TIDMUKR

RNS Number : 6167D

Ukrproduct Group Ltd

27 June 2019

27 June 2019

UKRPRODUCT GROUP LIMITED

("Ukrproduct", the "Company" or, together with its subsidiaries,

the "Group")

FINAL RESULTS FOR THE YEARED 31 DECEMBER 2018

NOTICE OF AGM

Ukrproduct Group Limited (AIM: UKR), one of the leading

Ukrainian producers and distributors of branded dairy foods and

beverages (kvass), today announces its audited results for the year

ended 31 December 2018.

Copies of the 2018 Annual Report and Accounts, will shortly be

posted to shareholders and will be available on the Company's

website at www.ukrproduct.com. In addition, a Notice of Annual

General Meeting ("AGM"), along with a Proxy Form, will shortly be

posted to shareholders and will be available at the Company's

website at www.ukrproduct.com.

The AGM will be held at the head office of the Company, 10th

Floor, 39-41 Shota Rustaveli Street, 01033 Kyiv, Ukraine at 6.00 pm

(Kyiv time) / 4.00 pm (London time) on 30 July 2019.

For further information contact:

Ukrproduct Group Ltd

Jack Rowell, Non-Executive Chairman Tel: +380 44 232 9602

Alexander Slipchuk, Chief Executive www.ukrproduct.com

Officer

Strand Hanson Limited

Nominated Adviser and Broker Tel: +44 20 7409 3494

Rory Murphy, James Dance, Jack Botros www.strandhanson.co.uk

Ukrproduct Group Ltd is one of the leading Ukrainian producers

and distributors of branded dairy products and kvass, a traditional

fermented beverage. The Group's current product portfolio includes

processed and hard cheese, packaged butter, skimmed milk powder

(SMP) and kvass. Ukrproduct has built a range of recognisable

product brands ("Our Dairyman", "People's Product", "Creamy

Valley", "Molendam", "Farmer's") that are well known and highly

regarded by consumers. Ukrproduct's securities are traded under the

symbol "UKR" on AIM, a market operated by the London Stock

Exchange.

Chairman and Chief Executive's Statement

Trading

During the year to 31 December 2018 ("FY 2018"), the Ukrainian

economy showed moderate growth, accompanied by wage inflation,

which has helped consumer confidence. Ukrproduct Group Ltd

("Ukrproduct", the "Company" or, together with its subsidiaries,

"the Group") continued focusing on cash generation while aiming to

address opportunities in export markets, beverages and B2B, as well

as expanding its dairy business.

The Group reports improved revenue of approximately GBP36,9

million (approximately 1.3 billion UAH). Gross profit in UAH terms

increased 4.3% to approximately 115 million UAH, however, in GBP

terms, the negative impact of exchange rate differences resulted in

a decrease of 2.5% to approximately GBP3.2 million.

The Group reports an operating profit of approximately GBP0.2

million (approximately UAH 6.2 million) in FY2018, compared with an

operating profit of approximately GBP0.5 million (approximately UAH

16.2 million) in 2017.

Overall, for FY 2018, the Company reports net profit of

approximately GBP0.1 million (approximately 2.7 million UAH)

compared to a loss of approximately GBP1.1 million (approximately

40.6 million UAH) in 2017. Net profit for 2018 is lower than

previously expected (as announced on 7 May 2019) as a result of

increased operating expenses. Net profit for FY2018 included lower

finance charges related to the outstanding debt with EBRD, although

total finance expenses increased to approximately GBP0.5 million

(approximately 16.2 million UAH) from approximately GBP0.4 million

(approximately 15.1 million UAH) in 2017.

Overall, the Group reports that its sales volumes have grown by

4%, including sales of branded products in its key packaged butter

and processed cheese segments. However, both export sales volumes

and revenue decreased due to the worldwide contraction of skimmed

milk powder prices. Although the Company continued to capitalise on

its spare dairy processing capacity by acquiring new B2B partners,

Ukrproduct's B2B gross profit slightly decreased in 2018. Whilst

gross profit of branded products showed substantial growth, it was

unfortunately offset by losses caused by the decline in both

skimmed milk powder and butter prices.

Sales of beverages significantly increased as a result of the

Group's targeted marketing initiatives and the introduction of new

drinks.

Financial Position

As at 31 December 2018, Ukrproduct reports net assets of

approximately GBP1.0 million (approximately 35.13 million UAH) and

net current liabilities of approximately GBP0.03 million

(approximately 1.05 million UAH), with cash balances of

approximately GBP0.2 million (approximately 6.4 million UAH).

During FY 2018, the Group met its outstanding obligations,

including the EBRD loan repayments, which were paid on schedule in

the amount of EUR0.52 million.

