Dow Jones received a payment from EQS/DGAP to publish this press

release.

Tern PLC (TERN)

Tern PLC: Unaudited Interim Results for the six months to 30 June 2018

17-Sep-2018 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

17 September 2018

Tern Plc

(AIM: TERN)

Unaudited Interim Results for the six months to 30 June 2018

Tern Plc ("Tern" or the "Company"), the AIM quoted investment company

specialising in the Internet of Things ("IoT") market, is pleased to

announce its interim results for the six months to 30 June 2018.

Key Highlights

30 June 2018 30 June 2017 31 December 2017

GBP GBP GBP

Net assets 13,942,757 10,787,236 10,580,802

Current assets 2,671,784 429,729 850,675

Total assets 14,221,704 11,031,059 11,069,300

Loss for the period (221,252) (469,116) (1,689,555)

· Raised GBP3.1m during the period and retired a convertible loan note

facility, strengthening the balance sheet and improving Tern's investment

options.

· GBP1.5m invested into growing the portfolio with a new medical Virtual

Reality (VR) IoT investment, FVRVS Limited (trading as FundamentalVR), and

into existing portfolio companies, Device Authority Limited ("Device

Authority") and InVMA Limited.

· Year-on-year turnover of principal portfolio companies1 from calendar

year 2016 to 2017 increased by 126% and the increase for calendar year

2017 to 2018 is expected to be of the order of 12%. This includes a

reduction in turnover for flexiOPS due to the receipt of the final EU

grants. Without this reduction, the growth increases to 50%.

· Year-on-year increase in employees within principal portfolio

companies1, a key growth measurement or KPI, increased by 55% from

calendar year 2016 to 2017 and increased a further 12% in the six months

to June 2018.

· A close focus on cost management ensured that monthly administrative

costs over the period remained comparable to the monthly burn rate in the

year ended 31 December 2017. The reduced loss for the period compared to

the six months to June 2017 was primarily due to a small fair value

increase (GBP282,987).

· Net asset value per share fell to 6.2p for the period, this was due to

share issues early in the year. The most recent fundraises were achieved

at an appreciative net asset value per share.

· Details of shareholder conference call, to be held on Thursday 20

September, can be found at the end of this release.

Al Sisto, CEO of Tern Plc, said:

"I am pleased that Tern has made positive progress in terms of positioning

our company as a leading investor in technology companies specialising in

the IoT sector in the UK. Our recent activities, which include strengthening

our balance sheet and making investments into new and potentially

high-growth companies at attractive valuations, place us in a more solid

position for the full year and beyond.

"Tern's hands-on approach, consultative support and excellent industry

network represents an appealing proposition to the IoT companies in which we

seek to invest. As a result, we believe that we are on track to meet our

goal of having a dozen companies in our portfolio by the 2019 year-end, as

we outlined at our Annual General Meeting (AGM) in April this year. The

increased turnover reported by our portfolio companies reflect their

positive progress and we are confident that we can continue to support this

type of success in the future.

"At this point of our company's development, we believe we have the

components in place for a scalable foundation that will drive sustainable

growth for our shareholders, brought about by our management's years of

experience in growing technology businesses; a unique approach in finding

opportunities; and a focus on the dynamic IoT sector. Looking forward, over

the next six months, we are planning to expand our team, by adding

additional technology expertise to support the growing portfolio."

Note 1: Portfolio company growth excludes Seal and Push, in which Tern has a

<1% holding and minimal influence.

Enquiries:

Tern Plc via Redleaf

Albert Sisto/Sarah Payne

Allenby Capital Limited Tel: 0203 328 5656

(Nomad and joint broker)

David Worlidge/Alex Brearley

Whitman Howard Tel: 020 7659 1234

(Joint broker)

Nick Lovering/Christopher Furness

Redleaf Communications Tel: 020 3757 6880

Elisabeth Cowell/Fiona Norman

Chief Executive's Statement

During the first six months of 2018, Tern focused on building a portfolio of

exciting IoT companies in the UK that the Board believes will be attractive

candidates for acquisition or IPO, with valuations between GBP1 million to GBP10

million.

