TIDMTLW TIDMTTM TIDMTTM

RNS Number : 1692W

Tullow Oil PLC

09 December 2019

Board changes and 2020 guidance

9 December 2019 - Tullow Oil plc (Tullow) today provides a

forward-looking production and financial update and announces a

number of changes to the Board that take effect immediately.

A conference call will be hosted by Dorothy Thompson, Les Wood

and Mark MacFarlane at 8:00am this morning. Details of the call can

be found at the end of this release.

Board CHANGES

Paul McDade, Chief Executive Officer, and Angus McCoss,

Exploration Director, have resigned from the Board of Tullow by

mutual agreement and with immediate effect. Dorothy Thompson has

been appointed Executive Chair on a temporary basis and Mark

MacFarlane, Executive Vice-President, East Africa and Non-Operated,

has been appointed as Chief Operating Officer in a non-Board role.

Les Wood continues as an Executive Director and Chief Financial

Officer. The Board has initiated a process to find a new Group

Chief Executive.

GROUP guidance

Production and reserves

As disclosed in Tullow's Trading Update on 13 November 2019, the

Group expects 2019 full year net production to average c.87,000

bopd. The Group also expects to deliver free cash flow of c.$350

million, has liquidity headroom in excess of $1 billion and no

near-term debt maturities. Whilst financial performance has been

solid, production performance has been significantly below

expectations from the Group's main producing assets, the TEN and

Jubilee fields in Ghana.

A review of the production performance issues in 2019 and its

implications for the longer-term outlook of the fields has been

undertaken and has shown that the Group needs to reset its

forward-looking guidance. 2020 Group production is forecast to

average between 70,000 and 80,000 bopd. Group production for the

following three years is expected to average around 70,000 bopd. A

breakdown of 2019 and 2020 Group production guidance is provided at

the end of this release.

A number of factors have been identified that have caused this

reduction in production guidance. On the Jubilee field, these

factors include significantly reduced offtake of gas by the Ghana

National Gas Company which Tullow makes available at no cost,

increased water cut on some wells, and lower facility uptime. At

Enyenra (one of the TEN fields) mechanical issues on two new wells

have limited the well stock available and there is faster than

anticipated decline on this field. The non-operated portfolio is

performing well, and production is expected to be sustained for the

medium term.

Independent reserves audits carried out during the year indicate

that oil reserves are likely to remain broadly flat at year-end

2019 compared to the previous year-end (excluding the impact of

2019 production). The audits show increased oil reserves for

Jubilee, Ntomme (one of the TEN fields) and the non-operated fields

which are largely offset by a c.30% decrease in Enyenra

reserves.

Taking action to underpin cash flow generation

In light of these new production forecasts, there will be a

thorough reassessment of the Group's cost base and future

investment plans in order to allocate appropriate capital to the

Group's core production assets, development projects and continued

exploration.

The Board believes that a series of actions will help deliver

sustainable free cash flow. These actions include reducing capital

expenditure, operating costs and corporate overheads. In 2020, the

Board expects the Group to generate underlying free cash flow of at

least $150 million at $60/bbl after a Group capital investment

of

c.$350 million. Considering this level of expected free cash

flow, the Board has decided to suspend the dividend.

Dorothy Thompson, Executive Chair, commented today:

"I would like to thank Paul and Angus for all their hard work

and dedication to Tullow over many years. They leave behind a

business that has delivered two major offshore developments in

Ghana, made significant oil discoveries in Kenya and Uganda and has

a high-impact exploration portfolio. These remain the key building

blocks of our business today.

"The Board has, however, been disappointed by the performance of

Tullow's business and now needs time to complete its thorough

review of operations. A full financial and operational update will

be provided at Tullow's Full Year Results on 12 February 2020, with

an update on progress to be given in the Group's Trading Statement

on 15 January 2020.

"Despite today's announcement, the Board strongly believes that

Tullow has good assets and excellent people capable of delivering

value for shareholders. We are taking decisive action to restore

performance, reduce our cost base and deliver sustainable free cash

flow."

