bearing due from banks, an increase of $428.4 million

in average securities, and an increase of $245.0 million in average

loans.

- Average interest-bearing liabilities increased $1.3 billion, or

4.9%, from the linked quarter, primarily driven by increases of

$903.2 million in interest-bearing deposits and $501.4 million in

federal funds and repurchase agreements, partially offset by a

decrease of $102.8 million in borrowed funds. Average

noninterest-bearing demand deposits decreased $52.3 million, or

0.5%, as compared to the linked quarter.

- Net interest margin for the first quarter was 2.48%, an

increase of two basis points from the linked quarter, driven by

increased loan yields, the benefit of free funds, favorable impact

of bond hedge gain amortization, and earning asset mix changes,

partially offset by the increased cost of interest-bearing

liabilities. The cost of interest-bearing liabilities increased

eight basis points to 4.03%. Total cost of funds increased nine

basis points from the linked quarter to 2.96%. Both average loan

yields and earning asset yields increased 10 basis points from the

linked quarter.

- On a year-over-year basis, net interest income decreased $2.3

million, or 0.9%, driven by higher interest expense, primarily due

to an unfavorable mix shift in the composition of liabilities and

new deposit client acquisitions at prevailing market rates. This

decrease was partially offset by a $2.1 billion, or 9.8%, increase

in average loans as well as the benefit from higher short-term

interest rates on loan pricing and yields.

- Compared to the first quarter of 2023, average earning assets

increased $3.4 billion, or 9.4%, largely driven by the increase in

average loans noted above and an increase of $1.8 billion in

interest-bearing due from banks, partially offset by a decrease of

$244.7 million in federal funds sold and resell agreements.

- Average deposits increased 6.2% compared to the first quarter

of 2023. Average noninterest-bearing demand deposit balances

decreased 15.5% compared to the first quarter of 2023, driven by

migration to rate-bearing deposit categories, as expected in a

higher interest rate environment. Average demand deposit balances

comprised 30.0% of total deposits, compared to 31.0% in the linked

quarter and 37.8% in the first quarter of 2023.

- Average borrowed funds decreased $102.8 million as compared to

the linked quarter and increased $983.1 million as compared to the

first quarter of 2023, driven by short-term borrowings with the

Federal Home Loan Bank and the Federal Reserve.

Noninterest income

- First quarter 2024 noninterest income increased $19.0 million,

or 13.5%, on a linked-quarter basis, largely due to:

- $8.4 million in higher investment securities gains, primarily

driven by a net $8.6 million gain on disposition of two of the

company's non-marketable securities. The company recognized a gain

of $10.7 million and a loss of $2.1 million, respectively, on these

two securities.

- An increase of $5.8 million in other miscellaneous income,

recorded in other income, related to a $4.0 million legal

settlement and a $1.8 million gain on sale of land, both recorded

during the first quarter of 2024.

- An increase of $3.3 million in bankcard income primarily driven

by higher interchange revenue and lower rebates and rewards expense

as compared to the linked quarter.

- Increases of $1.1 million in trust income, $1.0 million in fund

services income, and $0.8 million in corporate trust income, all

recorded in trust and securities processing.

- These increases were partially offset by decreases of $0.8

million in derivative income, recorded in other income, and $0.6

million in service charges on deposits.

- Compared to the prior year, noninterest income in the first

quarter of 2024 increased $29.0 million, or 22.3%, primarily driven

by:

- An increase of $14.7 million in investment securities gains,

primarily driven by a $10.7 million gain on disposition of one of

the company's non-marketable securities during the first quarter of

2024, coupled with the impairment loss on an available-for-sale

subordinated debt security recorded in the prior year.

- An increase of $5.7 million in other miscellaneous income,

recorded in other income, related to a $4.0 million legal

settlement and a $1.8 million gain on sale of land, both recorded

during the first quarter of 2024.

- Increases of $5.0 million in fund services income, $1.1 million

in trust income, and $1.0 million in corporate trust income, all

recorded in trust and securities processing.

- An increase of $3.8 million in bankcard income primarily driven

by higher interchange revenue and lower rebates and rewards expense

as compared to the prior year.

- These increases were partially offset by a decrease of $2.4

million in derivative income, recorded in other income.

Noninterest expense

Summary of noninterest expense

UMB Financial

Corporation

(unaudited, dollars in thousands)

Q1

Q4

Q1

CQ vs.

CQ vs.

