TIDMTXP

RNS Number : 7773D

Touchstone Exploration Inc.

07 March 2022

2021 YEAR- RESERVES AND OPERATIONAL UPDATE

CALGARY, ALBERTA (March 7, 2022) - Touchstone Exploration Inc.

("Touchstone", "we", "our", "us" or the "Company") (TSX, LSE: TXP)

is pleased to announce a summary of our 2021 year-end reserves and

an operational update.

Our independent reserves evaluation was prepared by GLJ Ltd. ( "

GLJ " ) with an effective date of December 31, 2021 (the " Reserves

Report " ). Highlights of our total proved ("1P"), total proved

plus probable ("2P") and total proved plus probable plus possible

("3P") reserves from the Reserves Report are provided below. All

finding and development ("F&D") costs below include changes in

future development capital ("FDC"). Unless otherwise stated, all

financial amounts referenced herein are stated in United States

dollars . Financial information contained herein is based on the

Company's unaudited results for the year ended December 31, 2021

and is subject to change. Readers are further cautioned to read the

applicable advisories contained herein.

2021 Year-end Reserves Report Highlights

-- Relative to year-end 2020, increased 3P gross reserves by 21%

to 121,332 Mboe, increased 2P gross reserves by 16% to 75,547 Mboe

and increased 1P gross reserves by 13% to 38,731 Mboe in 2021.

-- Touchstone's net present value of future net revenues

discounted at 10% ("NPV10") on a before tax 3P basis increased by

31% to $1.31 billion, before tax 2P NPV10 increased by 29% to

$881.8 million and before tax 1P NPV10 increased by 31% to $474.9

million from the prior year.

-- Realized after tax 3P NPV10 of $535.6 million, representing

an increase of 28% from the prior year, after tax 2P NPV10

increased by 26% from year-end 2020 to $363.1 million and after tax

1P NPV10 increased by 29% from the prior year to $210 million.

-- Achieved 1P F&D costs of $10.36 per boe, resulting in a

recycle ratio of 2.6 times using our unaudited annual estimated

2021 operating netback of $26.55 per boe.

-- Realized 2P F&D costs of $6.96 per boe, resulting in a 2P

recycle ratio of 3.8 times, demonstrating our capital efficient

operations on the Ortoire block.

-- Relative to year-end 2020, increased Cascadura 1P reserves by

14% to 26,902 Mboe and 2P total reserves by 16% to 52,082 Mboe

following our successful Cascadura Deep-1 well tested in 2021.

-- The Royston exploration discovery was assigned gross working

interest 3P reserves of 4,800 Mboe, gross working interest 2P

reserves of 3,520 Mboe and gross working interest 1P reserves of

1,280 Mboe.

-- Our independent reserves evaluator estimates that the Royston

structure has a low estimate of 128.3 MMbbl, a best estimate of

165.7 MMbbl and a high estimate of 211.7 MMbbl of total petroleum

initially-in-place from the overthrust and intermediate sheets of

the Herrera Formation, with no estimate provided in the subthrust

sheet.

Paul Baay, President and Chief Executive Officer, commented:

"Our 2021 independent reserves evaluation confirms the

significant opportunities at our Ortoire property and the

profitability of all of our assets in Trinidad. The estimated

additions of both future net revenues and reserves at the newly

discovered Royston light oil pool are reflective of our successful

drilling activities in 2021 and the considerable size of the

prospect in the Herrera Formation. The initial Royston reserves

evaluation was conservative, given only one well was drilled to

date and no reserves were assigned to the subthrust sheet. We have

two exciting opportunities to substantially increase reserves in

the area with the Royston Deep well intended to evaluate the

subthrust sheet of the Herrera Formation and the Kraken well

targeting the deeper Cretaceous Formation.

We are proceeding with the final step to bring the Coho gas

field online with anticipated first natural gas production in May

2022, which will represent a milestone for Touchstone and Trinidad.

We also remain on track with our operations at Cascadura, as we

have submitted the required regulatory applications and procured

the long lead items for the surface facility, providing visibility

to estimated completion in September 2022.

Our focus is to convert our extensive Trinidad resource base to

cash flows while continuing to target further exploration

opportunities across our licence areas. It is an exciting time for

Touchstone, as it is rare to have a combination of solid low

decline base production, a near-term step change in production, a

multi-year development drilling program and extensive exploration

opportunities. I would encourage anyone requiring additional

information to view the updated corporate presentation available on

our website. "

Operational Highlights

-- With all relevant agreements executed, pipeline tie-in

operations for the Coho-1 well are proceeding with anticipated

first gas in May 2022 subject to weather conditions.

-- The Company is currently awaiting regulatory approvals to

commence constructing the Cascadura natural gas facility, with

equipment procurement and delivery of pressure vessels on track for

facility completion in September 2022 assuming timely receipt of

required regulatory approvals.

-- The extended flow test at Royston has confirmed the well is

capable of over 675 bbls/d of light, sweet oil production from a

combination of the overthrust and intermediate sheets of the

Herrera Formation.

