TIDMTSCO

RNS Number : 4046F

Tesco PLC

09 March 2020

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART

IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A

VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION

FOR IMMEDIATE RELEASE

9 March 2020

Tesco PLC

("Tesco" or the "Company")

TESCO AGREES TO SELL ITS BUSINESSES IN THAILAND AND

MALAYSIA;

SIGNIFICANT RETURN TO SHAREHOLDERS, SIMPLIFICATION AND FURTHER

DE-RISKING

Highlights:

-- Proposed sale of Tesco's businesses in Thailand and Malaysia to a combination of CP Group entities, namely C.P.

Retail Development Company Limited, Charoen Pokphand Holding Co., Ltd, CP All Public Limited Company and C.P.

Merchandising Co., Ltd ("CP Group") (the "Disposal"), following inbound interest received and a detailed

strategic review

-- Consideration for the Disposal represents an enterprise value of $10.6 billion (equivalent to GBP8.2 billion) on

a cash and debt free basis, implying an EV/EBITDA multiple of 12.5x[1]

-- Net cash proceeds of $10.3 billion (equivalent to GBP8.0 billion) before tax and other transaction costs

-- Following completion of the Disposal, the Board intends to return c.GBP5.0 billion to shareholders via a special

dividend with associated share consolidation

-- The Disposal will further de-risk the Tesco business by reducing indebtedness through a GBP2.5 billion pension

contribution that, along with other measures, is expected to eliminate the current funding deficit and

significantly reduce the prospect of having to make further pension deficit contributions in the future

-- Disposal unanimously agreed by Tesco Board to be in the best interests of all stakeholders

-- Completion of the Disposal, which is conditional on Tesco shareholder approval and customary regulatory approvals

in Thailand and Malaysia, is expected during the second half of 2020

-- The Disposal will further simplify the Tesco Group, enabling a stronger focus on driving cash generation and

returns to shareholders from our retail businesses in the UK and Ireland and in Central Europe

Dave Lewis, Chief Executive of Tesco, said:

"Following inbound interest and a detailed strategic review of

all options, we are announcing today the proposed sale of Tesco

Thailand and Tesco Malaysia. This sale releases material value and

allows us to further simplify and focus the business, as well as to

return significant value to shareholders. I would like to thank all

of our Tesco Thailand and Tesco Malaysia colleagues for their

dedication, professionalism and service to our customers, which has

resulted in the creation of such a strong business. I am confident

that the agreement we have reached with CP Group presents an

exciting opportunity for their continued success."

This summary should be read in conjunction with the full text of

this announcement. This announcement is available at

http://www.tescoplc.com. A circular containing details of the

Disposal and a notice convening a general meeting of the Company

will be sent to Tesco shareholders as soon as is practicable.

Enquiries:

Tesco

Investor Relations Chris Griffith +44 (0) 1707 912 900

Media Christine Heffernan +44 (0) 1707 918 701

Philip Gawith (Teneo) +44 (0) 207 420 3143

Greenhill & Co. International Goldman Sachs International Barclays Bank PLC

LLP Joint Financial Adviser Joint Financial Adviser,

Joint Financial Adviser Sponsor and Corporate

(020 7774 1000) Broker

(020 7198 7400) * Anthony Gutman (020 7623 2323)

* David Wyles * Alisdair Gayne

* Milan Hasecic

* Charles Gournay * Omar Faruqui

* Nick Harper

* Nicola Tennent

TESCO PLC ("TESCO" OR THE "COMPANY") PROPOSED DISPOSAL OF TESCO

THAILAND AND TESCO MALAYSIA

1. Introduction

Tesco announces that it has entered into a conditional agreement

with a combination of CP Group entities, namely C.P. Retail

Development Company Limited, Charoen Pokphand Holding Co., Ltd, CP

All Public Limited Company and C.P. Merchandising Co., Ltd ("CP

Group") with respect to the sale of Tesco's businesses in Thailand

and Malaysia (the "Disposal"), which is comprised of Tesco's entire

shareholding in Tesco Stores (Thailand) Limited ("Tesco Thailand"),

Tesco Stores (Malaysia) Sdn Bhd ("Tesco Malaysia") and any

respective subsidiaries (together, the "Asia Business"). The

Disposal will simplify the Tesco Group, enabling a stronger focus

on its retail businesses in the UK and Ireland and in Central

Europe. The Disposal also realises material value for Tesco's

shareholders and allows the Tesco Group to further de-risk the

business by reducing indebtedness through a significant pension

contribution of GBP2.5 billion.

