Unilever PLC Treatment of hyperinflationary countries (8366M)

September 18 2019 - 9:00AM

UK Regulatory

TIDMULVR

RNS Number : 8366M

Unilever PLC

18 September 2019

Treatment of hyperinflationary countries in Underlying Sales

Growth (USG)

Until Q2 2019 our definition of Underlying Sales Growth (USG)

included the impact of volume and excluded the impact of price

growth in Argentina and Venezuela, as consumer price inflation

(CPI) rates had escalated to extreme levels.

After a full year of hyperinflationary conditions in Argentina,

one of our larger markets, it became clear that these conditions

would persist for some time. As a result, we announced with our

second quarter results that we would review our definition of USG.

Following the review, a new definition of USG for all countries

with hyperinflationary economies will be adopted from Q3 2019

onwards, including a change to historical comparators. A normalised

level of price growth will be included in USG, which will be capped

at an annual rate that is equivalent to approximately 2% per month

compounded. This cap is derived from one of the indicators of

hyperinflation cited in IAS 29 and ensures that any price growth

above this level will be excluded from USG.

This definition allows the full volume impact and limited price

growth to be included in USG but avoids the distortion of

hyperinflationary pricing beyond the capped level. We believe the

new definition better reflects our normal pricing actions, distinct

from those taken to respond to hyperinflationary conditions. This

also brings our definition of USG more in-line with peer group

companies.

The below tables show USG and UPG for the last four years

restated on the new basis and a comparison with the previously

reported numbers. There is no impact on turnover or any other line

of the income statement.

SAFE HARBOUR

This announcement may contain forward-looking statements,

including 'forward-looking statements' within the meaning of the

United States Private Securities Litigation Reform Act of 1995.

Words such as 'will', 'aim', 'expects', 'anticipates', 'intends',

'looks', 'believes', 'vision', or the negative of these terms and

other similar expressions of future performance or results, and

their negatives, are intended to identify such forward-looking

statements. These forward-looking statements are based upon current

expectations and assumptions regarding anticipated developments and

other factors affecting the Unilever Group (the 'Group'). They are

not historical facts, nor are they guarantees of future

performance.

Because these forward-looking statements involve risks and

uncertainties, there are important factors that could cause actual

results to differ materially from those expressed or implied by

these forward-looking statements. Among other risks and

uncertainties, the material or principal factors which could cause

actual results to differ materially are: Unilever's global brands

not meeting consumer preferences; Unilever's ability to innovate

and remain competitive; Unilever's investment choices in its

portfolio management; inability to find sustainable solutions to

support long-term growth including to plastic packaging; the effect

of climate change on Unilever's business; significant changes or

deterioration in customer relationships; the recruitment and

retention of talented employees; disruptions in our supply chain

and distribution; increases or volatility in the cost of raw

materials and commodities; the production of safe and high quality

products; secure and reliable IT infrastructure; execution of

acquisitions, divestitures and business transformation projects;

economic, social and political risks and natural disasters;

financial risks; failure to meet high and ethical standards; and

managing regulatory, tax and legal matters. These forward-looking

statements speak only as of the date of this announcement. Except

as required by any applicable law or regulation, the Group

expressly disclaims any obligation or undertaking to release

publicly any updates or revisions to any forward-looking statements

contained herein to reflect any change in the Group's expectations

with regard thereto or any change in events, conditions or

circumstances on which any such statement is based. Further details

of potential risks and uncertainties affecting the Group are

described in the Group's filings with the London Stock Exchange,

Euronext Amsterdam and the US Securities and Exchange Commission,

including in the Annual Report on Form 20-F 2018 and the Unilever

Annual Report and Accounts 2018.