Our focus remains on delivering consistent investee company turnover growth;

growing and expanding the existing investment business, as measured by

investee company employee number growth; and focusing on year-on-year net

asset growth.

With this in mind, we were pleased to have added an investment in an

additional company to our portfolio during the period. Accordingly, the

absolute net asset value of our holdings increased by 32% during the period.

Notably, since our 2017 half year end, we have increased the number of

portfolio companies from four to six. Our stated objective is to hold twelve

investments by 31 December 2019 within a synergistic portfolio and this

continues to be a focus of the Company.

Whilst acquiring investments has been one focus of the Board, it has also

worked on supporting our portfolio companies and developing strategic

relationships among our portfolio companies, with the aim of successfully

exiting investments within a timeframe of 36 - 60 months after our initial

investment. With this in mind, we delivered follow-on investment and support

amounting to GBP0.7m during the period. In particular, we are pleased by how

Device Authority continues to expand its important market ecosystem and its

strategic alliances and partnerships against our stated objectives outlined

in the 2017 annual report. We are also pleased to see the rapid progress

FundamentalVR has made in converting to a SaaS revenue model and expanding

into the important North America market since receiving our GBP0.8m

investment.

Key to our value creation is the increase in turnover delivered by our

portfolio companies. Pleasingly, the year-over-year growth in the aggregate

revenue of our principal portfolio companies1 increased by 126% from

calendar year 2016 to calendar year 2017 and we expect the growth in the

aggregate revenue of our investee companies from calendar year 2017 to

calendar year 2018 to be of the order of 12%. This growth would increase to

50% if the reduction in turnover from flexiOPS is removed, reflecting an

increase in customer contracts secured and delivered. flexiOPS received the

last of the EU grants in the first six months of 2018 and is now focused on

growing and securing contracts for Wyld Technologies. Another important

indicator in the growth and success of our principal portfolio companies1:

year-over-year employee headcount growth, increased by 55% from calendar

year 2016 to calendar year 2017, and 12% in the six months to June 2018,

highlighting a continuing growth in the portfolio overall.

The period also saw us build up our balance sheet resources. During the

first six months of 2018, Tern retired the convertible loan notes obtained

at the end 2017. We subsequently raised GBP3.1 million to improve our

deployment capabilities. Our strategy was further developed in July 2018,

when we added GBP2.9 million to our balance sheet to bolster our financial

position for upcoming investment opportunities and to provide additional

finance to develop the businesses of the existing portfolio companies. While

our net asset value per share decreased by 16% during the period, primarily

due to our funding activities in late 2017 and early 2018, during the latter

half of this period and looking forward into the second half of the year,

funding activities have been net asset value per share generative.

With the world becoming more connected than ever, we believe that 2018/19

will be an inflection point for the IoT sector. The IoT sector will be

facing greater investment and more widespread adoption of IoT applications.

An increase in IoT devices encompasses a wide range of physical devices with

embedded electronics, software, sensors or actuators, with many of them

allowing objects to be sensed or controlled remotely across networks. As a

result, businesses are becoming the top adopters of IoT solutions, motivated

by lower operating costs and increased productivity. IoT devices play a

crucial role in the management of our global critical infrastructure and

further adoption in critical infrastructure is expected to increase rapidly.

For example, a Business Intelligence report "The IOT Forecast Book 2018"

suggests that by 2023:

· Companies offering IoT platform software and services will bring in

nearly $18 billion annually;

· Total low-power wide-area network (LPWAN) connections will rise to more

than 2 billion devices with about 1 in every 20 IoT devices connected to

an LPWAN;

· The agriculture sector will install nearly 12 million sensors worldwide;

and

· The installed base for robotic systems will approach 6 million globally,

for example.

The Board believes that Tern is building a strong portfolio in industries

that support companies within several of these critical infrastructure

sectors with our companies addressing those segments of these markets where

utilisation and adoption is already occurring.