The consideration payable to Tesco pursuant to the Disposal

represents an enterprise value of $10.6 billion (equivalent to

GBP8.2 billion) on a cash and debt free basis, representing an

EV/EBITDA multiple of 12.5x([2]) .

Under the terms of the Disposal, net cash proceeds are expected

to be $10.3 billion (equivalent to GBP8.0 billion) before tax and

other transaction costs (the "Net Cash Proceeds").

The Disposal constitutes a Class 1 transaction for Tesco under

the Listing Rules and completion of the Disposal ("Completion") is

therefore conditional on, inter alia, the approval of Tesco

shareholders at a general meeting of the Company's shareholders.

The Disposal is also subject to customary regulatory approvals in

Thailand and Malaysia. A circular containing further details of the

Disposal and a notice convening the general meeting will be sent to

Tesco shareholders as soon as practicable. It is also expected that

shortly after Completion, a separate general meeting will be

convened to seek shareholder approval for the return of proceeds

and associated share consolidation. A separate circular will be

sent to shareholders containing further details on these.

2. Background to and reasons for the Disposal

Over the last four years Tesco's performance has significantly

improved, in particular within the UK, its largest and most

important market, but also across the wider Group. In October 2019,

Tesco announced that it had met or exceeded the targets it had set

against each of its six key strategic drivers, and that all

elements of its turnaround plan had been executed successfully.

The Group's balance sheet is now stronger, with total

indebtedness reduced by GBP7.0 billion since the financial year end

2014/15. This has been driven by strong business performance, the

release of GBP1.7 billion of value from the property portfolio, and

selective asset disposals, including of the Korean business in

2015. In addition, the Group has completed the merger with Booker,

combining the largest wholesale food business in the UK with the

largest food retailer and unlocking significant shareholder value

in the process. The improved business performance, combined with

the reduction in indebtedness, means that Tesco now has an

investment grade rating from its three covering rating

agencies.

With a renewed focus on customers, colleagues and suppliers, the

business is ideally positioned to deliver strong performance for

all of its stakeholders.

Throughout the Group's transformation, the Board and management

team have been focused on ensuring the strategy and the portfolio

management approach deliver attractive returns for shareholders. In

2017/18, on the back of stronger operational and financial

performance, the ordinary dividend was reintroduced and

subsequently it has increased by 92% last year. This year the

target pay-out of 50% of earnings is expected to be reached.

It is from this strengthened position that the Board has decided

to respond to the expressions of interest it received for the Tesco

Thailand and Tesco Malaysia. Tesco's Asian operations have been an

important part of the Group for many years and constitute an

exceptionally high-quality business, with market leading positions

in two key markets of Thailand and Malaysia. Given the high value

that could be received for Tesco Thailand and Tesco Malaysia, the

Board concluded that it would be in shareholders' best interests to

conduct a strategic review to determine the best option for

continued value creation. The conclusion of this strategic review

led the Board subsequently to launch a competitive process to

evaluate potential value creation through a disposal.

The Group received multiple offers for the Asia Business and the

Board has unanimously concluded that the offer by CP Group to

acquire the business for an enterprise value of GBP8.2 billion on a

cash and debt free basis should be recommended to shareholders. The

Board believes the Disposal will realise a significantly higher

value than could be generated from Tesco's continued ownership and

investment. It will also enable the Group to return significant

proceeds to shareholders, with c.GBP5.0 billion expected to be

returned via a special dividend, and to further de-risk the

business by reducing indebtedness through a significant pension

contribution of GBP2.5 billion.

3. Information on the Asia Business

Information on Tesco Thailand

Tesco began operating in Thailand in 1998 through Ek--Chai,

which operates under the name "Tesco Lotus", a network of stores

comprising various formats across Tesco Thailand as well as an

online shopping platform and third-party applications such as

Lazada and Happy Fresh.

Tesco Lotus is a leading grocery retailer in the Thailand market

and one of the most recognised retail brands in Thailand. It

generated approximately GBP4.1 billion in revenue (excl. VAT, incl.

fuel) in the financial year ended 23 February 2019, operates a

network of 1,967([3]) stores across Tesco Thailand and serves over

13 million customers each week. As part of its offer to customers

and to support the core grocery business, in many large freehold

and leasehold stores Tesco Thailand has developed an attractive and

profitable mall business, which in its own right is one of the

largest such operators in the market.

