Sun Life CIO: US Fed "Powerless" To Stimulate Economy

October 25 2011 - 10:05AM

Dow Jones News

A top Sun Life Financial Inc. (SLF) executive says the U.S.

Federal Reserve's main tool to stimulate economic growth is no

longer effective.

The U.S. central bank's ability to spur mortgage refinancing

through low interest rates isn't possible because housing prices

are too low, said Stephen Peacher, Sun Life's chief investment

officer.

The Fed "is powerless to stimulate the economy," he said at the

Toronto Forum for Global Cities conference in Toronto.

The Fed "can't do much about today's economy," he said.

The average mortgage rate fell from 11% in 1983 to 5%, he

said.

"It doesn't work today because home prices are too low," he

said.

Former Fed chief Paul Volcker is "singularly responsible" for

the 2008 financial crisis because "he broke the back of inflation"

in the 1980s, leading to steadily declining interest rates, and

rising asset prices that in turn led to excessive leverage in the

financial system, Peacher said.

"No good deed goes unpunished," Peacher said.

-By Caroline Van Hasselt; Dow Jones Newswires; 416-306-2023;

caroline.vanhasselt@dowjones.com

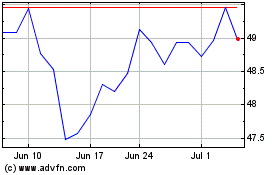

Sun Life Financial (NYSE:SLF)

Historical Stock Chart

From Aug 2024 to Sep 2024

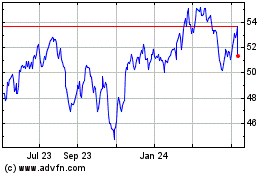

Sun Life Financial (NYSE:SLF)

Historical Stock Chart

From Sep 2023 to Sep 2024