TIDMTLW TIDMTTM TIDMTTM

RNS Number : 8466T

Tullow Oil PLC

30 March 2021

TULLOW OIL PLC

Annual report and accounts

Tullow Oil plc ("Tullow" or the "Company")

30 March 2021 - Following the release on 10 March 2021 of the

Company's preliminary full year results announcement for the year

ended 31 December 2020 (the "Preliminary Announcement"), the

Company announces it has published its Annual Report and Accounts

for this period (the "Annual Report and Accounts").

A copy of the Annual Reports and Accounts are available to view

on the Company's website: www.tullowoil.com

The Company is also pleased to announce it has published its

Sustainability Report and Climate Risk & Resilience Report,

which is also available on the Company's website: www.tullowoil.com

.

The Company's 2021 Annual General Meeting will be on a date to

be confirmed in due course.

In accordance with Disclosure Guidance and Transparency Rule

6.3.5(2)(b), additional information is set out in the appendices to

this announcement. This information is extracted in full unedited

text from the Annual Report and Accounts.

The Preliminary Announcement included a set of condensed

financial statements and a fair review of the development and

performance of the business and position of the Company and its

group.

In accordance with Listing Rule 9.6.1, a copy of the Annual

Report and Accounts have been submitted to the Financial Conduct

Authority via the National Storage Mechanism and will be available

for viewing shortly at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

In addition, all of the above documents have been submitted to

Euronext Dublin and the Ghana Stock Exchange, and therefore will

shortly be available for inspection at Euronext Dublin (Exchange

Buildings, Foster Place, Dublin 2) and will be available to

shareholders located in Ghana by contacting the Company's

registrar: Central Securities Depository (GH) Limited, 4th Floor,

Cedi House, PMB CT 465 Cantonments, Accra, Ghana (Telephone: +233

(0)302 906 576).

CONTACTS

=========================================== ===================

Tullow Oil plc Murrays

(London) (Dublin)

(+44 20 3249 9000) (+353 1 498 0300)

George Cazenove (Media) Pat Walsh

Matthew Evans and Chris Perry (Investors) Joe Heron

=========================================== ===================

Notes to editors

Tullow is an independent oil & gas, exploration and

production group which is quoted on the London, Irish and Ghanaian

stock exchanges (symbol: TLW) and is a constituent of the FTSE250

index. The Group has interests in over 50 exploration and

production licences across 11 countries including Ghana where it

operates the Jubilee and TEN fields. In March 2021, Tullow

committed to becoming Net Zero on its Scope 1 and 2 emissions by

2030.

Follow Tullow on:

Twitter: www.twitter.com/TullowOilplc

YouTube: www.youtube.com/TullowOilplc

Facebook: www.facebook.com/TullowOilplc

LinkedIn: www.linkedin.com/company/Tullow-Oil

Appendices

Appendix A : Directors' responsibility statement

The following directors' responsibility statement is extracted

from the Annual Report and Accounts (page 79).

Directors' responsibility statement required by DTR 4.1.12R

The Directors confirm, to the best of their knowledge:

- that the consolidated Financial Statements, prepared in

accordance with International Accounting Standards in conformity

with the requirements of the Companies Act 2006 and IFRSs adopted

pursuant to Regulation (EC) No.1606/2002 as it applies in the

European Union, give a true and fair view of the assets,

liabilities, financial position and profit of the Parent Company

and undertakings included in the consolidation taken as a

whole;

- that the Annual Report, including the Strategic Report,

includes a fair review of the development and performance of the

business and the position of the Company and undertakings included

in the consolidation taken as a whole, together with a description

of the principal risks and uncertainties that they face; and

- that they consider the Annual Report, taken as a whole, is

fair, balanced and understandable and provides the information

necessary for shareholders to assess the Company's position,

performance, business model and strategy.

By order of the Board

Rahul Dhir Les Wood

Chief Executive Chair Chief Financial Officer

9 March 2021 9 March 2021

Appendix B: A description of the principal risks and uncertainties that the Company faces

The following description of the principal risks and

uncertainties that the Company faces is extracted from the Annual

Report and Accounts (pages 31 to 35).

Risk appetite

The Board sets Tullow's risk appetite and acceptable risk

tolerance levels for each of the principal risk categories. In

considering Tullow's risk appetite, the Board reviewed the risk

process, the assessment of enterprise level risks and the existing

controls and mitigating actions that drive towards residual risk.

