Standard Chartered's Second-Quarter Profit Plunged 40%

July 30 2020 - 1:18AM

Dow Jones News

By Yifan Wang

Standard Chartered PLC's second-quarter pretax underlying profit

slumped 40% from a year earlier, as credit impairments continued to

surge amid the prolonged coronavirus pandemic.

Underlying profit before tax fell to $733 million, compared with

$1.23 billion a year earlier, the Asia-focused lender said

Thursday.

The decline was primarily due to a surge in credit impairments,

which jumped to $611 million from $176 million. The increase

followed an even-sharper increase in impairments in the first

quarter.

Operating income fell 4.2% to $3.72 billion.

Net interest income plunged 15% to $1.66 billion, mainly dragged

by margin compression. Net interest margin was 1.28%, down 0.39

percentage point from the same period in 2019.

For the second half, Standard Chartered expects income to

decline both sequentially and from the prior year, as some

countries' economic recoveries are unlikely to offset the negative

impact of low interest rates globally.

However, the lender believes credit impairments for the coming

months may come down from the first half-year, if economic

conditions in its markets do not materially deteriorate.

The bank added that it has extended its cost-control initiative

into 2021.

Standard Chartered had earlier canceled this year's interim

dividend and warned that the public health crisis could derail its

previous target to achieve at least 10% return on tangible equity

by 2021.

Write to Yifan Wang at yifan.wang@wsj.com

(END) Dow Jones Newswires

July 30, 2020 01:03 ET (05:03 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

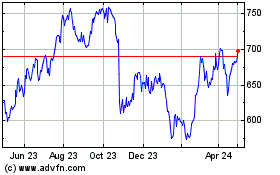

Standard Chartered (LSE:STAN)

Historical Stock Chart

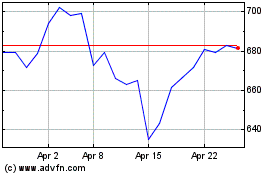

From Mar 2024 to Apr 2024

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Apr 2023 to Apr 2024