U.S. Stocks Open Lower Amid Trade Woes

August 12 2019 - 10:08AM

Dow Jones News

By Avantika Chilkoti and Akane Otani

U.S. stocks fell Monday, following global markets lower, as a

slide in bond yields pulled bank stocks lower.

The Dow Jones Industrial Average lost 176 points, or 0.7%, to

26111 shortly after the opening bell. The S&P 500 declined 0.5%

and the Nasdaq Composite fell 0.6%.

Worries about the path of U.S.-China trade negotiations and the

global economy have kept stocks and bond yields under pressure for

much of the month. Goldman Sachs analysts said Monday that the

outlook for trade talks had "collapsed," adding that they believe

Washington and Beijing won't reach an agreement before the 2020

elections.

Few analysts believe the U.S. is headed toward an imminent

downturn.

"Given the low unemployment and strong consumer confidence in

the U.S., it's unlikely we get a recession any time soon," said

Patrick Spencer, managing director at U.S. investment firm

Baird.

But others worry that the gloomy outlook reflected in bond

markets -- where yields across the globe have dropped in recent

months -- could soon be reflected in stocks too.

"If [yields] keep edging down, the equity market is clearly

wrong because the bond market will be telling you we have one

mother of a recession coming," said Neil Dwane, global strategist

at Allianz Global Investors.

Bank stocks took a fresh hit Monday as U.S. Treasury yields

retreated again, with Citigroup and Morgan Stanley each losing more

than 1%. Declining bond yields tend to weigh on banks by cutting

into their lending profitability.

Tyson Foods slipped 2.1% after saying it would have to rebuild a

beef plant in Kansas that was partially destroyed by a fire.

Elsewhere, the Stoxx Europe 600 edged down 0.2%, weighed down by

declines among lenders and travel and leisure stocks.

Among the biggest gainers in the region was Tullow Oil, whose

shares rose 18% after the company said it had found more oil off

the coast of Guyana.

Hong Kong's Hang Seng Index fell 0.4% after protests at the

city's airport prompted authorities to cancel more than 100

flights. Chinese authorities said the violent weekend

demonstrations marked the emergence of " the first signs of

terrorism" in the semiautonomous city, and vowed a merciless

crackdown.

"Hong Kong is clearly an important bellwether for just how far

China is willing to exert its influence," said Matthew Cairns, a

senior rates strategist at Rabobank.

"This is a clear show of Chinese strength and I don't think,

just as we are seeing in the trade war, that China will be willing

to allow overt breaches of its authority within the region and that

clearly is having pretty negative effect in terms of the Hang

Seng," he added.

The Shanghai Composite closed higher, though, notching a 1.5%

gain after China's central bank continued to weaken the yuan,

though at a slower pace than traders had expected. That helped ease

concerns of a sharp devaluation after President Trump last week

accused China of manipulating its currency.

--William Horner, Steven Russolillo and Frances Yoon contributed

to this article.

Write to Avantika Chilkoti at Avantika.Chilkoti@wsj.com and

Akane Otani at akane.otani@wsj.com

(END) Dow Jones Newswires

August 12, 2019 09:53 ET (13:53 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

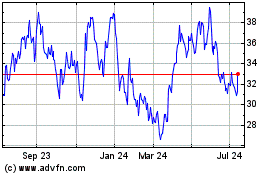

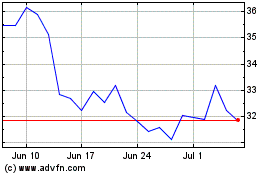

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Apr 2023 to Apr 2024