During this process, the Board articulated which risks Tullow

should not tolerate, which should be managed to an acceptable level

and which should be accepted in order to deliver our business

strategy.

The risk appetite is reviewed at least annually by the Board to

ensure that it reflects the current external and market conditions.

The Board last reviewed the risk appetites in February 2020. The

Senior Leadership Team reviewed the risk appetite statements in

February 2021 against the revised principal risks and the Board

will next review the risk appetite statements in March 2021.

Internal control

A foundation of effective governance, risk management and

control has been established throughout the organisation. Core to

this is our Integrated Management System (IMS) which sets out all

mandatory policies, standards and controls necessary to manage our

activities and associated risks. The effectiveness of the internal

control framework is reviewed through the risk management process

and challenged as described above. In addition to this, the Senior

Leadership Team and Audit Committee perform an annual review of the

effectiveness of internal control.

Nature of assurance

-- Assurance activities are put in place across the three lines

of defence to assure against key risks. These specifically focus on

areas where there are internal/external changes, control failures

and historical issues.

-- Business leadership acts as the first line of defence and is

responsible for ensuring their key risks are being managed

effectively and that adequate controls are in place to manage those

risks.

-- Group oversight acts as a second line of defence and as well

as setting functional standards is responsible for ensuring

compliance with them. They obtain assurance through periodic

reporting and focused assurance reviews. They are also responsible

for identifying and managing risks that fall under their remit.

Given the change in business structure and reporting lines the

assurance provided over the second line of defence is currently

under review.

-- Internal Audit acts as the third line of defence and is

responsible for providing independent assurance through its

risk-based internal audit programme. The Internal Audit Plan and

outputs are reviewed by the Audit Committee. Agreed actions for

improving the control environment and managing risk are owned by

assigned individuals and monitored through Tullow's performance

review process. The Audit Committee monitors the implementation for

recommendations arising.

-- Tullow's risk management and assurance processes provide the

Board and the Management Team with reasonable, but not absolute,

assurance that our assets and reputation are protected.

Evolution of Tullow's management of risk and control

Organisational and strategic changes made throughout the year

have redefined ownership and point of decision making across the

business. The changes aimed to promote accountability and challenge

at a senior level and remove the need for multiple layers of review

as Tullow becomes a more agile business.

During 2020 the risk management and control framework has been

evolved to align to the new ways of working and this will continue

to evolve into 2021. Although the controls have been in place to

mitigate key risks throughout 2020 the nature of these controls has

changed and the business has launched a programme of transformation

to review key processes and the IMS to make sure it continues to be

fit-for-purpose for the new business structure.

The risk framework has been realigned to the new business

reporting lines and senior risk owners have been identified to

ensure that a greater culture of risk awareness and challenge is

instilled throughout the business with an increased focus on

mitigating actions. This will continue into 2021 including updating

the accountability framework and reviewing the assurance processes

in place over the newly defined key controls.

Tullow's risk profile

The Company risk profile has been closely monitored throughout

the year, with consideration given to the risks to delivering the

Business Plan as well as whether the COVID-19 pandemic or oil price

volatility resulted in any new risks or changes to existing risks.

Risks associated with COVID-19 have been considered and managed

across all principal risk categories.

Strategy risk Link to 2021 scorecard - Business Plan Implementation

------------------------------------------------------------------------------------------------------------------------------

Risk of failure to deliver operations,

development and subsurface objectives Risk owner: Rahul Dhir

----------------------------------------------------------- -----------------------------------------------------------------

Risk details Risk mitigations

----------------------------------------------------------- -----------------------------------------------------------------

Tullow has developed a Business Plan

to deliver material value and * Well defined and integrated plan to deliver the

cash flow. This will help Tullow necessary inputs needed to achieve Business Plan

reduce leverage and create value objectives

for

our shareholders. The success of

the plan is reliant on delivery of * Clear KPIs and accountability defined

clear targets and disciplined allocation

of capital and our human

resources. Failure to achieve the * Ongoing business performance review process to

objectives will impair value and monitor performance

loss

of shareholder confidence and support.

