false

0001506251

0001506251

2024-05-14

2024-05-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported) May 14, 2024

Citius

Pharmaceuticals, Inc.

(Exact

name of registrant as specified in its charter)

Nevada

(State

or other jurisdiction of incorporation)

| 001-38174 |

|

27-3425913 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

| 11 Commerce Drive, 1st Floor, Cranford, NJ |

|

07016 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code (908) 967-6677

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, $0.001 par value |

|

CTXR |

|

The Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On

May 14, 2024, we issued a press release announcing our results of operations for the second quarter of fiscal 2024. A copy of the press

release is furnished as Exhibit 99.1 to this report and is incorporated herein by reference.

The

information in this Item 2.02 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific

reference in such a filing.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

CITIUS PHARMACEUTICALS, INC. |

| |

|

| Date: May 14, 2024 |

/s/

Leonard Mazur |

| |

Leonard Mazur |

| |

Chairman and Chief Executive Officer |

2

Exhibit 99.1

Citius Pharmaceuticals, Inc. Reports Fiscal

Second Quarter 2024 Financial Results and Provides Business Update

Mino-Lok data analysis on track with topline results

anticipated this quarter

LYMPHIR biologics license application accepted

with PDUFA target action date set for August 13, 2024

CRANFORD, N.J., May 14, 2024 -- Citius

Pharmaceuticals, Inc. (“Citius” or the “Company”) (Nasdaq: CTXR), a late-stage biopharmaceutical

company dedicated to the development and commercialization of first-in-class critical care products today reported business and

financial results for the fiscal second quarter 2024 ended March 31, 2024.

Second Quarter 2024 Business Highlights and

Subsequent Developments

| - | LYMPHIR™ (denileukin diftitox) biologics

license application (BLA) accepted by the U.S. Food and Drug Administration (FDA) with August 13, 2024, assigned as Prescription Drug

User Fee Act (PDUFA) target action date; |

| - | Data analysis underway for completed Mino-Lok®

Pivotal Phase 3 trial with topline results anticipated in calendar 2Q 2024; |

| - | Continued engagement with FDA following end of

Phase 2b meeting to determine next phase in the development of Halo-Lido for the treatment of hemorrhoids; |

| - | Merger of our wholly owned subsidiary with TenX

Keane Acquisition (Nasdaq: TENK) to form publicly listed Citius Oncology, Inc. is progressing and pending review by Securities and Exchange

Commission (SEC) and TENK shareholder approval; |

| - | Robert Smith elected to the Citius Board of Directors

at the Annual Meeting of Stockholders; and, |

| - | Completed $15 million registered direct offering

in April 2024 extending the Company’s cash runway. |

Financial Highlights

| - | Cash and cash equivalents of $12.6 million as

of March 31, 2024; |

| - | $15 million in gross proceeds from a registered

direct offering on April 30, 2024, extends the Company’s cash runway through December 2024; |

| - | R&D expenses were $3.6 million and $6.2 million

for the three and six months ended March 31, 2024, respectively, compared to $4.7 million and $8.2 million for the three and six months

ended March 31, 2023, respectively; |

| - | G&A expenses were $4.3 million and $7.9 million

for the three and six months ended March 31, 2024, respectively, compared to $4.8 million and $7.4 million for the three and six months

ended March 31, 2023, respectively; |

| - | Stock-based compensation expense was $3.1 million

and $6.1 million for the three and six months ended March 31, 2024, respectively, compared to $1.2 million and $2.4 million for the three

and six months ended March 31, 2023, respectively; and, |

| - | Net loss was $8.5 million and $17.8 million,

or ($0.05) and ($0.11) per share for the three and six months ended March 31, 2024, respectively, compared to a net loss of $10.5 million

and $14.1 million, or ($0.07) and ($0.10) per share for the three and six months ended March 31, 2023, respectively. |

“I am pleased to share that we made solid

progress this quarter as we focused on execution and managing our finances. The data analysis of our late-stage asset, Mino-Lok, the only

treatment of its kind in development to salvage infected catheters, remains on track. We look forward to reporting the topline results

later this quarter. Once we review the results, we plan to engage with the FDA to determine the optimal next steps in the program and

look forward to advancing this much-needed alternative to the current standard of care, which often involves painful and costly catheter

removal and replacement,” stated Leonard Mazur, Chairman and CEO of Citius.