2024

2023

2023

LQ

PY

Salaries and employee benefits

$

143,006

$

134,231

$

142,498

$

8,775

$

508

Occupancy, net

12,270

12,296

12,177

(26

)

93

Equipment

16,503

16,579

17,849

(76

)

(1,346

)

Supplies and services

3,301

5,546

3,875

(2,245

)

(574

)

Marketing and business development

6,025

6,659

5,335

(634

)

690

Processing fees

27,936

27,271

23,240

665

4,696

Legal and consulting

7,894

8,424

7,285

(530

)

609

Bankcard

10,567

8,677

7,133

1,890

3,434

Amortization of other intangible

assets

1,960

2,048

2,298

(88

)

(338

)

Regulatory fees

19,395

59,183

5,551

(39,788

)

13,844

Other

5,947

9,060

9,811

(3,113

)

(3,864

)

Total noninterest expense

$

254,804

$

289,974

$

237,052

$

(35,170

)

$

17,752

- GAAP noninterest expense for the first quarter of 2024 was

$254.8 million, a decrease of $35.2 million, or 12.1%, from the

linked quarter and an increase of $17.8 million, or 7.5% from the

first quarter of 2023. Operating noninterest expense, a non-GAAP

financial measure reconciled later in this release to noninterest

expense, the nearest comparable GAAP measure, was $241.2 million

for the first quarter of 2024, an increase of $5.4 million, or

2.3%, from the linked quarter and an increase of $4.7 million, or

2.0%, from the first quarter of 2023.

- The linked-quarter decrease in GAAP noninterest expense was

driven by:

- A decrease of $39.8 million in regulatory fees expense, driven

by the lower FDIC special assessment levied on banks to recoup the

losses related to two of the bank failures in March 2023. The

results for the first quarter of 2024 and the fourth quarter of

2023 include pre-tax expense of $13.0 million and $52.8 million,

respectively, for the industry-wide FDIC special assessment.

- A decrease of $2.2 million in supplies driven by purchases of

computers during the linked quarter.

- Decreases of $1.5 million in operational losses and $1.3

million in charitable contribution expense, both recorded in other

expense.

- These decreases were partially offset by a seasonal increase of

$9.1 million in payroll taxes, insurance, and 401(k) expense

recognized in the first quarter.

- The year-over-year increase in GAAP noninterest expense was

driven by:

- An increase of $13.8 million in regulatory fees, primarily

driven by the aforementioned $13.0 million FDIC special assessment

recorded in the first quarter of 2024.

- An increase of $4.7 million in processing fees expense due to

the ongoing modernization of the company’s core systems and the

timing of multiple software projects.

- An increase of $3.4 million in bankcard expense driven by

higher administrative expenses and fraud losses.

- These increases were partially offset by decreases of $3.5

million in operational losses, recorded in other expense, and $1.3

million in equipment expense, driven by reduced software

expense.

Income taxes

- The company’s effective tax rate was 17.6% for the three months

ended March 31, 2024, compared to 17.2% for the same period in

2023.

Balance sheet

- Average total assets for the first quarter of 2024 were $42.0

billion compared to $40.5 billion for the linked quarter and $38.5

billion for the same period in 2023.

Summary of average loans and leases -

QTD Average

UMB Financial

Corporation

(unaudited, dollars in thousands)

Q1

Q4

Q1

CQ vs.

CQ vs.

2024

2023

2023

LQ

PY

Commercial and industrial

$

9,942,457

$

9,825,043

$

9,287,319

$

117,414

$

655,138

Specialty lending

485,989

496,816

564,633

(10,827

)

(78,644

)

Commercial real estate

9,026,511

8,890,057

7,812,140

136,454

1,214,371

Consumer real estate

2,968,320

2,945,114

2,738,184

23,206

230,136

Consumer

154,062

153,791

136,571

271

17,491

Credit cards

489,546

495,502

453,704

(5,956

)

35,842

Leases and other

287,158

302,740

279,049

(15,582

)

8,109

Total loans

$

23,354,043

$

23,109,063

$

21,271,600

$

244,980

$

2,082,443

- Average loans for the first quarter of 2024 increased $245.0

million, or 1.1%, on a linked-quarter basis and $2.1 billion, or

9.8%, compared to the first quarter of 2023.

Summary of average securities - QTD

Average

UMB Financial

Corporation

(unaudited, dollars in thousands)

Q1

Q4

Q1

CQ vs.

CQ vs.

2024

2023

2023

LQ

PY

Securities available for sale:

U.S. Treasury

$

1,127,611

$

859,114

$

783,170

$

268,497

$

344,441

U.S. Agencies

199,719

169,723

171,825

29,996

27,894

Mortgage-backed

3,595,619

3,466,152

3,938,137

129,467

(342,518

)

State and political subdivisions

1,254,148

1,218,176

1,356,785

35,972

(102,637

)

Corporates

341,142

345,634

364,854

(4,492

)

(23,712

)

Collateralized loan obligations

347,063

349,149

348,477

(2,086

)

(1,414

)

Total securities available for sale

$

6,865,302

$

6,407,948

$

6,963,248

$

457,354

$

(97,946

)

Securities held to maturity:

U.S. Agencies

$

123,225

$

123,195

$

123,106

$

30

$

119

Mortgage-backed

2,707,780

2,756,528

2,934,113

(48,748

)

(226,333

)

State and political subdivisions

2,821,799

2,825,138

2,814,912

(3,339

)

6,887

Total securities held to maturity

$

5,652,804

$

5,704,861

$

5,872,131

$

(52,057

)

$

(219,327

)

Trading securities

$

17,893

$

16,880

$

9,258

$

1,013

$

8,635

Other securities

478,805

456,758

359,238

22,047

119,567

Total securities

$

13,014,804

$

12,586,447

$

13,203,875

$

428,357

$

(189,071

)

- Average total securities increased 3.4% on a linked-quarter

basis and decreased 1.4% compared to the first quarter of

2023.

