Cemex to Sell U.S Assets to Grupo Cementos de Chihuahua for $400 Million

May 02 2016 - 12:50PM

Dow Jones News

MEXICO CITY—Cement and building materials company Cemex SAB has

agreed to sell assets in the U.S. to Mexico's Grupo Cementos de

Chihuahua SAB for $400 million as part of its plans to sell as much

as $1.5 billion in assets this year and next.

The facilities include cement plants in Odessa, Texas, and

Lyons, Colo., three cement terminals and a building materials

business in El Paso, Texas, and Las Cruces, N.M, Cemex said Monday

in a release.

Grupo Cementos de Chihuahua, or GCC, which has operations in

Mexico and the U.S., said the planned acquisition will add 1

million metric tons of cement capacity to its existing 4.6 million

tons.

The assets strengthen GCC's geographic footprint in key regional

markets and support the company's long-term growth plans for the

U.S. with a 45% increase in its cement capacity there, GCC

said.

Cemex has a minority stake in Chihuahua-based GCC, which had

sales last year of $752 million, of which around 70% were in the

U.S.

The companies expect the deal to close by the end of this

year.

Monterrey-based Cemex aims to sell assets for as much as $1.5

billion in 2016 and 2017 to pay down debt as its seeks to recover

the investment grade ratings it lost during the 2008 global crisis.

The company aims to lower its debt by $2 billion this year and

next.

Cemex's debt was $16 billion at the end of March, although that

included proceeds from a recent $1 billion bond sale that it will

use to buy back existing debt in the current quarter.

Cemex shares were up 1.6% early Monday on the Mexican stock

exchange.

Write to Anthony Harrup at anthony.harrup@wsj.com

(END) Dow Jones Newswires

May 02, 2016 12:35 ET (16:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

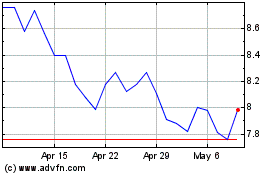

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Aug 2024 to Sep 2024

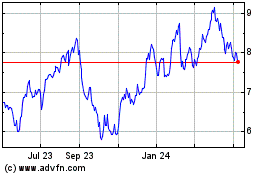

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Sep 2023 to Sep 2024