Note 1: Portfolio company growth excludes Seal and Push, in which Tern has a

<1% holding and minimal influence

Portfolio Review

Device Authority Limited ("Device Authority"): GBP9.9m valuation

Device Authority is an award winning, industry-recognised, international

business delivering innovations in IoT security with offices in the UK and

Silicon Valley. Since our initial investment in Cryptosoft Limited over

three years ago, Device Authority has expanded its product portfolio, world

class team and ecosystem of well-established business partners. Tern today

is a 56.8% shareholder in Device Authority.

We were disappointed that the original objectives for 2017 were delayed by

product integration issues, delays in customer implementation and

restructuring. During the first six months of 2018, Device Authority

continued to build on a strong base of strategic partners, including SyroCon

Consulting and Eonti, Larsen and Toubro Infotech ('LTI') and Gemalto.

Furthermore, it announced support for the Microsoft Azure IoT Hub. Device

Authority also continued to be recognised as a critical force in the global

IoT security market. For example, gaining recognition as a 2018 Emerging

Star in the IOT Security Market by Quadrant Knowledge Solutions. The Board

is pleased with Device Authority's continued focus and is encouraged by the

recent pipeline development for KeyScaler.

Following the announcement of a strategic partnership with Thales, Device

Authority and Thales announced the launch of their joint blueprint to secure

the connected health industry. This IoT market is a strategic focus for

Device Authority as healthcare forecasts predict growth to reach $612bn by

2024, according to a report by Grand View Research, Inc published in 2016.

During the period, Device Authority announced the launch of KeyScaler As A

Service, providing IoT Security in the Cloud. This service enables IoT

service providers and manufacturers to offer their customers the best

security for IoT devices without the infrastructure or running costs

associated with on-premise environments, expanding is ability to make market

for its platform by simplifying customer deployment options.

Device Authority's fundraising activities with US Capital Partners continue

in the US. A fundraise has not yet been completed but interested parties

continue to meet with Device Authority. In the meantime, the Device

Authority shareholders have supported the continued progress of the company

by providing a total of $2.9 million in the form of convertible loan notes

since November 2017, $1.7m of this provided by Tern ($0.5m post 30 June

2018).

As at 30 June 2018, the value of Tern's shareholding in Device Authority has

increased to GBP9.9 million (31 December 2017: GBP9.7 million) as a result of

favourable exchange rate movements.

The annual report and accounts for Device Authority for the year ended 31

December 2017 are expected to be released in September 2018.

FVRVS Limited ('Fundamental VR'): GBP0.8m valuation

Tern invested GBP0.8m in FundamentalVR in May 2018 for a 18.3% holding.

FundamentalVR provides Tern with exposure to the rapidly growing medical

simulation market using low cost open system IoT devices, a market

anticipated to grow to $2.3bn by 2021 according to a 2016 report by

MarketsandMarkets and provides a basis for developing our IoT analytics

pillar of the Tern investment strategy.

FundamentalVR has already begun to use the funds received from Tern to

further refine its SaaS delivery model and expand into the US market.

America is an important strategic market for the company and over the next

six months FundamentalVR will focus on the US medical industry as the next

stage of their ambition of building a world leading SaaS based immersive

surgical simulation and data gathering platform.

It is important to note that the decrease in turnover at FundamentalVR from

GBP1m in the year ended 31 December 2016 to GBP0.3m in the year ended 31

December 2017 reflects the beginning of the change in its business model

from one of bespoke sales to that of a growing subscription-based recurring

revenue model which is securing and growing the value of the business.

flexiOPS Limited ("flexiOPS"): GBP78,000 valuation

flexiOPS, a wholly-owned Tern investment, completed its historic portfolio

of EU funded research and development cloud projects during 2018. It has now

re-focused on supporting the networking element of our IoT enablement

strategy by aiding the growth and development of the Wyld Technology Limited

("Wyld Technology") ad-hoc mesh networking offering following their

acquisition in late 2017.

During the first six months of 2018, Wyld Technology has focused on building

out its development team and product platform, and now has a product roadmap

that is in line with current market requirements via its ability to deliver

and collect critical data via its ad-hoc mesh networking platform in the all

critical "last mile:".