Key execution risks not * Large portfolio of high-return drilling and

addressed elsewhere include: investment opportunities defined with JV support in

* Lack of ability to increase oil production and Ghana and across non-operated assets

replenish our resource base will reduce our ability

to deliver value and cash flow and could ultimately

impair our ability to reduce leverage * Improvements in facilities' reliability through

targeted interventions

* Operational and subsurface challenges prevent us from

achieving our planned oil production * Simplified well design and reduced completion

complexity

* Ghana gas market constraints reduce our planned gas

offtake which would impact oil production and our * Integrated planning across subsurface, drilling and

ability to reduce flaring projects teams

* Unable to progress the preparation of FDP in Kenya * Alignment with Government of Ghana on gas offtake for

and therefore any exercise to unlock Kenyan potential 2021 with longer term negotiations under way

* Inability to unlock the potential in emerging basins * Active engagement with JV and Government of Kenya to

may reduce value creation opportunities progress preparation of FDP in Kenya

* High concentration risk in Ghana and Gabon * Exploration plan in place for emerging basins,

particularly Argentina, Guyana and Suriname

----------------------------------------------------------- -----------------------------------------------------------------

Risk of failure to deliver commercially

attractive projects and operations

due to sustained low oil price Risk owner: Les Wood

----------------------------------------------------------- -----------------------------------------------------------------

Risk details Risk mitigations

----------------------------------------------------------- -----------------------------------------------------------------

The nature of the industry within

which we operate means the * Cost base reduced substantially to be viable in a

volatility of oil price is always lower oil price environment

a risk that Tullow remains exposed

to.

* Prolonged low oil price and increased volatility * 60 per cent of 2021 oil entitlement hedged at an

would lead to a decrease in asset values and reduced average floor price of $48/bbl.

access to funding

* Proven, tested and successful business continuity

process and plans in place for managing COVID-19

----------------------------------------------------------- -----------------------------------------------------------------

Stakeholder risk Link to 2021 scorecard - Leadership

--------------------------------------------------------------------------------------------------

Risk of disruption to business due

to inability to manage stakeholder

relations Risk owner: Rahul Dhir

------------------------------------------ ------------------------------------------------------

Risk details Risk mitigations

------------------------------------------ ------------------------------------------------------

The value of our assets and cash -- Well defined plan to engage proactively

flow generation may be eroded with all key stakeholders: all relevant

by unreasonable financial/fiscal stakeholders identified, and relationship

demands by host governments accountabilities defined

or actions that impair contract sanctity. -- Communication plan developed to

educate stakeholders on the broader

There is a risk of political interference impact of the Business Plan on the

in our operations that may impact nation.

our ability to award contracts to -- Reliance on robust stabilisation

the appropriate service providers. clauses in all our Petroleum Agreements.

Inability to manage relations with -- Tax advice obtained

key ministries, regulators and the

wider community could result in delays

in relevant approvals and

community ill will.

------------------------------------------ ------------------------------------------------------

Climate change risk Link to 2021 scorecard - Sustainability

----------------------------------------------------------------------------------------------------------------------

Risk of failure to manage impact

of climate change Risk owner: Julia Ross

-------------------------------------------------------- ------------------------------------------------------------

Risk details Risk mitigations

-------------------------------------------------------- ------------------------------------------------------------

The climate agenda is an increasing -- Cross-functional team established

area of focus globally, to identify opportunities to reduce

particularly for Tullow as we evolve carbon emissions across our operations

the business and work towards and/or investment in nature-based

improving our approach to environmental carbon removal projects to offset

impact. emissions impact

-- 2030 Net Zero (Scope 1 & 2) commitment

Failure to manage the impact of climate and pathway identified to decarbonise

change arising from evolving our Ghana assets

policies and increased volatility -- Long term gas offtake options

and downside risk in oil prices could support elimination of flaring

affect the commerciality of our portfolio, -- Enhanced understanding of climate

lead to loss of licence to related financial risks including

operate and result in limited access TCFD climate disclosure in our Annual

to/increased cost of capital. Report

* There may be challenges to delivering a suitable -- Stress test the portfolio to ensure

strategy to address climate change due to limited its resilience to IEA's

resources available * Sustainable Development scenario

-------------------------------------------------------- ------------------------------------------------------------

EHS or security risk Link to scorecard - Safety, Production and Business

Plan Implementation

----------------------------------------------------------------------------------------------------------------------

