TIDMSEC

Strategic Equity Capital PLC

HALF YEARLY REPORT AND FINANCIAL STATEMENTS SIX MONTH PERIOD ended 31 DECEMBER

2019

The full Half Yearly Report and Financial Statements can be accessed via the

Company's website at: www.strategicequitycapital.com or by contacting the

Company Secretary by telephone on 0131 538 1400.

Copies of the announcement, annual reports, quarterly update presentations and

other corporate information can be found on the Company's website at:

www.strategicequitycapital.com

FINANCIAL SUMMARY

Six months

As at As at As at % change to

31 December 30 June 31 December 31 December

Capital Return 2019 2019 2018 2019

Net asset value ("NAV") per

Ordinary share 286.07p 265.12p 233.72p 7.9%

Ordinary share price 245.00p 229.50p 196.00p 6.8%

Discount of Ordinary share

price to NAV 14.4% 13.4% 16.1% -

Average discount of Ordinary

share price to NAV for the 14.7% 15.2% 14.8% -

period

Total assets (GBP'000) 181,584 172,443 152,510 5.3%

Equity Shareholders' funds 181,073 169,037 152,022 7.1%

(GBP'000)

Ordinary shares in issue

with voting rights 63,296,844 63,759,589 65,045,291 (0.7)%

Six month Six month

period to Year ended period to

31 December 30 June 31 December

Performance 2019 2019 2018

NAV total return for the 8.5% 2.2% (9.5)%

period

Ongoing charges - annualised 1.12% 1.10% 1.12%

Ongoing charges (including

performance fee) - 1.17% 1.39% 1.12%

annualised

Revenue return per Ordinary 1.25p 2.11p 0.80p

share

Dividend yield n/a 0.7% n/a

Proposed dividend for the n/a 1.50p n/a

period

Interim period's Highs/Lows High Low

NAV per Ordinary share 286.70p 253.73p

Ordinary share price 245.00p 212.00p

Investment objective

The investment objective of the Company is to achieve absolute returns (i.e.

growth in the value of investments) rather than relative returns (i.e.

attempting to outperform selected indices) over a medium-term period,

principally through capital growth.

Investment Manager's strategy

The strategy of GVQ Investment Management Limited ("GVQIM" or the "Investment

Manager") is to invest in publicly quoted companies that will increase their

value through strategic, operational or management change. GVQIM follows a

practice of constructive corporate engagement and aims to work with management

teams in order to enhance shareholder value.

A more detailed explanation can be found in the Investment Manager's Report

below.

CHAIRMAN'S STATEMENT

Introduction

Last November I commented that it was the Board's view that the UK stock

market, particularly for smaller companies, had begun a process of transition.

The previous momentum led market was becoming more value based. This was good

news as it fits well with our established investment process: that of

identifying companies trading at a discount to their intrinsic value while

avoiding those that do not.

Following the outcome of the UK general election in December, UK equity markets

raced ahead until late January 2020, when COVID-19, the disease caused by the

Coronavirus, took to the stage. Since then stock markets have suffered heavily

amid widespread economic disruption. There are so many variables at play here

that predicting what will happen with this pandemic seems futile. While the

fear factor is adversely affecting stock markets at present, future market

moves will depend on how far the disease spreads and how long it is around.

Performance

It is not surprising therefore that the Company's portfolio performed well over

the period under review but has suffered heavily since. During the six months

to 31 December 2019, the Company's share price rose from 229.5 pence to 245.0

pence, representing a total return (with the dividend reinvested) of 7.5%. The

NAV per share rose by 7.9% to 286.07 pence per share and the NAV total return

was 8.5%. Over the same period, the FTSE Small Cap (ex Investment Companies)

Index delivered a total return of 10.9%. The share price discount to NAV ended

the period at 14.4%. As at 25 March 2020, the date for which a NAV is most

recently available at the time of writing, the NAV had fallen to 206.07 pence

per share.

Returns, on both an absolute and relative basis, have been encouraging over the

short and medium term. Over the three years ending 31 December 2019, the NAV

total return was 28.2%, against the benchmark return of 17.3%. Over the 12

months ending 31 December 2019, the NAV total return was 23.0%, against the

benchmark return of 17.7%. However, despite encouraging returns the discount

has remained range bound between 12-19% during 2019 and has become a source of

frustration to the Board.

Furthermore, the environment for UK active asset managers has been challenging

in recent years. In a competitive environment, a strong sales and marketing

capability is vital in order to attract new investors to a specialist strategy.

