false

0000864240

0000864240

2024-05-15

2024-05-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 15, 2024

Sypris Solutions, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

0-24020

|

|

61-1321992

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

| |

|

|

|

|

|

101 Bullitt Lane, Suite 450

|

|

|

|

|

|

Louisville, Kentucky

|

|

|

|

40222

|

|

(Address of Principal

Executive Offices)

|

|

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (502) 329-2000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

Emerging growth company

|

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

☐

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value per share

|

SYPR

|

The Nasdaq Global Select Market

|

Section 2 – Financial Information

Item 2.02 Results of Operations and Financial Condition.

On May 15, 2024, Sypris Solutions, Inc. (the “Company”) announced its financial results for the first quarter ended March 31, 2024. The full text of the press release is set forth in Exhibit 99 hereto. The Company has also released certain supplemental financial information that can be accessed through the Company’s website at http://www.sypris.com.

The information in this Form 8-K and the attached Exhibit is being furnished pursuant to Item 2.02 “Results of Operations and Financial Condition” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Section 7 – Regulation FD

Item 7.01 Regulation FD Disclosure.

On May 15, 2024, Sypris Solutions, Inc. (the “Company”) announced its financial results for the first quarter ended March 31, 2024. The full text of the press release is set forth in Exhibit 99 hereto. The Company has also released certain supplemental financial information that can be accessed through the Company’s website at http://www.sypris.com.

The information in this Form 8-K and the attached Exhibit as well as the supplemental information referenced above is being furnished pursuant to Item 7.01 “Regulation FD Disclosure” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

|

(d)

|

Exhibits.

|

|

| |

|

|

| |

Exhibit Number |

Description of Exhibit |

| |

99 |

Press release issued May 15, 2024. |

| |

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: May 15, 2024

|

Sypris Solutions, Inc.

|

| |

|

|

| |

By:

|

/s/ Richard L. Davis

|

| |

|

Richard L. Davis

|

| |

|

Vice President & Chief Financial Officer

|

Exhibit 99

For more information, contact:

Richard L. Davis

Chief Financial Officer

(502) 329-2000

SYPRIS REPORTS FIRST QUARTER RESULTS

GROWTH CONTINUES; REVENUE UP 10%; BACKLOG OVER $110 MILLION

LOUISVILLE, KY (May 15, 2024) – Sypris Solutions, Inc. (Nasdaq/GM: SYPR) today reported financial results for its first quarter ended March 31, 2024.

HIGHLIGHTS

| |

●

|

The Company’s first quarter 2024 consolidated revenue increased 10.1% to $35.6 million compared with the prior year quarter, representing the 11th quarter of double-digit year-over-year growth during the past 12 quarterly periods.

|

|

| |

●

|

Revenue for Sypris Electronics increased 34.5% year-over-year and 9.5% sequentially, reflecting the continued growth in shipments under recently announced contracts with customers serving the markets for electronic warfare, aircraft and missile avionics, and subsea communications.

|

|

| |

●

|

Revenue for Sypris Technologies decreased 5.9% year-over-year to $18.4 million, reflecting the short-term timing of certain energy, specialty automotive and ATV product shipments.

|

|

| |

●

|

Orders for Sypris Technologies energy products increased during the first quarter compared to the same period in 2023, driving backlog up 50.1% from year end.

|

|

| |

●

|

During the quarter, Sypris Technologies announced that it had received an award to supply specialty high-pressure closures for use in a large international liquified natural gas project. The closures will be integrated into the filtration systems of the carbon capture and storage facilities of the project. Production is expected to be completed during 2024.

|

|

| |

●

|

In May, Sypris Electronics announced that it received releases for an additional four systems under a multi-year production contract that was first announced in 2022. The modules to be produced by Sypris will be integrated into an electronic warfare improvement program for the U.S. Navy. Deliveries are expected to begin in 2024.

|

|

| |

●

|

The Company updated its full-year outlook for 2024, maintaining the expected increase in revenue at 10%-15% year-over-year, while adjusting the gross margin guidance to a 100-125 basis point increase, reflecting the impact of unfavorable foreign currency exchange rates and program ramp costs.

|

|

- MORE -

Sypris Reports First Quarter Results

Page 2

May 15, 2024

“We were pleased with the year-over-year revenue growth at Sypris Electronics,” commented Jeffrey T. Gill, President and Chief Executive Officer. “The backlog at Sypris Electronics exceeds $100 million and is expected to support growth through the remainder of 2024 and beyond. Customer funding has already been secured for a portion of these key programs, which enables us to procure inventory under multi-year purchase orders to mitigate future supply chain issues.