Risk of asset integrity breach or

major production failure Risk owner: Wissam Al-Monthiry

----------------------------------------------------------- ---------------------------------------------------------

Risk details Risk mitigations

----------------------------------------------------------- ---------------------------------------------------------

The nature of our operations will -- Asset and well integrity and maintenance

always have an inherent risk of a programmes with regular internal

major incident resulting in fatalities, verification and external assurance

loss of production, and/or -- Independently Verified Safety

extensive damage to facilities, the Case Document establishing quantitative

environment or communities. risk estimate assuming effective

The nature of our business at the systems and risk tolerance thresholds

moment means that we are reliant -- FPSO periodic planned shutdowns

on several key operated assets as to carry out required

well as our non-operated and * inspection, maintenance, repair and modificat

exploration portfolio. ion work

* A large gas release/asset integrity breach due to a

topside event resulting in a Major Accident Event may

occur, which may lead to injury to personnel, a -- Inherently Safer Design principles

prolonged production outage and potential significant application in engineering modifications

environmental damage -- Assurance and Compliance management

including Class

-- Increased level of assurance activity

on the FPSO with Tullow Offshore

field managers undertaking significant

assurance activities offshore

-- Comprehensive all-risk insurance

in place

----------------------------------------------------------- ---------------------------------------------------------

Financial risk Link to 2021 scorecard - Financial Performance and Capital

Structure

--------------------------------------------------------------------------------------------------------------

Risk of insufficient liquidity and

funding capacity Risk owner: Les Wood

----------------------------------------------------------- -------------------------------------------------

Risk details Risk mitigations

----------------------------------------------------------- -------------------------------------------------

Tullow remains exposed to erosion -- Range of high-quality assets that

of its balance sheet and revenues could be sold as part of portfolio

due to oil price volatility, unexpected management to unlock capital and

operational incidents, ongoing pay down debt

costs associated with the COVID-19 -- Leverage targets and minimum headroom

pandemic, failure to complete policy approved by the Board

portfolio options and inability to -- 2020 year-end undrawn facility

refinance. headroom and free cash of $1.1 billion

* Tullow may have difficulty securing a resolution of -- Dynamic working capital and cash

debt maturities due to failure to deliver its flow management including ability

Business Plan, which may lead to insufficient to flex capital investment

liquidity and potential impact on funding capacity -- Solid foundation to address debt

maturities

----------------------------------------------------------- -------------------------------------------------

Risk that we fail to deliver a sustainable

capital structure Risk owner: Les Wood

----------------------------------------------------------- -------------------------------------------------

Risk details Risk mitigations

----------------------------------------------------------- -------------------------------------------------

-- Plan to prioritise investments

* Tullow's ability to deliver the Business Plan is with high returns and short payback

dependent on developing a timely and sustainable -- Solid foundation to address debt

capital structure. maturities

-- RBL redetermination plan in place

-- Plan to drive gearing to 1x-2x

* Tullow may have challenges in the timely delivery of with appropriate liquidity headroom

a sustainable capital structure; this could impact

the ability to cover debt servicing costs over an

extended period or continued operations as the

capital structure is being implemented. Both

scenarios could potentially negatively impact the

ability to deliver the Business Plan.

----------------------------------------------------------- -------------------------------------------------

Organisation risk Link to 2021 scorecard - Business Plan Implementation

and Leadership

--------------------------------------------------------------------------------------------------------------------

Risk that the transformation plan

fails to support the strategy and

deliver cost savings Risk owner: Julia Ross

----------------------------------------------------------------- -------------------------------------------------

Risk details Risk mitigations

----------------------------------------------------------------- -------------------------------------------------

-- Transformation team established

* Tullow may be unable to maintain or improve which includes external advisors

operational performance and pursue growth if the -- Bottom-up review with external

Company is unable to evolve, maintain and sustain its consultant

organisational capabilities and deliver identified -- Transformation plan developed

cost savings and successfully fully implement its and key milestones identified and

planned transformational organisation change. tracked

-- Organisation restructured;

headcount

* The objectives/cost savings of the Transformation reduced by 53 per cent and

Project may not be achieved. This may result in a outsourcing

negative impact on cash flow and an organisation that of certain routine activities

is no longer fit-for-purpose from a cost perspective -- Cost-driven performance management

being implemented

----------------------------------------------------------------- -------------------------------------------------

