FOR: ARIAN SILVER CORPORATION

TSX VENTURE, AIM, PLUS SYMBOL: AGQ

FRANKFURT SYMBOL: I3A

December 1, 2008

Arian Silver Strategy Update and Results for the Three and Nine Months Ended September 30, 2008

LONDON, UNITED KINGDOM--(Marketwire - Dec. 1, 2008) -

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES NOR FOR DISTRIBUTION IN THE UNITED STATES

Arian Silver Corporation ("Arian" or the "Company")(TSX VENTURE:AGQ)(AIM:AGQ)(PLUS:AGQ)(FRANKFURT:I3A) today

announced a strategy update together with its unaudited results for the three and nine months ended September

30, 2008. Extracts from the management's discussion and analysis and financial statements are reported below.

All amounts are expressed in US dollars unless otherwise stated.

Arian's Chief Executive Officer, Jim Williams, commented today "Following on from the excellent progress at our

San Jose project reported in Q2, the final Phase-1 drilling results from our Tepal property were calculated,

which resulted in a 36% upgrade of previously reported "inferred" resources into the "indicated" resource

category. This confirms the excellent continuity of mineralisation in multiple directions on our Tepal

property, which in turn gives us great encouragement for potential expansion of resources.

Regarding our Phase-2 drilling programme at San Jose, we have now completed nearly 7,000m of drilling in 38

drill holes. Results from assay batches comprising the initial 19 drill holes were very encouraging as reported

in our press release dated 6 November 2008. On receipt of outstanding assay results a further update of the

resource model estimate will be calculated and reported to shareholders.

Meanwhile we continue to dewater the San Jose mine workings and will carry out additional underground sampling

to supplement our drilling on "new" areas exposed by lowering the water table. In addition we are also close to

completing an initial scoping study to examine a preliminary production scenario based on some of our existing

resources and involving contract mining and toll milling.

On 24 October 2008 we completed a non-brokered private placement at Cdn$0.10 per share which raised Cdn$1.75

million and we are also starting to receive repayment of approximately $1 million of Mexican sales tax relating

to past exploration expenditure. This should allow us to complete the scoping study and re-evaluate the overall

resource potential at San Jose. However, I am sure all shareholders are aware of the global financial issues

that are affecting not only our industry but also the whole investment spectrum. Our Company in common with all

junior exploration companies requires access to equity markets as they develop and of course during 2008 this

has become increasingly difficult. Accordingly we have decided to operate at a reduced pace until market

conditions improve. We have, therefore, deferred some 5,000m of additional drilling planned as a finalisation

of the Phase-2 programme at San Jose as well as curtailing exploration on the other projects in our extensive

portfolio. We are also making reductions in overheads in our London and Mexican offices.

We believe we have already identified a very significant silver-lead-zinc resource at San Jose with obvious

expansion potential. We have established excellent management teams in Mexico and London and once the financial

markets stabilize we expect the value of the assets in Arian to be recognized and re-rated in due course."

CURRENT STRATEGY

As the Company's projects are in an exploration phase it is currently reliant on external funding to progress

its programmes. Given the current turmoil in financial and securities markets the Board has implemented

measures to preserve the cash resources of the Company. To this end planned exploration programmes have been

deferred and those in progress largely curtailed; in addition, steps have been taken to reduce overheads

generally.

The directors are investigating potential sources of funding, other than through direct equity placements,

which may be available so as to enable the Company to continue to build on the exploration successes achieved

to-date and to further the development of the Company and its mineral properties.

See Liquidity and Capital Resources discussion below.

MANAGEMENT'S DISCUSSION AND ANALYSIS AND FINANCIAL STATEMENTS

The Management's Discussion and Analysis of results for the three and nine months ended September 30, 2008

("MD&A") and unaudited Financial Statements for the Company for the three and nine months ended September 30,

2008 ("Financials") are available at SEDAR at www.sedar.com or on the Company's website at www.ariansilver.com.

These documents can also be obtained on application to the Company. The following information has been

extracted from the MD&A and Financials. The financial information in this announcement does not constitute full

statutory accounts.

HIGHLIGHTS

Financial

- As at September 30, 2008, the Company had assets of $8.8 million, including intangible assets of $7.5

million, receivables of $1.0 million and cash of $0.2 million.