Mesh networks enable data to be transmitted from different devices

simultaneously. This topology can withstand high traffic and even if one of

the components fail, an alternative is always available, ensuring data

transfer is not affected. As mesh network topology is self-forming and

self-healing it is more efficient at creating robust ad-hoc networks;

providing assured quality to ensure continuity of service.

InVMA Limited ("InVMA"): GBP0.6m valuation

InVMA, a company in which Tern has a 50% holding, delivers IoT applications,

based on the industry leading PTC/Thingworx development platform that

deliver real business value and competitive advantage to its customers. Its

founding team combines years of world-class industrial design expertise with

the Thingworx platform to create state of the art IoT systems and products

in the medical and industrial IoT market segments.

Since our investment in late 2017, InVMA, as part of its business

transformation, has launched AssetMinder, a product which monitors and

manages data from all types of sensors that provides alerts when

pre-determined thresholds or rules have been met or broken. In the first

half of 2018, InVMA has focused on generating AssetMinder product sales to

drive value creation. InVMA also announced the integration of InVMA's

AssetMinder with Device Authority's KeyScaler which is an important proof

point of Tern's influence in integrating the products and technologies of

its portfolio companies.

Real-time monitoring's many benefits are fuelling IoT growth and 69% of

manufacturers are relying on real-time monitoring to increase the accuracy

of tracking production time, downtime, total parts created, rejects and

parts remaining to be produced, according to a 2018 report by IQMS

Manufacturing Software.

According to a report by Grand View Research published in 2016, the global

industrial IoT market is expected to reach US$933.62 billion by 2025 from

$109.28bn in 2016. Growth in this segment can be attributed to the

developing cloud computing market, increasing government initiatives for

supporting sustainable smart factories growth, and rising number of

connected devices that generate a large amount of data. InVMA have also

secured new strategic partnerships and contract wins in key segments of this

market already, including the announcement of a contract with ESAB, part of

the Colfax Group, to support the architecture of a new ESAB WorldCloud

platform which will be powered my Microsoft Azure IOT and PTC's ThingWorx

platform.

The annual report and accounts for InVMA for the year ended 31 December 2017

are expected to be released in September 2018.

Seal Software Group Limited ("Seal Software"): GBP125,439 valuation

During the first half of 2018, Seal Software, a company in which Tern holds

less than 1%, a leader in contract discovery and analytics, has continued to

grow and develop its business with numerous awards, new contracts and

strategic partnerships announced. Specifically:

· Seal Software unveiled a global partnership with DocuSign to automate

and connect the process of how agreements are prepared, signed, enacted

and managed.

· Seal Software won the award for Outstanding Data Analytics Solution at

the annual Big Data Excellence awards in May 2018. Seal Software was also

named a 2018 Cool Vendor in Content Services by Gartner.

· The annual report and accounts for Seal Software for the year ended 31

December 2017 are expected to be released in September 2018.

Push Technology Limited ("Push Technology"): GBP11,326 valuation

We have been informed by management that Push Technology, a company in which

Tern holds less than 1%, continues on its path to profitability following a

2017 strategic realignment from a product focused company to a customer

centric company outwardly focused on expanding into new markets. This

includes a reduction in the sales cycle and a move to work more efficiently

and control costs.

The annual report and accounts for Push Technology for the year ended 31

December 2017 are expected to be released in September 2018.

Financial

During the six months ended 30 June 2018, the Board focused on strengthening

the balance sheet to support the existing portfolio companies and to enable

investments in new exciting growth IoT companies. As a result, the total

assets of Tern increased to GBP14.2 million at 30 June 2018, compared to GBP11.1

million at 31 December 2017. The total assets at 30 June 2018 included a

cash balance of GBP1.5m and net current assets of GBP2.4m, of which GBP0.9m

related to the convertible loans issued to Device Authority during 2017 and

2018.

The improved loss for the period reflects a close focus on cost management,

with monthly administrative costs over the period remaining comparable to

the monthly burn rate in the year ended 31 December 2017. A small increase

in the fair value of the investment portfolio was recognised, reflecting a

positive exchange rate variance for Device Authority Limited (GBP0.2m) and a

100% increase in the valuation of Seal Software Group Limited following a

recent fundraise.

