WPP Withdraws Guidance and Suspends Buyback, Dividend

March 31 2020 - 3:04AM

Dow Jones News

By Adria Calatayud

WPP PLC said Tuesday that it is withdrawing guidance for 2020

and has suspended its buyback program and final dividend for last

year to maintain liquidity amid uncertainty caused by the

coronavirus pandemic.

The London-based advertising giant said like-for-like net sales

fell 0.6% in the first two months of the year, but rose 0.4%

excluding the greater China region. In March, WPP's performance has

weakened, reflecting the spread of the virus and

government-containment actions, it said

The suspension of the buyback and 2019 final dividend will

preserve around 1.1 billion pounds ($1.36 billion) of cash, the

company said. The company said it will continue to review the

status of the 2019 dividend.

The company is also freezing new hires, reviewing freelance

expenditure, stopping discretionary costs and postponing planned

salary increases for 2020. WPP's executive committee members, as

well as its directors, have committed to a 20% reduction in their

salaries or fees for an initial period of three months. These

measures will save between GBP700 million and GBP800 million, it

said.

WPP said it has identified savings in excess of GBP100 million

in property and IT capital expenditure, around a quarter of its

initial budget for 2020.

WPP said it expects the impact of Covid-19 on the business will

increase in the second quarter but it isn't possible at this stage

to quantify the depth or duration of the impact.

As of Dec. 31, the company had cash of GBP3.0 billion and total

liquidity of GBP4.8 billion, while net debt stood at GBP1.5

billion.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

March 31, 2020 02:49 ET (06:49 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

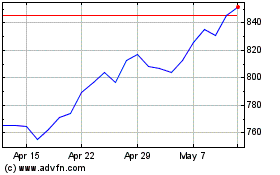

Wpp (LSE:WPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

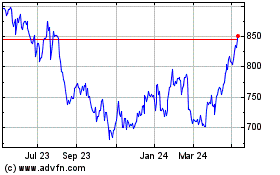

Wpp (LSE:WPP)

Historical Stock Chart

From Apr 2023 to Apr 2024