- Expenditure on projects in Mexico and on other assets in the nine months was $3.1 million.

- Consolidated pre-tax loss for the nine months of $3.3 million.

Post September 30, 2008

- In October 2008 the Company raised Cdn$1.75 million through an issue of shares at Cdn$0.10 per share.

Operational

- Two major Phase-1 drilling programmes completed at the San Jose project (11,722 metres ("m")) and at the

Tepal project (7,178m).

- Initial Canadian National Instrument 43-101 (NI 43-101) mineral resource estimates in respect of the San Jose

and Tepal projects released (March).

- Upgraded NI 43-101 mineral resource estimates released in respect of the San Jose project (August) and the

Tepal project (September).

- Phase-2 drill programme drilled 38 holes totaling 6,600m at the San Jose project. Initial results announced

November 6, 2008.

FINANCIAL RESULTS

Three months ended September 30, 2008

The loss for the period was $1.8 million (2007 - $1.1 million), consisting of the expensing of the fair value

of share options vesting of $0.4 million (2007 - $0.2 million), a foreign exchange charge of $0.6 million (2007

- crediting a foreign exchange gain of $0.1 million) and other administrative expenses of $0.8 million (2007 -

$1.1 million). The foreign exchange adjustments arise on consolidation, largely as a result of the translation

of the Mexican subsidiary's financial statements from Mexican Peso to US Dollars.

Nine months ended September 30, 2008

In the nine months to September 30, 2008, the Company incurred a loss of $3.3 million (2007 - $3.7 million)

after expensing the fair value of options vesting of $0.5 million (2007 - $1.0 million), a foreign exchange

charge of $0.2 million (2007 - crediting a foreign exchange gain of $0.2 million) and other administrative

expenses of $2.6 million (2007 - $3.0 million). The foreign exchange adjustments arise on consolidation,

largely as a result of the translation of the Mexican subsidiary's financial statements from Mexican Peso to US

Dollars. There was no income other than interest from short-term cash deposits of $20,000 (2007 - $44,000). The

Company continued to incur costs in relation to its Mexican operations and in respect of corporate overheads.

In the nine months to September 30, 2008, intangible assets increased by $3.0 million to $7.5 million in

respect of deferred exploration and evaluation costs related to the Mexican projects.

LIQUIDITY AND CAPITAL RESOURCES

In management's view, the most meaningful information concerning the Company relates to its current liquidity

and solvency since it is not currently generating any income from its mineral projects.

The Company will require additional funding in the future in order to progress exploration programmes on its

mineral projects, to meet property option payments, for development and for general working capital

requirements. Sources of funds currently available to the Company are through the issue of equity capital, the

sale of its interests in one or more of its projects, by way of project joint ventures or business

combinations.

The Company has accumulated IVA (sales tax), which amounted to $997,000 at September 30, 2008. This relates to

past exploration expenditure and is now being repaid in installments by the Mexican tax authorities. Any delay

in future repayments of this IVA debtor will have an impact on the timing of further funding required for the

Company and could bring forward a funding requirement into Q1 of 2009. The directors are currently

investigating funding options, other than through direct equity placements, which may be available to the

Company in the future.

Since the Company is at an early stage of development, it has in the past raised funds in several discrete

tranches, which is a common practice for junior mineral exploration companies. Although the Company has been

successful in the past in raising equity finance, there can be no assurance that the funding required by the

Company will be made available to it when needed or, if such funding were to be available, that it would be

offered on reasonable terms. The terms of such financing might not be favourable to the Company and might

involve substantial dilution to existing shareholders.

The directors of the Company currently believe it appropriate to prepare the Company's financial statements on

a going concern basis. However, if the Company is unable to raise sufficient financing in the future, it may

not be able to meet its ongoing working capital and other expenditure requirements. If these circumstances

arose this would cast significant doubt on the Company's ability to continue as a going concern.

See Risks and Uncertainties set out in the MD&A as well as Risks and Uncertainties - Requirement of Additional

Financing in the Company's 2007 Annual MD&A for details of additional risks associated with future funding of

the Company.

Working Capital

As at September 30, 2008, the Company had working capital of approximately $0.5 million (December 31, 2007:

$3.5 million). As detailed in Overview of Operations - Exploration and development commitments as at September

30, 2008 in the MD&A the Company will need to make some material payments in order to maintain in good standing

its interests in certain properties. The next such payment amounting to $255,000 falls due in February 2009.