Risk that the people strategy and

culture do not support the strategy Risk owner: Julia Ross

----------------------------------------------------------------- -------------------------------------------------

Risk details Risk mitigations

----------------------------------------------------------------- -------------------------------------------------

Tullow's success depends on the quality -- Revised Employee Value Proposition

of talent it can attract and (EVP) launched in 2020 aligning

retain and a strong ethically minded to restructured organisation

and performance-focused -- New approach to performance

culture. management

* Tullow may be unable to attract and retain suitably being implemented across the

experienced individuals which could lead to a lack of organisation

sufficient resource and capability to deliver core -- A renewed focus on Diversity

business activities. This may result in an inability and Inclusion

to meet strategic objectives and increased -- Review in progress to update

constraints on the capacity and moral of remaining succession plans for senior and

staff. critical roles

-- Focus on health and wellbeing;

rolling wellness programme

----------------------------------------------------------------- -------------------------------------------------

Conduct risk Link to scorecard - Business Plan Implementation and Leadership

----------------------------------------------------------------------------------------------------------------------

Risk of major compliance breach Risk owner: Mike Walsh

----------------------------------------------------------------- ---------------------------------------------------

Risk details Risk mitigations

----------------------------------------------------------------- ---------------------------------------------------

Tullow maintains high ethical standards -- Annual Code of Ethical Conduct

across the business without which staff eLearning and code certification

the company could be exposed to increased process

risk of non-compliance and bribery -- Third-party due diligence procedures

and corruption legislation or contractual and assurance processes in place

obligations along with other applicable -- Misconduct and loss reporting

business conduct requirements. standard and associated procedures

* In particular, an unforeseen material compliance in place

breach could lead to regulatory action, an unsettled -- Well established Anti-Bribery

litigation/dispute or additional failure litigation and Corruption governance

that may result in unplanned cash outflow, -- Process in place for GDPR

penalty/fines and a loss of stakeholder confidence in investigations

management. -- Anti-tax evasion risk assessment

undertaken with clear mitigation

actions identified

-- Recorded and investigated 52

concerns

raised, of which 50 cases are closed.

Appropriate actions have been taken

including employee dismissal (for

serious breaches).

----------------------------------------------------------------- ---------------------------------------------------

Cyber risk Link to 2021 scoreboard - Business Plan Implementation and

Leadership

----------------------------------------------------------------------------------------------------------------------

Risk of major cyber attack Risk owner: Mike Walsh

------------------------------------------------------------------ --------------------------------------------------

Risk details Risk mitigations

------------------------------------------------------------------ --------------------------------------------------

The external cyber threat environment -- Advanced security operations centre

is continuously evolving and in place providing 24/7 network and

intensifying; therefore, this is device monitoring

an ongoing risk that requires constant -- Security incident event management

monitoring and management. systems in place.

* Tullow may suffer an external cyber-attack which -- Security awareness programme in

could have far reaching consequences for the place

business. This could result in loss of sensitive -- Joint Tullow/MODEC industrial

personal or commercial data or allow external parties control system security programme

to limit our ability to operate, seize production or in place

potentially trigger a major incident -- Corporate security programme in

place

-- Annual mandatory security and

GDPR awareness training

-- Staff susceptibility to phishing

regularly tested

------------------------------------------------------------------ --------------------------------------------------

Viability statement

In accordance with the provisions of the UK Corporate Governance

Code, the Board has assessed the prospects and the viability of the

Group over a longer period than the 12 months required by the

'going concern' provision. The Board assesses the business over a

number of time horizons for different reasons, including the

following: Annual Corporate Budget (i.e. 2021), Two-year Forecast

(i.e. 2021-2022), Five-year Corporate Business Plan (i.e.

2021-2025), and Long-term Plan. The Board conducted the review for

the purposes of the Viability Statement over a three-year period.

The three-year period was selected for the following reasons:

i. in light of the current highly volatile market environment

the Group considers the Group's facility and free cash headroom,

debt: equity mix, and other financial ratios, over a three-year

period as opposed to the five-year Corporate Business Plan

period;

ii. the current contractual maturity of the Group's $300 million

Convertible Notes due in July 2021 and $650 million Senior Notes

due in April 2022 fall within a three-year period and as such the

three-year period is largely aligned with Tullow's funding cycle;

and

iii. this also aligns with the current transitional business

cycle with the significant projected increase in production and

operating cash flow generation in 2023 following a period of

significant capital investment in the Group's producing assets.

