TIDMTERN

RNS Number : 3676U

Tern PLC

02 December 2021

This announcement contains inside information for the purposes

of Regulation 11 of the Market Abuse (Amendment) (EU Exit)

Regulations 2019/310. With the publication of this announcement,

this information is now considered to be in the public domain.

2 December 2021

Tern Plc

("Tern" or the "Company")

Device Authority Strategic Investment from Venafi, Capital

Restructuring and Additional Funding

Tern Plc (AIM:TERN), the investment company specialising in the

Internet of Things ("IoT"), is pleased to announce that as part of

a US$2.91 million funding package for Tern's portfolio company,

Device Authority Limited ("Device Authority") has received a

US$1.25 million strategic investment from Venafi Inc ("Venafi"), a

leader in providing machine identities, alongside a further US$1.25

million investment from Tern (the "DA Fund Raise").

Highlights

-- US$2.91 million equity funding of Tern's portfolio company,

Device Authority, including a US$1.25 million strategic investment

from Venafi, a leading provider of machine identity protection who

Device Authority has been working with since 2019, and a US$1.25

million (GBP0.94 million) investment by Tern, alongside $0.41

million from other existing Device Authority shareholders, Alsop

Louie Partners and a Samenuk Family Trust.

-- Device Authority has simplified its capital structure,

involving, inter alia, the conversion of loan notes into equity,

including the US$4.3 million of convertible loan notes held by

Tern, plus interest of US$0.6 million accrued to date.

-- Following these initiatives Tern now holds 53.8% of Device

Authority's equity, with a book value of US$19.8 million

(approximately GBP14.8 million) as implied by the price at which

this latest funding has been undertaken. This compares to an

unaudited book value of GBP12.9 million as at 30 June 2021 and

Tern's investment of GBP0.94 million in the DA Fund Raise.

Commenting, Al Sisto, CEO of Tern, said: "I am very pleased that

Device Authority has been able to secure this strategic investment

from Venafi, uniting leading solutions to ensure IoT security from

the device to the data centre. The combination of the complementary

market positions of Device Authority and Venafi has already

delivered significant benefits for both companies and this

deepening of the relationship will, we believe, help deliver

increased future shareholder value.

"This strategic investment from Venafi has been structured to

maximise the commercial benefit to Device Authority, minimise the

impact to the current stakeholders and provide Device Authority

with sufficient capital for at least the next 12 months, given its

2022 growth plans. Alongside the strategic investment from Venafi

the capital structure of Device Authority has also been simplified

to make it more appropriate as the business matures. We look

forward to Tern continuing as Device Authority's majority

shareholder and benefiting from the results of the deeper

partnership with Venafi."

Commenting Darron Antill, CEO of Device Authority said: " Over

recent months we have been delighted to work with new customers in

industries such as automotive where IoT security is becoming even

more crucial as the C-suite continues to prioritize managing risk

within their organizations and their supply chains to protect

customers. We continue to see an increase in customers who require

a retrofit solution for legacy devices already deployed in the

field, as well as those who make security an important part of

their planning and development phase of a new IoT solutions. As the

requirement for a Software Bill of Materials (SBOM) becomes

mandatory in the US for software vendors contracting with the

federal government in 2022, the drive for transparency of security

within IoT products will force manufacturers to take action.

"I am delighted to welcome Venafi as a new strategic investment

partner to Device Authority and we are grateful for the continued

support of our existing investors."

Jeff Hudson, CEO of Venafi, commented "Since IoT devices are

critical business enablers for a wide range of organizations, this

investment is perfectly aligned with Venafi's mission to ensure all

machine identities are managed and protected. Venafi has always

been laser focused on innovation so we're excited about the

opportunity to deepen our relationship with Device Authority in

order to accelerate the delivery of fast, frictionless solutions

that secure the machine identities of edge and IoT devices against

devasting supply chain attacks."

Strategic investment by Venafi

Venafi has invested US$1.25 million in the DA Fund Raise to

secure a 3.4% equity stake in Device Authority to further deepen

the strategic relationship.

