SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of February, 2010

Commission File Number 1-14732

COMPANHIA SIDERÚRGICA NACIONAL

(Exact name of registrant as specified in its charter)

National Steel Company

(Translation of Registrant's name into English)

Av. Brigadeiro Faria Lima 3400, 20º andar

São Paulo, SP, Brazil

04538-132

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

MINUTES OF THE EXTRAORDINARY SHAREHOLDERS’ MEETING OF COMPANHIA SIDERÚRGICA NACIONAL HELD ON JANUARY 29, 2010, AND DRAWN UP IN SUMMARY FORM

Company Registry (NIRE): 33300011595

1. Date:

January 29, 2010.

2. Time:

2:00 p.m.

3. Venue:

Av. Brigadeiro Faria Lima, nº 3400 – 20º andar, São Paulo, SP.

4. Attendance:

The meeting was attended by Benjamin Steinbruch, Jacks Rabinovich, Antonio Francisco dos Santos, Yoshiaki Nakano, Dionísio Dias Carneiro, Gilberto Sayão da Silva, Fernando Perrone – Members; and Claudia Maria

Sarti – Secretary, with the meeting being held via conference call.

5. Agenda:

To resolve on the initial issue, by the Company, of up to 450 (four hundred and fifty) commercial promissory notes for public distribution with restricted placement efforts, in 3 (three) series, totaling up to

R$9,999,999,999.00 (nine billion, nine hundred and ninety-nine million, nine hundred and ninety-nine thousand, nine hundred and ninety-nine reais) (“

Commercial Notes

”), pursuant to CVM Instruction 134 (“

CVM

”) of

November 1, 1990, as amended (“

CVM Instruction 134

”) , CVM Instruction 155 of August 7, 1991, as amended, and CVM Instruction 476 of January 16, 2009 (“

CVM Instruction

476

”) (“

Offering

”).

6. Resolutions:

Pursuant to subitem XXVII, article 17 of the Company’s Bylaws, the Members of the Board of Directors unanimously decided, without any restrictions, to approve the following resolutions:

6.1 To undertake the Offering as follows:

I. Number of Issue. The Commercial Notes constitute the Company’s first issue of commercial promissory notes for public distribution.

II. Total amount of the Offering. The total amount of the Offering is up to R$9,999,999,999.00 (nine billion, nine hundred and ninety-nine million, nine hundred and ninety-nine thousand, nine hundred and ninety-nine reais) on the Issue Date (as

defined below).

III. Series. The Commercial Notes will be issued in 3 (three) series.

IV. Number. A total of 450 (four hundred and fifty) Commercial Notes will be issued, as follows: (i) up to 150 (one hundred and fifty) in the first series; (ii) up to 150 (one hundred and fifty) in the second series; and (iii) up to 150 (one hundred

and fifty) in the third series. The Company shall not place the second series of Commercial Notes before placing the entire first series or cancelling any remaining Notes, nor place the third series of Commercial Notes before placing the entire first and second series or

cancelling any remaining Notes. Accordingly, after the Commercial Notes of any series are placed, any remaining Notes from said series will be automatically canceled, the Company’s Executive Board being duly authorized to take any and all

measures and sign any and all documents needed for this purpose.

V. Nominal Unit Value: the nominal unit value of (i) the first series of Commercial Notes will be R$26,666,666.66 (twenty six million, six hundred and sixty-six thousand, six hundred and sixty-six reais and sixty-six centavos); (ii) the second

series of Commercial Notes will be R$20,000,000.00 (twenty million reais); and (iii) the third series Commercial Notes will be R$20,000,000.00 (twenty million reais) (the nominal unit value of the Commercial Notes will be referred to as

“

Nominal Unit Value” when being referred to in a non-

discriminatory manner.

VI. Form. The Commercial Notes will be issued in registered form and will be deposited with the service provider of the agent bank. The ownership of Commercial Notes held in custody by CETIP S.A. – OTC Clearing House (“

CETIP

"), for

all purposes of the law, will be confirmed via a statement issued by CETIP on behalf of the respective holders.