Outlook

Ukrproduct's strategy going forward is to generate cash by

improving the profitability of its key dairy product and beverage

segments and to further enhance its working capital position.

The Group expects to boost its sales volume and revenue in 2019

by launching new products in its key business areas, introducing

new marketing activities and capitalising further on export

opportunities.

Jack Rowell Alexander Slipchuk

Non-Executive Chairman Chief Executive Officer

Ukrproduct Group

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2018

(in thousand GBP, unless otherwise stated)

Year ended Year ended

---------------------------------------------

31 December 31 December

2018 2017

GBP '000 GBP '000

--------------------------------------------- ------------ ------------

Revenue 36 928 30 525

Cost of sales (33 751) (27 267)

------------ ------------

GROSS PROFIT 3 177 3 258

Administrative expenses (1 061) (1 031)

Selling and distribution expenses (1 799) (1 561)

Other operating expenses (131) (156)

------------ ------------

PROFIT FROM OPERATIONS 186 510

Net finance expenses (494) (437)

Net foreign exchange gain (loss) 398 (1 250)

------------ ------------

PROFIT / (LOSS) BEFORE TAXATION 90 (1 177)

Income tax expense - 62

------------ ------------

PROFIT / (LOSS) FOR THE YEAR 90 (1 115)

============ ============

Attributable to:

Owners of the Parent 90 (1 115)

Non-controlling interests - -

Earnings per share:

Basic (pence) 0,23 (2,81)

Diluted (pence) 0,23 (2,81)

OTHER COMPREHENSIVE INCOME:

Items that may be subsequently reclassified

to profit or loss

Currency translation differences (8) (113)

Items that will not be reclassified

to profit or loss

Gain on revaluation of property, plant

and equipment - -

Income tax in respect of revaluation

reserve - -

------------ ------------

OTHER COMPREHENSIVE INCOME, NET OF

TAX (8) (113)

------------ ------------

TOTAL COMPREHENSIVE INCOME FOR THE

YEAR 82 (1 228)

============ ============

Attributable to:

Owners of the Parent 82 (1 228)

Non-controlling interests - -

Ukrproduct Group

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 December 2018

(in thousand GBP, unless otherwise stated)

As at As at

--------------------------------------

31 December 31 December

2018 2017

GBP '000 GBP '000

-------------------------------------- ------------ ------------

ASSETS

Non-current assets

Property, plant and equipment 6 420 6 288

Intangible assets 524 543

------------ ------------

6 944 6 831

Current assets

Inventories 3 735 2 426

Trade and other receivables 3 156 2 171

Current taxes 349 271

Other financial assets 24 30

Cash and cash equivalents 181 496

------------ ------------

7 445 5 394

------------ ------------

TOTAL ASSETS 14 389 12 225

============ ============

EQUITY AND LIABILITIES

Equity attributable to owners of the

parent

Share capital 3 967 3 967

Share premium 4 562 4 562

Translation reserve (14 902) (14 894)

Revaluation reserve 3 619 3 769

Retained earnings 3 718 3 478

------------ ------------

964 882

Non-controlling interests - -

------------ ------------

TOTAL EQUITY 964 882

Non-Current Liabilities

Bank loans 5 208 5 716

Long-term payables 467 459

Deferred tax liabilities 274 262

------------ ------------

5 949 6 437

Current liabilities

Bank loans 2 455 1 318

Trade and other payables 5 008 3 565

Other taxes payable 13 23

------------ ------------

7 476 4 906

------------ ------------

TOTAL LIABILITIES 13 425 11 343

------------ ------------

TOTAL EQUITY AND LIABILITIES 14 389 12 225

============ ============

Ukrproduct Group

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

AS AT 31 December 2018

(in thousand GBP, unless otherwise stated)

Attributable to owners of the parent Total Non-con-trolling Total

interests Equity

Share Share Revaluation Retained Translation

capital premium reserve earnings reserve

------------------- --------- --------- ------------ ---------- ------------ ------ ----------------- --------

GBP GBP '000 GBP '000 GBP '000 GBP '000 GBP GBP '000 GBP

'000 '000 '000

------------------- --------- --------- ------------ ---------- ------------ ------ ----------------- --------

As At 1 January

2017 3 967 4 562 3 935 4 427 (14 781) 2 110 - 2 110

Loss for the (1

year - - - (1 115) - 115) - (1 115)

Other

comprehensive

income

Currency

translation

differences - - - - (113) (113) - (113)

--------- --------- ------------ ---------- ------------ ------ ----------------- --------

Total

comprehensive (1

income - - - (1 115) (113) 228) - (1 228)