Notwithstanding this fact the Group will continue to monitor the

business over all time horizons noted above. As noted on pages 22

to 23 in the Group's going concern assessment, the Directors have

concluded that the uncertainties associated with implementing a

Refinancing Proposal and obtaining amendments or waivers in respect

of future forecast covenant breaches or, in the event a Refinancing

Proposal does complete, the revised covenants are subsequently

breached, are material uncertainties that may cast significant

doubt that the Group will be able to continue as a going

concern.

On a longer-term basis, when considering the Viability Statement

under the Base Case assumptions and a combination of reasonably

plausible low case scenarios over the three-year period, the same

uncertainties exist. However, the Base Case assumes that the

Group's Refinancing Proposal is successfully completed, and the

Group obtains amendments or waivers in respect of future forecast

covenant breaches or, in the event a Refinancing Proposal is

implemented, the Group obtains amendments or waivers in respect of

any breaches of revised covenants, which results in, the Group

forecasting liquidity headroom over the three-year period. The

Group has additional mitigating actions available to it should the

combination of reasonably plausible low case scenarios arise,

including reductions to capital investment, protection of oil price

volatility through hedging, further portfolio management and, if

required, raising additional capital. The Directors are committed

to delivering a refinancing proposal, and further mitigating

actions if a combination of reasonably plausible low case scenarios

arises, and they therefore believe that the Group continues to be

viable over the three-year assessment period.

Tullow has also assessed its viability in line with the IEA's

Sustainable Development Scenarios; see page 19 for details.

Principal risks* Base assumption Downside scenario

Strategy risks Production is assumed to 8 per cent reduction in production.

be in line with the Oil price: 2021: $45/bbl, 2022:

Business Plan. $47.5/bbl, 2023+: $50/bbl.

Oil price: 2021: $50/bbl,

2022: $55/bbl, 2023+: $55/bbl.

-------------------------------- ---------------------------------------

Stakeholder Associated with host government Exposure beyond the $87 million

risks stakeholders the Group has included in the Base

included $87 million outflow Case is either not anticipated

associated with tax exposures to occur within the three-year

(refer to page 107 to 108 assessment period or is not reasonably

for a description plausible to occur at all.

of the Group's uncertain

tax positions).

-------------------------------- ---------------------------------------

Climate change The key impact of climate In a downside scenario the Group

risk change on the Groups' portfolio has assumed a

of assets is reflected in reduction in the Base Case assumption

oil prices, which are assumed which is below

as: the current IEA SDS scenario of:

2021: $50/bbl, 2022: $55/bbl 2021: $45/bbl, 2022:

and 2023+: $55/bbl. $47.5/bbl, 2023+: $50/bbl.

-------------------------------- ---------------------------------------

EHS or security Production, operating costs 8 per cent reduction in production

risks and capital investment are

assumed to be in line with

the Business Plan.

-------------------------------- ---------------------------------------

Financial risks Contractual maturities of Contractual maturities of debt

debt instruments. However, instruments. However, the

the refinancing proposal refinancing proposal is assumed

is assumed as a mitigating as a mitigating action.

action.

-------------------------------- ---------------------------------------

* For detailed information on risk mitigation, assurance and

progress in 2020 refer to discussion of the detailed risks

above.

For Organisational Risk, Conduct Risk and Cyber Risk the Group

has assessed that there is no reasonably plausible scenario that

can be modelled in isolation or in combination with other risks

from a cash flow perspective.

Liquidity risk management and going concern

Assessment period and assumptions

The Group closely monitors and carefully manages its liquidity

risk. Cash flow forecasts are regularly updated, and sensitivities

run for different scenarios, including, but not limited to, changes

in commodity price and different forecasts for the Group's

producing assets. The Directors consider the Going Concern

assessment period to be 13 months to April 2022, thereby including

the maturity of the $650 million Senior Notes due in April 2022 in

the assessment. Management has applied the following oil price

assumptions for the Going Concern assessment:

-- Base Case: $50/bbl for 2021 and $55/bbl for 2022, and

-- Low Case: $45/bbl for 2021 and $50/bbl for 2022.

The Low Case includes, amongst other downside assumptions, an 8%

production decrease compared to the Base Case as well as deferred

receipts from portfolio management and increased outflows

associated with ongoing disputes. No mitigating actions have been

included in either case.