“Importantly, the BLA submission for LYMPHIR,

our novel IL-2 receptor targeted oncology therapy, was accepted by the FDA, and assigned a late summer 2024 PDUFA target action date.

In anticipation of potential approval, we continue to align the organization for a successful launch,” added Mazur.

“Despite a tough capital market environment

for pre-revenue companies, we successfully completed a $15 million registered direct offering, expanding our cash runway and providing

capital to support the execution of our strategic plan. We believe that the merger of our oncology subsidiary with TenX to form a publicly

listed company will make our company more attractive to investors and increase the value of our assets. This transaction is progressing,

and we expect it to be completed in the coming months as we finalize SEC review and await approval by TENK shareholders. As we continue

to meet our goals, we believe additional opportunities to strengthen our capital structure will become available,” concluded Mazur.

second

QUARTER 2024 Financial Results:

Liquidity

As of March 31, 2024, the Company had $12.6 million

in cash and cash equivalents.

As of March 31, 2024, the Company had 159,094,781

common shares outstanding.

Based on our cash and cash equivalents as of March

31, 2024, and after giving effect to a capital raising that closed on April 30, 2024, we expect to have sufficient funds to continue our

operations through December 2024. We expect to raise additional capital in the future to support our operations beyond December 2024.

Research and Development (R&D) Expenses

R&D expenses were $3.6 million for the quarter

ended March 31, 2024, compared to $4.7 million for the quarter ended March 31, 2023. For the six months ended March 31, 2024, R&D

expenses were $6.2 million as compared to $8.2 million during the six months ended March 31, 2023, a decrease of $1.9 million. The decrease

primarily reflects incremental costs related to the completion of the Mino-Lok Phase 3 trial and remediation activities for the LYMPHIR

BLA resubmission, offset by lower costs in the current period due to the completion of the Halo-Lido Phase 2b trial.

We expect that research and development expenses

will stabilize at current levels in fiscal 2024 as we focus on the commercialization of LYMPHIR, complete our Phase 3 trial for Mino-Lok,

and analyze the data from our Phase 2b trial and begin planning our Phase 3 trial for Halo-Lido

General and Administrative (G&A) Expenses

G&A expenses were $4.3 million for the quarter

ended March 31, 2024, compared to $4.8 million for the quarter ended March 31, 2023. The decrease was primarily due to lower costs for

pre-launch and market research activities associated with LYMPHIR during the period.

For the six months ended March 31, 2024, G&A

expenses were $7.9 million as compared to $7.4 million during the six months ended March 31, 2023. The primary reason for the increase

was higher costs for pre-launch and market research activities associated with LYMPHIR.

General and administrative expenses consist primarily

of compensation costs, professional fees for legal, regulatory, accounting, and corporate development services, and investor relations

expenses.

Stock-based Compensation Expense

For the quarter ended March 31, 2024, stock-based

compensation expense was $3.1 million as compared to $1.2 million for the quarter ended March 31, 2023. For the six months ended March

31, 2024, stock-based compensation expense was $6.1 million as compared to $2.4 million for the six months ended March 31, 2023. The increase

is primarily due to the Citius Oncology stock plan.

Net loss

Net loss was $8.5 million, or ($0.05) per share

for the quarter ended March 31, 2024, compared to a net loss of $10.5 million, or ($0.07) per share for the quarter ended March 31, 2023.