Depreciation

on revaluation

of property,

plant and

equipment - - (166) 166 - - - -

--------- --------- ------------ ---------- ------------ ------ ----------------- --------

As At 31 December

2017 3 967 4 562 3 769 3 478 (14 894) 882 - 882

========= ========= ============ ========== ============ ====== ================= ========

Profit for

the year - - - 90 - 90 - 90

Other

comprehensive

income

Currency

translation

differences - - - - (8) (8) - (8)

--------- --------- ------------ ---------- ------------ ------ ----------------- --------

Total

comprehensive

income - - - 90 (8) 82 - 82

Depreciation

on revaluation

of property,

plant and

equipment - - (150) 150 - - - -

--------- --------- ------------ ---------- ------------ ------ ----------------- --------

As At 31 December

2018 3 967 4 562 3 619 3 718 (14 902) 964 - 964

========= ========= ============ ========== ============ ====== ================= ========

Ukrproduct Group

CONSOLIDATED STATEMENT OF CASH FLOWS

AS AT 31 December 2018

(in thousand GBP, unless otherwise stated)

Year ended Year ended

--------------------------------------------

31 December 31 December

2018 2017

GBP '000 GBP '000

-------------------------------------------- ------------ ------------

Cash flows from operating activities

Gain (loss) before taxation 90 (1 177)

Adjustments for:

Exchange difference (398) 1 250

Depreciation and amortisation 523 553

Loss on disposal of non-current assets 4 8

Write off of receivables/payables 21 (5)

Impairment of inventories 72 82

Loss from disposal of subsidiaries - -

Interest income - -

Interest expense on bank loans 494 437

------------ ------------

Operation cash flow before working

capital changes 806 1 148

Increase in inventories (1 380) (653)

Decrease / (Increase) in trade and

other receivables (1 096) 298

Increase in trade and other payables 1 437 473

------------ ------------

Changes in working capital (1 039) 118

------------ ------------

Cash (used in)/ generated from operations (233) 1 266

Interest received 2 1

Income tax paid 1 (31)

------------ ------------

Net cash (used in)/ generated from

operating activities (230) 1 236

Cash flows from investing activities

Purchases of property, plant and equipment

and intangible assets (181) (93)

Proceeds from sale of property, plant

and equipment - 1

Repayments of loans issued 7 (15)

------------ ------------

Net cash used in investing activities (174) (107)

Cash flows from financing activities

Interest paid (421) (378)

Decrease in short term borrowing 901 -

Repayments of long term borrowing (459) (259)

------------ ------------

Net cash (used in)/ generated from

financing activities 21 (637)

Net Increase / (decrease) in cash

and cash equivalents (383) 492

Effect of exchange rate changes on

cash and cash equivalents 68 (171)

------------ ------------

Cash and cash equivalents at the beginning

of the year 496 175

Cash and cash equivalents at the end

of the year 181 496

============ ============

These consolidated financial statements were approved and

authorised for issue by the Board of Directors on 26 June 2019 and

were signed on its behalf by Alexander Slipchuk.

Nature of Financial Information

The financial information contained in this announcement does

not constitute statutory accounts as defined under section 113 of

the Companies (Jersey) Law 1991 but has been extracted from the

Group's 2018 statutory financial statements. It contained no

statement under section 113B of the Companies (Jersey) Law 2011.

The financial statements for 2018 will be delivered to the

Registrar of Companies after adoption at the Company's Annual

General Meeting.

EXTRACTS FROM NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of preparation

The consolidated financial statements have been prepared on a

historical cost basis, except for significant items of property,

plant and equipment which have been measured using revaluation

model. The consolidated financial statements are presented in

British Pounds Sterling (GBP) and all values are rounded to the

nearest thousand (GBP000) except where otherwise indicated.

2. Going concern

The consolidated financial statements have been prepared on the

assumption that the Group is able to continue its operations on a

going concern basis for the foreseeable future.

For the year ended 31 December 2018, net profit amounted to

approximately GBP0.1 million (year ended 31 December 2017 net loss

of approximately GBP1.1 million). As at 31 December 2018, the Group

continued to breach certain loan covenant terms of its loan with

European Bank for Reconstruction and Development ("EBRD").

These conditions indicate a significant uncertainty with regard

to the Group's ability to continue its operations on a going

concern basis.