The decrease in working capital during the period is the result of project and administrative expenditure.

The most significant asset at September 30, 2008 was intangible assets of $7.5 million (December 31, 2007: $4.4

million). In addition, there were tangible assets of $0.2 million (December 31, 2007: $0.2 million) and

receivables were $1.0 million (December 31, 2007: $0.7 million). Cash was $0.2 million (December 31, 2007: $3.1

million). Payables were $0.6 million (December 31, 2007: $0.3 million).

In May 2008 the Company raised approximately Cdn$3 million by way of a private placement of approximately 12

million units (each a "Unit") at Cdn$0.25 per Unit. Each Unit consisted of one common share and one-half of one

common share purchase warrant. Each whole warrant will entitle the holder to acquire one common share of the

Company at an exercise price of Cdn$0.35 share for a period of 18 months from the closing date of the

placement. The warrants are also subject to an accelerated exercise provision.

In October 2008 the Company raised Cdn$1.75 million by way of a private placement of 17.5 million common shares

at Cdn$0.10 per share.

REVIEW OF OPERATIONS

The Company owns, or has options to purchase, 39 mineral concessions in Mexico totaling 21,691 hectares (Ha).

The Company's main projects are the Calicanto Group and San Jose, in Zacatecas state, and the Tepal project in

Michoacan State.

During the period, the Phase-1 drill programmes were completed on both the Tepal and San Jose Projects;

drilling at San Jose amounted to 11,722 metres (m) and 7,178m at Tepal. A Phase-2 drill programme was started

at San Jose during Q2 and was terminated in Q3 with approximately 6,600m drilled in 38 holes. Assaying of core

from the San Jose Phase-2 drilling programme is, however, being continued and in November 2008 the Company

announced the results from the first 19 drill holes from the Phase-2 drill programme. In July 2008 the Company

announced that a scoping study had been initiated at San Jose. At the Calicanto Project work focused on general

security and fences were erected around all open shafts and mine workings. Work also continued on sampling and

mapping to gain a better understanding of the mineral structural controls within the Calicanto Project area.

The Company reported its initial Canadian National Instrument 43-101 (NI 43-101) compliant resource estimates

for both San Jose and Tepal during Q1 of 2008. These were prepared by A.C.A. Howe International Limited,

independent consultants. During Q3 the Company announced updated mineral resource estimates in respect of both

San Jose and Tepal, details of which are set out below.

During the period, the Company appointed Graham Tye, a Spanish speaking mining engineer with over 25 years of

industry experience, as Chief Operating Officer.

Qualified Person

Mr. Jim Williams. Eur Ing, Eur Geol, BSc, MSc, D.I.C., FIMMM, the Chief Executive Officer of Arian, a

"Qualified Person" as defined in the AIM guidelines of the London Stock Exchange, and a "Qualified Person" as

such term is defined in NI 43-101 has reviewed and approved the technical information in this document other

than the mineral resource estimates.

San Jose Project, Ojocaliente District, Zacatecas State

On August 21, 2008 the Company announced an updated NI 43-101 mineral resource estimate for the property (see

the Company's press release dated August 21, 2008 entitled "Arian Silver Upgrades San Jose Resource Estimate").

The resource of 11,190,000 tonnes in the inferred mineral resource category, containing 33.76 million (M)

ounces (oz) of silver (Ag), 95.7 M pounds (lbs) of lead (Pb) and 205.5 Mlbs of zinc (Zn), has been defined from

the Phase-1 drill-holes drilled by Arian from May 2007 to March 2008.

/T/

NI 43-101 Resources at San Jose

----------------------------------------------------------------------------

Grade Contained Metal

Resource

Category Tonnes Ag Pb Zn Ag Pb Zn

----------------------------------------------------------------------------

g/t % % (oz) (t) (t)

----------------------------------------------------------------------------

Indicated 2,196,000 127.7 0.51 0.88 9.02 11,200 19,200

----------------------------------------------------------------------------

Inferred 11,190,000 93.8 0.39 0.83 33.76 43,400 93,200

----------------------------------------------------------------------------

1. Geological characteristics and +30 ppm grade envelopes used to define

resource volumes

2. The mineral resource estimates are in accordance with CIM and JORC

standards

3. The effective date of the mineral resource estimates is August 15, 2008

4. The estimates are based on geostatistical data assessment and

computerised IDW3, Ag grade wireframe restricted, linear block modeling.

