Tullow Oil PLC Trading Statement (3811U)

July 29 2020 - 2:00AM

UK Regulatory

TIDMTLW TIDMTTM TIDMTTM

RNS Number : 3811U

Tullow Oil PLC

29 July 2020

TULLOW OIL PLC

Trading Statement and Operational Update

29 JULY 2020 - Tullow Oil plc (Tullow) issues this statement to

summarise recent operational activities and to provide trading

guidance in respect of the financial half year to 30 June 2020.

This is in advance of the Group's Half Year Results, which are

scheduled for release on Wednesday 9 September 2020. The

information contained herein has not been audited and may be

subject to further review and amendment.

Rahul Dhir, Chief Executive Officer, Tullow Oil plc, commented

today:

"Since becoming CEO on 1 July, I have been impressed by the

quality of Tullow's people and the potential of our assets and I am

confident that we can build Tullow into a competitive and

successful business once again. Despite the challenging external

environment in the first half of the year, Tullow has performed

well; delivering production in line with forecast, agreeing the

sale of the Ugandan assets and re-shaping the Group's structure and

cost base. In the second half of 2020 our focus will remain on

continuing to deliver safe and reliable production from West

Africa, reducing debt and building a cost effective and efficient

organisation that can compete in a low oil price environment."

Operational Update

-- The impact of COVID-19 has been managed safely across our business with no impact on our operated

production.

-- Group working interest production in the first half of 2020 averaged 77,700 bopd in line with

expectations; full year guidance has been narrowed to 71,000-78,000 bopd reflecting continued

good performance across the portfolio.

-- In the first half of 2020, gross Jubilee production averaged 84,700 bopd (net: 30,000 bopd),

gross TEN production averaged 50,900 bopd (net: 24,000 bopd) and net production from the non-operated

portfolio was 23,700 bopd.

-- Ghana operational performance has been strong in the first half with uptime on both FPSOs

in excess of 95 per cent.

-- Completion operations on the Ntomme-9 production well at TEN are ongoing; the well is due

onstream in August.

-- The impact of COVID-19 on the Kenya work programme and fiscal framework has led the Joint

Venture to call Force Majeure on its licences which will delay FID and impact the ongoing

farm-down process. Constructive discussions are ongoing with Government regarding next steps.

-- In Suriname, the drilling of the Goliathberg-Voltzberg North prospect (GVN-1) in Block 47

is planned for the first quarter of 2021. A rig is expected to be contracted shortly for this

Upper Cretaceous prospect.

Financial Update

-- Revenue for the first half of 2020 is expected to be c.$0.7 billion with a realised oil price

of $52/bbl, including hedge receipts of $131 million.

-- At 30 June 2020, net debt is expected to be c.$3.0 billion and liquidity headroom and free

cash are expected to be c.$0.5 billion; full year free cash flow is forecast to break even

at the current forward curve.

-- Capital and decommissioning expenditure guidance for 2020 remains unchanged at c.$300 million

(1H20: $192 million) and c.$65 million (1H20: $38 million) respectively.

-- As a result of lower near-term oil price forecasts, and a revision in the Group's long-term

oil price assumption from $65/bbl to $60/bbl, the Group expects material impairment and exploration

write-offs to be recorded at the half-year in the range of $1.4-1.7 billion (pre-tax).

-- At 28 July, 60 per cent of 2020 sales revenue hedged with a floor of $57/bbl, 44 per cent

of 2021 sales revenue hedged with a floor of $51/bbl.

Uganda transaction update

-- Sale of Ugandan assets for $500 million in cash on completion and $75 million in cash following

FID, plus post first oil contingent payments, expected to complete before year-end.

-- Shareholder approval of the transaction confirmed at the General Meeting on 15 July with over

99 per cent of the 56 per cent votes cast in favour.

-- Transaction completion remains subject to the Government of Uganda and the Uganda Revenue

Authority entering into a binding Tax Agreement that reflects the agreed tax principles and

the Government of Uganda approving the transfer of Tullow's interests and Block 2 Operatorship

to Total.

-- This transaction represents an important first step to raising in excess of $1 billion proceeds

from portfolio management in what continues to be a challenging external environment for asset

sales and farm downs.

senior Management

-- Rahul Dhir joined Tullow as Chief Executive Officer on 1 July 2020.

-- Dorothy Thompson will resume her role as Non-Executive Chair of the Board after a short transitional

period.

-- Mike Walsh has been appointed as General Counsel & Director, Risk, Compliance & IS, effective

3 August 2020, reporting to the CEO. Mike joins Tullow from Delonex Energy Limited where he

was General Counsel.

production guidance

Group average working interest production H1 2020 actual (bopd) FY 2020 forecast (bopd)

=========================================== ====================== ========================

Ghana 54,000 51,600

=========================================== ====================== ========================

Jubilee 30,000 28,100

=========================================== ====================== ========================

TEN 24,000 23,500

=========================================== ====================== ========================

Equatorial Guinea 5,000 4,700

=========================================== ====================== ========================

Gabon 16,800 16,700

=========================================== ====================== ========================

C ô te d'Ivoire 1,900 2,000

=========================================== ====================== ========================

Oil production 77,700 75,000

=========================================== ====================== ========================

CONTACTS

Tullow Oil plc Murrays

(London) (Dublin)

(+44 20 3249 9000) (+353 1 498 0300)

Chris Perry, Matthew Evans (Investors) Pat Walsh

George Cazenove (Media) Joe Heron

======================================== ===================

Notes to editors

Tullow is an independent oil & gas, exploration and

production group, quoted on the London, Irish and Ghanaian stock

exchanges (symbol: TLW). The Group has interests in over 70

exploration and production licences across 15 countries.

For further information, please refer to our website at

www.tullowoil.com.

Follow Tullow on:

Twitter: www.twitter.com/TullowOilplc

YouTube: www.youtube.com/TullowOilplc

Facebook: www.facebook.com/TullowOilplc

LinkedIn: www.linkedin.com/company/Tullow-Oil

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTUWOVRRKUBUAR

(END) Dow Jones Newswires

July 29, 2020 02:00 ET (06:00 GMT)

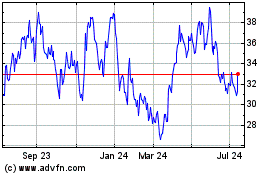

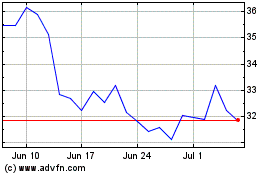

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Apr 2023 to Apr 2024