Moody's Hits a New 52-Week High - Analyst Blog

May 15 2013 - 8:20AM

Zacks

Shares of Moody's Corp (MCO)

reached a new 52-week high of $66.70 on Tuesday, May 14, 2013. The

company has recently announced modest first-quarter results and

provided a positive FY13 outlook.

The closing price of Moody’s on May 14 was $66.68, representing

a phenomenal one-year return of about 76.03% and a year-to-date

return of about 28.8%. Average volume of shares traded over the

last three months stands at approximately 1807.7K.

Moody’s delivered an average positive earnings surprise of

10.72% over the past four quarters. This Zacks Rank #2 (Buy)

company has a market cap of $14.86 billion and a long-term expected

earnings growth rate of 13.9%.

First Quarter Highlights

Moody’s reported earnings (including litigation settlement

charge) of 83 cents which increased 9% on a year-over-year basis.

Revenues surged 13.0% year over year to $731.8 million primarily

driven by strong performance from both Moody’s Investors Service

(“MIS”) and Moody's Analytics (“MA”) division.

Guidance

Moody’s expects 2013 revenues to grow in the high single-digit

percent range. Moreover, MIS revenues for 2013 are expected to

increase in the high single-digit percent range. Moody’s also

expects MA revenues for 2013 to increase in the high single-digit

percent range.

Earnings for 2013 are expected to be in the range of $3.49 to

$3.59 per share. The Zacks Consensus Estimate is pegged at $3.58

per share.

Estimate Revision

In the last 30-day period, the Zacks Consensus Estimate moved up

a penny to 89 cents for the second quarter. During the period, one

upward revision and one subsequent downward revision were done by

analysts covering the stock.

Conclusion

Moody’s remains a solid franchise in rating debt instruments

based on its diversified credit research business model and

international growth opportunities. Moreover, the strength in new

domestic debt issuance and the improving clarity over regulatory

climate in Europe are positives.

Other Stocks to Consider

Other stocks that are worth considering include Dun

& Bradstreet Corp (DNB) and Factset Research

Systems Inc (FDS) both of which carry a Zacks Rank #3

(Hold). Euronet Worldwide (EEFT) has a Zacks Rank

#2 (Buy).

DUN &BRADST-NEW (DNB): Free Stock Analysis Report

EURONET WORLDWD (EEFT): Free Stock Analysis Report

FACTSET RESH (FDS): Free Stock Analysis Report

MOODYS CORP (MCO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

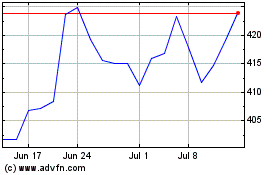

FactSet Research Systems (NYSE:FDS)

Historical Stock Chart

From Aug 2024 to Sep 2024

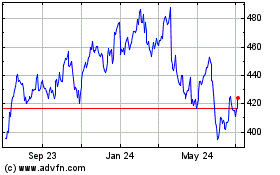

FactSet Research Systems (NYSE:FDS)

Historical Stock Chart

From Sep 2023 to Sep 2024