Ek--Chai, a subsidiary of Tesco Stores (Thailand) Limited,

supplies its stores from six distribution centres and two hubs

across Thailand. The stores and distribution centres are located on

and within land and buildings owned or leased by Ek--Chai. Ek--Chai

also leases space in its major shopping malls to tenants.

Information on Tesco Malaysia

Tesco began operating in Malaysia under the name Tesco Malaysia

in 2002, as part of a joint venture with Sime Darby Berhad. Tesco

Malaysia is a leading grocery retailer in the Malaysian market and

one of the most recognised retail brands in Malaysia. It generated

approximately GBP0.8 billion in revenue (excl. VAT, incl. fuel) in

the financial year ended 23 February 2019 and operates a network of

68([4]) stores across Malaysia. Tesco Malaysia supplies its stores

from two distribution centres in Malaysia, with its stores and

distribution centres located on and within land and buildings

either owned, leased or tenanted by Tesco Malaysia.

As in Thailand, Tesco Malaysia operates a highly successful mall

business alongside its retail stores from its freehold and

leasehold estate.

Trading results for the Asia Business

A summary of the trading results of the Asia Business for the

two 52-week periods ended 24 February 2018 and 23 February 2019,

extracted without material adjustments from the consolidation

schedules and supporting accounting records that underlie the Tesco

Group's audited consolidated financial statements for the financial

years ended 24 February 2018 and 23 February 2019 is set out

below.

The Asia Business has not in the past formed a legal group and

has not prepared separate consolidated financial statements. The

financial information shown for the financial years ended 24

February 2018 and 23 February 2019 has been prepared applying the

IFRS accounting principles adopted in the Tesco Group's

consolidated financial statements for the financial year ending 23

February 2019.

52 weeks ended 24 February 2018 52 weeks ended 23 February 2019 52 weeks ended 23 February 2019

(pre-IFRS 16) (pre-IFRS 16) (post-IFRS 16)

GBP million GBP million GBP million

unaudited unaudited unaudited

Revenue 4,947 4,873 4,873

Operating

profit 293 232 265

Profit

before

taxation 289 235 236

4. Summary of terms of the Disposal

The consideration payable to Tesco pursuant to the Disposal

represents an enterprise value of $10.6 billion (equivalent to

GBP8.2 billion) on a cash and debt free basis, representing an

EV/EBITDA multiple of 12.5x([5]) . The transaction values Tesco

Thailand at an enterprise value of $9.9 billion, including $0.4

billion of net cash. The transaction values Tesco Malaysia at an

enterprise value of $0.7 billion, including $0.6 billion of net

debt.

Under the terms of the Disposal, Net Cash Proceeds are expected

to be $10.3 billion (equivalent to GBP8.0 billion) before tax and

other transaction costs. Tax and other transaction costs are

expected to be in the region of GBP0.1 billion.

The Disposal is a Class 1 transaction for Tesco under the

Listing Rules and is therefore conditional upon the approval of its

shareholders. It is also conditional upon obtaining customary

regulatory approvals in Thailand and Malaysia, including the

approval of the Trade Competition Commission of Thailand (the TCC),

which is expected to be received during Q3 2020.

As is usual in transactions of this nature, the Sale Agreement

contains obligations on both sides to obtain the required

approvals, as well as customary warranties and indemnities. The

Disposal also includes certain transitional services to be provided

between Tesco and the Asia Business, and a transitional licence

permitting the Asia Business to continue to use the Tesco brand, in

each case for a limited period following Completion.

5. Use of proceeds and financial effects of the Disposal

Use of proceeds

Following Completion, the Board intends to return c.GBP5.0

billion to shareholders by way of special dividend. The Board also

intends to make a significant contribution of GBP2.5 billion to the

Group's UK defined benefit Pension Scheme and, to further increase

security in the Scheme, will provide properties as an additional

contingent asset with a value of GBP0.2 billion. This pension

contribution will enable further de-risking of the Scheme. Based on

the current technical provisions deficit in the Group's UK Pension

Scheme, and taking into account the GBP0.3 billion annual

contribution to be paid in FY2020/2021, the GBP2.5 billion pension

contribution is expected to eliminate the current funding deficit.

