Standard Chartered PLC Update on disposal of interest in PT Bank Permata (2264K)

April 20 2020 - 8:39AM

UK Regulatory

TIDMSTAN

RNS Number : 2264K

Standard Chartered PLC

20 April 2020

Standard Chartered PLC

Update on disposal of interest in PT Bank Permata Tbk

20 April 2020

Standard Chartered PLC (the Group) announces that its wholly

owned subsidiary Standard Chartered Bank (SCB) and its partner PT

Astra International Tbk (Astra) have agreed with Bangkok Bank

Public Company Limited (the Purchaser) to amend the terms of the

agreement announced on 12 December 2019 (the Transaction) to sell

their aggregate 89.12% equity interest in PT Bank Permata Tbk

(Permata).

The Purchaser has received approval for the Transaction from its

shareholders. Permata's shareholders are expected to approve the

acquisition plan at an extraordinary general meeting scheduled for

23 April 2020, at which both SCB and Astra are entitled to vote

their respective 44.56% shareholdings. T he Transaction remains

subject to certain conditions, including necessary approvals from

the regulatory authorities in Indonesia.

The parties to the Transaction have agreed to revise the

purchase price from 1.77 to 1.63 times Permata's shareholders'

equity as at 31 March 2020, subject to the Transaction closing on

or prior to 30 June 2020.

FINANCIAL IMPLICATIONS TO STANDARD CHARTERED OF THE

TRANSACTION

The latest estimated consideration payable to SCB in cash is

approximately IDR17 trillion (US$1.06 billion) being approximately

US$0.3 billion greater than the Group's carrying value. The 18%

reduction in estimated proceeds compared to that indicated on 12

December 2019 is attributable to the revised valuation multiple, a

reduction in Permata's shareholders' equity due to the adoption of

IFRS 9 and the recent depreciation of Indonesian Rupiah against the

US Dollar.

The Transaction would generate, on the basis of the Group's

financial results for the period ended 31 December 2019, an

increase in the Group's Common Equity Tier 1 capital ratio of

around 40 basis points, reflecting a reduction in risk-weighted

assets of around US$9.1 billion and the deconsolidation of US$0.5

billion minority interest equity (net of regulatory adjustments

including goodwill).

The impact of the Transaction will be included in normalised

items to determine the Group's performance. As the Transaction is

expected to close at a future date, the actual consideration and

the actual Common Equity Tier 1 capital impact will be determined

at completion.

Note:

In this announcement, the conversions of IDR into US$ have been

made at the rate of IDR15,800 to US$1. Such conversions are for

reference only and should not be construed as representations that

the IDR amount could be converted into United States dollars at

that rate.

Enquiries to :

Mark Stride, Head of Investor Relations +44 (0) 20 7885 8596

Julie Gibson, Head of Media Relations +44 (0) 20 7885 2434

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DISEAALEADAEEFA

(END) Dow Jones Newswires

April 20, 2020 08:39 ET (12:39 GMT)

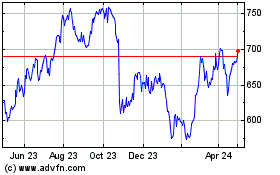

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

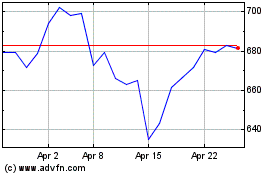

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Apr 2023 to Apr 2024