“The financial results of Sypris Electronics were impacted by additional costs related to two large programs that ramped during the quarter. As these programs stabilize, we anticipate increasing sequential margins for the remainder of the year.

“Demand from Sypris Technologies customers serving the automotive, commercial vehicle, sport utility and off-highway markets has remained relatively stable, with new product line shipments offsetting the anticipated cyclical decline for the commercial vehicle market. We believe that the market diversification Sypris Technologies has accomplished over recent years by adding new programs in the automotive, sport-utility and off-highway markets will help offset some of this decline.

“Orders for our energy products increased during the period, with open quotes yet to be closed still outstanding on several large projects. Additional opportunities for growth may exist with new global projects in support of increasing LNG demand. We are also actively pursuing applications for our products in adjacent markets to further diversify our industry and customer portfolios.”

First Quarter Results

The Company reported revenue of $35.6 million for the first quarter of 2024, compared to $32.3 million for the prior-year comparable period. Additionally, the Company reported a net loss of $2.2 million, or $0.10 per share, as compared to a net loss of $0.2 million, or $0.01 per share, for the prior-year period.

Sypris Technologies

Revenue for Sypris Technologies was $18.4 million in the first quarter of 2024 compared to $19.5 million for the prior-year period, reflecting the short-term timing of certain energy, specialty automotive and ATV product shipments. Gross profit for the first quarter of 2024 was $2.1 million, or 11.2% of revenue, compared to $2.6 million, or 13.5% of revenue, for the same period in 2023. Gross profit for the first quarter of 2024 was negatively impacted by lower volumes and an unfavorable mix. Additionally, gross profit was negatively impacted by foreign currency exchange rates for our Mexican subsidiary, resulting in a decrease of $0.4 million.

Sypris Electronics

Revenue for Sypris Electronics was $17.2 million in the first quarter of 2024 compared to $12.8 million for the prior-year period. Increased shipments for two follow-on programs contributed to the growth over the prior-year comparable period. Gross profit for the first quarter of 2024 was $0.8 million, or 4.8% of revenue, compared to $1.5 million, or 11.9% of revenue, for the same period in 2023 primarily due to additional costs incurred on two programs that ramped production during the period.

Outlook

Commenting on the future, Mr. Gill added, “While new program launch costs and an unfavorable mix impacted our first quarter 2024 results, demand from customers serving the automotive, commercial vehicle and sport utility markets remains positive. Similarly, demand from customers serving the markets for electronic warfare, aircraft and missile avionics, secure and subsea communications, and ground-based radar remain robust, while the outlook for the energy market continues to move in the right direction.

- MORE -

Sypris Reports First Quarter Results

Page 3

May 15, 2024

“With a strong backlog, new program wins, and long-term contract extensions in place, we are confident that 2024 has the potential to be very positive for Sypris. As a result, we continue to expect revenue to increase 10-15% year-over-year. We expect to achieve gross margin expansion in the range of 100 to 125 basis points with gross profit forecast to increase 20-25% in 2024.”

About Sypris Solutions

Sypris Solutions is a diversified manufacturing and engineering services company serving the defense, transportation, communications, and energy industries. For more information about Sypris Solutions, visit its Web site at www.sypris.com.