The $2 million decrease in the net loss was due to decreases of $1.1 million in research and development expenses and $0.5 million in

general and administrative expenses, and the increase in other income of $2.3 million, being partially offset by the increase in stock-based

compensation expense of $1.9 million.

Net loss was $17.8 million, or ($0.11) per share

for the six months ended March 31, 2024, compared to a net loss of $14.1 million, or ($0.10) per share for the six months ended March

31, 2023. The increase in the net loss was primarily due to the increase in stock-based compensation expense.

About Citius Pharmaceuticals, Inc.

Citius Pharma is a late-stage biopharmaceutical

company dedicated to the development and commercialization of first-in-class critical care products. The Company’s diversified

pipeline includes two late-stage product candidates. At the end of 2023, Citius completed enrollment in a Phase 3 pivotal superiority

trial of Mino-Lok®, an antibiotic lock solution to salvage catheters in patients with catheter-related bloodstream infections.

The Biologics License Application for LYMPHIR™, a novel IL-2R immunotherapy for an initial indication in cutaneous T-cell lymphoma,

is currently under review by the FDA with August 13, 2024 assigned as the PDUFA target action date. Citius previously announced plans

to form Citius Oncology, a standalone publicly traded company with LYMPHIR as its primary asset. LYMPHIR received orphan drug designation

by the FDA for the treatment of CTCL and PTCL. In addition, Citius completed enrollment in its Phase 2b trial of CITI-002 (Halo-Lido),

a topical formulation for the relief of hemorrhoids. For more information, please visit www.citiuspharma.com.

Forward-Looking Statements

This press release may contain “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

Such statements are made based on our expectations and beliefs concerning future events impacting Citius. You can identify these statements

by the fact that they use words such as “will,” “anticipate,” “estimate,” “expect,” “plan,”

“should,” and “may” and other words and terms of similar meaning or use of future dates. Forward-looking statements

are based on management’s current expectations and are subject to risks and uncertainties that could negatively affect our business, operating

results, financial condition and stock price. Factors that could cause actual results to differ materially from those currently anticipated

are: risks relating to the results of research and development activities, including those from existing and new pipeline assets; our

need for substantial additional funds; uncertainties relating to preclinical and clinical testing; the FDA may not approve LYMPHIR; our

ability to commercialize our products if approved by the FDA; our dependence on third-party suppliers; our ability to procure cGMP commercial-scale

supply; the estimated markets for our product candidates and the acceptance thereof by any market; the ability of our product candidates

to impact the quality of life of our target patient populations; our ability to obtain, perform under and maintain financing and strategic

agreements and relationships; the early stage of products under development; market and other conditions; our ability to attract, integrate,

and retain key personnel; risks related to our growth strategy; our ability to realize some or all of the benefits expected to result

from the anticipated spinoff of Citius Oncology or the delay of such benefits; our ongoing businesses which may be adversely affected

and subject to certain risks and consequences as a result of the anticipated spinoff transaction; patent and intellectual property matters;

our ability to identify, acquire, close and integrate product candidates and companies successfully and on a timely basis; government

regulation; competition; as well as other risks described in our SEC filings. These risks have been and may be further impacted by Covid-19

and could be impacted by any future public health risks. Accordingly, these forward-looking statements do not constitute guarantees of

future performance, and you are cautioned not to place undue reliance on these forward-looking statements. Risks regarding our business

are described in detail in our SEC filings which are available on the SEC’s website at www.sec.gov, including in our Annual Report

on Form 10-K for the year ended September 30, 2023, filed with the SEC on December 29, 2023, and updated by our subsequent filings with

the SEC. These forward-looking statements speak only as of the date hereof, and we expressly disclaim any obligation or undertaking to

release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations

or any changes in events, conditions or circumstances on which any such statement is based, except as required by law.

