TIDMTERN

RNS Number : 8182I

Tern PLC

17 August 2021

17 August 2021

Tern Plc

("Tern" or the "Company")

Investment in FundamentalVR and Portfolio Update

Notice of Interim Results and Investor Presentation

Tern Plc (AIM:TERN), the investment company specialising in the

Internet of Things ("IoT"), announces that it has made a further

GBP530,000 investment in its portfolio company, FVRVS Limited

("FundamentalVR"), and provides an update on the recent activities

of the Company and its portfolio companies, together with

announcing the date of release of the Company's interim results for

the six months ended 30 June 2021 and a planned investor

webinar.

Highlights

-- Strong business momentum continues across all of Tern's principal portfolio companies.

-- Further investment by Tern of GBP530,000 in FundamentalVR in

the form of convertible loan notes as part of a wider fund raise by

FundamentalVR from its existing institutional and other

shareholders.

-- FundamentalVR has seen increased adoption of its virtual

reality simulation solutions and continues to gain traction as a

result of the challenges of social distancing and the reduction in

elective surgeries, together with the introduction of new

capabilities .

-- Device Authority has continued to accelerate its annual

recurring revenue growth through its subscription base and its

modularised licence platform, KeyScaler, aided by the increasing

focus on IoT security, the launch of product enhancements and the

securing of further distribution partnerships.

-- Wyld Networks has continued to make significant progress

following its IPO on NASDAQ First North in Stockholm on 2 July

2021, including the signing of further distribution partnerships in

South America and South East Asia, and an agreement with

Chevron.

-- InVMA continues to enjoy growing sales and a strong sales pipeline. The global deployment of AssetMinder(R) has been further aided by the opening of InVMA's US operation with global professional services firm DEXIS now offering AssetMinder(R) to customers in Belgium and France.

-- Talking Medicines has continued the role out of its

PatientMetRx(R) data service and a leading global pharmaceutical

company has recently signed a commercial agreement with Talking

Medicines to start using PatientMetRx (R) .

Commenting Al Sisto, CEO of Tern, said :

"I am very pleased that the positive business momentum

previously reported has continued and all of our portfolio

companies have performed well in the year to date. We expect this

momentum to continue, building on recent commercial successes, as

our portfolio of IoT focussed businesses seek to provide innovative

and practical solutions to meet real world needs. In many instances

the wide-ranging effects of the Covid-19 pandemic has accelerated

the adoption of these solutions and we believe all of Tern's

portfolio companies are well positioned for the future.

"With the proceeds of the recent fundraise in July we are also

well positioned to support the further growth of our portfolio

companies, including the additional investment in FundamentalVR

announced today, and we look forward to providing additional

updates at the time of the release of our interim results on 14

September 2021."

Portfolio Update

FundamentalVR

FundamentalVR, of which Tern currently owns 26.9% of the equity,

has completed a GBP1,160,000 funding in the form of convertible

loan notes from Tern and its other existing institutional

shareholders who participated in the last FundamentalVR syndicated

funding round in October 2019. Tern has subscribed for GBP530,000.

In addition, FundamentalVR is anticipating raising further funds in

the form of advanced subscription agreements from certain of its

existing Enterprise Investment Scheme (EIS) investors.

Interest is payable by FundamentalVR on the convertible loan

notes at a rate of 10% per annum and they are convertible into

FundamentalVR equity at a 20% discount to the next equity fund

raising price, assuming it raises a minimum of GBP5 million.

FundamentalVR delivers virtual reality (VR) haptic 'flight

simulators' for surgery creating a safe, measurable and repeatable

space to refine skills. FundamentalVR's goal is to transform the

way surgeons prepare, practice, and refine their skills. It has

built an immersive, surgical simulation application platform,

Fundamental Surgery, to provide medical professionals with the

opportunity to rehearse, practice, and test themselves within a

safe, controllable space that is as close to real-life as

possible.

The proceeds of the fundraise will be used by FundamentalVR for

a number of initiatives targeted at the further growth of the

business and for general working capital purposes.

Based on FundamentalVR's latest statutory accounts for the year

ended 31 December 2019, as at that date it had net assets of

GBP3,393,976 and incurred a loss for the year of GBP1,603,520.