Forward Looking Statements

This press release contains “forward-looking” statements within the meaning of the federal securities laws. Forward-looking statements include our plans and expectations of future financial and operational performance. Each forward-looking statement herein is subject to risks and uncertainties, as detailed in our most recent Form 10-K and Form 10-Q and other SEC filings. Briefly, we currently believe that such risks also include the following: the fees, costs and supply of, or access to, debt, equity capital, or other sources of liquidity; our failure to achieve profitability on a timely basis by steadily increasing our revenues from profitable contracts with a diversified group of customers, which would cause us to continue to use existing cash resources or require us to sell assets to fund operating losses; risks of foreign operations, including foreign currency exchange rate risk exposure, which could impact our operating results; volatility of our customers’ forecasts and our contractual obligations to meet current scheduling demands and production levels, which may negatively impact our operational capacity and our effectiveness to integrate new customers or suppliers, and in turn cause increases in our inventory and working capital levels; cost, quality and availability or lead times of raw materials such as steel, component parts (especially electronic components), natural gas or utilities including increased cost relating to inflation; dependence on, retention or recruitment of key employees and highly skilled personnel and distribution of our human capital; the cost and availability of full-time accounting personnel with technical accounting knowledge to execute, review and approve all aspects of the financial statement close and reporting process; the cost, quality, timeliness, efficiency and yield of our operations and capital investments, including the impact of inflation, tariffs, product recalls or related liabilities, employee training, working capital, production schedules, cycle times, scrap rates, injuries, wages, overtime costs, freight or expediting costs; the termination or non-renewal of existing contracts by customers; our failure to successfully complete final contract negotiations with regard to our announced contract “orders”, “wins” or “awards”; significant delays or reductions due to a prolonged continuing resolution or U.S. government shutdown reducing the spending on products and services that Sypris Electronics provides; adverse impacts of new technologies or other competitive pressures which increase our costs or erode our margins; breakdowns, relocations or major repairs of machinery and equipment, especially in our Toluca Plant; the costs and supply of insurance on acceptable terms and with adequate coverage; the costs of compliance with our auditing, regulatory or contractual obligations; pension valuation, health care or other benefit costs; our reliance on revenues from customers in the oil and gas and automotive markets, with increasing consumer pressure for reductions in environmental impacts attributed to greenhouse gas emissions and increased vehicle fuel economy; our failure to successfully win new business or develop new or improved products or new markets for our products; war, geopolitical conflict, terrorism, or political uncertainty, or disruptions resulting from the Russia-Ukraine war or the Israel and Gaza conflict, including arising out of international sanctions, foreign currency fluctuations and other economic impacts; our reliance on a few key customers, third party vendors and sub-suppliers; inventory valuation risks including excessive or obsolescent valuations or price erosions of raw materials or component parts on hand or other potential impairments, non-recoverability or write-offs of assets or deferred costs; disputes or litigation involving governmental, supplier, customer, employee, creditor, stockholder, product liability, warranty or environmental claims; failure to adequately insure or to identify product liability, environmental or other insurable risks; unanticipated or uninsured product liability claims, disasters, public health crises, losses or business risks; labor relations; strikes; union negotiations; costs associated with environmental claims relating to properties previously owned; our inability to patent or otherwise protect our inventions or other intellectual property rights from potential competitors or fully exploit such rights which could materially affect our ability to compete in our chosen markets; changes in licenses, security clearances, or other legal rights to operate, manage our work force or import and export as needed; cyber security threats and disruptions, including ransomware attacks on our systems and the systems of third-party vendors and other parties with which we conduct business, all of which may become more pronounced in the event of geopolitical conflicts and other uncertainties, such as the conflict in Ukraine; our ability to maintain compliance with the Nasdaq listing standards minimum closing bid price; risks related to owning our common stock, including increased volatility; possible public policy response to a public health emergency, including U. S or foreign government legislation or restrictions that may impact our operations or supply chain; or unknown risks and uncertainties. We undertake no obligation to update our forward-looking statements, except as may be required by law.

- MORE -

Sypris Reports First Quarter Results

Page 4

May 15, 2024

SYPRIS SOLUTIONS, INC.

Financial Highlights

(In thousands, except per share amounts)

| |

|

Three Months Ended

|

|

| |

|

March 31,

|

|

|

April 2,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

(Unaudited)

|

|

|

Revenue

|

|

$ |

35,553 |

|

|

$ |

32,292 |

|

|

Net loss

|

|

$ |

(2,221 |

) |

|

$ |

(175 |

) |

|

Loss per common share:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

(0.10 |

) |

|

$ |

(0.01 |

) |

|

Diluted

|

|

$ |

(0.10 |

) |

|

$ |

(0.01 |

) |

|

Weighted average shares outstanding:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

21,965 |

|

|

|

21,796 |

|

|

Diluted

|

|

|

21,965 |

|

|

|

21,796 |

|

- MORE -

Sypris Reports First Quarter Results

Page 5

May 15, 2024

Sypris Solutions, Inc.

Consolidated Statements of Operations

(in thousands, except for per share data)

| |

|

Three Months Ended

|

|

| |

|

March 31,

|

|

|

April 2,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

(Unaudited)

|

|

|

Net revenue:

|

|

|

|

|

|

|

|

|

|

Sypris Technologies

|

|

$ |

18,350 |

|

|

$ |

19,500 |

|

|

Sypris Electronics

|

|

|

17,203 |

|

|

|

12,792 |

|

|

Total net revenue

|

|

|

35,553 |

|

|

|

32,292 |

|

|

Cost of sales:

|

|

|

|

|

|

|

|

|

|

Sypris Technologies

|

|

|

16,299 |

|

|

|

16,861 |

|

|

Sypris Electronics

|

|

|

16,370 |

|

|

|

11,270 |

|

|

Total cost of sales

|

|

|

32,669 |

|

|

|

28,131 |

|

|

Gross profit:

|

|

|

|

|

|

|

|

|

|

Sypris Technologies

|

|

|

2,051 |

|

|

|

2,639 |

|

|

Sypris Electronics

|

|

|

833 |

|

|

|

1,522 |

|

|

Total gross profit

|

|

|

2,884 |

|

|

|

4,161 |

|

|

Selling, general and administrative

|

|

|

4,258 |

|

|

|

3,745 |

|

|

Operating (loss) income

|

|

|

(1,374 |

) |

|

|

416 |

|

|

Interest expense, net

|

|

|

318 |

|

|

|

226 |

|

|

Other expense, net

|

|

|

341 |

|

|

|

71 |

|

|

(Loss) income before taxes

|

|

|

(2,033 |

) |

|

|

119 |

|

|

Income tax expense, net

|

|

|

188 |

|

|

|

294 |

|

|

Net loss

|

|

$ |

(2,221 |

) |

|

$ |

(175 |

) |

|

Loss per common share:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

(0.10 |

) |

|

$ |

(0.01 |

) |

|

Diluted

|

|

$ |

(0.10 |

) |

|

$ |

(0.01 |

) |

|

Dividends declared per common share

|

|

$ |

- |

|

|

$ |

- |

|

|

Weighted average shares outstanding:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

21,965 |

|

|

|

21,796 |

|

|

Diluted

|

|

|

21,965 |

|

|

|

21,796 |

|

- MORE -

Sypris Reports First Quarter Results

Page 6

May 15, 2024

Sypris Solutions, Inc.

Consolidated Balance Sheets

(in thousands, except for share data)

| |

|

March 31,

|

|

|

December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

(Unaudited)

|

|

|

(Note)

|

|

|

ASSETS

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

8,096 |

|

|

$ |

7,881 |

|

|

Accounts receivable, net

|

|

|

13,093 |

|

|

|

8,929 |

|

|

Inventory, net

|

|

|

70,890 |

|

|

|

77,314 |

|

|

Other current assets

|

|

|

10,777 |

|

|

|

9,743 |

|

|

Total current assets

|

|

|

102,856 |

|

|

|

103,867 |

|

|

Property, plant and equipment, net

|

|

|

16,706 |

|

|

|

17,133 |

|

|

Operating lease right-of-use assets

|

|

|

4,617 |

|

|

|

3,309 |

|

|

Other assets

|

|

|

4,866 |

|

|

|

5,033 |

|

|

Total assets

|

|

$ |

129,045 |

|

|

$ |

129,342 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

26,530 |

|

|

$ |

26,737 |

|

|

Accrued liabilities

|

|

|

56,314 |

|

|

|

56,232 |

|

|

Operating lease liabilities, current portion

|

|

|

1,122 |

|

|

|

1,068 |

|

|

Finance lease obligations, current portion

|

|

|

1,404 |

|

|

|

1,327 |

|

|

Equipment financing obligations, current portion

|

|

|

591 |

|

|

|

618 |

|

|

Working capital line of credit

|

|

|

500 |

|

|

|

500 |

|

|

Note payable - related party, current portion

|

|

|

2,000 |

|

|

|

- |

|

|

Total current liabilities

|

|

|

88,461 |

|

|

|

86,482 |

|

| |

|

|

|

|

|

|

|

|

|

Operating lease liabilities, net of current portion

|

|

|

3,868 |

|

|

|

2,642 |

|

|

Finance lease obligations, net of current portion

|

|

|

1,647 |

|

|

|

1,852 |

|

|

Equipment financing obligations, net of current portion

|

|

|

1,197 |

|

|

|

1,333 |

|

|

Note payable - related party, net of current portion

|

|

|

6,980 |

|

|

|

6,484 |

|

|

Other liabilities

|

|

|

6,043 |

|

|

|

8,082 |

|

|

Total liabilities

|

|

|

108,196 |

|

|

|

106,875 |

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, par value $0.01 per share, 975,150 shares authorized; no shares issued

|

|

|

- |

|

|

|

- |

|

|

Series A preferred stock, par value $0.01 per share, 24,850 shares authorized; no shares issued

|

|

|

- |

|

|

|

- |

|

|

Common stock, non-voting, par value $0.01 per share, 10,000,000 shares authorized; no shares issued

|

|

|

- |

|

|

|

- |

|

|

Common stock, par value $0.01 per share, 30,000,000 shares authorized; 22,475,484 shares issued and 22,430,092 outstanding in 2024 and 22,465,485 shares issued and 22,459,649 outstanding in 2023