2019 & 2020 PRODUCTION

Oil Production (bopd) FY 2019 forecast FY 2020 mid-point forecast

========================== ================= ===========================

Ghana

========================== ================= ===========================

Jubilee 31,400 29,000

========================== ================= ===========================

Business interruption 2,000 n/a

insurance

========================== ================= ===========================

TEN 28,700 23,000

========================== ================= ===========================

Non-operated portfolio 24,900 23,000

========================== ================= ===========================

TOTAL 87,000 75,000

========================== ================= ===========================

ADDITIONAL INFORMATION

The drilling of the Carapa-1 well on the Kanuku Block in Guyana

continues, with a result expected before the year-end. Carapa-1,

operated by Repsol, is the first well to test the deeper Cretaceous

play in Tullow's Guyana acreage.

Set out below is a summary of the terms relating to Mr McDade's

and Mr McCoss' departure from Tullow. These terms are in line with

Tullow's shareholder-approved 2017 Remuneration Policy. Save as set

out below, Mr McDade and Mr McCoss will not receive any

compensation or payment for the termination of their employment

agreements or for their ceasing to be directors.

-- In connection with the termination of their employment, Mr

McDade and Mr McCoss will receive a payment for salary and pension

contributions in lieu of their contractual notice period; continued

private healthcare insurance coverage for up to 12 months; and

capped contributions towards both their legal fees and the

provision of outplacement services.

-- Neither Mr McDade nor Mr McCoss will receive any cash or

share-based awards under the Tullow Incentive Plan (the TIP) in

respect of the financial years ending 31 December 2019 or 31

December 2020.

-- In respect of the TIP, the Remuneration Committee has

determined (in accordance with the good leaver provisions of the

TIP) that Mr McDade's and Mr McCoss' unvested awards may continue

to vest on their scheduled vesting dates, subject to the terms of

the TIP. In respect of the Tullow Share Incentive Plan (the SIP),

the shares which Mr McDade and Mr McCoss hold already pursuant to

the SIP will be released on termination of employment.

Further details of the remuneration payments to be made to Mr

McDade and Mr McCoss, in accordance with s430(2B) Companies Act

2006, can be found on Tullow's website (www.tullowoil.com).

This announcement includes inside information as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 and is being

released on behalf of Tullow by Adam Holland, Company

Secretary.

CONFERENCE CALL DETAILS:

8:00am UK time; Monday Replay (available until

9 December 16/12/2019)

Conference ID: 4454797 Conference ID: 4454797

From the UK: 08444819752 From the UK: 08082380667

Outside of the UK: +44 Outside of the UK: +44

(0) 2071 928338 (0) 3333009785

FOR FURTHER INFORMATION CONTACT:

Tullow Oil plc Murray Consultants

(London) (Dublin)

(+44 20 3249 9000) (+353 1 498 0300)

Julia Ross - Corporate Head Pat Walsh

of Strategy and Performance Joe Heron

Nicola Rogers - Head of Investor

Relations

George Cazenove - Head of

Corporate Affairs

Notes to Editors

Tullow Oil plc

Tullow is a leading independent oil & gas, exploration and

production group, quoted on the London, Irish and Ghanaian stock

exchanges (symbol: TLW). The Group has interests in 80 exploration

and production licences across 15 countries which are managed as

three business delivery teams: West Africa, East Africa and New

Ventures.

Follow Tullow on:

Twitter: www.twitter.com/TullowOilplc YouTube: www.youtube.com/TullowOilplc

Facebook: www.facebook.com/TullowOilplc LinkedIn: www.linkedin.com/company/Tullow-Oil

Website: www.tullowoil.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCQKLBBKLFZFBF

(END) Dow Jones Newswires

December 09, 2019 02:00 ET (07:00 GMT)

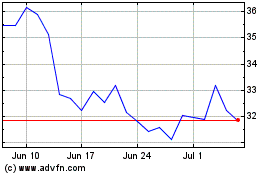

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Mar 2024 to Apr 2024

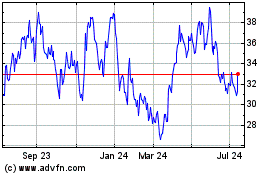

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Apr 2023 to Apr 2024