- At March 31, 2024, the unrealized pre-tax net loss on the

available-for-sale securities portfolio was $665.9 million, or 9.2%

of the $7.2 billion amortized cost balance. At March 31, 2024, the

unrealized pre-tax net loss on the securities designated as held to

maturity was $601.3 million, or 10.7% of the $5.6 billion amortized

cost value.

Summary of average deposits - QTD

Average

UMB Financial

Corporation

(unaudited, dollars in thousands)

Q1

Q4

Q1

CQ vs.

CQ vs.

2024

2023

2023

LQ

PY

Deposits:

Noninterest-bearing demand

$

10,066,409

$

10,118,748

$

11,919,277

$

(52,339

)

$

(1,852,868

)

Interest-bearing demand and savings

20,701,659

19,457,878

18,427,662

1,243,781

2,273,997

Time deposits

2,758,064

3,098,636

1,215,506

(340,572

)

1,542,558

Total deposits

$

33,526,132

$

32,675,262

$

31,562,445

$

850,870

$

1,963,687

Noninterest bearing deposits as % of

total

30.0

%

31.0

%

37.8

%

- Average deposits increased 2.6% on a linked-quarter basis and

6.2% compared to the first quarter of 2023.

- As of March 31, 2024, total estimated uninsured deposits were

$25.3 billion, or approximately 68.4% of total deposits. Estimated

uninsured deposits, when adjusted to exclude affiliate

(company-owned) and collateralized deposits, were $17.9 billion,

and represented approximately 48.6% of total deposits. During the

quarter, estimated adjusted uninsured deposits averaged $14.4

billion, or approximately 43.0% of total average deposits.

Capital

Capital information

UMB Financial

Corporation

(unaudited, dollars in thousands, except

per share data)

March 31, 2024

December 31, 2023

March 31, 2023

Total equity

$

3,152,816

$

3,100,419

$

2,814,659

Accumulated other comprehensive loss,

net

(594,538

)

(556,935

)

(626,776

)

Book value per common share

64.68

63.85

58.03

Tangible book value per common share

(Non-GAAP)(i)

59.01

58.12

52.17

Regulatory capital:

Common equity Tier 1 capital

$

3,503,837

$

3,418,676

$

3,196,111

Tier 1 capital

3,503,837

3,418,676

3,196,111

Total capital

4,115,097

4,014,910

3,776,407

Regulatory capital ratios:

Common equity Tier 1 capital ratio

11.09

%

10.94

%

10.57

%

Tier 1 risk-based capital ratio

11.09

10.94

10.57

Total risk-based capital ratio

13.03

12.85

12.49

Tier 1 leverage ratio

8.39

8.49

8.35

(i) See reconciliation of Non-GAAP

measures to their nearest comparable GAAP measures later in this

release.

- At March 31, 2024, the regulatory capital ratios presented in

the foregoing table exceeded all “well-capitalized” regulatory

thresholds.

Asset Quality

Credit quality

UMB Financial

Corporation

(unaudited, dollars in thousands)

Q1

Q4

Q3

Q2

Q1

2024

2023

2023

2023

2023

Net charge-offs (recoveries) - total

loans

$

3,017

$

1,352

$

4,618

$

(139

)

$

4,643

Net loan charge-offs (recoveries) as a %

of total average loans

0.05

%

0.02

%

0.08

%

(0.00

)%

0.09

%

Loans over 90 days past due

$

3,076

$

3,111

$

3,044

$

10,675

$

1,723

Loans over 90 days past due as a % of

total loans

0.01

%

0.01

%

0.01

%

0.05

%

0.01

%

Nonaccrual and restructured loans

$

17,756

$

13,212

$

17,042

$

19,347

$

15,480

Nonaccrual and restructured loans as a %

of total loans

0.08

%

0.06

%

0.07

%

0.09

%

0.07

%

Provision for credit losses

$

10,000

$

—

$

4,977

$

13,000

$

23,250

- Provision for credit losses for the first quarter increased

$10.0 million from the linked quarter and decreased $13.3 million

from the first quarter of 2023. This quarter's provision included

approximately $6.7 million related to the purchase of $109.4

million in co-branded credit card receivables. Excluding this, the

variances in provision expense were driven largely by changes in

macro-economic variables and credit metrics in the current period

as compared to the prior periods.

- Net charge-offs for the first quarter totaled $3.0 million, or

0.05% of average loans, compared to $1.4 million, or 0.02% of

average loans in the linked quarter, and $4.6 million, or 0.09% of

average loans for the first quarter of 2023.

Dividend Declaration and Share

Repurchase Authorization

At the company’s quarterly board meeting, the Board of Directors

declared a $0.39 per share quarterly cash dividend, payable on July

1, 2024, to shareholders of record at the close of business on June

10, 2024.