VII. Issue Date. The Issue Date of each Commercial Note will correspond to the date of subscription and payment of the respective

Commercial Note (“

Issue Date

”).

VIII. Term and Maturity Date. Each Commercial Note will mature 360 (three hundred and sixty) days after the Issue Date (“

Maturity Date

”).

IX. Placement. The Commercial Notes will be

publicly distributed with restricted placement efforts to qualified investors, pursuant to article 4 of CVM Instruction 476 ("

Qualified

Investors

"), under a firm settlement guarantee. The Offering will be deemed to have been carried

out even if only 1 (one) Commercial Note is placed.

X. Subscription: The Commercial Notes will be subscribed in accordance with the procedures of the NOTA – Commercial Note Module ("

NOTA Module

"), administered and conducted by CETIP, which will also be responsible for the settlement of

the Offering.

XI. Price and Means of Payment. Each Commercial Note will paid in cash, in local currency, on the respective Issue Date, at the Nominal Unit Value.

XII. Trading. The Commercial Notes will be registered for trading on the secondary market, through the NOTA Module, and settled and deposited electronically by CETIP. The Commercial Notes will be traded by Qualified Investors only and trading may

only begin 90 (ninety) days after the respective subscription or acquisition date, pursuant to Article 13 of CVM Instruction 476.

XIII. Payment of Nominal Unit Value. The Nominal Unit Value of each Commercial Note will be paid on the respective Maturity Date or, if the case may be, on the early redemption or early maturity dates, pursuant to the terms and conditions in the

documentation of the Commercial Notes.

XIV. Remuneration. The Nominal Unit Value of each Commercial Note will not be restated monetarily. Interest on the Nominal Unit Value of each Commercial Note will be 105.2% (one hundred and five point two per cent) of the variation in the average

daily Interbank Deposit (DI) rate,

over extra-grupo

, expressed as an annual percentage, based on 252 (two hundred and fifty-two) business days, calculated and published daily by CETIP in its daily bulletin on its website

(

http://www.cetip.com.br

) ("

Remuneration

"), calculated exponentially and cumulatively on a

pro rata temporis

basis per business day elapsed between the Issue Date and the effective Payment Date, calculated according to the

criteria defined by CETIP based on the formula available on its website (

http://www.cetip.com.br

). The Remuneration will be paid 180 (one hundred and eighty) days after the Issue Date and on the respective Maturity Date or, if the case may be, on the early redemption or early maturity dates, pursuant to the terms and conditions in the

documentation of the Commercial Notes.

XV. Early Redemption. Pursuant to article 7, paragraph 2 of CVM Instruction 134, and having been authorized to do so by the holders of the Commercial Notes upon their subscription or acquisition, the Company may unilaterally redeem said Notes in

advance, either wholly or partially, at any time as of 30 (thirty) days after the Issue Date, in accordance with the following procedures:

(a) within at least 5 (five) business days prior to the date of said redemption, the company shall send a

communication to the Fiduciary Agent and CETIP containing (i) the redemption date; and (ii) a declaration of whether the redemption will be total or partial, and, if partial, the number of Commercial Notes to be redeemed, subject to item (d) below;

2

(b) within 4 (four) business days as of the receipt of the communication referred to in item (a) above, the Fiduciary Agent shall submit said communication to the holders of the Commercial Notes;

(c) the total early redemption of the Commercial

Notes must always comprise all 3 (three) series; and

(d) The partial early redemption of the Commercial Notes should (i) correspond to, at least, the lower amount between (1) the amount equivalent to 30% (thirty percent) of the remaining balance of

the Commercial Notes; and (2) R$2,000,000,000.00 (two billion reais), except if the early payment refers to the final remaining balance of the Commercial Notes, in which case the due Remuneration must be added; (ii) correspond to all the

Commercial Notes; (iii) correspond to the same number of Commercial Notes from each of the (3) three series; and (iv) pursuant to article 7, paragraph 4 of CVM Instruction 134, be preceded by a draw, to be held by the Fiduciary Agent at the expense

of the Company, in compliance with item (iii) above, after which the result shall be communicated to the holders of the Commercial Notes within a minimum of 3 (three) business days before the date of the respective redemption.

