TIDMTLW TIDMTTM TIDMTTM

RNS Number : 8037Z

Tullow Oil PLC

15 January 2020

Tullow Oil plc - Trading Statement & Operational Update

15 January 2020 - Tullow Oil plc (Tullow) issues this update and

guidance in advance of the Group's 2019 Full Year Results. The

information contained herein has not been audited and may be

subject to further review and amendment. Tullow will hold a

conference call at 8:30am today, please see below for details.

Dorothy Thompson, Executive Chair, Tullow Oil plc, commented

today:

"Tullow has ended 2019 with average production of 86,700 bopd

and free cash flow generation of c.$350 million. Since our December

announcement, Tullow's senior team has been working hard on a major

review focused on delivering a more efficient and effective

organisation. The fundamentals of our business remain intact:

recent reserves audits demonstrate that we have a solid underlying

reserves and resources base in West and East Africa, our producing

assets continue to generate good cash flow and we retain a

high-quality exploration portfolio. The Board and senior management

are confident of the long-term potential of the portfolio and see

meaningful opportunities to improve operational performance, reduce

our cost base, deliver sustainable free cash flow and reduce our

debt."

Financial and operational update

2019 performance

-- Group working interest oil production averaged 86,700 bopd in 2019 in line with expectations.

-- 2019 full year total revenue is expected to be c.$1.7

billion; gross profit is expected to be c.$0.7 billion. Capital

expenditure in 2019 was c.$490 million.

-- Free cash flow for the full year 2019 is expected to be

c.$350 million, with net debt reduced to c.$2.8 billion and gearing

expected to be around 2.0 times.

-- Tullow expects to report pre-tax impairments and exploration

write-offs of c.$1.5 billion (c.$1.3 billion post tax) primarily

due to a $10/bbl reduction in the Group's long-term accounting oil

price assumption to $65/bbl and a reduction in TEN 2P reserves.

2020 outlook

-- In 2020, capital expenditure is expected to be c.$350

million, with an additional c.$100 million expected to be spent on

decommissioning. Tullow expects to generate underlying free cash

flow of at least $150 million from 75,000 bopd at $60/bbl.

-- Operations across the Group's production assets have started

the year in line with expectations and 2020 Group average

production guidance remains unchanged at 70,000 to 80,000 bopd.

-- In Ghana, recent activity at Jubilee includes the tie-in of

the J-54 water injector well and planning for a maintenance period

at the end of January to increase gas processing capacity. At TEN,

the drilling of a production well on the Ntomme field has commenced

and the well is expected to be tied-in by the end of the first

quarter.

-- In Kenya, the early oil pilot scheme (EOPS) is suspended due

to severe damage to roads caused by adverse weather in the fourth

quarter of 2019. Trucking remains on hold until all roads are

repaired to a safe standard. Work continues with Joint Venture

Partners and the Government of Kenya to progress the development

project.

-- In Uganda, Joint Venture conversations with the Government

are ongoing. Tullow remains committed to reducing its equity stake

in the project ahead of FID.

-- Tullow recently announced the results of the Carapa-1

exploration well offshore Guyana, which proved the extension of the

Cretaceous oil play into the Group's Guyana acreage. Next steps

will include the integration of the Carapa result into geological

and geophysical models and high-grading of the Cretaceous portfolio

across both the Kanuku and Orinduik blocks.

-- The Marina-1 well offshore Peru is due to spud at the end of

January 2020 and is expected to take around 60 days.

Group reserves and resources

In late 2018, Tullow appointed TRACS as its independent reserves

auditor. Over the course of 2019, over 95% of the Group's reserves

and resources have been audited and the results underpin the

quality of the asset base. Group net 2P reserves at year-end 2019

are 245 mmboe (2018: 280 mmboe). Excluding the impact of 2019

production (31 mmboe), reserves are largely unchanged year-on-year

and reflects an increase in reserves at the Jubilee field and

non-operated assets, offset by a reduction in reserves at the

Enyenra field at TEN. Group net 2C resources have increased to

1,102 mmboe (2018: 874 mmboe), largely driven by additions in

Ghana. Tullow will publish its full audited reserves and resources

with its 2019 Full Year Results.

Business Review update & reporting timetable

The Board's business review covering all areas of Tullow's

operations, cost-base and reporting is progressing well. The Board

is confident that the outcomes will deliver significant

improvements to the Group's organisational structure, major

reductions in G&A and a more efficient and effective business.

Actions taken in December included the implementation of a smaller,

more focused interim Executive team and initial restructuring of

the next level of leadership. Since then, work has focused on

simplifying the structure of the organisation and these changes

will be implemented in the coming months. The next phase of the

review will focus on the investment plans for each of the Group's

major assets.

One of the decisions already made by the Board is to align the

Group's reporting calendar to that of its E&P peers and, going

forward, the Group will report its Full Year Results in March and

its Half Year Result in September. The 2019 Full Year Results will

be released on 12 March 2020. The new timetable will enable Tullow

to report on the key outcomes of the ongoing business review in its

Full Year Results and its 2019 Annual Report and Accounts.

The recruitment of a new Chief Executive Officer is well under

way with the assistance of an executive search firm.

Trading Statement Guidance

Guidance is provided in relation to Tullow's full year reporting

to 31 December 2019 in advance of the Group's Full Year Results

release on 12 March 2020. Guidance figures have not been audited

and may be subject to further review and amendment.