The Board has therefore been mindful of the pressures on boutique asset

managers and the resource that is required to effectively implement and market

our investment strategy.

Given these circumstances, the Board has felt compelled to review its

investment management contract with its investment manager GVQ IM, the

consequences of which are explained below.

Development of the Company

During the period the Board reviewed alternative management options for the

Company and the potential for changes to improve the Company's prospects. This

review was conducted with the assistance of the Company's broker, Investec Bank

Plc. Following this review, and after extensive due diligence, we have today

announced that we have entered into heads of terms to appoint Gresham House

Asset Management Limited as the Company's new investment manager and

alternative investment fund manager with the intention thereafter for Aberdeen

Standard Gresham House Investment Management ("Aberdeen Standard Gresham

House"), the proposed joint venture between Gresham House plc and Aberdeen

Standard Investments, to assume these roles once in receipt of regulatory

approval and satisfaction of other conditions. We are delighted, however, that

our current portfolio managers, Jeff Harris and Adam Khanbai, have accepted an

offer to join the new manager as part of this transaction.

Aberdeen Standard Gresham House will combine the strategic public equity

capability of Gresham House with the marketing and distribution strength of

Aberdeen Standard Investments. Tony Dalwood, the CEO of Gresham House, has

known the Company for many years. In fact, he set up Strategic Equity Capital

in 2005, devised its investment strategy and managed it in its early years.

More recently he has transformed Gresham House into a leading investor in UK

smaller companies using private equity type techniques. Gresham House is a

public company, vibrant and growing strongly with a sound balance sheet. It has

a highly regarded name in the market, is well-resourced at all levels and

operates with an effective marketing team.

In addition, and of great attraction to us, is the support to the joint venture

from Aberdeen Standard Investments, Europe's fourth largest investment house.

Aberdeen Standard Investments selected Gresham House for this joint venture to

offer their customers access to the Gresham House Strategic Public Equity

strategy, a style comparable and complementary to our own. Aberdeen Standard

Investments will provide marketing and sales support to the joint venture in

respect of the Company going forward.

Gresham House has committed to investing significantly into the Company over

the medium term, and I look forward to welcoming them as shareholders.

Combining their efforts on marketing with Aberdeen Standard Investments, an

enhanced investment process, and the Gresham House direct investment, the Board

believes that the prospects for the Company are substantially improved as a

result of the change.

Further updates on the transition will be announced by the Company to the Stock

Exchange and I look forward to updating you on the impact of the changes when I

report at the end of this financial year.

Gearing and Cash Management

The Company operates without a debt or overdraft facility, a policy that is

periodically reviewed by the Board in conjunction with the Investment Manager.

The Board and the Investment Manager have a conservative approach to gearing as

a result of the concentrated nature of the Company's portfolio. No gearing has

been in place at any point during the period. Cash positions are generally

maintained to take advantage of suitable investment opportunities as they

arise.

Dividend

The Directors continue to expect that returns for Shareholders will derive

primarily from the capital appreciation of the shares rather than from

dividends. In line with previous years, the Board does not intend to propose an

interim dividend.

Discount and Discount Management

During the period, the Company's shares continued to trade at a discount to

NAV. In the six months to 31 December 2019, the discount to NAV averaged 14.7%

and ended the period at 14.4%. Over the period, the Company bought back 462,745

shares.

The Board has continued to monitor closely the discount to NAV at which the

Company's shares have traded. The appointment of Aberdeen Standard Gresham

House, as explained above, is intended to enhance the prospects of the Company

going forward.

Outlook

Our plan remains to follow rigorously and consistently our disciplined

investment process which has been in place since the Company was first

launched. We sense more than ever that investors are concentrating on

fundamental valuations, which in these volatile and uncertain times should

offer the best protection and prospects whatever the final legacy of COVID-19.

The impact of the pandemic will pass and we look forward to the Company

participating in the recovery. In the medium term, we are excited about the

changes announced today and we believe that the Company has a strong future as

London's leading quoted vehicle for smaller company investment, adopting

private equity investment techniques.

Richard Hills

Chairman

26 March 2020

INvestment Manager's report

Investment Strategy

Our strategy is to invest in publicly quoted companies that we believe will

increase in value through strategic, operational or management change. We

follow a practice of constructive corporate engagement and aim to work with

management teams in order to enhance shareholder value. We seek to build a

consensus with other stakeholders and prefer to work alongside like-minded

co-investors as leaders, followers or supporters. We try to avoid confrontation

with investee companies as we believe that there is strong evidence that

overtly hostile activism generally produces poor returns for investors.