-- The three development wells drilled on our legacy crude oil

blocks in the fourth quarter of 2021 have produced a field

estimated 210 bbls/d since coming on production, contributing to

our current field estimated aggregate net base production of

approximately 1,449 bbls/d, excluding production testing volumes

from Royston-1.

Operational Update

Coho

All of the required agreements with our third-party partners to

allow for the final tie-in of the Coho gas field on the Ortoire

block have been executed. Pipeline installation operations have

commenced with first gas anticipated in May 2022 subject to weather

delays that may hinder trenching and welding operations. Following

testing and purging of the pipeline, we are anticipating natural

gas production to increase over time to a gross target of 10 MMcf/d

(8 MMcf/d net, representing approximately 1,333 boe/d net

production).

Cascadura

The Cascadura facility is proceeding with the major facility

components nearing completion for transportation to Trinidad. The

components will be delivered on skids and will be assembled in the

field by local contractors. In parallel with the facilities

procurement and construction, we have submitted the required

regulatory application and expect to receive a response on or

before mid-May 2022. Upon approval, we will proceed with four

distinct projects at Cascadura: road construction, condensate

pipeline construction, facility construction and construction of

future development drilling locations.

Royston

We commenced a long-term production test of the uppermost 84

feet of the Herrera overthrust section in January 2022 with the

goal of evaluating different flowing regimes and possible pump

configurations to maximize oil production. While conducting the

test, approximately 2,200 feet of pipe and perforating guns were

stuck in the bottom portion of the well, not allowing any further

testing of the deeper zones. However, with these constraints, the

well has continued to deliver both pumping and flowing volumes from

the uppermost 84 feet.

Combined with the previous test in the intermediate zone, the

well has shown that the completed intervals are capable of

producing over 675 bbls/d of oil. Produced oil is being sold at our

Barrackpore sales facility, and all associated water has been

separated on-site and reinjected at our water disposal facility. We

anticipate production testing continuing until the commencement of

future drilling operations at Royston.

Legacy Wells

The three development wells drilled by the Company in the fourth

quarter of 2021 are on production. Since being brought onstream,

they have contributed an aggregate average of 210 bbls of net oil

per day. We have prepared the next location on our Coora-1 block

where we plan to drill two commitment infill wells targeting the

Forest and Cruse Formations.

James Shipka, Chief Operating Officer, commenting on the

Royston-1 well test, said:

"Testing of the Royston-1 exploration well resumed in early

January with the well initially flowing at rates of over 250

barrels of oil per day from the uppermost 84 feet of the overthrust

reservoir. Over the course of flow testing and, as anticipated,

production rates gradually declined due to liquid loading in the

wellbore and we subsequently moved a service rig to the location to

install a pump to increase production. While attempting to raise

the downhole assembly, we discovered an issue with the casing at

approximately 7,250 feet that prevented us to run the optimized

downhole pumping assembly. The wellbore could not be cleared, and

we ultimately severed the existing tubing string at approximately

7,200 feet. In early February, we ran a downhole pump above the

pre-existing tubing string, and we are currently working on

optimizing production in this restricted configuration.

Despite these mechanical challenges, our testing program at

Royston-1 has confirmed that the Royston structure will be a core

oil development property for Touchstone. The light oil discoveries

in the intermediate and overthrust sheets have displayed production

rates in excess of 675 barrels of oil per day from the structure.

With an independent estimate of up to 212 million barrels of total

petroleum initially-in-place in the high case, including upside

potential from the upper two sheets, Royston will be an exciting

long-term project. Our 2021 reserves bookings reflect Royston's

initial development stage, and we look forward to our future

exploration wells which will further delineate and expand our

understanding of the structure. Until then, we will continue our

testing program at Royston to gather additional information and

refine our model of the reservoir. The similarities between Royston

and the Penal-Barrackpore fields are significant and have given us

confidence in our understanding of how the different thrust sheets

may contribute to the ultimate recovery of the field."

2021 Year-end Reserves Report Summary

Touchstone's 2021 capital program focused on exploration

activities on our Ortoire property, where we conducted production

testing operations on the Cascadura Deep-1 well drilled in the

fourth quarter of 2020, completed the Royston area 22-kilometre

seismic program, and drilled and tested the Royston-1 exploration

well. In addition, we drilled three gross and net wells on our

legacy oil properties representing our first infill drilling since

2019. The Reserves Report includes those reserves associated with

our legacy development properties, our Coho natural gas discovery

in 2019, our Cascadura discovery in 2020, as well as additions

relating to the Cascadura Deep-1 and Royston-1 wells.

Touchstone's year-end crude oil, natural gas and NGL reserves in

Trinidad were evaluated by independent reserves evaluator, GLJ, in

accordance with definitions, standards and procedures contained in

the Canadian Oil and Gas Evaluation Handbook and National

Instrument 51-101 Standards of Disclosure for Oil and Gas

Activities ( " NI 51-101 " ). Additional reserves information as

required under NI 51-101 will be included in the Company's Annual

Information Form, which will be filed on SEDAR on or before March

31, 2022. The reserve estimates set forth below are based upon

GLJ's Reserves Report dated March 4, 2022 with an effective date of

December 31, 2021. All values in this announcement are based on

GLJ's forecast prices and estimates of future operating and capital

costs as of December 31, 2021. Please refer to "Advisories:

Reserves Advisories" for further information. In certain tables set

forth below, the columns may not add due to rounding.