Investor Relations for Citius Pharmaceuticals:

Investor Contact:

Ilanit Allen

ir@citiuspharma.com

908-967-6677 x113

Media Contact:

STiR-communications

Greg Salsburg

Greg@STiR-communications.com

-- Financial Tables Follow –

CITIUS PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | |

March 31, | | |

September 30, | |

| | |

2024 | | |

2023 | |

| ASSETS | |

| | |

| |

| Current Assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 12,559,607 | | |

$ | 26,480,928 | |

| Prepaid expenses | |

| 9,014,124 | | |

| 7,889,506 | |

| Total Current Assets | |

| 21,573,731 | | |

| 34,370,434 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 275 | | |

| 1,432 | |

| Operating lease right-of-use asset, net | |

| 352,505 | | |

| 454,426 | |

| Deposits | |

| 38,062 | | |

| 38,062 | |

| In-process research and development | |

| 59,400,000 | | |

| 59,400,000 | |

| Goodwill | |

| 9,346,796 | | |

| 9,346,796 | |

| | |

| | | |

| | |

| Total Assets | |

$ | 90,711,369 | | |

$ | 103,611,150 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 2,669,507 | | |

$ | 2,927,334 | |

| Accrued expenses | |

| 151,204 | | |

| 476,300 | |

| Accrued compensation | |

| 1,123,076 | | |

| 2,156,983 | |

| Operating lease liability | |

| 229,733 | | |

| 218,380 | |

| Total Current Liabilities | |

| 4,173,520 | | |

| 5,778,997 | |

| | |

| | | |

| | |

| Deferred tax liability | |

| 6,425,800 | | |

| 6,137,800 | |

| Operating lease liability – noncurrent | |

| 145,098 | | |

| 262,865 | |

| Total Liabilities | |

| 10,744,418 | | |

| 12,179,662 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ Equity: | |

| | | |

| | |

| Preferred stock – $0.001 par value; 10,000,000 shares authorized; no shares issued and outstanding | |

| — | | |

| — | |

| Common stock – $0.001 par value; 400,000,000 shares authorized; 159,094,781 and 158,857,798 shares issued and outstanding at March 31, 2024 and September 30, 2023, respectively | |

| 159,095 | | |

| 158,858 | |

| Additional paid-in capital | |

| 259,214,194 | | |

| 252,903,629 | |

| Accumulated deficit | |

| (180,006,718 | ) | |

| (162,231,379 | ) |

| Total Citius Pharmaceuticals, Inc. Stockholders’ Equity | |

| 79,366,571 | | |

| 90,831,108 | |

| Non-controlling interest | |

| 600,380 | | |

| 600,380 | |

| Total Equity | |

| 79,966,951 | | |

| 91,431,488 | |

| | |

| | | |

| | |

| Total Liabilities and Equity | |

$ | 90,711,369 | | |

$ | 103,611,150 | |

CITIUS PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE THREE AND SIX MONTHS ENDED MARCH 31,

2024 AND 2023

(Unaudited)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

March 31, | | |

March 31, | | |

March 31, | | |

March 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenues | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | — | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Expenses | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 3,605,898 | | |

| 4,726,855 | | |

| 6,227,808 | | |

| 8,172,370 | |

| General and administrative | |

| 4,285,911 | | |

| 4,792,850 | | |

| 7,946,639 | | |

| 7,396,137 | |

| Stock-based compensation – general and administrative | |

| 3,078,392 | | |

| 1,165,595 | | |

| 6,136,577 | | |

| 2,366,676 | |

| Total Operating Expenses | |

| 10,970,201 | | |

| 10,685,300 | | |

| 20,311,024 | | |

| 17,935,183 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Loss | |

| (10,970,201 | ) | |

| (10,685,300 | ) | |

| (20,311,024 | ) | |

| (17,935,183 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 182,205 | | |

| 303,275 | | |

| 435,843 | | |

| 517,824 | |

| Gain on sale of New Jersey net operating losses | |

| 2,387,842 | | |

| — | | |

| 2,387,842 | | |

| 3,585,689 | |

| Total Other Income | |

| 2,570,047 | | |

| 303,275 | | |

| 2,823,685 | | |

| 4,103,513 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before Income Taxes | |

| (8,400,154 | ) | |

| (10,382,025 | ) | |

| (17,487,339 | ) | |

| (13,831,670 | ) |

| Income tax expense | |

| 144,000 | | |

| 144,000 | | |

| 288,000 | | |

| 288,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

$ | (8,544,154 | ) | |

$ | (10,526,025 | ) | |

$ | (17,775,339 | ) | |

$ | (14,119,670 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss Per Share - Basic and Diluted | |