The Board also approved the repurchase of up to 1,000,000 shares

of the company's common stock. Share repurchases may occur from

time to time at any point until the regular meeting of the Board

that immediately follows the 2025 annual meeting of the company’s

shareholders. Shares acquired under the repurchase program may be

available for reissuance or resale, including in connection with

the company's compensation plans and dividend reinvestment plan.

Under the repurchase program, the company may acquire the shares

from time to time in open market or privately negotiated

transactions, at the discretion of management.

Conference Call

The company will host a call for the investment community on

Monday, April 29, 2024, at 7:30 a.m. (CT). This call has been

rescheduled from the previously announced date and time.

Interested parties may access the call by dialing (toll-free)

833-470-1428 or (international) 404-975-4839 and requesting to join

the UMB Financial call with access code 397231. The live call may

also be accessed by visiting investorrelations.umb.com or by using

the following link:

UMB Financial Conference Call

A replay of the conference call may be heard through May 13,

2024, by calling (toll-free) 866-813-9403 or (international)

929-458-6194. The replay access code required for playback is

182605. The call replay may also be accessed at

investorrelations.umb.com.

Non-GAAP Financial

Information

In this release, we provide information about net operating

income, operating earnings per share – diluted (operating EPS),

operating return on average equity (operating ROE), operating

return on average assets (operating ROA), operating noninterest

expense, operating efficiency ratio, operating pre-tax,

pre-provision income (operating PTPP), operating pre-tax,

pre-provision earnings per share – diluted (operating PTPP EPS),

operating pre-tax, pre-provision income on a fully tax equivalent

basis (operating PTPP-FTE), operating pre-tax, pre-provision FTE

earnings per share – diluted (operating PTPP-FTE EPS), tangible

shareholders’ equity, and tangible book value per share, all of

which are non-GAAP financial measures. This information supplements

the results that are reported according to generally accepted

accounting principles in the United States (GAAP) and should not be

viewed in isolation from, or as a substitute for, GAAP results. The

differences between the non-GAAP financial measures – net operating

income, operating EPS, operating ROE, operating ROA, operating

noninterest expense, operating efficiency ratio, operating PTPP,

operating PTPP EPS, operating PTPP-FTE, operating PTPP-FTE EPS,

tangible shareholders’ equity, and tangible book value per share –

and the nearest comparable GAAP financial measures are reconciled

later in this release. The company believes that these non-GAAP

financial measures and the reconciliations may be useful to

investors because they adjust for acquisition- and

severance-related items, and the FDIC special assessment that

management does not believe reflect the company’s fundamental

operating performance.

Net operating income for the relevant period is defined as GAAP

net income, adjusted to reflect the impact of excluding expenses

related to acquisitions, severance expense, the FDIC special

assessment, and the cumulative tax impact of these adjustments.

Operating EPS (diluted) is calculated as earnings per share as

reported, adjusted to reflect, on a per share basis, the impact of

excluding the non-GAAP adjustments described above for the relevant

period. Operating ROE is calculated as net operating income,

divided by the company’s average total shareholders’ equity for the

relevant period. Operating ROA is calculated as net operating

income, divided by the company’s average assets for the relevant

period. Operating noninterest expense for the relevant period is

defined as GAAP noninterest expense, adjusted to reflect the

pre-tax impact of non-GAAP adjustments described above. Operating

efficiency ratio is calculated as the company’s operating

noninterest expense, net of amortization of other intangibles,

divided by the company’s total non-GAAP revenue (calculated as net

interest income plus noninterest income, less gains on sales of

securities available for sale, net).

Operating PTPP income for the relevant period is defined as GAAP

net interest income plus GAAP noninterest income, less noninterest

expense, adjusted to reflect the impact of excluding expenses

related to acquisitions and severance, and the FDIC special

assessment.

Operating PTPP-FTE for the relevant period is defined as GAAP

net interest income on a fully tax equivalent basis plus GAAP

noninterest income, less noninterest expense, adjusted to reflect

the impact of excluding expenses related to acquisitions and

severance, and the FDIC special assessment.

Tangible shareholders’ equity for the relevant period is defined

as GAAP shareholders’ equity, net of intangible assets. Tangible

book value per share is defined as tangible shareholders’ equity

divided by the Company’s total shares outstanding.