This will significantly reduce the prospect of having to make

further deficit contributions in the future, and release c.GBP260

million of annual free cash flow. The IAS19 deficit is also

expected to be significantly reduced. Agreement has been reached

with the Trustees of the Group's UK Pension Scheme in respect of

the contribution to be paid to the Scheme, and clearance received

from the Pension Regulator in connection with the Disposal and the

expected return of proceeds. The agreement with the Trustees also

covers the key principles of the triennial scheme valuation, which

will be calculated as at 31 December 2019. The balance of the Net

Cash Proceeds, expected to be c.GBP0.5 billion, will be retained to

strengthen the balance sheet and used for general corporate

purposes.

Return of proceeds to shareholders

It is currently expected that the return of proceeds to

shareholders of c.GBP5.0 billion will be implemented by way of a

special dividend. In order to maintain the comparability of the

Group's share price and per-share metrics before and after the

return of proceeds, the Company also intends to undertake a share

consolidation in conjunction with the return of proceeds. It is

expected that full details of the return of proceeds and share

consolidation will be made available to shareholders shortly after

Completion, at which time a separate general meeting will be

convened to seek shareholder approval for the return of proceeds

and associated share consolidation.

Financial effects of the Disposal on the Retained Group

In the 52 weeks ending 23 February 2019, the Asia Business

contributed EBITDA of GBP640 million and operating profit of GBP265

million to Tesco. As at 23 February 2019, the Asia Business had

gross assets of GBP4.4 billion and net assets of GBP2.6

billion.

Following the Disposal, Tesco will continue to be a highly cash

generative business with a robust and prudently managed balance

sheet. Going forward, reflecting the Group's more focused

operations, the Board is targeting leverage of around 2.5x total

indebtedness/EBITDAR, the lower end of the current range. The Board

and executive management team will continue to focus on delivering

excellent customer satisfaction, cash profitability, free cash flow

and earnings growth. The Group will also have a clear capital

allocation policy centred around investing in the business to

maintain the Group's market leading position and delivering

sustainable returns to shareholders.

As the business is expected to continue to be highly cash

generative following the Disposal, it is envisaged that the

ordinary dividend will be supplemented in due course with

additional returns to shareholders, likely to be in the form of

share buybacks.

6. Summary of information on the Retained Group and future strategy

Following Completion, Tesco will be a significantly more focused

business with the leading market position in the UK and Ireland,

with 3,769([6]) stores from convenience formats through to larger

stores, as well as our wholesale business, Booker.

In addition, the Group has an established presence in four

Central European countries, with 895 stores comprising hypermarkets

and convenience formats in the Czech Republic, Slovakia, Hungary

and Poland. The Group also operates Tesco Bank, which provides a

simple and convenient retail bank to 6 million customers.

The Board is encouraged by the growth and value creation

opportunities it sees across the Group. At the Capital Markets Day

on 18 June 2019, the Executive team outlined many of the untapped

value opportunities ranging from greater innovation in product

offering and how we serve customers, further cost reduction

opportunities, greater focus on customer loyalty (e.g. the new

Clubcard Plus initiative) and further integration and growth from

Booker.

In the UK and Ireland, the competitiveness of the offer has been

rebuilt and this is where the greatest opportunity is seen, looking

forward. There is a strong market position as the leading food

retailer with c.27% market share, 3,769 stores in the UK and

ROI([7]) and over 99% online coverage in the UK. There is a strong,

trusted brand with an NPS score up 8 points over the last year. The

business is fully price competitive, with Exclusively at Tesco

competing directly with discount retailers. Tesco was recognised

for quality as winner of 'Britain's Favourite Supermarket' for the

fifth consecutive year and with Tesco Finest producing offerings

capable of competing directly with premium brands. Tesco also has

one of the largest loyalty programmes in UK retail with a 19

million+ customer base of Clubcard and Clubcard Plus members.

Innovation is being driven across the product offering in the

fastest growing market segments, with a leading UK market position

in "free from" and vegan ranges in addition to leading positions in

healthy offerings, which we believe offers customers healthier

products, for example through sugar and salt reduction.

The business has the opportunity to further expand its strong

online presence, leveraging its position as the largest UK online

grocer by opening more than 25 urban fulfilment centres over the

next three years and doubling its online capacity. Tesco has, and

is collaborating in the development of, leading technology, with

Trigo frictionless shopping technology and the 'Scan, Pay, Go' app.