UNDERLYING SALES GROWTH UNDERLYING PRICE GROWTH

Beauty & Foods & Home Total Beauty & Foods & Home Total

Personal Refresh-ment Care Unilever Personal Refresh-ment Care Unilever

Care Care

------------------------- --------- -------------- ----- --------- ---------- -------------- ------ ----------

2016 Full Year

As previously

reported

(%) 4.2 2.7 4.9 3.7 2.6 2.6 3.6 2.8

Restated (%) 4.2 2.5 4.9 3.6 2.6 2.4 3.6 2.7

------------------------- --------- -------------- ----- --------- ---------- -------------- ------ ----------

2017 Full Year

As previously reported

(%) 2.9 2.7 4.4 3.1 1.5 3.0 2.3 2.3

Restated (%) 2.9 2.1 4.4 2.8 1.5 2.3 2.3 2.0

------------------------- --------- -------------- ----- --------- ---------- -------------- ------ ----------

2018 H1

As previously

reported

(%) 2.7 1.8 3.5 2.5 (0.2) 0.6 0.3 0.2

Restated (%) 2.7 1.8 3.5 2.5 (0.2) 0.6 0.3 0.2

------------------------- --------- -------------- ----- --------- ---------- -------------- ------ ----------

2018 H2

As previously

reported

(%) 3.5 2.3 4.9 3.4 1.5 1.0 3.6 1.7

Restated (%) 4.0 2.7 5.8 3.9 2.0 1.4 4.5 2.3

------------------------- --------- -------------- ----- --------- ---------- -------------- ------ ----------

2018 Full Year

As previously

reported

(%) 3.1 2.0 4.2 2.9 0.6 0.7 1.9 0.9

Restated (%) 3.4 2.2 4.7 3.2 0.9 0.9 2.4 1.2

------------------------- --------- -------------- ----- --------- ---------- -------------- ------ ----------

2019 H1

As previously

reported

(%) 3.3 1.3 7.4 3.3 1.6 1.4 4.5 2.1

Restated (%) 3.6 1.4 7.9 3.6 1.8 1.5 5.0 2.4

--------- -------------- ----- --------- ---------- -------------- ------ ----------

UNDERLYING SALES GROWTH UNDERLYING PRICE GROWTH

The LATAM Emerging The LATAM Emerging

Americas Markets Americas Markets

----------------------------- ---------- ------ ---------- ------ ---------

2016 Full Year

As previously reported

(%) 6.0 11.4 6.5 6.3 13.3 5.4

Restated (%) 5.7 10.8 6.4 6.0 12.7 5.3

----------------------------- ---------- ------ --------- ---------- ------ ---------

2017 Full Year

As previously reported

(%) 2.4 5.3 5.9 2.2 4.9 4.2

Restated (%) 1.6 3.5 5.4 1.4 3.1 3.7

----------------------------- ---------- ------ --------- ---------- ------ ---------

2018 H1

As previously reported

(%) (0.8) (2.6) 4.1 (0.3) (0.4) 0.8

Restated (%) (0.8) (2.5) 4.1 (0.3) (0.4) 0.8

----------------------------- ---------- ------ --------- ---------- ------ ---------

2018 H2

As previously reported

(%) 0.9 0.5 5.1 1.3 1.9 2.6

Restated (%) 2.5 4.1 6.0 3.0 5.5 3.6

----------------------------- ---------- ------ --------- ---------- ------ ---------

2018 Full Year

As previously reported

(%) - (1.0) 4.6 0.5 0.7 1.7

Restated (%) 0.8 0.8 5.0 1.3 2.6 2.1

----------------------------- ---------- ------ --------- ---------- ------ ---------

2019 H1

As previously reported

(%) 2.1 4.9 6.2 2.2 4.4 3.6

Restated (%) 3.0 7.0 6.7 3.1 6.5 4.1

---------- ------ --------- ---------- ------ ---------

UNDERLYING SALES GROWTH UNDERLYING PRICE GROWTH

------------------------------------------

Beauty & Foods & Home Total Beauty & Foods & Home Total

Personal Refresh-ment Care Unilever Personal Refresh-ment Care Unilever

Care Care

--------- ----------------- --------- ------------- ----- --------- --------- ------------- ------ ----------

As

previously

reported

2016 Q1 (%) 5.8 2.7 7.0 4.7 1.9 2.0 2.4 2.0

---------

Restated (%) 5.8 2.6 7.0 4.6 1.9 1.9 2.4 2.0

--------------------------- --------- ------------- ----- --------- --------- ------------- ------ ----------