Forward-Looking

Statements:

This press release contains, and our other communications may

contain, forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements

can be identified by the fact that they do not relate strictly to

historical or current facts. Forward-looking statements often use

words such as “believe,” “expect,” “anticipate,” “intend,”

“estimate,” “project,” “outlook,” “forecast,” “target,” “trend,”

“plan,” “goal,” or other words of comparable meaning or

future-tense or conditional verbs such as “may,” “will,” “should,”

“would,” or “could.” Forward-looking statements convey our

expectations, intentions, or forecasts about future events,

circumstances, results, or aspirations. All forward-looking

statements are subject to assumptions, risks, and uncertainties,

which may change over time and many of which are beyond our

control. You should not rely on any forward-looking statement as a

prediction or guarantee about the future. Our actual future

objectives, strategies, plans, prospects, performance, condition,

or results may differ materially from those set forth in any

forward-looking statement. Some of the factors that may cause

actual results or other future events, circumstances, or

aspirations to differ from those in forward-looking statements are

described in our Annual Report on Form 10-K for the year ended

December 31, 2023, our subsequent Quarterly Reports on Form 10-Q or

Current Reports on Form 8-K, or other applicable documents that are

filed or furnished with the U.S. Securities and Exchange Commission

(SEC). In addition to such factors that have been disclosed

previously: macroeconomic and adverse developments and

uncertainties related to the collateral effects of the collapse of,

and challenges for, domestic and international banks, including the

impacts to the U.S. and global economies; sustained levels of high

inflation and the potential for an economic recession on the heels

of aggressive quantitative tightening by the Federal Reserve; and

impacts related to or resulting from instability in the Middle East

and Russia’s military action in Ukraine, such as the broader

impacts to financial markets and the global macroeconomic and

geopolitical environments, may also cause actual results or other

future events, circumstances, or aspirations to differ from our

forward-looking statements. Any forward-looking statement made by

us or on our behalf speaks only as of the date that it was made. We

do not undertake to update any forward-looking statement to reflect

the impact of events, circumstances, or results that arise after

the date that the statement was made, except to the extent required

by applicable securities laws. You, however, should consult further

disclosures (including disclosures of a forward-looking nature)

that we may make in any subsequent Annual Report on Form 10-K,

Quarterly Report on Form 10-Q, Current Report on Form 8-K, or other

applicable document that is filed or furnished with the SEC.

About UMB:

UMB Financial Corporation (Nasdaq: UMBF) is a financial services

company headquartered in Kansas City, Missouri. UMB offers

commercial banking, which includes comprehensive deposit, lending

and investment services, personal banking, which includes wealth

management and financial planning services, and institutional

banking, which includes asset servicing, corporate trust solutions,

investment banking, and healthcare services. UMB operates branches

throughout Missouri, Illinois, Colorado, Kansas, Oklahoma,

Nebraska, Arizona and Texas. As the company’s reach continues to

grow, it also serves business clients nationwide and institutional

clients in several countries. For more information, visit UMB.com,

UMB Blog, UMB Facebook and UMB

LinkedIn.

Consolidated Balance Sheets

UMB Financial

Corporation

(unaudited, dollars in thousands)

March 31,

2024

2023

ASSETS

Loans

$

23,637,649

$

21,812,972

Allowance for credit losses on loans

(226,159

)

(210,509

)

Net loans

23,411,490

21,602,463

Loans held for sale

4,415

1,422

Securities:

Available for sale

6,541,391

6,907,897

Held to maturity, net of allowance for

credit losses

5,622,617

5,859,323

Trading securities

40,187

19,823

Other securities

473,434

416,337

Total securities

12,677,629

13,203,380

Federal funds sold and resell

agreements

180,275

368,158

Interest-bearing due from banks

6,673,104

3,121,323

Cash and due from banks

356,963

472,248

Premises and equipment, net

231,918

260,623

Accrued income

221,447

181,586

Goodwill

207,385

207,385

Other intangibles, net

69,052

76,426

Other assets

1,309,697

1,112,176

Total assets

$

45,343,375

$

40,607,190

LIABILITIES

Deposits:

Noninterest-bearing demand

$

13,251,090

$

12,488,803

Interest-bearing demand and savings

21,018,911

16,760,603

Time deposits under $250,000

2,044,280

456,129

Time deposits of $250,000 or more

599,329

2,226,369

Total deposits

36,913,610

31,931,904

Federal funds purchased and repurchase

agreements

2,225,474

2,160,808

Short-term debt

1,800,000

2,800,000

Long-term debt

383,742

381,796

Accrued expenses and taxes

374,888

207,633

Other liabilities

492,845

310,390

Total liabilities

42,190,559

37,792,531

SHAREHOLDERS' EQUITY

Common stock

55,057

55,057

Capital surplus

1,127,806

1,120,877

Retained earnings

2,903,106

2,609,928

Accumulated other comprehensive loss,

net

(594,538

)

(626,776

)

Treasury stock

(338,615

)

(344,427

)

Total shareholders' equity

3,152,816

2,814,659

Total liabilities and shareholders'

equity

$

45,343,375

$

40,607,190

Consolidated Statements of

Income

UMB Financial

Corporation

(unaudited, dollars in thousands except

share and per share data)

Three Months Ended

March 31,

2024

2023

INTEREST INCOME

Loans

$

385,566

$

308,441

Securities:

Taxable interest

61,111

53,049

Tax-exempt interest

25,333

25,306

Total securities income

86,444

78,355

Federal funds and resell agreements

3,062

5,651

Interest-bearing due from banks

44,688

16,166

Trading securities

305

134

Total interest income

520,065

408,747

INTEREST EXPENSE

Deposits

223,875

127,899

Federal funds and repurchase

agreements

27,662

23,302

Other

29,094

15,850

Total interest expense

280,631

167,051

Net interest income

239,434

241,696

Provision for credit losses

10,000

23,250

Net interest income after provision for

credit losses

229,434

218,446

NONINTEREST INCOME

Trust and securities processing

69,478

62,359

Trading and investment banking

5,462

5,308

Service charges on deposit accounts

20,757

21,159

Insurance fees and commissions

283

274

Brokerage fees

13,160

13,676

Bankcard fees

21,968

18,172

Investment securities gains (losses),

net

9,371

(5,324

)

Other

18,765

14,576

Total noninterest income

159,244

130,200

NONINTEREST EXPENSE

Salaries and employee benefits

143,006

142,498

Occupancy, net

12,270

12,177

Equipment

16,503

17,849

Supplies and services

3,301

3,875

Marketing and business development

6,025

5,335

Processing fees

27,936

23,240

Legal and consulting

7,894

7,285

Bankcard

10,567

7,133

Amortization of other intangible

assets

1,960

2,298

Regulatory fees

19,395

5,551

Other

5,947

9,811

Total noninterest expense

254,804

237,052

Income before income taxes

133,874

111,594

Income tax expense

23,616

19,157

NET INCOME

$

110,258

$

92,437

PER SHARE DATA

Net income – basic

$

2.27

$

1.91

Net income – diluted

2.25

1.90

Dividends

0.39

0.38

Weighted average shares outstanding –

basic

48,663,515

48,435,016

Weighted average shares outstanding –

diluted

48,920,863

48,746,562

Consolidated Statements of

Comprehensive Income

UMB Financial

Corporation

(unaudited, dollars in thousands)

Three Months Ended

March 31,

2024

2023

Net income

$

110,258

$

92,437

Other comprehensive (loss) income, before

tax:

Unrealized gains and losses on debt

securities:

Change in unrealized holding gains and

losses, net

(41,553

)

93,657

Less: Reclassification adjustment for net

(gains) losses included in net income

(139

)

433

Amortization of net unrealized loss on

securities transferred from available-for-sale to

held-to-maturity

8,789

9,983

Change in unrealized gains and losses on

debt securities

(32,903

)

104,073

Unrealized gains and losses on derivative

hedges:

Change in unrealized gains and losses on

derivative hedges, net

(13,658

)

(1,527

)

Less: Reclassification adjustment for net

gains included in net income

(3,660

)

(2,561

)

Change in unrealized gains and losses on

derivative hedges

(17,318

)

(4,088

)

Other comprehensive (loss) income, before

tax

(50,221

)

99,985

Income tax benefit (expense)

12,618

(24,026

)

Other comprehensive (loss) income

(37,603

)

75,959

Comprehensive income

$

72,655

$

168,396

Consolidated Statements of

Shareholders' Equity

UMB Financial

Corporation

(unaudited, dollars in thousands except

per share data)

Common Stock

Capital Surplus

Retained Earnings

Accumulated Other

Comprehensive (Loss) Income

Treasury Stock

Total

Balance - January 1, 2023

$

55,057

$

1,125,949

$

2,536,086

$

(702,735

)

$

(347,264

)

$

2,667,093

Total comprehensive income

—

—

92,437

75,959

—

168,396

Dividends ($0.38 per share)

—

—

(18,595

)

—

—

(18,595

)

Purchase of treasury stock

—

—

—

—

(7,902

)

(7,902

)

Issuances of equity awards, net of

forfeitures

—

(9,764

)

—

—

10,483

719

Recognition of equity-based

compensation

—

4,516

—

—

—

4,516

Sale of treasury stock

—

71

—

—

56

127

Exercise of stock options

—

105

—

—

200

305

Balance - March 31, 2023

$

55,057

$

1,120,877

$

2,609,928

$

(626,776

)

$

(344,427

)

$

2,814,659

Balance - January 1, 2024

$

55,057

$

1,134,363

$

2,810,824

$

(556,935

)

$

(342,890

)

$

3,100,419

Total comprehensive income (loss)

—

—

110,258

(37,603

)

—

72,655

Dividends ($0.39 per share)

—

—

(17,976

)

—

—

(17,976

)

Purchase of treasury stock

—

—

—

—

(7,537

)

(7,537

)

Issuances of equity awards, net of

forfeitures

—

(10,964

)

—

—

11,667

703

Recognition of equity-based

compensation

—

4,271

—

—

—

4,271

Sale of treasury stock

—

70

—

—

60

130

Exercise of stock options

—

66

—

—

85

151

Balance - March 31, 2024

$

55,057

$

1,127,806

$

2,903,106

$

(594,538

)

$

(338,615

)

$

3,152,816

Average Balances / Yields and

Rates

UMB Financial

Corporation

(tax - equivalent basis)

(unaudited, dollars in thousands)

