TIDMUKOG

RNS Number : 5032Z

UK Oil & Gas PLC

21 May 2021

UK Oil & Gas PLC

("UKOG" or the "Company")

Notice of General Meeting

UK Oil & Gas PLC (London AIM: UKOG) is pleased to announce

that it will hold a General Meeting ("GM") at 1100 hrs on Monday

7th June 2021 at Hays House, Millmead, Guildford, Surrey, GU2 4HJ,

United Kingdom. Copies of the GM Notice ("Notice") and Proxy form

have been posted to registered shareholders and the Notice is

available on the Company's website, https://www.ukogplc.com/ .

In keeping with the government's current Covid-19 health and

safety advice, the GM will be held with a Board quorate only.

Consequently, we kindly request that shareholders do not attend the

meeting in person. Please do not travel to the meeting, as you will

be refused entry. Shareholders should note the arrangements in

place for this GM detailed in the Notice and below.

Summary Reasons for the General Meeting:

The Company is an energy company primarily focused upon oil and

gas exploration and production in the UK and Turkey onshore

sectors. The Company aims to build a sustainable oil and gas

production base that can act as a springboard to further worldwide

petroleum opportunities and to help its diversification into the

emerging geothermal and renewable energy fields.

The Company holds operated and non-operated interests in six

licences in the UK, which include two producing oil fields, Horse

Hill and Horndean and four undeveloped oil and gas discoveries,

including the significant Loxley gas discovery, assessed to be the

second largest in the UK onshore's history.

The Company's new portfolio in Turkey consists of a 50%

non-operated working interest in the 305 km(2) M47-b1, b2 licence

(the Resan Licence) in south east Turkey, containing the

potentially significant undeveloped Basur-Resan oil discovery and a

further identified exploration prospect, Prospect A.

As previously reported on 9(th) December 2020, the Company has

also applied to the Turkish regulatory authorities for a 50%

interest in four further highly prospective blocks ("Application

Blocks") within 3 licences lying to the south and south east of the

Resan Licence, covering approximately 600 km(2) in total. The

Application Block immediately adjacent to the SE of the Resan

Licence is assessed to contain a possible extension of the

Basur-Resan oil accumulation.

As stated in the Company's announcement of 15th January 2021,

the Basur-Resan appraisal project is assessed to contain

significantly greater discovered oil volumes than any of the

Company's UK projects. It is therefore the focus of the Company's

2021 activities.

The Resan Licence is the subject of ongoing operational

activities, with the construction of the well site and drilling pad

for the first modern appraisal well, Basur-3, near complete. The

company has contributed its share of Basur-3 site construction

costs, long lead well equipment and all 2D seismic reprocessing

costs necessary to define the Basur-3 drilling location and well

plan. As previously reported, the Company expects the Basur-3 well

to commence drilling in summer this year.

As announced on 23rd July and 14th October 2020, under the terms

of the Company's acquisition of its 50% interest in the Resan

Licence the Company agreed to wholly fund the first $5 million of

the Resan Licence's commitment work programme, currently 4 wells

and 100 km of seismic. Thereafter the Company will pay its 50%

working share of all costs.

The agreed 2021 joint venture work programme of Basur-3 and 120

line km of seismic is estimated at an aggregate gross cost of

approximately US $5 million excluding coring, post well analyses,

seismic processing and drill and seismic related contingencies. A

further appraisal well, Resan-6, is expected to be drilled next

year following processing and interpretation of the new seismic

data.

Should the Application Block immediately to the SE of the Resan

Licence be awarded to the Company and its joint venture partner,

the Basur-Resan seismic programme is planned to be extended into

the new block. This will ensure that any extension of the

Basur-Resan accumulation can be properly assessed and included in a

forward drilling programme. Any additional acquisition will

increase gross seismic acquisition costs directly in proportion to

the additional kilometres acquired.

In order to deliver the Company's stated strategy and growth

objectives, it will require further funds in the near future for,

amongst other things, its funding obligations under the agreed work

programme for the Resan Licence and any of the new Application

Blocks should they be awarded to the Company and its partner.

The Directors therefore seek specific shareholder approval for

authority to issue shares and dis-apply pre-emption rights in

respect of those shares in order that the Company can raise money

for its working capital obligations.

The Company will make available to the Shareholders an

opportunity to participate in any fundraising on terms which are

the same as the terms that will be offered to any placing to new

investors by way of an open offer on a pre-emptive basis.

Should an open offer be successful on a cost benefit basis the

Company will make available to the Shareholders an opportunity to

participate in all future fundraisings either: (i) by way of an

open offer on a pre-emptive basis; or (ii) through a mechanism that

allows shareholders participate in fundraising on a more general

basis.

GM and Covid-19

To ensure that shareholders can still participate in an orderly

and safe GM during the Covid-19 pandemic, this year's meeting will

be held via an electronic platform. The platform will permit

shareholders to hear the meeting's chairman and to submit questions

on the two resolutions.

Questions can be submitted via the platform during a 48-hour

period from 11:00 am 5(th) June 2021 and real-time during the GM.

Questions submitted via any other method than the platform will not

be answered.

Shareholders are, therefore, strongly encouraged to exercise

their voting rights by submitting the proxy form attached with the

GM notice. The deadline for submission of proxies to the Registrar

is 1100 hrs BST Saturday 5(th) June 2021. You are strongly advised

to appoint the chairman of the meeting as your proxy to ensure your

vote is counted.

The Company will continue to monitor Government advice in

relation to the Coronavirus pandemic, and in turn urges you to

monitor the Company's website for updates on changes to

arrangements for the GM which we may need to make.

The result of the GM will be announced shortly after its

conclusion and published on the UKOG website.

For further information, please contact:

UK Oil & Gas Plc

Stephen Sanderson / Kiran Morzaria Tel: 01483 941493

WH Ireland Ltd (Nominated Adviser and Broker)

James Joyce / James Sinclair-Ford Tel: 020 7220 1666

Communications

Brian Alexander Tel: 01483 941493

The information contained within this announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulation (EU) No. 596/2014

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOGUAVNRAVUVUAR

(END) Dow Jones Newswires

May 21, 2021 13:05 ET (17:05 GMT)

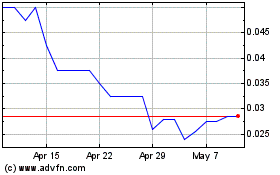

Uk Oil & Gas (LSE:UKOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uk Oil & Gas (LSE:UKOG)

Historical Stock Chart

From Apr 2023 to Apr 2024