$ | (0.05 | ) | |

$ | (0.07 | ) | |

$ | (0.11 | ) | |

$ | (0.10 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Common Shares Outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 159,072,239 | | |

| 146,251,945 | | |

| 159,013,769 | | |

| 146,231,313 | |

CITIUS PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND

2023

(Unaudited)

| | |

2024 | | |

2023 | |

| Cash Flows From Operating Activities: | |

| | |

| |

| Net loss | |

$ | (17,775,339 | ) | |

$ | (14,119,670 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Stock-based compensation expense | |

| 6,136,577 | | |

| 2,366,676 | |

| Issuance of common stock for services | |

| 174,225 | | |

| 102,000 | |

| Amortization of operating lease right-of-use asset | |

| 101,921 | | |

| 93,869 | |

| Depreciation | |

| 1,157 | | |

| 1,461 | |

| Deferred income tax expense | |

| 288,000 | | |

| 288,000 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Prepaid expenses | |

| (1,124,618 | ) | |

| (2,983,022 | ) |

| Accounts payable | |

| (257,827 | ) | |

| 1,560,215 | |

| Accrued expenses | |

| (325,096 | ) | |

| 845,442 | |

| Accrued compensation | |

| (1,033,907 | ) | |

| (736,474 | ) |

| Operating lease liability | |

| (106,414 | ) | |

| (95,932 | ) |

| Net Cash Used In Operating Activities | |

| (13,921,321 | ) | |

| (12,677,435 | ) |

| | |

| | | |

| | |

| Cash Flows From Financing Activities: | |

| | | |

| | |

| Proceed from common stock option exercise | |

| — | | |

| 31,267 | |

| Net Cash Provided By Financing Activities | |

| — | | |

| 31,267 | |

| | |

| | | |

| | |

| Net Change in Cash and Cash Equivalents | |

| (13,921,321 | ) | |

| (12,646,168 | ) |

| Cash and Cash Equivalents - Beginning of Period | |

| 26,480,928 | | |

| 41,711,690 | |

| Cash and Cash Equivalents - End of Period | |

$ | 12,559,607 | | |

$ | 29,065,522 | |

7

v3.24.1.1.u2

Cover

|

May 14, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 14, 2024

|

| Entity File Number |

001-38174

|

| Entity Registrant Name |

Citius

Pharmaceuticals, Inc.

|

| Entity Central Index Key |

0001506251

|

| Entity Tax Identification Number |

27-3425913

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

11 Commerce Drive

|

| Entity Address, Address Line Two |

1st Floor

|

| Entity Address, City or Town |

Cranford

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07016

|

| City Area Code |

908

|

| Local Phone Number |

967-6677

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, $0.001 par value

|

| Trading Symbol |

CTXR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

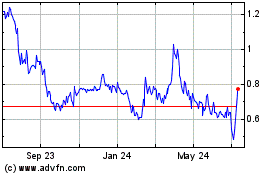

Citius Pharmaceuticals (NASDAQ:CTXR)

Historical Stock Chart

From Apr 2024 to May 2024

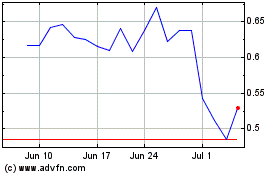

Citius Pharmaceuticals (NASDAQ:CTXR)

Historical Stock Chart

From May 2023 to May 2024