Tern PLC Device Authority convertible loan note funding (4774E)

October 28 2022 - 2:45AM

UK Regulatory

TIDMTERN

RNS Number : 4774E

Tern PLC

28 October 2022

28 October 2022

Tern Plc

("Tern" or the "Company")

Device Authority convertible loan note funding

Tern Plc (AIM:TERN), the company focused on value creation from

Internet of Things ("IoT") technology businesses, announces that

Device Authority Limited ("Device Authority"), of which Tern

currently owns 53.8% of the equity, has completed a US$440,000

working capital funding in the form of unsecured convertible loan

notes (the "Convertible Notes") from Tern and certain of its other

existing shareholders, including Venafi and Alsop Louie Partners.

Tern has subscribed for approximately US$303,401 of Convertible

Notes, representing approximately 69% of the total funding.

The Convertible Notes and accrued interest (at a rate of 9% per

annum) are repayable or convertible into Device Authority equity,

at the holder's election, at the earlier of the maturity date of 30

June 2023 (the "Maturity Date"), and inter alia, on a change of

control of Device Authority, or on Device Authority completing a

qualifying fundraise, being a new equity financing of Device

Authority which raises aggregate gross cash proceeds of at least

US$5 million.

On a change of control of Device Authority prior to the Maturity

Date, being a sale or disposal of the business as defined in Device

Authority's Articles of Association, the Convertible Note holders

will be entitled to a premium payment equal to 300% of the original

principal amount of the Convertible Notes, or at the discretion of

the Convertible Note holders the outstanding principal amount and

accrued interest may be converted into the most senior class of

share at a 30% discount to the price paid for the shares sold at

the change of control. Additionally, subscribers to the Convertible

Notes have received warrants to acquire additional Device Authority

equity at a fixed price, exercisable on a change of control of

Device Authority prior to the Maturity Date (the "Warrants").

Alternatively, should Device Authority complete a qualifying

fundraise before the Maturity Date, the Convertible Notes are

convertible into Device Authority equity at a 30% discount to the

fundraising price. If a qualifying fundraise occurs the Warrants

will expire and become non-exercisable. The Convertible Notes

provide for customary events of default.

The valuation of Tern's holding in Device Authority, as stated

in the Company's unaudited interim results for the six months to 30

June 2022, was GBP16.3 million. Based on Device Authority's latest

statutory accounts for the year ended 31 December 2021, as at that

date it had net assets of GBP3,824,398 and incurred a loss for the

year of GBP2,185,382. Given the historic nature of these figures

Tern does not consider this to be representative of the current

business and trading performance of Device Authority.

Tern also currently has loans of approximately US$175,000 to

Device Authority, which are short-term, non-convertible, unsecured

loans.

Commenting Al Sisto, CEO of Tern, said :

"As outlined at the time of Tern's recent fundraise, the use of

proceeds included capital that we can deploy to provide further

funding for Tern's portfolio companies, both protecting Tern's

position and providing them with the growth capital they

require.

"We are delighted with the progress Device Authority is

continuing to make and we are very happy to continue to support its

working capital needs as it continues to grow its monthly recurring

revenues through its subscription base and modularised licence

platform, KeyScaler(R).

"The Board remains focussed on continuing to maximise the

investment value for Tern shareholders and I look forward to making

further announcements in due course."

Enquiries

Tern Plc via IFC Advisory

Al Sisto (CEO)

Sarah Payne (CFO)

Allenby Capital Limited Tel: 0203 328 5656

(Nominated Adviser and Broker)

David Worlidge / Alex Brearley (Corporate

Finance)

Matt Butlin / Kelly Gardiner (Sales

and Corporate Broking)

IFC Advisory Tel: 0203 934 6630

(Financial PR and IR) tern@investor-focus.co.uk

Tim Metcalfe

Graham Herring

Florence Chandler

About Device Authority

Device Authority is a global leader in Identity and Access

Management (IAM) for the IoT; focused on the automotive, medical

device (IoMT) and industrial (IIoT) sectors. Device Authority's

KeyScaler(TM) platform provides zero touch provisioning and

complete automated lifecycle management for securing IoT devices

and data at scale, with frictionless deployment across device

provisioning, authentication, credential management, policy based

end-to-end data security/encryption and secure OTA (over the air)

and HSM (hardware security module) updates.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFIFSRIVLTFIF

(END) Dow Jones Newswires

October 28, 2022 02:45 ET (06:45 GMT)

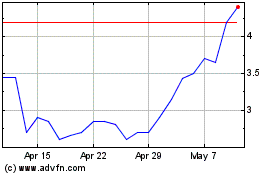

Tern (LSE:TERN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tern (LSE:TERN)

Historical Stock Chart

From Apr 2023 to Apr 2024