|

|

|

225 |

|

|

|

224 |

|

|

Additional paid-in capital

|

|

|

156,439 |

|

|

|

156,242 |

|

|

Accumulated deficit

|

|

|

(119,153 |

) |

|

|

(116,932 |

) |

|

Accumulated other comprehensive loss

|

|

|

(16,662 |

) |

|

|

(17,067 |

) |

|

Treasury stock, 45,392 in 2024 and 5,835 in 2023

|

|

|

- |

|

|

|

- |

|

|

Total stockholders’ equity

|

|

|

20,849 |

|

|

|

22,467 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

129,045 |

|

|

$ |

129,342 |

|

Note: The balance sheet at December 31, 2023, has been derived from the audited consolidated financial statements at that date but does not include all information and footnotes required by accounting principles generally accepted in the United States for a complete set of financial statements.

- MORE -

Sypris Reports First Quarter Results

Page 7

May 15, 2024

Sypris Solutions, Inc.

Consolidated Cash Flow Statements

(in thousands)

| |

|

Three Months Ended

|

|

| |

|

March 31,

|

|

|

April 2,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

(Unaudited)

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(2,221 |

) |

|

$ |

(175 |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

845 |

|

|

|

774 |

|

|

Deferred income taxes

|

|

|

39 |

|

|

|

(136 |

) |

|

Stock-based compensation expense

|

|

|

197 |

|

|

|

263 |

|

|

Deferred loan costs amortized

|

|

|

2 |

|

|

|

2 |

|

|

Provision for excess and obsolete inventory

|

|

|

73 |

|

|

|

(87 |

) |

|

Non-cash lease expense

|

|

|

293 |

|

|

|

179 |

|

|

Other noncash items

|

|

|

69 |

|

|

|

33 |

|

|

Contributions to pension plans

|

|

|

- |

|

|

|

(10 |

) |

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(4,326 |

) |

|

|

(2,691 |

) |

|

Inventory

|

|

|

6,405 |

|

|

|

(9,942 |

) |

|

Prepaid expenses and other assets

|

|

|

(866 |

) |

|

|

154 |

|

|

Accounts payable

|

|

|

(208 |

) |

|

|

3,118 |

|

|

Accrued and other liabilities

|

|

|

(2,011 |

) |

|

|

7,277 |

|

|

Net cash used in operating activities

|

|

|

(1,709 |

) |

|

|

(1,241 |

) |

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Capital expenditures

|

|

|

(316 |

) |

|

|

(708 |

) |

|

Net cash used in investing activities

|

|

|

(316 |

) |

|

|

(708 |

) |

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Proceeds from equipment financing obligations

|

|

|

198 |

|

|

|

210 |

|

|

Proceeds from Note Payable - related party

|

|

|

2,500 |

|

|

|

- |

|

|

Principal payments on finance lease obligations

|

|

|

(324 |

) |

|

|

(271 |

) |

|

Principal payments on equipment financing obligations

|

|

|

(164 |

) |

|

|

(95 |

) |

|

Indirect repurchase of shares for minimum statutory tax withholdings

|

|

|

- |

|

|

|

(48 |

) |

|

Net cash provided by (used in) financing activities

|

|

|

2,210 |

|

|

|

(204 |

) |

|

Effect of exchange rate changes on cash balances

|

|

|

30 |

|

|

|

(14 |

) |

|

Net increase (decrease) increase in cash and cash equivalents

|

|

|

215 |

|

|

|

(2,167 |

) |

|

Cash and cash equivalents at beginning of period

|

|

|

7,881 |

|

|

|

21,648 |

|

|

Cash and cash equivalents at end of period

|

|

$ |

8,096 |

|

|

$ |

19,481 |

|

- END -

v3.24.1.1.u2

Document And Entity Information

|

May 15, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Sypris Solutions, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 15, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

0-24020

|

| Entity, Tax Identification Number |

61-1321992

|

| Entity, Address, Address Line One |

101 Bullitt Lane, Suite 450

|

| Entity, Address, City or Town |

Louisville

|

| Entity, Address, State or Province |

KY

|

| Entity, Address, Postal Zip Code |

40222

|

| City Area Code |

502

|

| Local Phone Number |

329-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

SYPR

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000864240

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

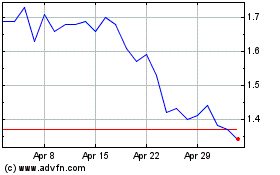

Sypris Solutions (NASDAQ:SYPR)

Historical Stock Chart

From Apr 2024 to May 2024

Sypris Solutions (NASDAQ:SYPR)

Historical Stock Chart

From May 2023 to May 2024