/T/

The "Qualified Person" as such term is defined in NI 43-101 who prepared the above mineral resource estimates

is Mr. Galen R White. Mr. White was at the time these estimates were prepared an employee of A.C.A. Howe

International Limited.

On November 6, 2008 the Company announced the results from the first 19 drill holes from the Phase-2 drill

programme (see the Company's press release dated November 6, 2008 entitled "Arian Silver Reports Phase-2 Assays

on Initial 19 Holes at San Jose"). The results continue to confirm the high-grade zones discovered in the Phase-

1 drill programme and show that the high-grade zones are even more extensive. In addition, several drill holes

intersected newly discovered high-grade silver mineralisation.

/T/

The latest results included:

- 2m @ 915 g/t Ag, 0.54% Pb and 0.46% Zn

- 3m @ 319 g/t Ag, 0.32% Pb and 0.62% Zn

- 6m @ 223 g/t Ag

- 2.1m @ 775 g/t Ag

- 3.6m @ 253 g/t Ag, 0.58% Pb, 1.07% Zn

/T/

Tepal Project; Michoacan State

On September 24, 2008 the Company announced an updated mineral resource estimate in respect of Tepal (see the

Company's press release dated September 24, 2008 entitled "Arian Silver Upgrades Tepal Resource Estimate")

details of which are set out below.

The latest resource estimate is 54,964,000 tonnes in the inferred mineral resource category, containing 720,000

ounces (oz) of gold (Au) and 265.4 million pounds (lbs) of copper (Cu), for a gold-equivalent (Au-Eq) of

1,612,000 oz, has been defined from the Phase-1 drill-holes drilled from April 2007 to April 2008. In addition,

the resource estimate has upgraded 36% of the previously defined inferred mineral resource to the indicated

mineral resource category, and this represents 24,995,000 tonnes, containing 440,000 oz of Au and 147.1 million

lbs of Cu, for a Au-Eq of 938,000 oz.

/T/

Tepal Mineral Resources

-----------------------

----------------------------------------------------------------------------

Grade Contained Metal

Tonnes Au Cu AuEq Au Cu AuEq

----------------------------------------------------------------------------

('000) g/t % g/t (oz x 000's) (Mlbs) (oz x 000's)

----------------------------------------------------------------------------

Indicated 24,995 0.54 0.27 1.2 440 147.1 938

----------------------------------------------------------------------------

Inferred 54,964 0.41 0.22 0.9 720 265.4 1,612

----------------------------------------------------------------------------

1 Au equals Gold. Cu equals Copper. AuEq equals Gold Equivalent

2 Arian Silver has an exclusive option agreement to purchase 100% of the

Tepal properties

3 Gold Equivalent Grades (g/t) were calculated using metal prices of

US$600/oz Au, US$2/lb Cu and assuming 100% recoveries

4 The mineral resource estimates are in accordance with CIM and JORC

standards

5 The effective date of the mineral resource estimates is September 24, 2008

6 The estimates are based on geostatistical data assessment and computerised

IDW3, 0.18 g/t Au grade wireframe envelope restricted, linear block

modeling

/T/

The "Qualified Person", as such term is defined in NI 43-101, who prepared the above mineral resource

estimates, is Mr. Galen White. Mr. White was at the time these estimates were prepared an employee of A.C.A.

Howe International Limited.

Arian Silver Corporation is a silver exploration company listed on London's AIM and "PLUS", on Toronto's TSX

Venture Exchange and on the Frankfurt Stock Exchange. Arian is active in Mexico, the world's largest silver

producing country. The Company's main projects are the Calicanto Group and San Jose, in Zacatecas state, and

the Tepal project in Michoacan State. Part of Arian's forward-looking strategy lies in the envisaged use of

large scale mechanised mining techniques over wider mineralised structures, which reduces the overall operating

cost per ounce of silver, and to build up National Instrument 43-101 compliant resources.

