U.K. Makes U-Turn on Huawei After U.S. Pressure

July 14 2020 - 8:16AM

Dow Jones News

By Stephen Fidler and Max Colchester

LONDON -- The British government said it would bar telecom

companies from purchasing new equipment made by China's Huawei

Technologies Co. and gave them until 2027 to remove its technology

from their 5G networks, a sharp about-face that marks a significant

victory for the U.S.

The decision follows new U.S. restrictions on the sale of Huawei

computer chips and comes amid a broader deterioration of relations

between the U.K. and China, most recently relating to China's

imposition of a new security law over the former British colony of

Hong Kong.

Oliver Dowden, the British minister in charge of digital issues,

told the House of Commons on Tuesday that new purchases of Huawei

5G equipment would be barred from the end of this year and that the

Chinese company's gear would have to be stripped out of British

networks by 2027. As recently as January, the U.K. said it could

mitigate the risk of Huawei equipment in its networks.

The U.K is launching a consultation on when to ban the purchase

of Huawei kit from the country's fiber optic network. This will be

followed by a transition period that isn't expected to exceed two

years.

The move comes as U.S. pressure builds on European governments

to shut Huawei out of their 5G networks. Senior U.S. officials, led

by U.S. national security adviser, Robert O'Brien, and his

counterparts from Italy, Germany, France and the U.K. are meeting

in Paris this week.

The Trump administration ratcheted up its pressure on Huawei in

May, using export rules to bar global suppliers from selling the

company's chips produced using U.S. tools. British officials said

this raised questions about the quality of Huawei kit in the

future.

U.S. officials have long said Beijing could direct Huawei to

sabotage or spy through 5G networks, which promise to provide

superfast wireless speeds for coming technologies such as

self-driving cars. Huawei and the Chinese government reject the

charges.

Victor Zhang, head of Huawei's U.K. operations, said in June

that the company had a proven record and was happy to work with the

British government regarding "any concerns they may have and to

continue the working relationship we have had for the last 10

years." Huawei has secured a significant U.K. market share,

resulting from telecom providers' views of the company's equipment

as high-quality and inexpensive.

British relations with China have rapidly soured since Prime

Minister Boris Johnson gave Huawei the green light to build part of

its 5G network in January this year. At the time, government

officials said the risks related to Huawei could be mitigated, with

the equipment maker permitted to only have a maximum 35% market

share of the 5G network and to be excluded from its "core," where

much of the information on the network is processed.

The U.K.'s National Cyber Security Centre, part of the nation's

GCHQ electronic intelligence agency, launched a new review of

Huawei triggered by the U.S. export bans in May. The swift policy

reversal played out during the coronavirus pandemic.

The decision is expected to fuel broader discussions about how

the U.K., U.S. and other allies can wean themselves off Chinese

technology and production, an issue underscored in recent months by

reliance on Chinese-made medical supplies for hospitals and

caregivers.

Canada remains the lone country in the Five Eyes intelligence

alliance -- which also includes the U.S., U.K. Australia and New

Zealand -- that has yet to decide whether Huawei equipment can be

used in the domestic 5G network.

British telecoms executives have said that imposing a rapid

deadline to tear out Huawei gear from their networks would lead to

coverage blackouts for customers, cost billions of pounds and delay

the introduction of 5G.

Senior executives from Vodafone Group PLC and BT Group PLC told

a parliamentary committee last week that a five-to-seven-year time

frame would be needed to remove Huawei equipment to avoid

disruption. But a group of Conservative lawmakers has been pressing

the government to remove the equipment at a faster pace.

--Jenny Strasburg contributed to this article.

Write to Stephen Fidler at stephen.fidler@wsj.com and Max

Colchester at max.colchester@wsj.com

(END) Dow Jones Newswires

July 14, 2020 08:01 ET (12:01 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

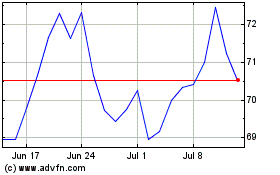

Vodafone (LSE:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

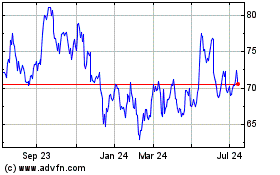

Vodafone (LSE:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024