We are long-term investors and typically aim to hold companies for the duration

of rolling three-year investment plans that include an entry and exit strategy

and a clearly identified route to value creation. The duration of these plans

can be shortened by transactional activity or lengthened by adverse economic

conditions. Before investing we undertake an extensive due diligence process,

assessing market conditions, management and stakeholders. Our investments are

underpinned by valuations which we derive using private equity-based

techniques. These include a focus on cash flows, the potential value of the

company to trade or financial buyers and potentially beneficial changes in

capital structure over the investment period.

The typical investee company, at the time of initial investment, is too small

to be considered for inclusion in the FTSE 250 Index. We believe that smaller

companies provide the greatest opportunity for our investment style as they are

relatively under-researched, often have more limited resources, and frequently

can be more attractively valued.

We believe that this approach, if properly executed, has the potential to

generate favourable risk-adjusted returns for shareholders over the long term.

Market Background

In the UK market, the second half of 2019 was dominated by the anticipated

General Election and share prices responded favourably to the outcome. From a

low valuation base, the market was led by domestic cyclical stocks. The indices

of smaller companies lagged the more domestically focused mid cap market, with

the FTSE Small Cap Index and the FTSE AIM All-Share Index increasing by 10.9%

and 5.0% respectively.

We estimate that the smaller company index re-rated by around 30% in aggregate,

given the more favourable backdrop compared to the same point a year ago.

However, the earnings outlook remains uncertain for various companies and

sectors given continuing challenging external conditions.

Performance Review

Although the Company has no exposure to retailers, banks and housebuilders;

sectors which benefited most from the improvement in sentiment, the majority of

holdings in the portfolio saw good share price appreciation. This was held back

by larger holdings including Tribal, Clinigen and Equiniti which are discussed

further below.

Top 5 Contributors to Performance

Valuation Period

at period end attribution

Company GBP'000 (basis

points)

Wilmington 14,596 202

Ergomed 9,482 160

Medica 10,897 147

4imprint 6,172 122

Alliance Pharma 9,870 98

Wilmington re-rated following more recent results showing a return to organic

growth under new management. Ergomed shares were strong with upgrades at its

interim results and a significant strengthening of its management team and

board of directors. Medica saw its share price increase following strong

interim results and a new CEO joining. 4imprint saw expectations upgraded and a

re-rating in the period and Alliance Pharma delivered above market levels of

organic growth with very strong cash flow.

Bottom 5 Contributors to Performance

Valuation

at period Period

end attribution

Company GBP'000 (basis points)

Tribal 9,714

-113

Clinigen 14,410 -67

Equiniti 19,668 -64

EMIS 5,611 -52

Dialight - -32

Operational performance on the whole was good across the portfolio. Tribal

de-rated over the period. The company is undertaking investment in its next

generation cloud based product platform and at the same time its end markets

are in a lull ahead of this being delivered. Clinigen de-rated owing to the

company having a historically high level of gearing post recent acquisitions.

Equiniti's shares were weaker given uncertainty in the UK impacting higher

margin corporate actions and lower levels of share dealing. Furthermore, the

market is waiting for improved cash generation to bring gearing levels down.

After a strong run, EMIS shares were slightly weaker, although the company was

awarded a place on the framework for the NHS GP Futures procurement contract.

Our holding in Dialight was exited following the company warning on profits and

changing its CEO.

Dealing activity

There were full exits in IFG Group following its takeover by Epiris in August

and in Dialight. Positions in 4imprint, EMIS and Oxford Metrics were reduced on

valuation grounds. We sold half of the cost of our investment in Ergomed at a

significant profit, retaining a mid-weight position in the portfolio.

New investments were undertaken in XPS Pensions Group, the professional

services business. The company suffered a material de-rating following its full

year results which provided a liquidity opportunity and a rebasing of

forecasts. The shares have partially recovered since. A new investment was made

in Huntsworth, the healthcare marketing services business. The shares heavily

de-rated owing to a tempering of growth expectations. We consider the long term

structural growth opportunity and cash characteristics as attractive at a

discounted valuation. The company was bid for by Clayton, Dubilier & Rice

private equity at a significant premium post the period end. There were further

liquidity opportunities in Hostelworld and Benchmark Holdings. Hostelworld, the

niche hostel booking platform, has suffered a severe de-rating as it invests in

its technological capabilities which has impacted the growth rate. At the same

time, churn in the register has put pressure on the share price. Benchmark, the

leading aquaculture business, has seen a wholesale change in management

following poor capital allocation and an ill-defined strategy. The company has

also seen a significant churn in its shareholder base. New management have a

significant self-help opportunity for an asset with strong market positions and

intellectual property.