Further information can be found by visiting Arian's website: www.ariansilver.com or the Company's publicly

available records at www.sedar.com.

THIS PRESS RELEASE IS NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES NOR FOR DISSEMINATION IN THE

UNITED STATES

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the

securities of the Company in the United Sates. The securities of the Company have not been and will not be

registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state

securities laws and may not be offered or sold within the United States or to U.S. persons unless registered

under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is

available.

Cautionary Note Regarding Forward-Looking Statements

This press release contains certain "forward-looking statements". All statements, other than statements of

historical fact, that address activities, events or developments that the Company believes, expects or

anticipates will or may occur in the future (including, without limitation, the mineral resource estimates

contained in this press release, statements regarding exploration results, potential mineralisation, potential

mineral resources, future production and the Company's exploration and development plans and objectives) are

forward-looking statements. These forward-looking statements reflect the current expectations or beliefs of the

Company based on information currently available to the Company. Forward-looking statements are subject to a

number of risks and uncertainties that may cause the actual results of the Company to differ materially from

those discussed in the forward-looking statements, and even if such actual results are realised or

substantially realised, there can be no assurance that they will have the expected consequences to, or effects

on the Company. Factors that could cause actual results or events to differ materially from current

expectations include, among other things, failure to establish estimated mineral reserves, the possibility that

future exploration results will not be consistent with the Company's expectations, uncertainties relating to

the availability and costs of financing needed in the future, changes in commodity prices, changes in equity

markets, political developments in Mexico, changes to regulations affecting the Company's activities, delays in

obtaining or failures to obtain required regulatory approvals, the uncertainties involved in interpreting

exploration results and other geological data, and the other risks involved in the mineral exploration and

development industry. Any forward-looking statement speaks only as of the date on which it is made and, except

as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any

forward-looking statement, whether as a result of new information, future events or results or otherwise.

Although the Company believes that the assumptions inherent in the forward-looking statements are reasonable,

forward-looking statements are not guarantees of future performance and accordingly undue reliance should not

be put on such statements due to the inherent uncertainty therein.

The mineral resource figures disclosed in this press release are estimates and no assurances can be given that

the indicated levels of minerals will be produced. Such estimates are expressions of judgment based on

knowledge, mining experience, analysis of drilling results and industry practices. Valid estimates made at a

given time may significantly change when new information becomes available. While the Company believes that the

resource estimates included in this press release are well established, by their nature resource estimates are

imprecise and depend, to a certain extent, upon statistical inferences, which may ultimately prove unreliable.

If such estimates are inaccurate or are reduced in the future, this could have a material adverse impact on the

Company.

Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no

certainty that mineral resources can be upgraded to mineral reserves through continued exploration.

-30-

FOR FURTHER INFORMATION PLEASE CONTACT:

Arian Silver Corporation

Jim Williams

CEO

(London) +44 (0)207 529 7511

Email: jwilliams@ariansilver.com

Website: www.ariansilver.com

OR

Bishopsgate Communications Limited

Nick Rome

(London) +44 (0)207 562 3350

Email: Nick.Rome@bishopsgatecommunications.com

OR

Vicarage Capital Limited

Martin Wood

(London) +44 (0)207 562 3350

Email: martin@vicaragecapital.com

OR

Grant Thornton Corporate Finance

Gerry Beaney

(London) +44 (0)207 385 5100

Email: gerry.d.beaney@gtuk.com

OR

CHF Investor Relations

Alison Tullis

(Canada) (416) 868-1079 Ext. 233

Email: Alison@chfir.com

The TSX Venture Exchange does not accept responsibility for the adequacy or accuracy of this release.

No stock exchange, securities commission or other regulatory authority has approved or disapproved the

information contained herein.

-0-

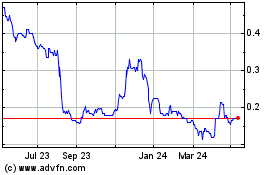

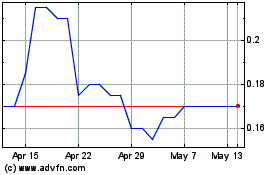

Arian Silver

Alien Metals (LSE:UFO)

Historical Stock Chart

From May 2024 to Jun 2024

Alien Metals (LSE:UFO)

Historical Stock Chart

From Jun 2023 to Jun 2024