2021 Reserves Summary by Category

1P 2P 3P

------------------------------------- -------- -------- ----------

Total gross reserves(1) (Mboe) 38,731 75,547 121,332

Reserve additions(2) (Mboe) 4,985 11,092 21,674

NPV10 before income tax(3) ($000's) 474,922 881,753 1,313,006

NPV10 after income tax(3) ($000's) 210,036 363,068 535,613

Notes:

(1) Gross reserves are the Company's working interest share before deduction of royalties.

(2) See "Advisories: Oil and Gas Metrics".

(3) Based on GLJ's December 31, 2021 forecast prices and costs.

See " Forecast prices and costs " .

Year-Over-Year Reserves Data

December December % Change

31, 2021 31, 2020(1)

---------------------------------------- ---------- ------------- ---------

1P gross reserves(2) (Mboe) 38,731 34,238 13

2P gross reserves(2) (Mboe) 75,547 64,947 16

3P gross reserves(2) (Mboe) 121,332 100,150 21

1P NPV10 before income tax(3) ($000's) 474,922 362,891 31

2P NPV10 before income tax(3) ($000's) 881,753 683,084 29

3P NPV10 before income tax(3) ($000's) 1,313,006 1,002,835 31

1P NPV10 after income tax(3) ($000's) 210,036 163,022 29

2P NPV10 after income tax(3) ($000's) 363,068 289,172 26

3P NPV10 after income tax(3) ($000's) 535,613 419,434 28

Notes:

(1) Prior year reserve estimates per GLJ's independent reserves

evaluation dated March 4, 2021 with an effective date of December

31, 2020.

(2) Gross reserves are the Company's working interest share before deduction of royalties.

(3) Based on GLJ's December 31, 2021 forecast prices and costs.

See " Forecast prices and costs " .

Summary of Crude Oil and Natural Gas Reserves by Product

Type

Company Gross (1) Reserves Light Heavy Conventional Natural Total

and Medium Crude Natural Gas Liquids Oil Equivalent

Crude Oil Gas (MMcf) (Mbbl) (Mboe)

Oil (Mbbl) (Mbbl) (2)

---------------------------- ------------ -------- ------------- ------------- ----------------

Proved

Developed Producing 3,387 261 - - 3,648

Developed Non-Producing 2,148 210 93,252 2,198 20,098

Undeveloped 4,638 - 53,841 1,374 14,985

---------------------------- ------------ -------- ------------- ------------- ----------------

Total Proved 10,174 471 147,093 3,571 38,731

Probable 8,908 458 144,642 3,342 36,815

---------------------------- ------------ -------- ------------- ------------- ----------------

Total Proved plus Probable 19,082 929 291,735 6,913 75,547

Possible 6,186 340 205,727 4,972 45,785

---------------------------- ------------ -------- ------------- ------------- ----------------

Total Proved plus Probable

plus Possible 25,268 1,269 497,462 11,885 121,332

---------------------------- ------------ -------- ------------- ------------- ----------------

Notes:

(1) Gross reserves are the Company's working interest share before deduction of royalties.

(2) NGLs are comprised of 100% condensate.

Company Net (1) Reserves Light Heavy Conventional Natural Total

and Medium Crude Natural Gas Liquids Oil Equivalent

Crude Oil Gas (MMcf) (Mbbl) (Mboe)

Oil (Mbbl) (Mbbl) (2)

---------------------------- ------------ -------- ------------- ------------- ----------------

Proved

Developed Producing 2,119 232 - - 2,352

Developed Non-Producing 1,599 187 81,595 1,923 17,308

Undeveloped 3,285 - 47,111 1,202 12,339

---------------------------- ------------ -------- ------------- ------------- ----------------

Total Proved 7,003 419 128,706 3,125 31,999

Probable 6,719 407 126,561 2,925 31,145

---------------------------- ------------ -------- ------------- ------------- ----------------

Total Proved plus Probable 13,723 827 255,268 6,049 63,143

Possible 4,581 302 180,011 4,350 39,236

---------------------------- ------------ -------- ------------- ------------- ----------------

Total Proved plus Probable

plus Possible 18,304 1,129 435,279 10,399 102,379

---------------------------- ------------ -------- ------------- ------------- ----------------

Notes:

(1) Net reserves are the Company's working interest share after

the deduction of royalty obligations.

(2) NGLs are comprised of 100% condensate.