Three Months Ended March

31,

2024

2023

Average

Average

Average

Average

Balance

Yield/Rate

Balance

Yield/Rate

Assets

Loans, net of unearned interest

$

23,354,043

6.64

%

$

21,271,600

5.88

%

Securities:

Taxable

9,264,789

2.65

9,349,351

2.30

Tax-exempt

3,732,122

3.42

3,845,266

3.35

Total securities

12,996,911

2.87

13,194,617

2.61

Federal funds and resell agreements

206,443

5.97

451,188

5.08

Interest bearing due from banks

3,304,142

5.44

1,533,704

4.27

Trading securities

17,893

7.33

9,258

6.31

Total earning assets

39,879,432

5.31

36,460,367

4.62

Allowance for credit losses

(222,116

)

(196,128

)

Other assets

2,360,092

2,239,140

Total assets

$

42,017,408

$

38,503,379

Liabilities and Shareholders'

Equity

Interest-bearing deposits

$

23,459,723

3.84

%

$

19,643,168

2.64

%

Federal funds and repurchase

agreements

2,384,754

4.67

2,461,942

3.84

Borrowed funds

2,183,494

5.36

1,200,346

5.36

Total interest-bearing liabilities

28,027,971

4.03

23,305,456

2.91

Noninterest-bearing demand deposits

10,066,409

11,919,277

Other liabilities

779,510

554,211

Shareholders' equity

3,143,518

2,724,435

Total liabilities and shareholders'

equity

$

42,017,408

$

38,503,379

Net interest spread

1.28

%

1.71

%

Net interest margin

2.48

2.76

Business Segment Information

UMB Financial

Corporation

(unaudited, dollars in thousands)

Three Months Ended March 31,

2024

Commercial Banking

Institutional Banking

Personal Banking

Total

Net interest income

$

157,247

$

49,860

$

32,327

$

239,434

Provision for credit losses

7,520

479

2,001

10,000

Noninterest income

42,966

92,716

23,562

159,244

Noninterest expense

92,420

100,376

62,008

254,804

Income (loss) before taxes

100,273

41,721

(8,120

)

133,874

Income tax expense (benefit)

17,223

7,656

(1,263

)

23,616

Net income (loss)

$

83,050

$

34,065

$

(6,857

)

$

110,258

Three Months Ended March 31,

2023

Commercial Banking

Institutional Banking

Personal Banking

Total

Net interest income

$

151,027

$

55,085

35,584

$

241,696

Provision for credit losses

21,045

96

2,109

23,250

Noninterest income

22,902

84,238

23,060

130,200

Noninterest expense

84,002

89,372

63,678

237,052

Income (loss) before taxes

68,882

49,855

(7,143

)

111,594

Income tax expense (benefit)

11,646

8,504

(993

)

19,157

Net income (loss)

$

57,236

$

41,351

$

(6,150

)

$

92,437

The company has strategically aligned its operations into the

following three reportable segments: Commercial Banking,

Institutional Banking, and Personal Banking. Senior executive

officers regularly evaluate business segment financial results

produced by the company’s internal reporting system in deciding how

to allocate resources and assess performance for individual

business segments. The company’s reportable segments include

certain corporate overhead, technology and service costs that are

allocated based on methodologies that are applied consistently

between periods. For comparability purposes, amounts in all periods

are based on methodologies in effect at March 31, 2024.

Non-GAAP Financial Measures

Net operating income Non-GAAP

reconciliations:

UMB Financial

Corporation

(unaudited, dollars in thousands except

per share data)

Three Months Ended March

31,

2024

2023

Net income (GAAP)

$

110,258

$

92,437

Adjustments:

Acquisition expense

431

39

Severance expense

146

486

FDIC special assessment

13,000

—

Tax-impact of adjustments (i)

(3,123

)

(126

)

Total Non-GAAP adjustments (net of

tax)

10,454

399

Net operating income (Non-GAAP)

$

120,712

$

92,836

Earnings per share - diluted (GAAP)

$

2.25

$

1.90

Acquisition expense

0.01

—

Severance expense

—

0.01

FDIC special assessment

0.27

—

Tax-impact of adjustments (i)

(0.06

)

—

Operating earnings per share - diluted

(Non-GAAP)

$

2.47

$

1.91

GAAP

Return on average assets

1.06

%

0.97

%

Return on average equity

14.11

13.76

Non-GAAP

Operating return on average assets

1.16

%

0.98

%

Operating return on average equity

15.44

13.82

(i) Calculated using the company’s

marginal tax rate of 23.0% for 2024 and 24.0% for 2023.