The Base Case and Low Case scenarios forecast sufficient

financial headroom for the 12 months from approval of the 2020

Annual Report and Accounts on 10 March 2021. However, both

scenarios forecast a liquidity shortfall in April 2022 following

the repayment of the $650 million Senior Notes due in April 2022,

which falls within the liquidity forecast test periods in respect

of the February 2021, September 2021 and March 2022 RBL

redeterminations. Both cases assume amendments or waivers are

received for any forecast Liquidity Forecast Test or gearing

covenant breach as described below.

Refinancing Proposal

The Base Case and Low Case scenarios forecast a liquidity

shortfall in April 2022, which could result in a failure to pass

the Liquidity Forecast Test, as described below, in respect of the

February 2021, September 2021 and March 2022 RBL redeterminations,

and the gearing covenant tests, as described below, in respect of

30 June 2021 and 31 December 2021. The Group's management has

therefore commenced discussions with its existing and potential new

creditors, the objective of which is to raise new funding and/or

agree certain amendments to the terms, including the covenants

and/or maturity dates, of some or all of the RBL Facility, the

Convertible Bonds, the 2022 Senior Notes and the 2025 Senior Notes

with, if necessary, such amendments being approved by shareholders

(Refinancing Proposal). Whilst the Directors believe that a

Refinancing Proposal would be in the commercial interests of all

stakeholders, there can be no certainty that the creditors and, if

necessary, shareholders will agree to a Refinancing Proposal,

implementation of which is therefore outside the control of the

Group.

Liquidity Forecast Test covenant compliance

As part of each RBL redetermination process the Group is

required to demonstrate to the reasonable satisfaction of the

relevant majority of its lenders under the RBL Facility that it

has, or will have, sufficient funds available to meet the Group's

financial commitments for a period of 18 months starting from the

first month immediately following the relevant RBL redetermination

(Liquidity Forecast Test).

On 26 February 2021 the Group submitted a Liquidity Forecast

Test to the lenders in respect of the February 2021 RBL

redetermination. The Directors concluded that the information

submitted to the lenders under the RBL Facility, which is different

from the Base Case and the Low Case scenarios described above and

includes mitigating actions, fulfilled the requirements of the

Liquidity Forecast Test. At the date of approving the 2020 Annual

Report and Accounts, an approval in respect of this test is yet to

be received, therefore a risk remains that the Group could fail

this test.

If the lenders under the RBL Facility were to conclude that the

information submitted does not fulfil the requirements of the

Liquidity Forecast Test and the Group was unable to cure the

resulting default by the end of April 2021, there would be an event

of default. Such event of default would allow the lenders under the

RBL Facility, at their discretion, to cancel the RBL Facility and

demand that all outstanding borrowings under the RBL Facility be

repaid and/or enforce their security rights. This would in turn

trigger other creditors' rights to call cross-defaults under the

other financing arrangements of the Group (namely the Convertible

Bonds, the 2022 Senior Notes and the 2025 Senior Notes) which could

result in the entirety of the Group's borrowings potentially

becoming immediately repayable by the end of April 2021. While

discussions in respect of a Refinancing Proposal are continuing the

Directors believe that, if required, a waiver of such a potential

event of default in respect of the Liquidity Forecast Test could be

agreed with the lenders under the RBL Facility.

The Group is also required to submit Liquidity Forecast Tests in

respect of the September 2021 and March 2022 RBL redeterminations.

The Base Case and Low Case scenarios forecast, before mitigations,

a potential liquidity shortfall and therefore a potential failure

of these tests. However, the Directors believe that a Refinancing

Proposal could be implemented in time for the September 2021 RBL

redetermination such that no shortfall will be forecast as part of

the Liquidity Forecast Tests in September 2021 and March 2022. If

no Refinancing Proposal has been implemented, and refinancing

discussions were no longer continuing, by September 2021 there

would be a significant risk of the Group entering into, or being

in, insolvency proceedings, the implications of which are described

in the section Implications and material uncertainties below.