Through "Simplify to serve" the business continues its journey to

focus on improving customer service and lowering operating costs,

with simplified Group structures, long term partnerships with

suppliers and with procurement efficiencies generated through the

Carrefour buying alliance.

Significant growth opportunities are seen in convenience,

catering, delivery and services which are accessed through the

Booker business which is on track to meet its GBP2.5 billion

incremental revenue ambition outlined at the time of the merger.

The Group will also continue to utilise its strong supplier

relationships to improve the quality, choice and range for all of

Booker's customers, deploying relevant skills and platforms across

the combined business.

As such, the business is in a strong position to generate

sustainable competitive growth in the UK and Ireland, and with it,

strong cash generation.

The Central European business operates in Poland, Czech

Republic, Hungary and Slovakia and provides the Group with

geographic diversification. The ongoing transformation of this

division continues, so as to ensure the business is re-positioned

to drive sustainable long-term growth in the region.

In summary, the strategy will seek to create value for

shareholders through maintaining and strengthening the

competitiveness of the offer for customers across all the Group's

markets. This will allow the business to continue to leverage its

unique market position to generate an attractive and sustainable

level of free cash flow. This cash will be utilised according to

the capital allocation priorities set out below, and which are

consistent with the capital allocation framework under which the

business has operated in recent years:

1. Disciplined reinvestment in our business with ongoing capex

guidance of GBP0.9 - 1.2 billion p.a.

2. Target leverage of c.2.5x, with a strong investment grade credit rating

3. Dividends at a 50% pay-out ratio

4. Selective and opportunistic investment in inorganic growth opportunities that may arise

5. Return surplus cash to shareholders, expected to be via share buybacks

The Board expects the execution of this strategy to result in

improved customer satisfaction, enhanced earnings and increased

returns for shareholders.

7. Information on CP Group

CP Group comprises various public and private entities including

Charoen Pokphand Foods Public Company Limited, and CP ALL Public

Company Limited.

Charoen Pokphand Group Co. Ltd

Charoen Pokphand Holding Co., Ltd. serves as a parent company of

the CP Group. As a holding company, Charoen Pokphand Group Co.,

Ltd. holds shares of subsidiaries in Thailand and overseas. The

Group operates across many industries ranging from industrial to

service sectors, which are categorised into 8 Business Lines

covering 13 Business Groups. Currently, the Group has investments

in 21 countries and economies.

CPF

Charoen Pokphand Foods Public Company Limited ("CPF") operates

integrated agro-industrial and food business including livestock

and aquaculture such as swine, broiler, layer, duck, shrimp and

fish across 17 countries with its vision to become Kitchen of the

World.

CPALL

CP All Public Company Limited ("CPALL") is the sole operator of

7-Eleven convenience stores in Thailand. In 2013, CPALL acquired

Siam Makro Public Company Limited operating membership based Cash

and Carry trade centres.

8. Expected timetable to Completion

A circular containing further details of the Disposal, the

Board's recommendation, and the notice of the general meeting and

the resolution required to approve the Disposal will be sent to

Tesco's shareholders as soon as practicable. Completion is expected

to occur during the second half of calendar year 2020.

9. Advisers

Greenhill & Co. International LLP, Goldman Sachs

International and Barclays Bank PLC, acting through its Investment

Bank ("Barclays"), are acting as Joint Financial Advisers to Tesco

in relation to the Disposal. Barclays is acting as Financial

Sponsor and Corporate Broker to Tesco in relation to the Disposal.

Freshfields Bruckhaus Deringer LLP is acting as legal adviser to

Tesco.

Enquiries:

Tesco

Investor Relations Chris Griffith +44 (0) 1707 912 900

Media Christine Heffernan +44 (0) 1707 918 701

Philip Gawith (Teneo) +44 (0) 207 420 3143

Greenhill & Co. International Goldman Sachs International Barclays Bank PLC

LLP Joint Financial Adviser Joint Financial Adviser,

Joint Financial Adviser Sponsor and Corporate

(020 7774 1000) Broker

(020 7198 7400) * Anthony Gutman (020 7623 2323)

* David Wyles * Alisdair Gayne

* Milan Hasecic

* Charles Gournay * Omar Faruqui

* Nick Harper

* Nicola Tennent

Tesco plc is listed on the London Stock Exchange. More

information can be found at www.tescoplc.com.

