TIDMSSE

RNS Number : 2118H

SSE PLC

02 August 2021

SSE plc

SSE AGREES SALE OF STAKE IN SGN FOR GBP1.225BN

2 August 2021

SSE has agreed to sell its entire 33.3% stake in gas

distribution operator Scotia Gas Networks Ltd (SGN) to a consortium

comprising existing SGN shareholder Ontario Teachers' Pension Plan

Board (Ontario Teachers') and Brookfield Super-Core Infrastructure

Partners (Brookfield) (the Consortium).

The transaction is based on an effective economic date of 31

March 2021 and is for a consideration of GBP1,225m in cash. It is

expected to complete within the current financial year and is

conditional on certain regulatory approvals.

SSE initially acquired a 50% equity share in SGN in 2005 for a

total of GBP505m, before selling a 16.7% stake to a wholly owned

subsidiary of the Abu Dhabi Investment Authority (ADIA) in 2016.

The Consortium has also agreed to acquire the 16.7% stake in SGN

owned by ADIA.

SGN includes Scotland Gas Networks plc and Southern Gas Networks

plc, two of the eight regulated gas distribution networks in

England, Wales and Scotland, in addition to SGN Natural Gas Ltd,

which provides gas to customers in the west of Northern Ireland as

well as other non-regulated ancillary businesses. SGN is focused on

sustainability, having committed to ensuring all its business

operations are net zero by 2045, and is taking a leadership role in

supporting the transition to a hydrogen economy.

This deal will conclude SSE's GBP2bn plus disposals programme

announced in June 2020, with total proceeds amounting to over

GBP2.7bn. The programme has realised significant value from

non-core assets while intensifying SSE's strategic focus on its

core low-carbon electricity businesses and the transition to net

zero.

SSE's strategy is to create value for shareholders and society

in a sustainable way by developing, building, operating, and

investing in the electricity infrastructure and businesses needed

in the transition to net zero. Its strategic focus is on renewables

and regulated electricity networks, businesses which have strong,

net zero-aligned growth potential with common skills and

capabilities in the development, construction, procurement,

financing, and operation of world-class, highly technical

electricity assets. The other businesses retained in the SSE group

are highly complementary to this low-carbon core.

The disposal proceeds will reduce net debt in the short term and

will help support the delivery of SSE's capital investment plans.

As indicated in May, SSE will provide an update on these plans at

its interim results in November.

Gregor Alexander, Finance Director of SSE, said:

"SGN has been a hugely successful investment for SSE during the

past 16 years. It is a strong business delivering consistently for

customers and will have a key role to play in the future

development of the hydrogen economy. However, it has become purely

a financial investment for SSE as we have sharpened our focus on

our low-carbon electricity core, and it is therefore the right time

for SGN to continue to thrive under new ownership.

"We see significant growth opportunities in our core networks

and renewables businesses in the transition to net zero and the

capital we are releasing through our disposals programme will help

enable us to maximise the delivery of our low-carbon electricity

orientated strategy and ultimately create sustainable long-term

value for customers, shareholders and society. Completion of our

disposals programme will leave SSE more streamlined and

strategically aligned than ever before, with a business mix that is

very deliberate, highly effective, fully focused and well set to

prosper on the journey to net zero and beyond."

In total, Ontario Teachers' will acquire an additional 12.5% of

SGN and Brookfield will acquire a 37.5% stake in SGN. StepStone

Clients are participating in both the Brookfield and Ontario

Teachers' investments. This means following completion of both

transactions, SGN's direct shareholders will comprise Ontario

Teachers' (37.5%), Brookfield (37.5%) and OMERS Infrastructure (25%

unchanged).

The Transaction constitutes a class 2 transaction for the

purposes of the UK Financial Conduct Authority's Listing Rules and,

as such, does not require SSE shareholders' approval. At 31 March

2021, SGN had a regulated asset value (RAV) of GBP6,003m, and SSE's

interest in SGN had a carrying value of GBP744.4m and contributed

GBP88.6m to the Group's profits after tax for the year then

ended.

Morgan Stanley and Credit Suisse acted as financial advisers and

CMS Cameron McKenna Nabarro Olswang LLP as legal advisers to SSE.

Nomura acted as financial adviser and Freshfields Bruckhaus

Deringer LLP acted as legal advisers to ADIA. Evercore acted as

financial adviser to Ontario Teachers' and Linklaters acted as

legal advisers to the Consortium.

ENDS

About SSE

SSE has the largest renewable electricity portfolio in the UK

and Ireland, providing energy needed today while building a better

world of energy for tomorrow. It develops, builds, operates and

invests in low-carbon electricity infrastructure needed in the

transition to net zero, including onshore and offshore wind, hydro

power, electricity transmission and distribution grids, and

efficient gas, alongside providing energy products and services for

businesses. UK listed, SSE is a major contributor to the UK and

Ireland economies, employs around 10,000 people and is real Living

Wage and Fair Tax Mark accredited.

About SGN

SGN is the second largest UK gas distribution network ('GDN') in

the UK and owns Scotland Gas Networks plc and Southern Gas Networks

plc, two of the eight regulated gas distribution networks in

England, Wales and Scotland, operating under a license from Ofgem

to distribute gas through their infrastructure network. SGN Natural

Gas Ltd provides gas to customers in the west of Northern Ireland.

SGN also includes other non-regulated ancillary businesses relating

to metering, real estate development, heat networks and renewables

amongst others. The derived EBITDA from these non-regulated

activities in the year to 31 March 2021 was GBP21m.

SGN is a leader in the development and use of green hydrogen for

heating and is delivering a suite of innovative projects that will

help to make hydrogen the backbone of the UK's future gas network.

SGN plans to repurpose its existing gas network for Scotland's

north-east and central belt, as well as its network across southern

and south east England, into 100% renewable energy systems,

primarily through the use of hydrogen. By 2023, SGN's pioneering

H100 Fife project in Scotland aims to put several hundred customers

on to its network using hydrogen; this is the neighbourhood part of

the UK government's hydrogen programme.

In addition to working to decarbonise the UK's gas network, SGN

is reducing the environmental impact from its own operations and is

targeting a net-zero carbon footprint by 2045. Its key initiatives

include reducing leakage from its network pipes, using 100%

renewable energy and rolling out zero-emission vehicles.

Contact:

Media: media@sse.com | +44 (0)345 0760 530

Investors: ir@sse.com | +44 (0)345 0760 530

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISUURNRAOUWRRR

(END) Dow Jones Newswires

August 02, 2021 02:04 ET (06:04 GMT)

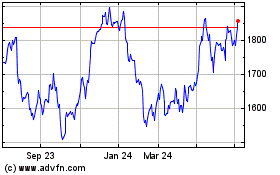

Sse (LSE:SSE)

Historical Stock Chart

From Mar 2024 to Apr 2024

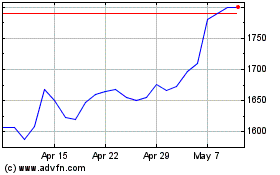

Sse (LSE:SSE)

Historical Stock Chart

From Apr 2023 to Apr 2024