As previously

reported

2016 Q2 (%) 5.6 3.5 6.0 4.7 2.2 2.7 4.5 2.8

---------

Restated (%) 5.6 3.3 6.0 4.6 2.2 2.5 4.5 2.8

--------------------------- --------- ------------- ----- --------- --------- ------------- ------ ----------

As previously

reported

2016 Q3 (%) 3.1 3.1 3.9 3.2 3.3 3.2 5.1 3.6

---------

Restated (%) 3.1 2.9 3.9 3.1 3.3 2.9 5.1 3.5

--------------------------- --------- ------------- ----- --------- --------- ------------- ------ ----------

As previously

reported

2016 Q4 (%) 2.5 1.4 3.0 2.2 3.0 2.4 2.3 2.6

Restated (%) 2.5 1.1 3.0 2.0 3.0 2.0 2.3 2.5

--------------------------- --------- ------------- ----- --------- --------- ------------- ------ ----------

As previously

reported

2017 Q1 (%) 3.1 2.2 4.1 2.9 2.8 3.4 2.6 3.0

---------

Restated (%) 3.1 1.6 4.1 2.7 2.8 2.8 2.6 2.7

--------------------------- --------- ------------- ----- --------- --------- ------------- ------ ----------

As previously

reported

2017 Q2 (%) 2.2 3.9 2.5 3.0 2.5 3.7 2.4 3.0

---------

Restated (%) 2.2 3.3 2.5 2.8 2.5 3.1 2.4 2.7

--------------------------- --------- ------------- ----- --------- --------- ------------- ------ ----------

As previously

reported

2017 Q3 (%) 1.8 2.3 4.6 2.6 0.9 3.3 3.3 2.4

---------

Restated (%) 1.8 0.9 4.6 1.9 0.9 1.9 3.3 1.8

--------------------------- --------- ------------- ----- --------- --------- ------------- ------ ----------

As previously

reported

2017 Q4 (%) 4.4 2.3 6.5 4.0 - 1.3 1.1 0.7

Restated (%) 4.4 2.4 6.5 4.0 - 1.4 1.1 0.8

--------------------------- --------- ------------- ----- --------- --------- ------------- ------ ----------

As previously

reported

2018 Q1 (%) 3.9 2.3 4.9 3.4 (0.2) 0.2 0.1 0.1

---------

Restated (%) 3.9 2.3 4.9 3.4 (0.2) 0.2 0.1 0.1

--------------------------- --------- ------------- ----- --------- --------- ------------- ------ ----------

As previously

reported

2018 Q2 (%) 1.6 1.3 2.2 1.6 (0.3) 0.8 0.6 0.3

---------

Restated (%) 1.6 1.3 2.2 1.6 (0.3) 0.8 0.6 0.3

--------------------------- --------- ------------- ----- --------- --------- ------------- ------ ----------

As previously

reported

2018 Q3 (%) 4.0 3.2 4.5 3.8 1.2 0.7 3.0 1.4

---------

Restated (%) 4.5 3.6 5.5 4.4 1.7 1.1 3.9 1.9

--------------------------- --------- ------------- ----- --------- --------- ------------- ------ ----------

As previously

reported

2018 Q4 (%) 3.0 1.3 5.3 2.9 1.7 1.4 4.1 2.1

Restated (%) 3.5 1.7 6.2 3.5 2.2 1.8 5.0 2.7

--------------------------- --------- ------------- ----- --------- --------- ------------- ------ ----------

As previously

reported

2019 Q1 (%) 3.1 1.5 6.0 3.1 1.2 1.0 4.8 1.9

---------

Restated (%) 3.4 1.7 6.4 3.4 1.4 1.2 5.2 2.2

--------------------------- --------- ------------- ----- --------- --------- ------------- ------ ----------

As previously

reported

2019 Q2 (%) 3.5 1.0 8.9 3.5 1.9 1.6 4.3 2.3

Restated (%) 3.8 1.2 9.4 3.8 2.2 1.8 4.7 2.5

--------------------------- --------- ------------- ----- --------- --------- ------------- ------ ----------

UNDERLYING SALES GROWTH UNDERLYING PRICE GROWTH

The LATAM Emerging The LATAM Emerging

Americas Markets Americas Markets

--------- ----------------------------- ---------- ------ ---------- ------ ---------