Exchange rates

Historic exchange rates have been used to convert THB and MYR to

GBP where relevant. In respect of each of the financial periods

ended 24 February 2018 and 23 February 2019, the exchange rates

are:

Thailand Malaysia

FY Period Date Balance Sheet P&L Balance Sheet P&L

17/18 12 24 February 2018 43.93 43.73 5.477 5.526

18/19 12 23 February 2019 40.89 42.63 5.322 5.357

------ ------- ----------------- -------------- ------ -------------- ------

Terms of the Disposal presented in GBP use a rate of

USD1.29:GBP1.00 based on the average daily closing rate from Monday

2 to Friday 6 March 2020.

IFRS 16

Financial information shown, unless otherwise stated, is stated

on a post-IFRS 16 basis.

Important information relating to financial advisers

Greenhill & Co. International LLP, which is authorised and

regulated in the UK by the Financial Conduct Authority, is acting

exclusively for Tesco and for no one else in connection with the

matters described in this document and is not, and will not be,

responsible to anyone other than Tesco for providing the

protections afforded to its clients nor for providing advice in

connection with the matters set out in this document.

Goldman Sachs International, which is authorised by the

Prudential Regulation Authority and regulated by the Financial

Conduct Authority and the Prudential Regulation Authority in the

UK, is acting exclusively for Tesco and for no one else in

connection with the matters described in this document and is not,

and will not be, responsible to anyone other than Tesco for

providing the protections afforded to its clients nor for providing

advice in connection with the matters set out in this document.

Barclays, which is authorised by the Prudential Regulation

Authority and regulated in the United Kingdom by the Financial

Conduct Authority and the Prudential Regulation Authority, is

acting exclusively for Tesco and no one else in connection with the

Disposal and will not be responsible to anyone other than Tesco for

providing the protections afforded to clients of Barclays nor for

providing advice in relation to the Disposal or any other matter

referred to in this announcement.

Forward looking statements

This document contains statements which are, or may be deemed to

be, "forward looking statements" which are prospective in nature.

All statements other than statements of historical fact are forward

-- looking statements. They are based on current expectations and

projections about future events, and are therefore subject to risks

and uncertainties which could cause actual results to differ

materially from the future results expressed or implied by the

forward -- looking statements. Often, but not always, forward

looking statements can be identified by the use of forward looking

words such as "plans", "expects", "is expected", "is subject to",

"budget", "scheduled", "estimates", "forecasts", "intends",

"anticipates", "believes", "targets", "aims", "projects" or words

or terms of similar substance or the negative thereof, are forward

-- looking statements, as well as variations of such words and

phrases or statements that certain actions, events or results

"may", "could", "should", "would", "might" or "will" be taken,

occur or be achieved. Such statements are qualified in their

entirety by the inherent risks and uncertainties surrounding future

expectations. Forward -- looking statements include statements

relating to (a) future capital expenditures, expenses, revenues,

earnings, economic performance, indebtedness, financial condition,

dividend policy, losses and future prospects, (b) business and

management strategies and the expansion and growth of Tesco's

operations, and (c) the effects of global economic conditions on

Tesco's business.

Such forward--looking statements involve known and unknown risks

and uncertainties that could significantly affect expected results

and are based on certain key assumptions. Many factors may cause

actual results, performance or achievements of Tesco to be

materially different from any future results, performance or

achievements expressed or implied by the forward looking

statements. Important factors that could cause actual results,

performance or achievements of Tesco to differ materially from the

expectations of Tesco, include, among other things, general

business and economic conditions globally, industry trends,

competition, changes in government and other regulation and policy,

including in relation to the environment, health and safety and

taxation, labour relations and work stoppages, interest rates and

currency fluctuations, changes in its business strategy, political

and economic uncertainty and other factors. Such forward--looking

statements should therefore be construed in light of such factors.

Neither Tesco nor any of its directors, officers or advisers

provides any representation, assurance or guarantee that the

occurrence of the events expressed or implied in any

forward--looking statements in this document will actually occur.

You are cautioned not to place undue reliance on these

forward--looking statements, which speak only as of the date

hereof. Other than in accordance with its legal or regulatory

obligations (including under the UK Listing Rules and the

Disclosure and Transparency Rules), Tesco is not under any

obligation and Tesco expressly disclaims any intention or

obligation to update or revise any forward--looking statements,

whether as a result of new information, future events or

otherwise.