XVI. Guarantees. The following guarantees will be constituted, without any suretyship: (a) the pledge of the total number of shares issued by CIMPOR – Cimentos de Portugal, SGPS, S.A. ("

CIMPOR

") owned by the Company or its subsidiaries,

along with all their respective rights, including the right to dividends and similar payments; and (b) the fiduciary assignment of credit rights held by the Company for the proceeds credited after the issue of the Commercial Notes, held in deposit

in specific accounts owned by CSN while they are not being used for the purposes set forth in the Commercial Notes, as described below.

XVII. Allocation of Proceeds. The net proceeds raised by the Company through the issue of the Commercial Notes will be used exclusively to (i) pay for the acquisition of the shares issued by CIMPOR within the scope of the general and voluntary

public offering for the acquisition of 672,000,000 (six hundred and seventy-two million) common, registered, book-entry shares representing 100% of CIMPOR’s capital by the Company or its subsidiary; or (ii) settle “Bank Letter of Credit

175.505.401” issued by the Company in favor of Banco do Brasil S.A., in the principal amount of R$4,000,000,000.00 (four billion reais), “Bank Letter of Credit 100110010007000” issued by the Company in favor of Banco Itaú

BBA S.A., in the principal amount of R$3,000,000,000.00 (three billion reais) and “Bank Letter of Credit 237/2372/181” issued by the Company in favor of Banco Bradesco S.A., in the principal amount of R$3,000,000,000.00 (three

billion reais).

XVIII. Early Maturity. The Commercial Notes will have early maturity under the conditions set forth in the documentation of the Commercial Notes.

XIX. Place of Payment: Payments related to the Commercial Notes and any other amounts due by the Company in accordance with the terms of said Notes will be effected (i) in the case of those Commercial Notes deposited with CETIP, pursuant to

CETIP’s procedures; and (ii) in relation to those Commercial Notes not deposited with CETIP, pursuant to the procedures of the agent bank or at the Company’s headquarters.

XX. Extension of Terms. The payment terms of any obligations envisaged by the Commercial Notes will be extended to the first subsequent business day if the maturity date coincides with a non-business day for commercial banks in the city and state of

São Paulo, with no addition to the amount due, except when said payments are made through CETIP, when such extensions will be granted only if the payment date coincides with national holidays, Saturdays or Sundays.

6.2 To authorize the Company’s Executive Officers to (i) take all the measures necessary to effect the Offering, pursuant to the applicable legislation; (b) to sign all instruments and take all the measures needed to implement the Offering and

the Issue of Commercial Notes; and (iii) to hire the services of (a) BB-Banco de Investimento S.A., Banco Itaú BBA S.A. and Banco Bradesco BBI S.A to manage the Offering; and (b) other service providers for the Offering, such as the agent bank, fiduciary agent, depositary institutions and legal advisors, among others, and negotiate and sign the respective contracts.

3

6.3 To ratify all acts related to the Offering that were previously executed by the Company’s Executive Board, including the granting of proxies.

This is a free translation of the original minutes filed at the Company’s headquarters.

COMPANHIA SIDERÚRGICA NACIONAL

|

|

|

|

|

|

|

|

|

|

Claudia Maria Sarti

|

|

|

|

Secretary

|

|

4

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 10, 2010

|

COMPANHIA SIDERÚRGICA NACIONAL

|

|

|

|

By:

|

/

S

/ Benjamin Steinbruch

|

|

|

Benjamin Steinbruch

Chief Executive Officer

|

|

|

|

|

|

By:

|

/

S

/ Paulo Penido Pinto Marques

|

|

|

Paulo Penido Pinto Marques

Chief Financial Officer and Investor Relations Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or

results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

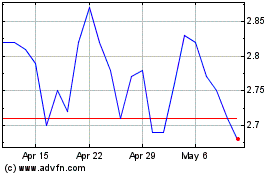

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Apr 2024 to May 2024

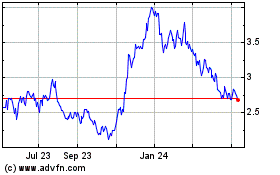

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From May 2023 to May 2024