As previously reported

2016 Q1 (%) 8.5 17.9 8.3 7.3 15.1 4.4

---------

Restated (%) 8.4 17.5 8.2 7.2 14.8 4.4

--------------------------------------- ---------- ------ --------- ---------- ------ ---------

As previously reported

2016 Q2 (%) 6.4 11.8 7.7 7.3 15.2 5.4

---------

Restated (%) 6.1 11.3 7.6 7.0 14.6 5.3

--------------------------------------- ---------- ------ --------- ---------- ------ ---------

As previously reported

2016 Q3 (%) 5.8 9.7 5.6 8.0 15.5 6.6

---------

Restated (%) 5.5 9.1 5.5 7.7 14.8 6.5

--------------------------------------- ---------- ------ --------- ---------- ------ ---------

As previously reported

2016 Q4 (%) 3.7 7.2 4.6 2.8 8.1 5.1

Restated (%) 3.2 6.3 4.3 2.4 7.1 4.9

--------------------------------------- ---------- ------ --------- ---------- ------ ---------

As previously reported

2017 Q1 (%) 1.2 3.5 6.1 3.4 7.1 5.3

---------

Restated (%) 0.4 1.9 5.7 2.6 5.4 4.9

--------------------------------------- ---------- ------ --------- ---------- ------ ---------

As previously reported

2017 Q2 (%) 3.7 6.3 4.8 2.8 5.1 5.0

---------

Restated (%) 2.8 4.4 4.3 1.9 3.2 4.5

--------------------------------------- ---------- ------ --------- ---------- ------ ---------

As previously reported

2017 Q3 (%) 1.4 6.6 6.3 2.9 7.0 4.4

---------

Restated (%) (0.5) 2.4 5.2 0.9 2.8 3.4

--------------------------------------- ---------- ------ --------- ---------- ------ ---------

As previously reported

2017 Q4 (%) 3.4 4.6 6.3 - 1.0 2.0

Restated (%) 3.6 5.0 6.4 0.2 1.4 2.1

--------------------------------------- ---------- ------ --------- ---------- ------ ---------

As previously reported

2018 Q1 (%) 2.5 2.2 5.1 (1.0) (1.5) 0.8

---------

Restated (%) 2.5 2.2 5.1 (1.0) (1.4) 0.8

--------------------------------------- ---------- ------ --------- ---------- ------ ---------

As previously reported

2018 Q2 (%) (3.8) (6.9) 3.1 0.3 0.6 0.8

---------

Restated (%) (3.8) (6.9) 3.1 0.3 0.7 0.8

--------------------------------------- ---------- ------ --------- ---------- ------ ---------

As previously reported

2018 Q3 (%) 1.7 1.5 5.6 1.5 1.4 2.1

---------

Restated (%) 3.4 5.2 6.5 3.2 5.1 3.1

--------------------------------------- ---------- ------ --------- ---------- ------ ---------

As previously reported

2018 Q4 (%) - (0.4) 4.5 1.1 2.3 3.2

Restated (%) 1.7 3.1 5.4 2.8 5.9 4.1

--------------------------------------- ---------- ------ --------- ---------- ------ ---------

As previously reported

2019 Q1 (%) 0.4 0.4 5.0 2.1 4.6 3.2

---------

Restated (%) 1.3 2.4 5.5 3.0 6.7 3.7

--------------------------------------- ---------- ------ --------- ---------- ------ ---------

As previously reported

2019 Q2 (%) 3.7 9.3 7.4 2.3 4.1 4.0

Restated (%) 4.6 11.6 7.9 3.3 6.4 4.5

--------------------------------------- ---------- ------ --------- ---------- ------ ---------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCCKFDBBBKDQCD

(END) Dow Jones Newswires

September 18, 2019 09:00 ET (13:00 GMT)

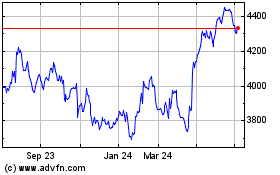

Unilever (LSE:ULVR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Unilever (LSE:ULVR)

Historical Stock Chart

From Apr 2023 to Apr 2024