Portfolio Review

At the end of the financial period, the portfolio remained highly focused, with

a total of 23 holdings and the top 10 holdings accounting for 66.9% of the NAV.

Apart from the approximately GBP30k invested in Vintage, the portfolio is wholly

invested in quoted companies with a 4.4% cash balance at the end of the period.

Portfolio as at 31 December 2019

Company Sector Date of Cost GBP % of % of

Classification first '000 % of invested net

Investment invested portfolio assets

Valuation portfolio at 30

GBP'000 at 31 June 2019

December

2019

Equiniti Support Mar 2016 18,581 19,668 11.3% 13.3% 10.9%

Services

Wilmington Media Oct 2010 11,942 14,596 8.4% 7.0% 8.1%

Clinigen Healthcare Jul 2014 10,027 14,410 8.3% 7.1% 8.0%

Tyman Industrials Apr 2007 11,115 13,111 7.6% 7.2% 7.2%

Medica Healthcare Mar 2017 9,673 10,897 6.3% 5.4% 6.0%

Brooks Financials Jun 2016 8,139 9,973 5.7% 5.0% 5.5%

Macdonald

Alliance Pharma Healthcare May 2017 6,768 9,870 5.7% 4.9% 5.4%

Tribal Technology Dec 2014 11,643 9,714 5.6% 7.1% 5.4%

Ergomed Healthcare Apr 2018 4,515 9,482 5.5% 6.1% 5.2%

XPS Pensions Support Jul 2019 7,908 9,351 5.4% - 5.2%

Services

Harworth Property Jul 2016 3,798 6,450 3.7% 3.6% 3.6%

Hostelworld Technology Oct 2019 6,256 6,440 3.7% - 3.5%

4imprint Support Feb 2006 1,044 6,172 3.6% 6.9% 3.4%

Services

EMIS Technology Mar 2014 3,982 5,611 3.2% 5.5% 3.1%

Benchmark Healthcare Jun 2019 5,021 4,833 2.8% 1.1% 2.7%

JTC Support Jun 2019 3,447 3,854 2.2% 0.9% 2.1%

Services

Huntsworth Media Sep 2019 4,139 3,786 2.2% - 2.1%

Oxford Metrics Technology Dec 2014 1,399 3,626 2.1% 3.5% 2.0%

Strix Industrials May 2019 2,569 3,224 1.9% 1.7% 1.8%

Numis Financials Oct 2017 3,100 3,053 1.8% 2.1% 1.7%

Proactis Technology Nov 2017 9,308 2,808 1.6% 1.2% 1.5%

Eckoh Technology Mar 2019 1,922 2,499 1.4% 1.0% 1.4%

Vintage 1 Unquoted Mar 2017 5 32 0.0% 0.4% 0.0%

Total investments 173,460 95.8%

Cash 7,886 4.4%

Net current liabilities (273) (0.2%)

Total shareholders' funds 181,073 100.0%

Sector split by industry %

Healthcare 27.3

Support Services 21.6

Technology 16.9

Media 10.2

Industrials 9.0

Financials 7.2

Property 3.6

Net cash 4.2

Unquoted 0.0

Size split by market %

capitalisation

Greater than GBP500m 32.5

GBP300m - GBP500m 22.2

GBP100m - GBP300m 39.5

Less than GBP100m 1.6

Net cash 4.2

Unquoted 0.0

Portfolio Characteristics

Consensus Median portfolio Strategic Equity FTSE Small Cap

characteristics Capital ex Investment

Trusts

Price/Earnings ratio (FY1) 14.0x 12.8x

Dividend yield 2.8% 3.3%

Price/Sales ratio 2.1x 0.7x

GVQIM Cashflow yield* 9.8% n/a

Forecast earnings growth (FY1) 11.5% 10.0%

Forecast net debt to EBITDA 0.5x 3.1x

Source: Factset Portfolio Analysis System, Bloomberg. Portfolio excludes

Vintage and Harworth Group

* GVQIM cashflow yield: (12 month forward Cash EBITDA minus maintenance capex)/

(market capitalisation plus 12 month forward net debt).

Unlisted Investments

Over the period, the Company received a total of GBP545k from Vintage I. As no

further draw downs have been made since initial investment in 2005, the adviser

has communicated that it does not expect to make any further net draw downs.

