Tesco Agrees to Sell Asia Supermarket Business to Thai Tycoon for $10.6 Billion -- Update

March 09 2020 - 5:48AM

Dow Jones News

By P.R. Venkat

U.K. retailer Tesco PLC, cutting debt and narrowing its focus,

agreed to sell its Asia assets to Thailand's richest family in a

deal that values the business at $10.58 billion.

Tesco, among the world's largest grocers by sales, reached an

agreement to sell its Thailand and Malaysia assets to CP Group

entities. That will allow it to focus more on generating cash and

shareholder returns from its operations in the U.K. and Ireland and

in Central Europe, Tesco said Monday.

Since 2011, Tesco has exited markets including Japan, the U.S.

and South Korea, and ceded some control of its operations in China.

In the U.K. is locked in a price battle with discount grocers and

online competitors such as Amazon.com Inc. and Ocado Group PLC.

The shift home is one also being made by some of its

counterparts, such as French players Carrefour SA and Casino

Guichard-Perrachon, which have exited operations in countries such

as Indonesia, Thailand and Vietnam in recent years.

Tesco had said in December that it started reviewing options for

its businesses in Thailand and Malaysia, including possible sales.

Tesco Lotus operates around 2,000 stores in Thailand and 74 in

Malaysia.

Tesco said its net cash proceeds from the sale, which is subject

to regulatory approvals in Thailand and Malaysia, will come to

$10.3 billion before tax and other transaction costs. It said it

will return GBP5 billion ($6.52 billion) to shareholders through a

special dividend with associated share consolidation.

For CP Group, which sold the Thailand assets to Tesco during the

1998 Asian financial crisis for $365 million, the deal is one of

its biggest acquisitions. Notable past purchases include the $9.4

billion deal for a stake in Chinese insurer Ping An Insurance

(Group) Co. of China Ltd. in 2013.

Owned by the Chearavanont family-- Thailand's richest, with a

net worth of $29.5 billion--CP Group has business interests

spanning from property development and telecommunications to

consumer goods and pharmaceuticals.

Tesco said that it expects to receive regulatory approval for

the sale during the third quarter of this year. If successful, it

will be the biggest M&A transaction in Thailand since 1995,

according to Dealogic data.

Write to P.R. Venkat at venkat.pr@wsj.com

(END) Dow Jones Newswires

March 09, 2020 05:33 ET (09:33 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

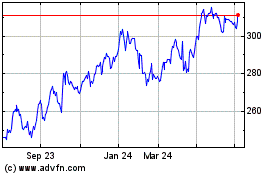

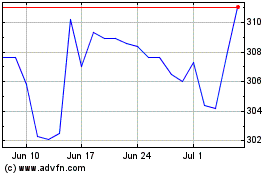

Tesco (LSE:TSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesco (LSE:TSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024