The adoption of FundamentalVR's haptics virtual reality

simulation solutions, as a credible alternative to in-person and on

human learning, has accelerated as a result of the challenges of

social distancing and the reduction in elective surgeries. Both

medical device and pharmaceutical companies are adopting the

platform to facilitate the introduction, sales and marketing of new

products that require repetition as part of training in the use of

these new devices and drug therapy. During the year to date,

FundamentalVR has experienced expanded interest in its platform

from new customers and repeat sales to its existing customer

base.

FundamentalVR has also continued to innovate and recently added

advanced simulated soft tissue capabilities with kinesthetic

haptics to its portfolio.

Device Authority Limited ("DA" or "Device Authority")

During 2021, Device Authority has continued to accelerate its

annual recurring revenue growth through its subscription base and

its modularised licence platform, KeyScaler. This has been aided by

Device Authority being part of the FIDO Alliance that has created a

new onboarding standard to secure the IoT, together with further

governmental pressure on major companies in a number of territories

to increase cyber security.

Device Authority continues to build on its success within the

automotive and transport markets with growing sales from a number

of existing clients as their components move to volume production

and the addition of new client wins in the automotive, automotive

supply chain and shipping industries. With smart connected

technologies being adopted in these markets, transfer of ownership

and public key infrastructure (PKI) management throughout the

lifecycle of the automobile or engine is becoming increasingly

relevant.

In addition to new customer wins, Device Authority have entered

into further distribution partnerships, including with Crossroads

Innovation Group, to expand its reach within the US public sector,

and with Medigate, an IoT device security and asset management

company dedicated to the healthcare sector.

Earlier this month, Device Authority joined the Ericsson IoT

partner ecosystem to help enterprises leverage the full Ericsson

IoT ecosystem value. This partnership incorporates the tools and

necessary processes with a view to increasing the return on

investment for IoT customers, using cellular connectivity as the

foundation . The partnership with Ericsson is in addition to Device

Authority's existing partnerships with leading IoT ecosystem

providers, including AWS, DigiCert, Entrust, HID Global, Microsoft,

PTC, Thales, Venafi and Wipro, amongst others.

Device Authority has also continued to enhance and expand its

product offering. It recently announced a new version of KeyScaler

which includes enhanced support for Microsoft Azure Key Vault with

its hardware security module (HSM) Access Controller. Cloud

deployments allow for easier management and scalability for IoT

devices and applications and the HSM Access Controller represents a

new technology feature that enables flexibility for cloud

deployment with secure key storage.

In addition, Device Authority has extended further the

interoperability of KeyScaler and Microsoft Azure IoT with the goal

of solving security problems and improving return on investment for

its joint customers, specifically to address Enterprise Edge

devices and sensor use cases in the retail, automotive, healthcare

and industrial sectors.

Device Authority has been gaining further industry recognition

and was highlighted in ABI Research's 'IoT Device Onboard and

Lifecycle Management Competitive Ranking' as a leader in its SPARK

Matrix(TM) and IoT Identity and Access Management (IoT IAM).

InVMA Limited ("InVMA")

During 2020, InVMA began to scale up its Industrial IoT

connected asset software as a service (SaaS) product,

AssetMinder(R), from several initial pilot customers to create

product adoption momentum which has continued in 2021. InVMA is

experiencing further interest from large industrial customers who

are looking to connect large numbers of assets to AssetMinder(R),

particularly as the Covid-19 crisis accelerated the need for

contactless monitoring of factory and remote assets. To facilitate

servicing this demand, particularly in North America, InVMA has

opened a US operation, AssetMinder USA, based in Durham, North

Carolina, USA.

InVMA continues to enjoy growing sales and a strong sales

pipeline. The global deployment of AssetMinder(R) has been further

aided by Dexis Consulting Group (DEXIS), the global professional

services firm which provides, amongst other things, industrial

maintenance solutions, now offering AssetMinder(R) to customers in

Belgium and France.

During July 2021, Tern advanced GBP100,000 of convertible loan

notes to InVMA, which carry a coupon rate of 8% per annum and are

convertible into InVMA shares at a 20% discount to any future third

party fundraising.

Wyld Networks AB (publ) ("Wyld Networks" or "Wyld")

Wyld Networks has continued to make significant progress

following its IPO on the NASDAQ First North Growth Market in

Stockholm on 2 July 2021. In particular, it has continued with the

commercialisation of Wyld Connect, its terrestrial low-power

wide-area network (LPWAN) IoT module, securing further commercial

deals, specifically addressing one of the issues hampering the

growth and roll out of IoT applications, notably a lack of

affordable global wireless connectivity.