The release, publication or distribution of this announcement in

jurisdictions other than the United Kingdom may be restricted by

law and therefore any persons who are subject to the laws of any

jurisdiction other than the United Kingdom should inform themselves

about, and observe, any applicable requirements. This announcement

has been prepared for the purposes of complying with the UK Listing

Rules and the information disclosed may not be the same as that

which would have been disclosed if this announcement had been

prepared in accordance with laws and regulations of any

jurisdiction outside of England.

Cautionary statement

This announcement is not intended to, and does not constitute,

or form part of, any offer to sell or an invitation to purchase or

subscribe for any securities or a solicitation of any vote or

approval in any jurisdiction. Shareholders are advised to read

carefully the formal documentation in relation to the Disposal once

it has been despatched. Any response to the proposals should be

made only on the basis of the information in the formal

documentation to follow.

Tesco PLC's LEI number is: 2138002P5RNKC5W2JZ46

Appendix

The following definitions apply throughout this announcement,

unless the context otherwise requires:

"Asia Business": means Tesco Thailand, Tesco Malaysia and any

respective subsidiaries.

"Barclays": means Barclays Bank PLC acting through its

Investment Bank.

"Board": means the board of directors of the Company.

"Company" or "Tesco": means Tesco PLC.

"Completion": means completion of the Disposal in accordance

with the provisions of the Sale Agreement.

"CP Group": means C.P. Retail Development Company Limited,

Charoen Pokphand Holding Co., Ltd, CP All Public Limited Company

and C.P. Merchandising Co., Ltd.

"Disclosure and Transparency Rules": means the Disclosure

Guidance and Transparency Rules made by the FCA for the purposes of

Part VI of FSMA, as amended from time to time.

"Disposal": means the sale of Tesco's businesses in Thailand and

Malaysia to CP Group.

"EBITDA": means earnings before interest, taxation, exceptional

items, depreciation and amortisation.

"Group's Pension Scheme": means the Tesco PLC Pension

Scheme.

"Listing Rules": means the Listing Rules made by the FCA for the

purposes of Part VI of FSMA, as amended from time to time.

"Net Cash Proceeds": means net cash proceeds from the Disposal

before adjustment for estimated tax and other transaction costs.

.

"Retained Group": means the Company and its subsidiaries and

subsidiary undertaking from time to time excluding the Asia

Business, being the continuing business of the Tesco Group

following Completion.

"Sale Agreement": means the share and purchase agreement dated 9

March 2020 entered into between the Tesco Stores Limited, Tesco

Holdings B.V., C.P. Retail Development Company Limited, Charoen

Pokphand Holding Co., Ltd, CP All Public Limited Company and C.P.

Merchandising Co., Ltd in connection with the Disposal.

"Tesco Group": means in respect of any time prior to Completion,

Tesco and its consolidated subsidiaries and subsidiary undertakings

and, in respect of any time following Completion, the Retained

Group.

"Tesco Malaysia": means Tesco Stores (Malaysia) Sdn Bhd.

"Tesco Thailand": means Tesco Stores (Thailand) Limited.

"Trustees of the Pension Scheme": means the trustees of the

Group's Pension Scheme.

"UK" or "United Kingdom": means the United Kingdom of Great

Britain and Northern Ireland.

([1]) Based on the financial year ended 23 February 2019 on a

post-IFRS 16 basis.

([2]) Based on the financial year ended 23 February 2019 on a post-IFRS 16 basis.

([3]) As at 24 August 2019.

([4]) As at 24 August 2019.

([5]) Based on the financial year ended 23 February 2019 on a

post-IFRS 16 basis.

([6]) As at 24 August 2019.

([7]) As at 24 August 2019.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DISEAKDNESDEEEA

(END) Dow Jones Newswires

March 09, 2020 03:00 ET (07:00 GMT)

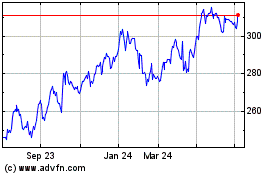

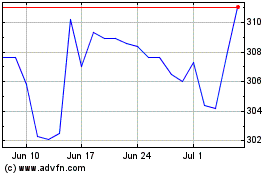

Tesco (LSE:TSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesco (LSE:TSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024