Gearing covenant compliance

The RBL Facility contains a gearing covenant which is tested for

each 12-month period ending on 30 June and 31 December each year,

and which requires that net debt of the Group as defined in the RBL

Facility agreement is lower than 3.5 times consolidated EBITDAX

(earnings before interest tax, depreciation and exploration

write-offs) for each relevant 12-month period. Under both the Base

Case and the Low Case scenarios, the Group's gearing is forecast to

be in excess of the RBL gearing covenant when calculated at 30 June

2021 and 31 December 2021, the two testing dates falling within the

Going Concern assessment period.

The Group has requested an amendment in respect of these gearing

covenant testing dates as part of the Refinancing Proposal

described above. In the event that such amendments are not agreed

on time for the testing date falling on 30 June 2021, the Directors

would expect to request a waiver or amendment for that testing date

only in the first instance, and if needed for the testing date

falling on 31 December 2021 in the second half of the year. The

Directors believe that the Group would be able to secure such

amendments or waivers, which would be both consistent with past

practice and the Directors' reasonable expectation of the

commercial interests of the Group and its lenders.

If the Group is unable to agree an amendment or waiver of the

gearing covenant, if required, in respect of the 30 June 2021

testing date, the Directors will deliver to the relevant lenders a

notification of non-compliance, which is required to be delivered

as soon as the Group's unaudited financial statements for the half

year ended 30 June are available, but no later than 28 September

2021. If a subsequent 75-day period expires without the Company

having resolved the non-compliance there will be an event of

default under the RBL Facility by mid-December 2021.

Implications and material uncertainties

The Directors note that implementing a Refinancing Proposal or

obtaining amendments or waivers in respect of covenant breaches is

outside the control of the Group. If the Directors are unable to

implement a Refinancing Proposal or, if necessary, obtain

amendments or waivers in respect of covenant breaches, the ability

of the Group to continue trading would depend upon the Group being

able to negotiate a financial restructuring proposal with its

creditors and, if necessary, that proposal being approved by

shareholders. Whilst the Board would seek to negotiate such a

financial restructuring proposal with its creditors, there is no

certainty that the creditors would engage with the Board in those

circumstances. There would therefore be a significant risk of the

Group entering into insolvency proceedings, which the Directors

consider would likely result in limited or no value being returned

to shareholders.

The Directors have concluded that the uncertainties associated

with implementing a Refinancing Proposal and obtaining amendments

or waivers in respect of covenant breaches or, in the event a

Refinancing Proposal is implemented, the revised covenants are

subsequently breached, are material uncertainties that may cast

significant doubt that the Group will be able to continue as a

Going Concern. Notwithstanding these material uncertainties, the

Board's confidence in the Group's ability to implement a

Refinancing Proposal supports the preparation of the financial

statements on a Going Concern basis. The financial statements do

not include the adjustments that would result if the Group were

unable to continue as a Going Concern.

Appendix C: Related party transactions

The following related party transactions are extracted from the

Annual Report and Accounts (page 135).

The Directors of Tullow Oil plc are considered to be the only

key management personnel as defined by IAS 24 Related Party

Disclosures.

2020 2019

$m $m

------------------------------ ----- -----

Short term employee benefits 2.7 3.1

Post-employment benefits 0.2 0.5

Share-based payments 2.3 3.2

------------------------------ ----- -----

5.2 6.8

------------------------------ ----- -----

Short term employee benefits

These amounts comprise fees paid to the Directors in respect of

salary and benefits earned during the relevant financial year, plus

bonuses awarded for the year.

Post-employment benefits

These amounts comprise amounts paid into the pension schemes of

the Directors.

Share-based payments

This is the cost to the Group of Directors' participation in

share-based payment plans, as measured by the fair value of options

and shares granted, accounted for in accordance with IFRS 2

Share-based Payment.

There are no other related party transactions. Further details

regarding transactions with the Directors of Tullow Oil plc are

disclosed in the Remuneration Report on pages 57 to 73.

[END]

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSFZGZFFLZGMZM

(END) Dow Jones Newswires

March 30, 2021 02:00 ET (06:00 GMT)

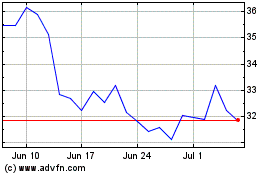

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Mar 2024 to Apr 2024

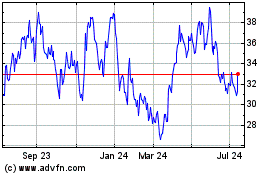

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Apr 2023 to Apr 2024