Operating noninterest expense and

operating efficiency ratio Non-GAAP reconciliations:

UMB Financial

Corporation

(unaudited, dollars in thousands)

Three Months Ended March

31,

2024

2023

Noninterest expense

$

254,804

$

237,052

Adjustments to arrive at operating

noninterest expense (pre-tax):

Acquisition expense

431

39

Severance expense

146

486

FDIC special assessment

13,000

—

Total Non-GAAP adjustments (pre-tax)

13,577

525

Operating noninterest expense

(Non-GAAP)

$

241,227

$

236,527

Noninterest expense

$

254,804

$

237,052

Less: Amortization of other

intangibles

1,960

2,298

Noninterest expense, net of amortization

of other intangibles (Non-GAAP) (numerator A)

$

252,844

$

234,754

Operating noninterest expense

$

241,227

$

236,527

Less: Amortization of other

intangibles

1,960

2,298

Operating expense, net of amortization of

other intangibles (Non-GAAP) (numerator B)

$

239,267

$

234,229

Net interest income

$

239,434

$

241,696

Noninterest income

159,244

130,200

Less: Gains (losses) on sales of

securities available for sale, net

139

(2

)

Total Non-GAAP Revenue (denominator A)

$

398,539

$

371,898

Efficiency ratio (numerator A/denominator

A)

63.44

%

63.12

%

Operating efficiency ratio (Non-GAAP)

(numerator B/denominator A)

60.04

62.98

Operating pre-tax, pre-provision income

non-GAAP reconciliations:

UMB Financial

Corporation

(unaudited, dollars in thousands except

per share data)

Three Months Ended March

31,

2024

2023

Net interest income (GAAP)

$

239,434

$

241,696

Noninterest income (GAAP)

159,244

130,200

Noninterest expense (GAAP)

254,804

237,052

Adjustments to arrive at operating

noninterest expense:

Acquisition expense

431

39

Severance expense

146

486

FDIC special assessment

13,000

—

Total Non-GAAP adjustments

13,577

525

Operating noninterest expense

(Non-GAAP)

241,227

236,527

Operating pre-tax, pre-provision income

(Non-GAAP)

$

157,451

$

135,369

Net interest income earnings per share -

diluted (GAAP)

$

4.89

$

4.96

Noninterest income (GAAP)

3.26

2.67

Noninterest expense (GAAP)

5.21

4.86

Acquisition expense

0.01

—

Severance expense

—

0.01

FDIC special assessment

0.27

—

Operating pre-tax, pre-provision earnings

per share - diluted (Non-GAAP)

$

3.22

$

2.78

Operating pre-tax, pre-provision income

- FTE Non-GAAP reconciliations:

UMB Financial

Corporation

(unaudited, dollars in thousands except

per share data)

Three Months Ended March

31,

2024

2023

Net interest income (GAAP)

$

239,434

$

241,696

Adjustments to arrive at net interest

income - FTE:

Tax equivalent interest

6,516

6,555

Net interest income - FTE (Non-GAAP)

245,950

248,251

Noninterest income (GAAP)

159,244

130,200

Noninterest expense (GAAP)

254,804

237,052

Adjustments to arrive at operating

noninterest expense:

Acquisition expense

431

39

Severance expense

146

486

FDIC special assessment

13,000

—

Total Non-GAAP adjustments

13,577

525

Operating noninterest expense

(Non-GAAP)

241,227

236,527

Operating pre-tax, pre-provision income -

FTE (Non-GAAP)

$

163,967

$

141,924

Net interest income earnings per share -

diluted (GAAP)

$

4.89

$

4.96

Tax equivalent interest

0.13

0.13

Net interest income - FTE (Non-GAAP)

5.02

5.09

Noninterest income (GAAP)

3.26

2.67

Noninterest expense (GAAP)

5.21

4.86

Acquisition expense

0.01

—

Severance expense

—

0.01

FDIC special assessment

0.27

—

Operating pre-tax, pre-provision income -

FTE earnings per share - diluted (Non-GAAP)

$

3.35

$

2.91

Tangible book value non-GAAP

reconciliations:

UMB Financial

Corporation

(unaudited, dollars in thousands except

share and per share data)

As of March 31,

2024

2023

Total shareholders' equity (GAAP)

$

3,152,816

$

2,814,659

Less: Intangible assets

Goodwill

207,385

207,385

Other intangibles, net

69,052

76,426

Total intangibles, net

276,437

283,811

Total tangible shareholders' equity

(Non-GAAP)

$

2,876,379

$

2,530,848

Total shares outstanding

48,743,348

48,507,116

Ratio of total shareholders' equity (book

value) per share

$

64.68

$

58.03

Ratio of total tangible shareholders'

equity (tangible book value) per share (Non-GAAP)

59.01

52.17

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240420807468/en/

Media Contact: Stephanie Hague: 816.729.1027 Investor Relations

Contact: Kay Gregory: 816.860.7106

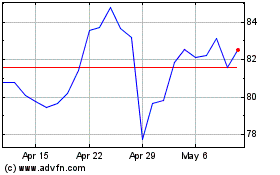

UMB Financial (NASDAQ:UMBF)

Historical Stock Chart

From Apr 2024 to May 2024

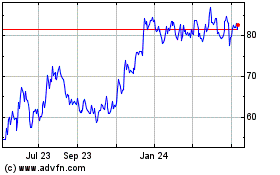

UMB Financial (NASDAQ:UMBF)

Historical Stock Chart

From May 2023 to May 2024