The net asset value per share fell slightly during the period, caused by the

conversion of the loan note in 2017 with shares issued in 2018 and a further

conversion in January 2018.

Post balance sheet events

A placing of 11,192,307 ordinary shares at an issue price of 26 pence

raising gross proceeds of GBP2.9m was completed in July 2018, which has

strengthened the cash and current asset position of the Company. The

proceeds place the Company in a stronger financial position for upcoming

investment negotiations and also provides additional finance to develop the

existing portfolio company businesses.

Outlook

The Board remains committed to increasing our investment in the IoT market

in the UK, focusing on adding new technology companies to the portfolio,

including UK companies delivering platforms that include AI and machine

learning for IoT, while continuously supporting and growing the existing

portfolio. Adding an additional technology strong director to the Tern team

will help support this aim.

We have set for ourselves a financial benchmark of achieving an average of

20% year-on-year growth in portfolio value by year end 2019 and at the half

year we have achieved a 13% growth in the portfolio and stand well

positioned to deliver over the full year with significant cash balances

remaining to deploy.

By changing the traditional venture capital model and making our expertise

accessible to a wider group of companies we believe we are breaking new

ground. Our partnership approach offers Tern investors access to exciting

technology companies which may not otherwise be available to them. The

placings of GBP3.1 million in the first six months of 2018, gives us

additional capacity and negotiating strength and is a validation of that

model, having attracted support from high profile new investors, as well as

the strong existing shareholder base.

We feel confident of making further progress during the second half of 2018

and look forward to making more announcements about business performance,

new developments and improvements for each of our portfolio companies and

reporting exciting new additions to the Tern portfolio.

Finally, I wish to thank all shareholders for their support and acknowledge

the hard work of the all the directors and our advisors.

Al Sisto

Chief Executive Officer

14 September 2018

Unaudited Statement of Comprehensive Income

for the 6 months ended 30 June 2018

Notes 6 months to 6 months to 12 months

30 June 30 June to 31

2018 2017 December

2017

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Revenue 64,245 42,639 97,940

Movement in fair value 282,987 - (757,705)

of investments

Gross Profit/(Loss) 347,232 42,639 (659,765)

Administration costs (571,952) (522,105) (1,030,60

3)

Operating loss (224,720) (479,466) (1,690,36

8)

Finance 4,376 10,484 1,020

income

Finance costs (908) (134) (207)

Loss before tax (221,252) (469,116) (1,689,55

5)

Tax - - -

Loss for the period (221,252) (469,116) (1,689,55

5)

Earnings per share 6

Basic (0.1)p (0.4)p (1.4)p

Diluted (0.1)p (0.4)p (1.4)p

Unaudited Statement of Financial Position

as at 30 June 2018

30 June 30 June 31

December

2017

2018 2017

(Unaudited) (Unaudited) (Audited)

Note GBP GBP GBP

Assets

Investments held for 11,549,920 10,601,330 10,218,62

trading 5

Loans to - - -

investee

companies

Non-current 11,549,920 10,601,330 10,218,62

assets 5

Current

assets

Trade and 1,133,132 93,763 576,849

other

receivables

Cash and 1,538,652 335,966 273,826

cash

equivalents

2,671,784 429,729 850,675

Total assets 14,221,704 11,031,059 11,069,30

0

Equity

attributable

to the

Company's

equity

holders

Share 7 1,346,665 1,325,614 1,330,225

capital

Share 16,833,172 12,420,593 13,237,36

premium 2

Loan note - 17,479 123,482

equity

reserve

Share option and - 1,126,581 175,982

warrant reserve

Retained (4,237,080) (4,103,031) (4,286,24

earnings 9)