As satellite IoT adoption accelerates, particularly in emerging

markets, Wyld Networks has recently partnered with companies in

South America and South East Asia to deliver its

sensor-to-satellite solution, Wyld Connect, to the agriculture

market, facilitating the affordable implementation of IoT

connectivity and in line with Wyld's go-to-market strategy of using

resellers across the globe to help promote and commercialise Wyld's

solutions . In South America, agreement has been reached with two

well established partners, the Wezen Group and the Colombian Fruit

Group. In the Philippines, a partnership has been entered into with

East-West Seed Philippines, a tropical vegetable seed provider in

South East Asia, to bring remote sensor connectivity to the South

East Asian seed production market.

Additionally, Wyld Networks has entered into a partnership with

Chevron, the US-headquartered multinational energy company with

2020 revenues of over US$94 billion, to pilot Wyld's satellite IoT

solution to enable remote sensor connectivity within Chevron's IoT

infrastructure. Use of Wyld's solution by Chevron has the aim of

improving operational efficiency by cost-effectively collecting

data from IoT sensors in remote locations within the Chevron oil

and gas operational infrastructure, particularly where there is no

cellular or wireless coverage. This data provides insight and

information to help reduce equipment downtime and enable

preventative maintenance to ensure improved operational efficiency

within complex infrastructure in the oil and gas environment.

Wyld Networks also continues to work with multiple other

resellers, including ASCOM, a global ICT solution vendor, and

Alliance Corporation, based in North America.

Wyld also continues to promote its Wyld Mesh and Fusion

solution, launched in 2020, which is an innovative solution for

delivering location-aware, relevant and actionable content over 4G,

WiFi and mesh networks for a range of applications in retail,

venues, hospitality, transportation and smart factories. With the

gradual opening up of venues following Covid-19 related

restrictions, Wyld is seeing increased interest in Wyld Mesh and

Fusion.

Talking Medicines Limited ("Talking Medicines")

As previously announced, Talking Medicine's ambition in 2021 is

to establish its PatientMetRx(R) data service as the gold service

standard provider of intelligence on patient experience by

medicine. Tern is pleased to report that a leading global

pharmaceutical company has recently signed a commercial agreement

with Talking Medicines to start using PatientMetRx (R) .

Talking Medicines also entered into a strategic partnership at

the end of July 2021 with Closing Delta, a large US headquartered

digital transformation consultancy and advisory firm, that helps

pharmaceutical companies accelerate digital transformation, in

particular now utilising PatientMetRx (R) to measure patient

confidence .

Notice of Interim Results

The Company advises that its interim results for the six months

ended 30 June 2021 will be announced on Tuesday 14 September

2021.

Online Investor Presentation and Q&A Session

Tern's management and senior management from two of Tern's

portfolio companies, Device Authority and FundamentalVR, will be

hosting an online presentation and Q&A session at 5.30 p.m. BST

on Tuesday 14 September 2021. This session is open to all existing

and prospective shareholders. Those who wish to attend should email

tern@investor-focus.co.uk and they will be provided with access

details. Participants will have the opportunity to submit questions

during the session, but questions are welcomed in advance and may

be submitted to: tern@investor-focus.co.uk .

Enquiries

Tern Plc via IFC Advisory

Al Sisto (CEO)

Sarah Payne (CFO)

Allenby Capital Limited Tel: 0203 328 5656

(Nominated Adviser and Broker)

David Worlidge / Alex Brearley (Corporate

Finance)

Matt Butlin / Kelly Gardiner (Sales

and Corporate Broking)

IFC Advisory Tel: 0203 934 6630

(Financial PR and IR) tern@investor-focus.co.uk

Tim Metcalfe

Graham Herring

Florence Chandler

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDDGGDIBSBDGBL

(END) Dow Jones Newswires

August 17, 2021 02:00 ET (06:00 GMT)

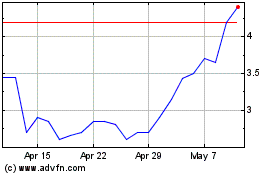

Tern (LSE:TERN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tern (LSE:TERN)

Historical Stock Chart

From Apr 2023 to Apr 2024