Banks Restrict Travel, Cancel Functions, Warn of Slower Growth -- WSJ

February 28 2020 - 3:02AM

Dow Jones News

By Simon Clark, Patricia Kowsmann and Ben Dummett

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 28, 2020).

LONDON -- Banks with heavy exposure to Europe and Asia have

warned profits could be hit by the coronavirus outbreak as they

tell employees to restrict travel and initiate special measures to

help customers.

Banking stocks sold off heavily Thursday with shares in several

European lenders falling more than 7%. Those retreats outstripped

declines in broad stock market indexes, which slid toward

correction territory as virus concerns continued to roil global

markets.

The spread of the virus will make it more difficult for

Asia-focused, London-based Standard Chartered PLC to hit its

financial targets, Chief Executive Bill Winters said as the bank

warned that profit growth would slow this year.

That warning comes after rival HSBC Holdings PLC said earlier

this month that it could take up to $600 million in additional loan

loss provisions if the crisis extends into the second half of the

year.

Other banks are curbing travel plans, canceling functions,

conducting business by videoconference and circulating employee

hygiene advice as disruption caused by the virus spreads. Some have

introduced relief measures for customers, such as delaying mortgage

repayments.

For Standard Chartered, the fallout from the virus coupled with

other political headwinds make for a gloomy short-term outlook. Mr.

Winters declined to estimate a cost of or worst-case scenario for

the impact of the virus but said the bank is in a strong financial

position to withstand any outcome.

"We have not put a number on it," he said, adding that his

"singular focus" was to get the bank through "a bumpy period."

A quarter of Standard Chartered's Hong Kong branches are closed

and there are no face-to-face services in some mainland China

branches as a precaution due to the coronavirus outbreak, the bank

said. It said some clients affected by the virus can delay

repayments on mortgages and business loans. The bank also said it

is waiving fees on personal loans, and extending the repayment

dates of companies' trade finance loans.

Elsewhere, most banks are following advice from the World Health

Organization, with several imposing restrictions on travel to China

and Italy.

Citigroup Inc. told employees that all travel into, between and

out of all countries in the Asia-Pacific region must be approved by

their chief country officer. JP Morgan Chase & Co. employees

also need line-manager approval for travel to Italy. HSBC told

staff not to book travel to Hong Kong until after April 20, and has

banned travel to mainland China until further notice.

Deutsche Bank has imposed staff travel restrictions to and from

mainland China, Hong Kong, the affected parts of Italy and South

Korea. It asked staff to defer all nonessential travel.

"We continue to monitor the government authorities' assessment

and advice and change our procedures accordingly," the bank said in

a statement. "We have analyzed where our staff's exposure to the

virus may be greatest and are working with local offices to

minimize the risk to local staff and travelling populations."

Deutsche Bank also changed the format of a discussion on the

state of the global economy due to take place in Frankfurt Thursday

evening so that its senior economists could join by videoconference

from London and New York, avoiding travel, replacing a sit-down

dinner with a cold buffet to make the event easier to hear.

Banks are relying on videoconferencing and other methods of

communication to ensure the coronavirus fallout doesn't impede

their ability to compete for business. Italy-based SIA SpA is

pursuing a possible initial public offering, and some banks without

a significant presence in Milan where the payments company is based

are pitching for an underwriter role remotely because of their

in-house travel restrictions, according to people familiar with the

matter. Some Milan-based bankers are still making their case in

person, some of the people said.

Bankers said that the broad market selloff is pushing companies

in sectors such as energy, retail and travel -- whose businesses

are at particular risk because of the virus -- to put on hold any

IPO plans that they had been considering, but not made public.

That said, the market volatility hasn't interrupted SIA's plan

for a possible IPO, which was announced earlier this month and

remains on track, according to a person familiar with the

matter.

A spokesman at Swiss bank Julius Baer Group AG, said it is

restricting travel in general, and in particular to the affected

regions. Earlier this month, it sent 100,000 medical masks to China

to help control the outbreak. The spokesman on Thursday said it has

a supply of masks for its staff in Asia and Switzerland.

At a conference on financial transaction clearing in Frankfurt

Thursday, attendees and speakers from banks and stock exchanges

were assessed at check-in by an infrared camera measuring body

temperature, according to the organizer. "Our security and

paramedic will approach you in case of any indication," a note at

the entrance said.

Outside, an ambulance was on standby.

Margot Patrick and Tom Fairless contributed to this article.

Write to Simon Clark at simon.clark@wsj.com, Patricia Kowsmann

at patricia.kowsmann@wsj.com and Ben Dummett at

ben.dummett@wsj.com

(END) Dow Jones Newswires

February 28, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

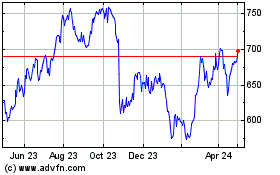

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

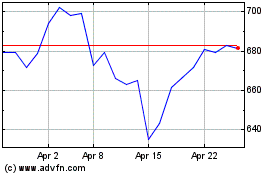

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Apr 2023 to Apr 2024