Summary of Net Present Values of Future Net Revenues (1)

Net Present Values Before Undiscounted Discounted Discounted Discounted Discounted

Income Taxes ($000's) at 5% at 10% at 15% at 20%

---------------------------- ------------- ----------- ----------- ----------- -----------

Proved

Developed Producing 70,586 59,730 51,737 45,799 41,267

Developed Non-Producing 375,339 302,251 253,336 217,580 190,218

Undeveloped 285,210 217,561 169,849 135,347 109,717

---------------------------- ------------- ----------- ----------- ----------- -----------

Total Proved 731,135 579,541 474,922 398,726 341,202

Probable 827,687 559,969 406,831 310,348 245,521

---------------------------- ------------- ----------- ----------- ----------- -----------

Total Proved plus Probable 1,558,822 1,139,510 881,753 709,074 586,723

Possible 1,050,052 636,255 431,253 315,331 243,050

---------------------------- ------------- ----------- ----------- ----------- -----------

Total Proved plus Probable

plus Possible 2,608,874 1,775,765 1,313,006 1,024,405 829,773

---------------------------- ------------- ----------- ----------- ----------- -----------

Net Present Values Undiscounted Discounted Discounted Discounted Discounted

After Income Taxes (2) at 5% at 10% at 15% at 20%

($000's)

---------------------------- ------------- ----------- ----------- ----------- -----------

Proved

Developed Producing 40,461 38,818 35,781 32,906 30,445

Developed Non-Producing 93,106 77,056 66,818 59,345 53,537

Undeveloped 178,040 136,986 107,437 85,756 69,482

---------------------------- ------------- ----------- ----------- ----------- -----------

Total Proved 311,607 252,860 210,036 178,006 153,464

Probable 317,593 213,545 153,032 114,800 89,205

---------------------------- ------------- ----------- ----------- ----------- -----------

Total Proved plus Probable 629,200 466,405 363,068 292,806 242,669

Possible 413,968 254,122 172,545 126,103 97,118

---------------------------- ------------- ----------- ----------- ----------- -----------

Total Proved plus Probable

plus Possible 1,043,168 720,527 535,613 418,909 339,787

---------------------------- ------------- ----------- ----------- ----------- -----------

Notes:

(1) Based on GLJ's December 31, 2021 forecast prices and costs.

See " Forecast prices and costs " .

(2) The after-tax net present values prepared by GLJ in the

evaluation of the Company's crude oil and natural gas assets

presented herein are calculated by considering current Trinidad tax

regulations and are based on the Company's estimated tax pools and

non-capital losses as of December 31, 2021. The values reflect the

expected income tax burden on the assets on a consolidated basis.

Values do not represent an estimate of the value at the business

entity level or consider tax planning, which may be significantly

different. See "Advisories: Unaudited Financial Information".

Reconciliation of Gross Reserves by Product Type

The following table sets forth a reconciliation of the Company's

total gross proved, gross probable and total gross proved plus

probable reserves as of December 31, 2021 by product type against

such reserves as at December 31, 2020 based on forecast prices and

cost assumptions.

Reserves Category and Light Heavy Conventional Natural Total

Factors and Medium Crude Natural Gas Liquids Oil Equivalent

Crude Oil Gas (MMcf) (Mbbl) (Mboe)

Oil (Mbbl) (Mbbl) (1)

Total Proved

December 31, 2020 (2) 8,890 542 130,021 3,136 34,238

Exploration discoveries(3) 1,280 - - - 1,280

Extensions and improved

recovery(4) 244 - 17,072 436 3,525

Technical revisions(5) 195 (16) - - 179

Dispositions(6) - (11) - - (11)

Economic factors(7) 13 - - - 13

Production (449) (43) - - (492)

---------------------------- ------------ -------- ------------- ------------- ----------------

December 31, 2021 10,174 471 147,093 3,571 38,731

---------------------------- ------------ -------- ------------- ------------- ----------------

Total Probable

December 31, 2020 (2) 6,562 469 125,022 2,842 30,709

Exploration discoveries(3) 2,240 - - - 2,240

Extensions and improved

recovery(4) 72 - 19,620 500 3,842

Technical revisions(5) 28 (6) - - 22

Dispositions(6) - (5) - - (5)

Economic factors(7) 7 - - - 7

Production - - - - -

---------------------------- ------------ -------- ------------- ------------- ----------------

December 31, 2021 8,908 458 144,642 3,342 36,815

---------------------------- ------------ -------- ------------- ------------- ----------------

Total Proved plus Probable

December 31, 2020 (2) 15,452 1,010 255,043 5,977 64,947

Exploration discoveries(3) 3,520 - - - 3,520

Extensions and improved

recovery(4) 316 - 36,691 936 7,367

Technical revisions(5) 222 (21) - - 201

Dispositions(6) - (16) - - (16)

Economic factors(7) 20 - - - 20

Production (449) (43) - - (492)

---------------------------- ------------ -------- ------------- ------------- ----------------

December 31, 2021 19,082 929 291,735 6,914 75,547

---------------------------- ------------ -------- ------------- ------------- ----------------

Notes:

(1) NGLs are comprised of 100 percent condensate.

(2) Prior year reserve estimates per GLJ's independent reserves

evaluation dated March 4, 2021 with an effective date of December

31, 2020.

(3) Discoveries are associated with the evaluation of the

Royston area discovery on the Ortoire block.