13,942,757 10,787,236 10,580,80

2

Current

liabilities

Trade 34,024 542 47,600

payables

Accruals and 244,923 168,077 229,564

other

payables

278,947 168,619 277,164

Non-current

liabilities

Borrowings - 75,204 211,334

Total 278,947 243,823 488,498

liabilities

Total equity 14,221,704 11,031,059 11,069,30

and 0

liabilities

Unaudited Changes in Equity

as at 30 June 2018

Share Share Loan Option Retained Total

note and

warrant

equity

capital premium reserve reserve earnings equity

GBP GBP GBP GBP GBP GBP

Balance at 1,325,27 12,390,31 20,650 1,088,5 (3,637,0 11,187,

1 January 0 0 95 86) 739

2017

Total - - - - (469,116 (469,11

comprehensi ) 6)

ve income

Issue of 344 30,283 - - - 30,627

share

capital

Transfer on - - (3,171) - 3,171 -

conversion

of

convertible

loan notes

Share based - - - 37,986 - 37,986

payment

charge

Balance at 1,325,61 12,420,59 17,479 1,126,5 (4,103,0 10,787,

30 June 4 3 81 31) 236

2017

Total - - - - (1,220,4 (1,220,

comprehensi 39) 439)

ve income

Issue of 4,611 941,925 - - - 946,536

share

capital

Issue of - - 112,563 - - 112,563

convertible

loan note

Share and - (125,156) - - - (125,15

loan issue 6)

costs

Transfer on - - (6,560) - 6,560 -

conversion

of

convertible

loan notes

Transfer of - - - (713,32 713,326 -

lapsed and 6)

exercised

warrants

Transfer of - - - (199,28 199,287 -

option 7)

reserve

Share based - - - (37,986 118,048 80,062

payment )

charge

Balance at 1,330,22 13,237,36 123,482 175,982 (4,286,2 10,580,

31 December 5 2 49) 802

2017

Total - - - - (221,252 (221,25

comprehensi ) 2)

ve income

Issue of 16,440 3,953,310 - - - 3,969,7

share 50

capital

Share and - (357,500) - - - (357,50

loan issue 0)

costs

Conversion - - (123,482 - - (123,48

of ) 2)

convertible

loan notes

Transfer of - - (175,98 175,982 -

lapsed 2)

warrants

Share based - - - - 94,439 94,439

payment

charge

Balance at 1,346,66 16,833,17 - - (4,237,0 13,942,

30 June 5 2 80) 757

2018

Unaudited Statement of Cash flows

for the 6 months ended 30 June 2018

6 months to 6 months to 12 months

30 June 2018 30 June 2017 to 31

December

2017

(Unaudited) (Unaudited) (Audited)

Note GBP GBP GBP

Cash flows from

operating activities

Net cash used in 8 (503,436) (438,760) (783,866)

operations

Purchase of (1,048,309) - (375,000)

investments

Loan to investment (465,240) - (402,436)

company

Net cash from (2,016,985) (438,760) (1,561,302

operating activities )

Cash flows from

financing activities

Proceeds on issue of 3,100,000 - 603,110

shares

Proceeds on issue of 550,000 - 550,000

loan note

Share issue expenses (357,500) - (125,156)

and Loan note issue

expenses

Proceeds from - 2,377 34,303

exercise of warrants

Proceeds from 8,500 9,000 9,000

exercise of options

Repayment of loan (20,000) - -

stock

Interest received 811 498 1,020

Net cash from 3,281,811 11,875 1,072,277

financing activities

Increase/(decrease) 1,264,826 (426,885) (489,025)

in cash and cash

equivalents

Cash and cash

equivalents at

beginning of period

273,826 762,851 762,851

Cash and cash 1,538,652 335,966 273,826

equivalents at end

of period

Notes to the unaudited interim statement

for the 6 months ended 30 June 2018

1) General information

The Company is a public limited company which has its ordinary shares

admitted to trading on the AIM market operated by the London Stock Exchange

and is incorporated in England and Wales.

The address of its registered office is 27-28 Eastcastle Street, London, W1W

8DH. Items included in the financial statements of the Company are measured

in Pound Sterling which is the currency of the primary economic environment

in which the entity operates. The financial statements are also presented in

Pound Sterling which is the Company's presentational currency.