Venafi is a privately held cybersecurity company that develops

software to secure and protect cryptographic keys and digital

certificates. In December 2020, Thoma Bravo, a leading private

equity investment firm focused on the software and

technology-enabled services sectors, acquired a majority stake in

Venafi in a deal valuing Venafi at US$1.15 billion.

Device Authority has been working closely with Venafi since

joining its Machine Identity Protection Development Fund in late

2019, as announced by Tern on 31 October 2019. The fund was used to

provide a new turnkey code signing and update delivery extension to

Device Authority's KeyScaler product, powered by Venafi CodeSign

Protect, to connect security team policy and controls, securing the

code signing process. Device Authority has since created a security

certificate authority service connector for the Venafi Platform,

which will allow KeyScaler customers to use the Venafi platform as

a source for certificate issuance.

Investment by Tern, capital restructuring, warrant issue and

conversion of loan notes

The structure of the DA Fund Raise, which comprises the issue of

" Class A" shares in DA, is intended to support Device Authority's

2022 plans and provide them with an operational runway for at least

the next 12 months. Alongside the US$1.25 million investment from

Venafi and a further US$0.41 million investment by existing Device

Authority shareholders, Alsop Louie Partners and a Samenuk Family

Trust, Tern has invested US$1.25 million in the DA Fund Raise. The

amounts invested by the existing Device Authority shareholders,

including Tern, incorporate short term loans advanced to Device

Authority against such shareholders' commitment under the DA Fund

Raise whilst the transaction was being negotiated.

The opportunity has also been taken to simplify the capital

structure of Device Authority by removing the rights of the "Class

B" shares and the "Class C" shares to receive, in aggregate, 25% of

the total sale proceeds on a liquidity event.

Device Authority's existing outstanding convertible loan notes

have been converted into "Class A" shares, in line with their

terms. Tern held US$4.9 million of loan notes and interest accrued

to date, all of which has been converted to equity. US$2.4 million

of convertible loan notes, including interest, outstanding to other

Device Authority shareholders has also been converted to equity on

the same terms.

The investors in the DA Fund Raise, together with the holders of

the loan notes that have been converted, have been issued with

warrants over Device Authority ordinary shares. All the Device

Authority warrants in issue are now exercisable only in the event

that the company is sold at a valuation in excess of US$50 million.

Tern holds 54% of the Device Authority warrants in issue, with an

aggregate exercise cost of approximately GBP0.63 million.

Following the DA Fund Raise and capital reorganisation the

implied post money valuation of Device Authority, at the DA Fund

Raise price, is US$36.7 million (approximately GBP27.5 million).

Tern holds 53.8% of Device Authority's equity which has a book

value of US$19.8 million (approximately GBP14.8 million) based on

this valuation. This compares to an unaudited book value of Tern's

holding in Device Authority of GBP12.9 million as at 30 June 2021

and Tern's investment of GBP0.94 million in the DA Fund Raise. On a

full exercise of all the warrants issued by Device Authority, but

not including the exercise of any share options granted to Device

Authority employees, Tern would own 54.0% of Device Authority's

then diluted equity.

Enquiries

Tern Plc via IFC Advisory

Al Sisto (CEO)

Sarah Payne (CFO)

Allenby Capital Limited Tel: 0203 328 5656

(Nominated Adviser and Broker)

David Worlidge / Alex Brearley (Corporate

Finance)

Matt Butlin / Kelly Gardiner (Sales

and Corporate Broking)

IFC Advisory Tel: 0203 934 6630

(Financial PR and IR) tern@investor-focus.co.uk

Tim Metcalfe

Graham Herring

Florence Chandler

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCKLLBBFLLEFBV

(END) Dow Jones Newswires

December 02, 2021 05:00 ET (10:00 GMT)

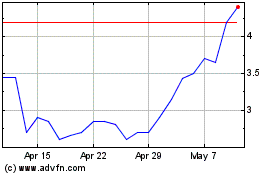

Tern (LSE:TERN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tern (LSE:TERN)

Historical Stock Chart

From Apr 2023 to Apr 2024