SUMMARY FINANCIALS

2019

================================== ==========

Total revenue ($bn) 1.7

---------------------------------- ----------

Gross profit ($bn) 0.7

---------------------------------- ----------

Administrative expenses ($bn) 0.1

---------------------------------- ----------

Free cash flow ($bn) 0.4

---------------------------------- ----------

Net debt ($bn) 2.8

---------------------------------- ----------

Gearing (net debt: Adj EBITDAX) 2.0 times

================================== ==========

Note 1: Revenue driven by realised post-hedge oil price of

$63/bbl. Total revenue does not include receipts from Tullow's

Corporate Business Interruption insurance of c.$40 million. This is

included in Other Operating Income which is a component of Gross

Profit.

IMPAIRMENTS and Exploration write-offs

Pre-tax write-off Tax effect Net write-off

===================================== ================== =========== ==============

Impairment of PP&E, net ($bn) 0.7 (0.2) 0.5

------------------------------------- ------------------ ----------- --------------

Exploration costs written-off ($bn) 0.8 - 0.8

===================================== ================== =========== ==============

Note 2: Impairments of property, plant and equipment are largely

associated with a reduction in the Group's long-term accounting oil

price assumption from $75/bbl to $65/bbl and a 2P reserves

reduction at the Enyenra field at TEN.

Note 3: Exploration costs written off are predominately driven

by a write-down of the value of the Kenya and Uganda assets due to

a reduction in the Group's long-term accounting oil price

assumption from $75/bbl to $65/bbl. The remaining write-offs

include Jethro, Joe and Carapa well costs in Guyana as a result of

drilling results and Kenya Block 12A, Mauritania C3, PEL37 Namibia

and Jamaica licence costs due to the levels of planned future

activity or licence exits.

CAPITAL AND OTHER EXPITURE

2019 2020

=============================================================================== ============ ===========

Capital expenditure ($m) 490 350

------------------------------------------------------------------------------- ------------ -----------

Decommissioning expenditure ($m) 81 100

=============================================================================== ============ ===========

Note 4: 2019 capex reduction from previous guidance due to deferral and reduction of expenditure

and release of accruals.

Note 5: 2020 capex breakdown of c.$140 million in Ghana, c.$80 million on West Africa non-operated,

c.$40 million in Kenya, c.$15 million in Uganda and c.$75 million on exploration and appraisal

activities.

Note 6: Decommissioning expenditure is gross of any tax relief and relates to UK and Mauritania

decommissioning activities.

2020 Hedging position

Hedge structure Bopd Bought put (floor) Sold call Bought call

---------------------------------- ------- ------------------- ---------- ------------

Collars 33,000 $57.60 $79.21 -

---------------------------------- ------- ------------------- ---------- ------------

Three-way collars (call spread) 12,000 $56.42 $77.82 $87.68

---------------------------------- ------- ------------------- ---------- ------------

Total / weighted average 45,000 $57.28 $78.84 $87.68

---------------------------------- ------- ------------------- ---------- ------------

Note 7: 2021 hedging position at 31 Dec 2019: c.22,000 bopd

hedged with an average floor price protected of c.$52.80/bbl.

GROUP AVERAGE WORKING INTEREST PRODUCTION

FY 2020 forecast

FY 2019 Actuals mid-point

Oil Production (kbopd) (kbopd)

=========================================================== ================ ==================

Ghana 59.9 52.0

=========================================================== ================ ==================

Ghana Jubilee production-equivalent 2.0 N/A

insurance payments

=========================================================== ================ ==================

Equatorial Guinea 5.4 5.0

=========================================================== ================ ==================

Gabon 16.7 16.0

=========================================================== ================ ==================

Côte d'Ivoire (includes condensate) 2.7 2.0

=========================================================== ================ ==================

OIL PRODUCTION TOTAL (inc. Jubilee production-equivalent) 86.7 75.0

=========================================================== ================ ==================

This announcement includes inside information as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 and is being

released on behalf of Tullow by Adam Holland, Company

Secretary.

CONFERENCE CALL DETAILS:

8:30am UK time Wednesday Replay:

15 January: Conference ID: 5346287

Conference ID: 5346287 From the UK: 0844 571 8951

From the UK: 0844 481 UK free phone: 0808 238

9752 0667

UK free phone: 0800 2796 Outside of the UK: +44 (0)

619 3333 009 785

Outside of the UK: +44

(0) 207 1928 338

FOR FURTHER INFORMATION CONTACT:

Tullow Oil plc Murray Consultants

(London) (Dublin)

(+44 20 3249 9000) (+353 1 498 0300)

IR: Chris Perry, Nicola Pat Walsh

Rogers, Matt Evans Joe Heron

Media: George Cazenove

Notes to Editors

Tullow Oil plc

Tullow is a leading independent oil & gas, exploration and

production group, quoted on the London, Irish and Ghanaian stock

exchanges (symbol: TLW). The Group has interests in 80 exploration

and production licences across 15 countries which are managed as

three business delivery teams: West Africa, East Africa and New

Ventures.

Follow Tullow on:

Twitter: www.twitter.com/TullowOilplc YouTube: www.youtube.com/TullowOilplc

Facebook: www.facebook.com/TullowOilplc LinkedIn: www.linkedin.com/company/Tullow-Oil

Website: www.tullowoil.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCKKQBKFBKDCDD

(END) Dow Jones Newswires

January 15, 2020 02:00 ET (07:00 GMT)

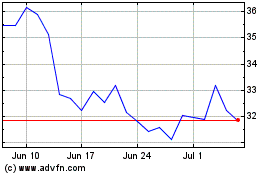

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Mar 2024 to Apr 2024

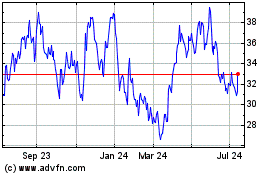

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Apr 2023 to Apr 2024