(4) Reserve amounts for Infill Drilling, Extensions and Improved

Recovery are combined and reported as "Extensions and Improved

Recovery".

(5) Technical revisions factor includes all changes in reserves

due to well performance and previously booked wells which were

drilled in the year.

(6) The assets associated with three non-core properties were

classified as held for sale with an effective date of December 31,

2021. The Company is currently awaiting regulatory approvals to

close the asset dispositions.

(7) Economic factors are the change in reserves exclusively due to changes in pricing.

In comparison to December 31, 2020 on a proved plus probable

reserve basis, light and medium crude oil reserves increased 558

Mbbl from technical revisions, economic factors and drilling

extensions in 2021. 222 Mbbl of the annual increase reflected

improved well performance from our Coora, WD-4, WD-8, San Francique

and Barrackpore blocks, and 316 Mbbl of this change was based on

our 2021 drilling campaign at WD-4 and WD-8 resulting in drilling

extension reserve additions. In addition, heavy crude oil was

attributed downward technical revisions and economic factors of 21

Mbbl as of December 31, 2021, primarily due to reduced well

performance at our Fyzabad block. Effective December 31, 2021, we

sold our non-core New Dome, South Palo Seco, and Palo Seco

properties, resulting in an aggregate decrease of 16 Mbbl.

Our successful Royston-1 exploration well drilled in 2021 on the

Ortoire block led to a proved plus probable exploration discovery

of 3,520 Mbbl of light and medium crude oil reserves in 2021. In

addition, our Cascadura Deep-1 well which was tested in the first

quarter of 2021 led to a 7,051 Mboe increase in proved plus

probable conventional natural gas and NGL reserves as of December

31, 2021.

Future Development Costs

The following table provides information regarding the

development costs deducted in the estimation of the Company's

future net revenue using forecast prices and costs as included in

the Reserves Report.

Year ($000's) 1P 2P 3P

---------------------------------- ------- -------- --------

2022 27,708 31,098 31,098

2023 23,700 37,353 37,353

2024 8,126 36,650 36,650

2025 10,341 14,542 14,542

2026 10,138 13,931 13,931

Thereafter - - -

---------------------------------- ------- -------- --------

Total undiscounted 80,014 133,574 133,574

Total discounted at 10% per year 67,375 110,397 110,397

---------------------------------- ------- -------- --------

The following table sets forth the changes in undiscounted

future development costs included in the Reserves Report against

such costs in our December 31, 2020 reserves report prepared by GLJ

dated March 4, 2021.

($000's unless otherwise stated) 1P 2P 3P

------------------------------------------- ------- ------- -------

Increase in forecasted well costs 1,859 3,154 3,154

Increase in forecasted facility

and pipeline costs 3,867 4,707 4,707

Royston exploration discovery development

costs 18,368 41,786 41,786

------------------------------------------- ------- ------- -------

Total increase in future development

costs from 2020 24,094 49,647 49,647

Total increase in future development

costs from 2020 (%) 43 59 59

------------------------------------------- ------- ------- -------

Forecast Pricing and Costs

Forecast pricing and costs are prices and costs that are

generally acceptable, in the opinion of GLJ, as being a reasonable

outlook of the future as of the evaluation effective date. The

forecast cost assumptions consider inflation with respect to future

operating and capital costs. The following table sets forth the

benchmark reference prices and inflation rates reflected in the

Reserves Data as of December 31, 2021. These price assumptions were

provided to the Company by GLJ and were GLJ's then current forecast

as of the date of the Reserves Report.

Summary of GLJ January 1, 2022 Forecast Prices and Inflation

Rate Assumptions

Forecast Year Brent Spot Henry Hub Conway Condensate Inflation

Crude Oil Natural Gas (1) Rate

(1) (1)

($/bbl) ($/MMBtu) ($/bbl) (% per year)

--------------- ------------- ------------- ------------------- --------------

2022 76.00 3.80 67.16 0.0

2023 72.51 3.50 63.49 3.0

2024 71.24 3.15 61.86 2.0

2025 72.66 3.21 63.09 2.0

2026 74.12 3.28 64.36 2.0

2027 75.59 3.34 65.64 2.0

2028 77.11 3.41 66.96 2.0

2029 78.66 3.48 68.30 2.0

2030 80.22 3.55 69.66 2.0

2031 81.83 3.62 71.06 2.0

Thereafter +2.0% / year +2.0% / year +2.0% / year 2.0

Note:

(1) This summary table identifies benchmark reference pricing

schedules that might apply to a reporting issuer. Product sales

prices will reflect these reference prices with further adjustments

for specific marketing arrangements, quality differentials and

transportation to point of sale.

