Standard Chartered Second-Quarter Profit Rose 6.5%

July 29 2022 - 1:03AM

Dow Jones News

By Clarence Leong

Standard Chartered PLC's second-quarter profit rose 6.5%

compared to the same period a year earlier, thanks to stronger

interest income, as it announced a new $500 million share buyback

program.

The Asia-focused bank Friday posted second-quarter underlying

pretax profit of $1.32 billion. Operating income rose 6.5% to $3.93

billion, driven by higher net-interest income as central banks

increased interest rates aggressively to fight elevated

inflation.

Its net-interest income rose 8.2% to $1.85 billion, while its

net-interest margin increased by 0.13 percentage point to

1.35%.

For the first half, credit impairments were $267 million, up

$314 million from a year earlier. The bank said it is alert to "an

unpredictable and challenging external environment including the

continued impact of COVID-19 in key markets, pressures in the China

commercial real estate sector, commodity price volatility and the

impact of the Russia/Ukraine war."

"Looking forward, whilst recession risks are rising in the West,

we are seeing the early stages of a post-pandemic recovery in many

of the markets in which we operate, underpinning our prospects for

growth," Stanchart's Chief Executive Bill Winters said.

Write to Clarence Leong at clarence.leong@wsj.com

(END) Dow Jones Newswires

July 29, 2022 00:48 ET (04:48 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

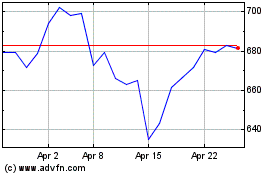

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

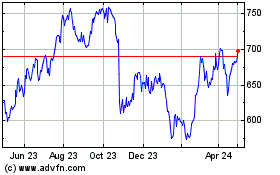

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Apr 2023 to Apr 2024