MARKET COMMENT: S&P/ASX 200 +0.9% As Offshore Risks Fade; NAB Leads

06 March 2013 - 11:31AM

Dow Jones News

0001 GMT [Dow Jones] Australia's S&P/ASX 200 is up 0.9% at

5119.1 on broad-based gains after hitting a 4 1/2 year high of

5124.6 in response to an abatement of offshore risks overnight. NAB

(NAB.AU) leads banks with a 2.4% rise on reports of plans to cut

A$900 million in costs over five years. Nufarm (NUF.AU) bounces 10%

on broker upgrades. Among other standouts, Woodside (WPL.AU), News

Corp. (NWS.AU), Brambles (BXB.AU), Macquarie (MQG.AU) and Amcor

(AMC.AU) are up 1.3%-2.1%. BHP (BHP.AU) is up 1.1%, but miners are

undershooting offshore peers' gains. Fortescue (FMG.AU) is down

0.9% after reversing a 2% rise, with spot iron ore down 2.4%

overnight. "The market has some blue sky above the previous high of

5112.5," says IG market strategist Stan Shamu. "While the Dow Jones

Industrial Average has set record highs, we are around 34% from our

record high of 6851." Mr. Shamu says improving confidence in

China's ability to rebalance its economy and sustain a high level

of economic growth is the key factor for Australia. "China has

reinforced the fact they are focused on a 7.5% GDP target by

flagging a 10% rise in fiscal spending this year." The market

awaits domestic 4Q GDP data at 0030 GMT.

(david.rogers1@wsj.com)

Contact us in Singapore. 65 64154 140; MarketTalk@dowjones.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

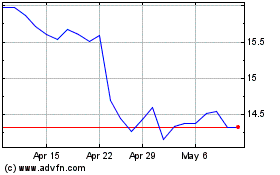

Brambles (ASX:BXB)

Historical Stock Chart

From Apr 2024 to May 2024

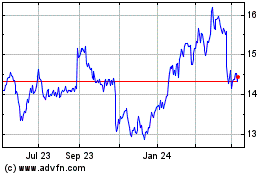

Brambles (ASX:BXB)

Historical Stock Chart

From May 2023 to May 2024