Stocks Edge Lower Amid Hong Kong Protests, Trade Woes

August 12 2019 - 8:37AM

Dow Jones News

By Avantika Chilkoti

-- U.S. stock futures slipped

-- Chinese stocks rose as the yuan's slow devaluation

continued

-- Hong Kong equities dropped after flights were canceled

U.S. stock futures and European equities declined as escalating

tensions between Chinese authorities and protesters in Hong Kong

added to investors' concerns about global trade.

Hong Kong's Hang Seng Index closed 0.4% lower after protests at

the city's airport prompted authorities to cancel more than 100

flights. Chinese authorities said the violent weekend

demonstrations marked the emergence of " the first signs of

terrorism" in the semiautonomous city, and vowed a merciless

crackdown.

"Hong Kong is clearly an important bellwether for just how far

China is willing to exert its influence," said Matthew Cairns, a

senior rates strategist at Rabobank.

"This is a clear show of Chinese strength and I don't think,

just as we are seeing in the trade war, that China will be willing

to allow overt breaches of its authority within the region and that

clearly is having pretty negative effect in terms of the Hang

Seng," he added.

Futures tied to the S&P 500 fell 0.7%. Concerns about the

fate of U.S.-China trade talks following Mr. Trump's comments on

Friday that negotiations could break off -- which had left U.S.

stocks lower for the week -- prompted investors to look to haven

assets.

Yields on 10-year U.S. Treasurys fell to 1.690% Monday from

1.731% Friday, continuing the steep slide from last week. Yields

fall when bond prices rise.

The gloomy outlook reflected in bond markets -- where yields

across the globe have dropped in recent months -- could soon be

reflected in stocks too, according to Neil Dwane, global strategist

at Allianz Global Investors.

"If they [yields] keep edging down, the equity market is clearly

wrong because the bond market will be telling you we have one

mother of a recession coming," he said.

Meanwhile, the Shanghai Composite Index climbed 1.5% as the

Chinese central bank continued to weaken the yuan, though at a

slower pace than traders had expected. That eased concerns of a

sharp devaluation after President Trump last week accused China of

manipulating its currency.

"While the direction of travel is clear and that the yuan is

likely to weaken further, it would appear that as long as the

decline happens gradually, markets are more likely to be

comfortable with it," Michael Hewson, chief market analyst at CMC

Markets UK, said in a research note.

The benchmark Stoxx Europe 600 index slipped 0.2% after wavering

between gains and losses.

Among the biggest gainers in the region was Tullow Oil, whose

shares rose about 17% after the company said it had found more oil

off the coast of Guyana. Shares in ams, a 3-D sensor maker that

supplies to Apple, dropped 8.3% on reports that the Austrian

company has put in a bid to take over German lighting company Osram

Licht, creating a bidding war with private-equity buyers. Shares in

Osram were up 9.5% on Monday.

In Asia, amid a day of light trading with a number of regional

exchanges closed, Cathay Pacific fell 4.9%, putting the Hong Kong

airline on course to close at its lowest level in more than a

decade. China's aviation authority on Friday ordered the carrier to

remove all employees involved in the protests in Hong Kong from

flights to mainland China. The most closely watched class of shares

in Swire Pacific, the Hong Kong conglomerate that is Cathay's

largest shareholder, fell 6.2%.

In commodities, the price of Brent crude dropped 0.4%, while

gold prices climbed 0.6%.

This week, investors will watch for new consumer price inflation

estimates from the U.S. on Tuesday after the Federal Reserve cited

subdued inflation as one reason for cutting rates last week.

Consumer prices increased 0.1% between May and June.

"Given the low unemployment and strong consumer confidence in

the U.S., it's unlikely we get a recession any time soon," said

Patrick Spencer, managing director at U.S. investment firm Baird.

"It's a muddle-along economy then with markets continuing to trade

higher."

--William Horner, Steven Russolillo and Frances Yoon contributed

to this article.

Write to Avantika Chilkoti at Avantika.Chilkoti@wsj.com

(END) Dow Jones Newswires

August 12, 2019 08:22 ET (12:22 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

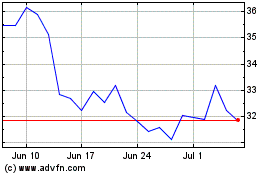

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Mar 2024 to Apr 2024

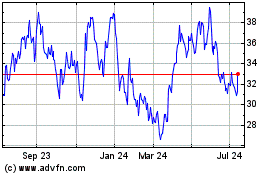

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Apr 2023 to Apr 2024