2) Basis of preparation

The interim financial statements of Tern Plc have been prepared in

accordance with IAS 34, Interim Financial Reporting, as adopted by the

European Union (EU). They do not include all of the information required for

full annual financial statements, and should be read in conjunction with

Tern plc's audited financial statements for the year ended 31 December 2017.

The financial information for the year ended 31 December 2017 set out in

this interim report does not constitute statutory accounts as defined in

Section 434 of the Companies Act 2006. The Company's statutory financial

statements for the year ended 31 December 2017 have been filed with the

Registrar of Companies and can be found on the website www.ternplc.com [1].

The auditor's report on those financial statements was unqualified and did

not contain statements under Section 498 (2) or Section 498 (3) of the

Companies Act 2006.

These interim financial statements have been prepared under the historical

cost convention and have been approved for issue by the Board of Directors.

3) Going concern

The financial statements have been prepared on the going concern basis.

The directors have a reasonable expectation that the Company has adequate

resources to continue operating for the foreseeable future. For this reason,

they continue to adopt the going concern basis in preparing the Company's

financial statements

4) Critical accounting judgements

Estimates and judgements are continually evaluated and are based on

historical experience and other factors, including expectations of future

events that are believed to be reasonable under the circumstances.

The Company makes estimates and assumptions concerning the future. The

resulting accounting estimates will, by definition, rarely equal the related

actual results. The estimates and assumptions that have a significant risk

of causing a material adjustment to the carrying amounts of assets and

liabilities within the next financial year are outlined below.

Income taxes

Judgement is required in determining the Company's provision for income tax.

Where the final tax outcome is different from the amounts that were

initially recorded, the differences will impact the income tax and deferred

tax provisions in the period in which such determination is made.

Fair value of financial instruments

The Company holds investments that have been designated as held for trading

on initial recognition. Where practicable the Company determines the fair

value of these financial instruments that are not quoted (Level 3) using the

most recent bid price at which a transaction has been carried out. These

techniques are significantly affected by certain key assumptions, such as

market liquidity. Given the nature of the investments being early stage

business, other valuation methods such as discounted cash flow analysis

assess estimates of future cash flows to derive fair value estimates cannot

always be substantiated by comparison with independent markets and, in many

cases, may not be capable of being realised immediately.

Share based payments

The calculation of the fair value of equity-settled share based awards and

the resulting charge to the statement of comprehensive income requires

assumptions to be made regarding future events and market conditions. These

assumptions include the future volatility of the Company's share price.

These assumptions are then applied to a recognised valuation model in order

to calculate the fair value of the awards.

5) Segmental reporting

The accounting policy for identifying segments is based on internal

management reporting information that is regularly reviewed by the chief

operating decision maker, which is identified as the Board of Directors.

In identifying its operating segments, management generally follows the

Company's service lines which represent the main products and services

provided by the Company. The directors believe that the Company's continuing

investment operations comprise one segment.

6) Earnings per share

Earnings per share is calculated by reference to the weighted average shares

in issue as follows:

6 months to 6 months to 12 months to

30 June 2018 30 June 2017 31 December

2017

Weighted average

number of ordinary

shares (see note

below):

For calculation of 199,609,225 119,668,783 124,586,665

basic earnings per

share

For calculation of 199,609,225 119,668,783 124,586,665

fully diluted

earnings per share

The same number of shares is used for the calculation of the diluted loss

per share as for the basic loss per share for the six months to 30 June 2018

as the losses in these periods have an anti-dilutive effect.

7) Share capital

30 June 2018 30 June 2017 31 December 2017

Number Number Number

Issued and fully

paid:

Ordinary shares 225,484,580 120,230,677 143,286,855

of GBP0.0002

Deferred shares 42,247 42,247 42,247

of GBP29.999

Deferred shares 34,545,072 34,545,072 34,545,072

of GBP0.00099

GBP GBP GBP

Issued and fully

paid:

Ordinary shares 45,097 24,046 28,657

of GBP0.0002

Deferred shares 1,267,368 1,267,368 1,267,368

of GBP29.999

Deferred shares 34,200 34,200 34,200

of GBP0.00099

1,346,665 1,325,614 1,330,225

The deferred shares have negligible value, being subject to restrictions as

to voting, participation and redemption according to the new Articles of

Association then adopted, nor are they quoted on the AIM market of the

London Stock Exchange.