Capital Program Efficiency

2021 2021 - 2019 Total

----------------------------- --------------------

1P 2P 1P 2P

----------------------------- ------- --------- ---------

Estimated exploration

and development capital

expenditures(1) ($000's) 27,546 27,546 57,617 57,617

Change in FDC ($000's) 24,094 49,647 34,015 64,932

----------------------------- ------- ------- --------- ---------

F&D costs (2),(4) ($000's) 51,640 77,193 91,632 122,549

----------------------------- ------- ------- --------- ---------

Reserve additions (2),(3)

(Mboe) 4,985 11,092 29,168 57,931

F&D costs per boe (2),(4)

($/boe) 10.36 6.96 3.14 2.12

Estimated operating netback

(1),(4) ($/boe) 26.55 26.55 22.88 22.88

Recycle ratio (2),(4) 2.6x 3.8x 7.3x 10.8x

----------------------------- ------- ------- --------- ---------

Notes:

(1) Financial information is based on the Company's preliminary

2021 unaudited financial statements and is therefore subject to

change. See "Advisories: Unaudited Financial Information".

(2) See "Advisories: Reserves Advisory" and "Advisories: Oil and Gas Metrics".

(3) Based on gross reserves, which are the Company's working

interest share before deduction of royalties.

(4) Non-GAAP financial measure or ratio. See "Advisories:

Non-GAAP Financial Measures and Ratios".

Touchstone Exploration Inc.

Touchstone Exploration Inc. is a Calgary, Alberta based company

engaged in the business of acquiring interests in petroleum and

natural gas rights and the exploration, development, production and

sale of petroleum and natural gas. Touchstone is currently active

in onshore properties located in the Republic of Trinidad and

Tobago. The Company's common shares are traded on the Toronto Stock

Exchange and the AIM market of the London Stock Exchange under the

symbol " TXP " .

For further information about Touchstone, please visit our

website at www.touchstoneexploration.com or contact:

Mr. Paul Baay, President and Chief Executive Officer Tel: +1

(403) 750-4487

Mr. James Shipka, Chief Operating Officer

Mr. Scott Budau, Chief Financial Officer

Shore Capital (Nominated Advisor and Joint Broker)

Daniel Bush / Toby Gibbs / Michael McGloin Tel: +44 (0) 207 408

4090

Canaccord Genuity (Joint Broker)

Adam James / Henry Fitzgerald O'Connor / Thomas Diehl Tel: +44

(0) 207 523 8000

Camarco (Financial PR)

Billy Clegg / Emily Hall / Lily Pettifar Tel: +44 (0) 203 781

8330

Advisories

Forward-Looking Statements

Certain information provided in this announcement may constitute

forward-looking statements and information (collectively,

"forward-looking statements") within the meaning of applicable

securities laws. Such forward-looking statements include, without

limitation, forecasts, estimates, expectations and objectives for

future operations that are subject to assumptions, risks and

uncertainties, many of which are beyond the control of the Company.

Forward-looking statements are statements that are not historical

facts and are generally, but not always, identified by the words

"expects", "plans", "anticipates", "believes", "intends",

"estimates", "projects", "potential" and similar expressions, or

are events or conditions that "will", "would", "may", "could" or

"should" occur or be achieved.

Forward-looking statements in this announcement may include, but

is not limited to, statements relating to Touchstone's near-term

priorities, Touchstone's exploration opportunities, Royston-1 well

potential production capability and the field becoming a future

core development property, estimated crude oil, natural gas and NGL

reserves and the net present values of future net revenue

therefrom, total petroleum-initially-in-place estimated by GLJ, the

forecasted future production, commodity prices, inflation rates and

all future costs used by GLJ in their evaluation, field estimated

production, the Company's exploration plans and strategies,

including anticipated future exploration well drilling, production

testing operations, pipeline installation operations, ultimate

natural gas production and targeted production rates from the

Coho-1 well, receipt of regulatory approvals, anticipated

completion of the Cascadura natural gas facility, and the expected

timing thereof . Although the Company believes that the

expectations and assumptions on which the forward-looking

statements are based are reasonable, undue reliance should not be

placed on the forward-looking statements because the Company can

give no assurance that they will prove to be correct. Since

forward-looking statements address future events and conditions, by

their very nature they involve inherent risks and uncertainties.

Actual results could differ materially from those currently

anticipated due to a number of factors and risks. Certain of these

risks are set out in more detail in the Company's 2020 Annual

Information Form dated March 25, 2021 which has been filed on SEDAR

and can be accessed at www.sedar.com . The forward-looking

statements contained in this announcement are made as of the date

hereof, and except as may be required by applicable securities

laws, the Company assumes no obligation to update publicly or

revise any forward-looking statements made herein or otherwise,

whether as a result of new information, future events or

otherwise.

In addition, statements relating to reserves are by their nature

forward-looking statements, as they involve the implied assessment,

based on certain estimates and assumptions, that the reserves

described exist in the quantities predicted or estimated, and can

be profitably produced in the future. The recovery and reserve

estimates of Touchstone's reserves provided herein are estimates

only, and there is no guarantee that the estimated reserves will be

recovered. Consequently, actual results may differ materially from

those anticipated in the forward-looking statements.

Reserves Advisory

The disclosure in this announcement summarizes certain

information contained in the Reserves Report but represents only a

portion of the disclosure required under NI 51-101. Full disclosure

with respect to the Company's reserves as at December 31, 2021 will

be contained in the Company's Annual Information Form for the year

ended December 31, 2021 which will be filed on SEDAR on or before

March 31, 2022.