Outlook

Whilst concerns persist over the future relationship between the UK and the EU

and beyond that, the USA's relations with China and activities in the Middle

East, UK equities stand to benefit from any reversal of the 'structural

underweight' allocation of the past three years.

Despite the strong growth in the Company's NAV, the valuations of portfolio

companies remain attractive in our view. When looking at a traditional P/E

ratio compared to historical levels, all but one of the top ten companies are

rated at below their five year mid point. On our preferred valuation metric,

the GVQ cash yield, the weighted average portfolio valuation corroborates this

positive outlook.

Furthermore, irrespective of whether markets remain supportive, portfolio

companies have specific opportunities to grow profitability and cash flow and

improve their business models. For example; leveraging investment recently

undertaken, improving capital allocation, reducing balance sheet leverage

through cash generation, more efficient operations and improving communications

and investor perceptions are all means to grow their value. We continue to

engage with investee companies on these areas.

Whilst smaller companies remain at a discounted rating to medium sized and

larger companies owing to poor liquidity and risk aversion, the opportunity for

an actively managed small cap investment trust is acute. This is particularly

so given the weight of money in private equity funds alongside the

generationally cheap levels of financing.

Jeff Harris / Adam Khanbhai

GVQ Investment Management Limited

26 March 2020

Top 10 Investee Company Review (as at 31 December 2019)

Alliance Pharma is an international healthcare business specialising in the

sale of over 90 pharmaceutical and consumer healthcare products in over 100

countries. The business model is capital-lite with limited investment in

research and development allowing it to generate prodigious cash flow. The

company has a history of creating value through a sensible buy and build model

enhancing the product portfolio and territorial footprint. The company has

ambitions to continue this growth leveraging its existing infrastructure and

utilising its cash flow. Funds managed by the Investment Manager hold c.4% of

the company's equity.

Brooks Macdonald is a UK based wealth management firm providing investment

services to professional advisors, high net worth individuals and institutions.

Founded in 1991, the company now has over GBP13 billion in discretionary funds

under management. We believe the company is well positioned in a structurally

growing market as the requirements for self-investment solutions increases.

Following a period of investment under new management, we believe the company

is well positioned to grow its operating profits and continue its strong cash

generation. Funds managed by the Investment Manager hold c.3% of the company's

equity.

Clinigen is a speciality pharmaceutical and services company. It has three

business units -Clinical Trial Services, Unlicensed Medicines and Commercial

Medicines. Activities undertaken by these businesses include: acquiring,

licencing and revitalising hospital-only critical care medicines; and providing

patient access to its own or other pharmaceutical companies' products, whether

to meet unmet medical needs or for use in clinical trials. The company has

grown rapidly since its IPO in 2012, both organically and through targeted

acquisitions. We believe the cash flow characteristics are underappreciated and

the company has a leading position in a multi-year growth market. Funds managed

by the Investment Manager hold c. 3% of the company's equity.

Equiniti is a business services company providing administration, processing

payments services and technology products typically to FTSE 350 companies and

large public sector organisations. It is one of the three main share registrars

for UK quoted companies. It administers company benefits schemes and share

savings schemes. It also provides software and services to help manage the

administration of company and public sector pension funds. We believe the

business has a strong combination of stable, long-term repeatable

non-discretionary corporate services alongside offering technology based

solutions to growing regulatory requirements. The business was founded with the

buyout of Lloyds TSB Share Registrars by private equity house Advent

International in 2007. Following the buyout the company added to its product

and service capability through a number of targeted acquisitions. The company

IPO'd in October 2015 and undertook a strategic entry into North America in

2017. With moderate organic growth we believe that the company has the

potential to deliver high single digit/low double digit earnings growth, which

should not be significantly impacted by the broad market cycle. Despite its

quality, the company trades at a moderate rating. Funds managed by the

Investment Manager currently hold c.6% of the company's equity.

Ergomed is a pharmaceutical services company providing pharmacovigilance and

clinical research services to healthcare clients. Following a change in

strategy away from product development, the company now specialises in

providing services to a growing market for outsourcing. Growth rates have

historically been high and are forecast to continue based on market growth and

Ergomed taking share. The company has significantly strengthened its management

team and Board of Directors to aid with its next phase of growth. Fund managed

by the Investment Manager currently hold c. 5% of the company's equity.

