Banks Add CFO Roles To Prepare For Brexit -- WSJ

July 02 2019 - 3:02AM

Dow Jones News

By Nina Trentmann

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 2, 2019).

A handful of international banks have created new chief

financial officer positions in continental Europe to satisfy

regulatory requirements that will kick in once Britain leaves the

European Union.

Regulations and frameworks that currently govern the U.K.'s

financial sector -- including the system known as passporting that

lets U.K.-based banks offer their services across Europe -- will no

longer apply once the U.K. has left the bloc. That has prompted

financial services firms that manage their European operations from

London to apply for new banking licences or expand their business

on the continent in preparation for Brexit.

Banks including Standard Chartered PLC, Wells Fargo & Co.,

Mizuho International PLC and Nomura Holdings Inc. have set up new

CFO positions in Europe as part of their preparation for life after

Brexit.

More of these appointments are in the works. Heidrick &

Struggles International Inc., an executive recruiter, said it

recently advised two large international banks on CFO appointments

to fill new positions in Frankfurt. Stanton Chase, another

recruitment firm, has also been involved with finding candidates

for recently created CFO positions on the continent, said Philippe

Tschannen, a partner for the firm in Zurich.

Standard Chartered, the London-based emerging-markets bank,

expanded its existing branch in Germany into a subsidiary --

Standard Chartered Bank AG -- and appointed Alexander Engel as its

new CFO.

The bank had many corporate clients on the continent prior to

the 2016 referendum when 51.9% of Britons voted to leave, Mr. Engel

said. Standard Chartered used passporting rules to serve these

customers, but had to make changes once it became clear that the

framework would cease to apply to the U.K. after Brexit, Mr. Engel

told CFO Journal. "For us, there was no other option but to set up

a new EU hub," Mr. Engel said.

He took the new CFO role in March and was tasked with ensuring

the subsidiary is compliant with regulatory requirements imposed by

the European Central Bank and by BaFin, the German banking

regulator.

BaFin requires local subsidiaries of foreign banks to have at

least two managing directors, one with responsibility for the front

office and one for the back office.

Wells Fargo, the U.S. bank, established a new CFO position for

Wells Fargo Securities Europe SA, a broker-dealer based in Paris

that is currently awaiting regulatory approval. The entity will

become a Wells Fargo subsidiary and offer capital markets and

investment banking services to customers in Europe, the bank

said.

"Through Wells Fargo Securities Europe, we expect to leverage

our network in the region and beyond by establishing a Paris hub in

continental Europe," said Alicia Reyes, head of the bank's

securities business in Europe, the Middle East and Africa.

Mizuho hired a new CFO for its continental European subsidiary

in Frankfurt. The position was created because of Brexit, a

spokeswoman said. The bank previously served EU-customers from its

London office.

Another Japanese lender, Nomura, also set up a new

Frankfurt-based broker dealer and appointed a CFO, alongside a

chief executive, a chief risk officer and a chief operations

officer.

Other banks are expanding the remit of existing CFO positions.

Royal Bank of Scotland PLC repurposed a Dutch entity to become the

main hub for its investment-banking business on the continent, and

added to the responsibilities of Cornelis Visscher, who has been

the unit's CFO since 2013.

Some banks, particularly those with limited operations in

Europe, decided against hiring a Brexit CFO. Lloyds Banking Group

PLC said it doesn't need to create a new CFO position in

continental Europe, while Morgan Stanley said it doesn't plan to do

so.

Write to Nina Trentmann at Nina.Trentmann@wsj.com

(END) Dow Jones Newswires

July 02, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

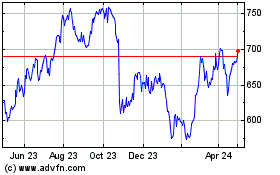

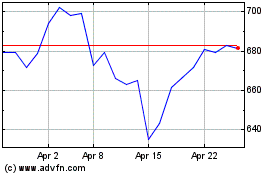

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Apr 2023 to Apr 2024