The recovery and reserve estimates of crude oil, natural gas and

NGL reserves provided herein are estimates only, and there is no

guarantee that the estimated reserves will be recovered. Actual

reserves may eventually prove to be greater than or less than the

estimates provided herein. This announcement summarizes the crude

oil, natural gas and NGL reserves of the Company and the net

present values of future net revenue for such reserves using

forecast prices and costs as at December 31, 2021 prior to

provision for interest and finance costs, general and

administration expenses, and the impact of any financial

derivatives. It should not be assumed that the present worth of

estimated future net revenues presented in the tables above

represent the fair market value of the reserves. There is no

assurance that the forecast prices and costs assumptions will be

attained, and variances could be material.

"Proved Developed Producing Reserves" are those reserves that

are expected to be recovered from completion intervals open at the

time of the estimate. These reserves may be currently producing, or

if shut-in, they must have previously been on production, and the

date of resumption of production must be known with reasonable

certainty.

"Proved Developed Non-Producing Reserves" are those reserves

that either have not been on production or have previously been on

production but are shut-in, and the date of resumption of

production is unknown.

"Undeveloped Reserves" are those reserves expected to be

recovered from known accumulations where a significant expenditure

(for example, when compared to the cost of drilling a well) is

required to render them capable of production. They must fully meet

the requirements of the reserves category (proved, probable,

possible) to which they are assigned.

"Proved" reserves are those reserves that can be estimated with

a high degree of certainty to be recoverable. It is likely that the

actual remaining quantities recovered will exceed the estimated

proved reserves.

"Probable" reserves are those additional reserves that are less

certain to be recovered than proved reserves. It is equally likely

that the actual remaining quantities recovered will be greater or

less than the sum of the estimated proved plus probable

reserves.

"Possible" reserves are those additional reserves that are less

certain to be recovered than probable reserves. There is a 10%

probability that the quantities actually recovered will equal or

exceed the sum of proved plus probable plus possible reserves. It

is unlikely that the actual remaining quantities recovered will

exceed the sum of the estimated proved plus probable plus possible

reserves.

In the Reserves Report, GLJ forecasted reserve volumes and

future cash flows based upon current and historical well

performance through to the economic production limit of individual

wells. Notwithstanding established precedence and contractual

options for the continuation and renewal of the Company's existing

licence, sub-licence and marketing agreements , in many cases the

forecasted economic limit of individual wells is beyond the current

term of the relevant agreements. There is no certainty as to any

renewal of the Company's existing exploration, production, and

marketing arrangements.

This announcement uses the term "total petroleum

initially-in-place", which means the quantity of petroleum that is

estimated to exist originally in naturally occurring accumulations.

It includes that quantity of petroleum that is estimated, as of a

given date, to be contained in known accumulations, prior to

production, plus those estimated quantities in accumulations yet to

be discovered. There is no certainty that any portion of the

resources will be discovered. If discovered, there is no certainty

that it will be commercially viable to produce any portion of the

resources. In their evaluation of the Royston structure, GLJ

estimated that the overthrust and intermediate sheet structures in

the Royston area contained a low estimate of 128.3 MMbbl, a best

estimate of 165.7 MMbbl and a high estimate of 211.7 MMbbl of total

petroleum initially-in-place.

Oil and Gas Measures

Where applicable, natural gas has been converted to barrels of

oil equivalent based on six thousand cubic feet to one barrel of

oil. The barrel of oil equivalent rate is based on an energy

equivalent conversion method primarily applicable at the burner

tip, and given that the value ratio based on the current price of

crude oil as compared to natural gas is significantly different

than the energy equivalency of the 6:1 conversion ratio, utilizing

the 6:1 conversion ratio may be misleading as an indication of

value.

Oil and Gas Metrics

This announcement contains several oil and gas metrics that are

commonly used in the oil and gas industry such as reserves

additions, finding and development costs, and recycle ratio. These

metrics have been prepared by Management and do not have

standardized meanings or standardized methods of calculation, and

therefore such measures may not be comparable to similar measures

presented by other companies and should not be used to make

comparisons. Such metrics have been included herein to provide

readers with additional measures to evaluate the Company's

performance; however, such measures are not reliable indicators of

the future performance of the Company, and future performance may

not compare to the performance in prior periods, and therefore such

metrics should not be unduly relied upon. The Company uses these

oil and gas metrics for its own performance measurements and to

provide shareholders with measures to compare the Company's

operations over time. Readers are cautioned that the information

provided by these metrics, or that can be derived from the metrics

presented in this announcement, should not be relied upon for

investment purposes.

Reserve additions are calculated as the change in reserves from

the beginning to the end of the applicable period excluding period

production. Management uses this measure to determine the relative

change of its reserves base over a period of time.

F&D costs represent the costs of exploration and development

incurred. Specifically, F&D is calculated as the sum of

exploration and development capital expenditures incurred in the

period and the change in future development costs required to

develop those reserves. The Company's annual audit of its December

31, 2021 consolidated financial statements is not complete.