According to the Company's management, the Group's ability to

continue its operations on a going concern basis is permissible

based on the following assumptions:

1. The Group received waivers from EBRD - in respect of the

annual financial statements for 2018 and the first quarter of 2019

and the Board believes that EBRD will not demand accelerated

repayment of the loan due to the breach of covenants;

2. The Group continues to repay the loan to EBRD according to

the agreement and timely settled the last two tranches after the

reporting date;

3. On 7 February 2018, the Company announced that it had entered

into an agreement for a new loan facility with PJSC Creditwest Bank

("Creditwest Bank"), under which it could draw down up to UAH 65

million for refinancing purposes (to repay the OTP Bank Loan) as

well as for financing working capital ("New Loan Agreement"). All

amounts drawn down by the Group under the New Loan Agreement,

together with interest accrued, is due to be repaid on 5 February

2021. The interest rate under the New Loan Agreement is fixed at

18% per annum. Any draw down under the facility is secured on

appropriate collateral provided by the Group (real estate,

equipment etc), including non-current assets located in Zhytomyr

and equipment for production of Zhiviy Kvass. On 9 February 2018,

the Group announced that it had drawn down UAH 32.3 million under

the terms of the New Loan Agreement in order to fully repay all

amounts outstanding to OTP Bank. Accordingly, the Group

extinguished all outstanding liabilities to OTP Bank; and

4. The Group is planning to raise funding in H2 2019.

The Group's current strategy is to further expand its export

sales worldwide with a focus on Asia and Africa. CIS markets also

remain strategically important for the Group not least Kazakhstan

where the Company increased its export volumes. Ukrproduct is also

looking to expand domestic sales in Ukraine driven in part by the

introduction of new products and rebranding. The Group continues to

boost its dairy processing volumes via close cooperation with local

farmers and cooperatives, thereby increasing its capacity

utilization.

3. Bank Loans and Overdrafts

On 7 February 2018, the Company announced that it had entered

into an agreement for a new loan facility with PJSC Creditwest Bank

("Creditwest Bank"), under which it could draw down up to UAH 65

million for refinancing purposes (to repay the OTP Bank Loan) as

well as for financing working capital ("New Loan Agreement"). All

amounts drawn down by the Group under the New Loan Agreement,

together with interest accrued, is due to be repaid on 5 February

2021. The interest rate under the New Loan Agreement is fixed at

18% per annum. Any draw down under the facility is secured on

appropriate collateral provided by the Group (real estate,

equipment etc), including non-current assets located in Zhytomyr

and equipment for production of Zhiviy Kvass.

On 9 February 2018, the Group announced that it had drawn down

UAH 32.3 million under the terms of the New Loan Agreement in order

to fully repay all amounts outstanding to OTP Bank. Accordingly,

the Group extinguished all outstanding liabilities to OTP Bank.

As at 31 December 2018 the Group has two loans: the loan from

Creditwest Bank in the amount of 1 850 thousand GBP (in UAH 65,0

million) and the loan from EBRD in the amount of 5,813 thousand GBP

(in EUR 6,439 thousand).

During 2018, the Group fulfilled its obligations under the EBRD

loan in accordance with the agreement. The Group completed

installments of payments and in accordance with an agreement

between all parties, the payment of the tranche in December was

postponed to subsequent periods.

Fixed assets with a net book value of GBP 4,872 thousand at 31

December 2018 (2017: GBP 4,829 thousand) were pledged as

collateral.

Assets pledged as security for the EBRD loan include property

and land in Starokonstantinov, equipment for dairy production and

production of hard cheese, as well as trademarks.

Bank Currency Type Opening Termination Interest Limit As At As at

date date rate 31 December 31 December

2018 2017

------------ ---------- -------- ------------ ------------- ---------

GBP GBP '000 GBP '000

'000

------------ ---------- -------- ------------ ------------- --------- ------ ------------- -------------

EBRD EUR Loan 31.03.2011 30.11.2024 5-7% 7 493 5 813 6 178

Credit

OTP Bank UAH line 09.08.2011 09.02.2018 2,12% 1 139 - 856

Creditwest

Bank Credit

Ukraine UAH line 05.02.2018 05.02.2021 15,89% 1 850 1 850 -

Total 7 663 7 034

============= =============

The average interest rate as at 31 December 2018 was 6,15%

(2017: 5,27%).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR SEDSIWFUSELM

(END) Dow Jones Newswires

June 27, 2019 02:01 ET (06:01 GMT)

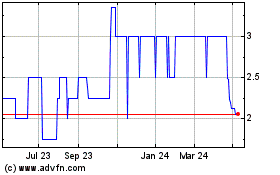

Ukrproduct (LSE:UKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

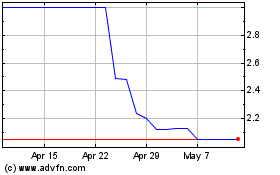

Ukrproduct (LSE:UKR)

Historical Stock Chart

From Apr 2023 to Apr 2024