8) Note to the cash flow statement

6 months to 30 6 months to 30 12 months to

June 2018 June 2017 31 Dec 2017

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Loss for the (221,252) (469,116) (1,689,555)

period

Adjustments for

items not

included in

cash flow:

Movement in (282,987) - (17,621)

fair value of

investments

Exchange rate - - 775,326

loss

Share based 94,439 37,986 118,048

payment charge

Finance expense - - 207

Finance income (4,376) (10,484) (1,020)

Operating cash (414,176) (441,614) (814,615)

flows before

movements in

working capital

Adjustments for

changes in

working

capital:

- (91,043) 6,752 (73,898)

(Increase)/decr

ease in trade

and other

receivables

(excluding loan

to investee

companies)

- 1,783 (3,898) 104,647

Increase/(decre

ase) in trade

and other

payables

Cash used in (503,436) (438,760) (783,866)

operations

9) Availability of interim results

Copies of this report will be available from the Company's website

www.ternplc.com [1].

Shareholder Conference Call

Tern will be hosting a shareholder conference call with accompanying

presentation slides at 10:30 AM GMT on Thursday 20 September 2018.

The call will be hosted by the Tern's CEO, Al Sisto, who will discuss the

recent results, as well as answering submitted shareholder questions. To

submit a question, please email tern@redleafpr.com no later than 24 hours

before the scheduled call time. Unfortunately, the Company will be unable to

accept questions submitted after 10:30 AM GMT on 19 September 2018. Al Sisto

will aim to answer as many pre-submitted questions as possible during the

call.

Instructions

To participate in this conference call, please enter your local dial-in

number [2] and 64 70 02 62 followed by the hash key on any telephone device.

Please note that all lines will be muted with the exception of the Tern

host.

A presentation will be live to accompany the call once it has commenced, and

be available to view on desktop, smart phones and tablets during the event,

but will require a Cisco WebEx [3] application to be installed on certain

devices.

To view the presentation on a desktop computer, please click on this link

https://arkadin-event.webex.com/arkadin-event/onstage/g.php?MTID=ee37e5f4109

43dfc6deaddf89c24e6577 [4], followed by event password 301 240 867. If you

wish to view the presentation on a smartphone or tablet, please first

download the WebEx application and follow the instructions on the screen,

entering the password 702 631 511 for access.

It is advisable to check compatibility and log in 10 minutes ahead of the

call to ensure a smooth experience.

A recording of the call will be available on the Company's website as soon

as practicable.

ISIN: GB00BFPMV798

Category Code: IR

TIDM: TERN

LEI Code: 2138005F87SODHL9CQ36

Sequence No.: 6028

EQS News ID: 724049

End of Announcement EQS News Service

1: https://link.cockpit.eqs.com/cgi-bin/fncls.ssp?fn=redirect&url=6e8b33afd1df64b06916721dbe62d785&application_id=724049&site_id=vwd_london&application_name=news

2: https://link.cockpit.eqs.com/cgi-bin/fncls.ssp?fn=redirect&url=613eca41519d9d6f5215db81483fc182&application_id=724049&site_id=vwd_london&application_name=news

3: https://link.cockpit.eqs.com/cgi-bin/fncls.ssp?fn=redirect&url=4672f19e6c5415cb987f4d1e1b707fbc&application_id=724049&site_id=vwd_london&application_name=news

4: https://link.cockpit.eqs.com/cgi-bin/fncls.ssp?fn=redirect&url=fb9a830f773472994cb912f3da9906bd&application_id=724049&site_id=vwd_london&application_name=news

(END) Dow Jones Newswires

September 17, 2018 02:02 ET (06:02 GMT)

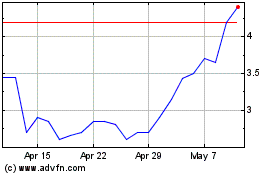

Tern (LSE:TERN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tern (LSE:TERN)

Historical Stock Chart

From Apr 2023 to Apr 2024