Accordingly, unaudited exploration and development capital

expenditure amounts used in the calculation of F&D costs are

Management's estimates and are subject to change. F&D costs per

barrel is determined by dividing current period reserve additions

to the corresponding period's F&D costs. Readers are cautioned

that the aggregate of capital expenditures incurred in the most

recent financial year and the change during that year in estimated

FDC generally will not reflect total F&D costs related to

reserves additions for that year. Management uses F&D costs as

a measure of its ability to execute its capital program, the

success in doing so, and of the Company's asset quality.

Recycle ratio is a measure used by Management to evaluate the

effectiveness of its capital reinvestment program and is calculated

by dividing the annual F&D costs per barrel to operating

netback per barrel prior to realized gains or losses on commodity

derivative contracts in the corresponding period (see "Advisories:

Non-GAAP Financial Measures and Ratios"). The Company's annual

audit of its December 31, 2021 consolidated financial statements is

not complete. Accordingly, unaudited operating netbacks used in

calculations of recycle ratios are Management's estimates and are

subject to change. The recycle ratio compares netbacks from

existing reserves to the cost of finding new reserves and may not

accurately indicate the investment success unless the replacement

of reserves are of equivalent quality as the produced reserves.

Unaudited Financial Information

Certain annual 2021 financial information disclosed herein

including capital expenditures and operating netback are based on

unaudited estimated results and are subject to the same limitations

as discussed in the forward-looking statements advisory disclosed

herein. These estimated results are subject to change upon

completion of the Company's audited financial statements for the

year ended December 31, 2021, and changes could be material.

Touchstone anticipates filing its audited consolidated financial

statements and related management's discussion and analysis for the

year ended December 31, 2021 on SEDAR on March 28, 2022.

Non-GAAP Financial Measures and Ratios

Certain financial measures and ratios included herein do not

have a standardized meaning as prescribed by International

Financial Reporting Standards and therefore are considered non-GAAP

financial measures and ratios. These measures and ratios may not be

comparable to similar measures and ratios presented by other

issuers. These measures and ratios are commonly used in the crude

oil and natural gas industry and by the Company to provide

shareholders and potential investors with additional information

regarding the Company's performance and capital efficiency.

Non-GAAP financial measures and ratios include operating netback,

F&D costs and recycle ratio.

The Company uses operating netback as a key performance

indicator of field results. The Company considers operating netback

to be a key measure as it demonstrates Touchstone's profitability

relative to current commodity prices and assists Management and

investors with evaluating operating results on a historical basis.

Operating netback is calculated by deducting royalties and

operating expenses from petroleum sales. Operating netback per

barrel is calculated by dividing the operating netback by

production volumes for the period. Operating netback is presented

herein prior to realized gains or losses on commodity derivative

contracts.

The following table presents the computation of estimated

operating netback disclosed herein, using unaudited financial

information for the year ended December 31, 2021 in both

periods.

($000's unless otherwise Year ended Three years

stated) December ended December

31, 2021 31, 2021

----------------------------- ----------- ----------------

Petroleum sales 29,568 87,814

Royalties (9,251) (25,725)

Operating expenses (7,286) (23,920)

------------------------------- ----------- ----------------

Estimated operating netback 13,031 38,169

------------------------------- ----------- ----------------

Production (bbls) 490,741 1,668,065

Estimated operating netback

($/bbl) 26.55 22.88

------------------------------- ----------- ----------------

Refer to "Advisories: Oil and Gas Metrics" regarding F&D

costs and recycle ratio.

Abbreviations

bbl(s) barrel(s)

bbls/d barrels per day

Mbbl thousand barrels

MMbbl million barrels

Mcf thousand cubic feet

MMcf million cubic feet

MMBtu million British Thermal Units

NGL(s) natural gas liquid(s)

boe barrels of oil equivalent

Mboe thousand barrels of oil equivalent

Competent Persons Statement

In accordance with the AIM Rules for Companies, the technical

information contained in this announcement has been reviewed and

approved by James Shipka, Chief Operating Officer of Touchstone

Exploration Inc. Mr. Shipka is a qualified person as defined in the

London Stock Exchange's Guidance Note for Mining and Oil and Gas

Companies and is a Fellow of the Geological Society of London (BGS)

as well as a member of the Canadian Society of Petroleum Geologists

and the Geological Society of Trinidad and Tobago. Mr. Shipka has a

Bachelor of Science in Geology from the University of Calgary and

has over 30 years of oil and gas exploration and development

experience.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFLAVAIRIIF

(END) Dow Jones Newswires

March 07, 2022 02:00 ET (07:00 GMT)

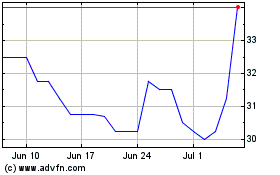

Touchstone Exploration (LSE:TXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Touchstone Exploration (LSE:TXP)

Historical Stock Chart

From Apr 2023 to Apr 2024