Medica is the leading provider of teleradiology services in the UK. The company

provides outsourced interpretation and reporting of MRI, CT and plain film

X-ray images. This is delivered through three primary services to UK hospital

radiology departments: Nighthawk out-of-hours service; Routine cross-sectional

reporting on MRI and CT scans; and Routine plain film reporting on x-ray

images. Teleradiology as a service aims to improve patient care through faster

response and overcoming the challenge hospitals face in the increasing volume

in scanning activity. Medica was previously owned by Close Brothers Private

Equity following a 2013 buyout. The company IPO'd in March 2017 on the LSE and

admitted to the FTSE Small Cap index in June 2017. Funds managed by the

Investment Manager currently hold c.10% of the company's equity.

Tribal is a global provider of products and services to the international

education, training and learning markets. Today, the company focuses its

activities on student records and administration systems and quality review

inspection services. It has a high market share in a number of product niches

and geographies. We believe that the company has the potential to grow through

increasing its international sales, as well as updating and upselling to its

existing UK customer base. Since November 2015 the company's board has been

substantially refreshed, a non-core subsidiary sold and equity raised to

strengthen the balance sheet. The company has effectively reduced its overhead

and is developing its next generation software platform. Funds managed by the

Investment Manager currently hold 8% of the company's equity.

Tyman is a leading international supplier of engineered components to the door

and window industry in the new build and repair and maintenance (RMI) markets.

Historically, the company has undertaken M&A in Europe and North America to

complement organic growth from increasing building activity. Whilst more

recently, operational issues have hindered the company's progress, under the

new management team, the company is well placed to continue growing the

business organically whilst generating strong cash flow. Tyman has many of the

characteristics we believe are attractive to private equity. Funds managed by

the Investment Manager currently hold c.6% of the company's equity.

Wilmington Group provides business information and training services to

professional business customers in the financial services, medical and

white-collar professional service sectors. More than 80% of revenues in the

main publishing and information divisions are delivered digitally, typically on

a subscription basis, and with high levels of client retention. A new high

quality management team is well placed to accelerate the growth of the business

following recent investment in systems and to provide a coherent strategy and

capital allocation framework. Funds managed by the Investment Manager currently

hold c.10% of the company's equity.

XPS Pensions Group is a pensions administration and advisory business. Formed

following the merger between Xafinity and Punter Southall, XPS is a leader for

mid-market pension schemes with an opportunity to take share from the 'Big 3'

pensions consultants. The company has predictable revenue streams bolstered by

project work driven by an increasingly complex changing pensions landscape.

Owing to its capital-lite model, the company generates strong cash flow

utilised for bolt-on acquisitions and the payment of a healthy dividend. Funds

managed by the Investment Manager currently hold c. 4% of the company's equity.

GVQ Investment Management Limited

26 March 2020

The unconstrained, long-term philosophy and concentrated portfolios resulting

from the Investment Manager's investment style can lead to periods of

significant short-term variances of performance relative to comparative

indices. The Investment Manager believes that evaluating performance over

rolling periods of no less than three years, as well as assessing risk taken to

generate these returns, is most appropriate given the investment style and

horizon. Properly executed, the Investment Manager believes that this

investment style can generate attractive long-term risk adjusted returns.

All statements of opinion and/or belief contained in this Investment Manager's

report and all views expressed and all projections, forecasts or statements

relating to expectations regarding future events or the possible future

performance of the Company represent the Investment Manager's own assessment

and interpretation of information available to it at the date of this report.

As a result of various risks and uncertainties, actual events or results may

differ materially from such statements, views, projections or forecasts. No

representation is made or assurance given that such statements, views,

projections or forecasts are correct or that the objectives of the Company will

be achieved.

Statement of Directors' Responsibilities, Going Concern, Principal Risks and

Uncertainties

Statement of Directors' Responsibilities

The Directors confirm that to the best of their knowledge:

* the condensed set of financial statements contained within the Half-Yearly

Report has been prepared in accordance with International Accounting

Standard ("IAS") 34, 'Interim Financial Reporting' issued by the

International Accounting Standards Board ("IASB") as adopted by the EU, and

gives a true and fair view of the assets, liabilities, financial position

and profit of the Company as required by Disclosure Guidance and

Transparency Rule ("DTR") 4.2.4R;

* the Half-Yearly Report includes a fair review of the information required

by:

(a) DTR 4.2.7 of the Disclosure Guidance and Transparency Rules, being an

indication of important events that have occurred during the first six months

of the financial year and their impact on the condensed set of financial

statements; and a description of the principal risks and uncertainties for the

remaining six months of the year; and

(b) DTR 4.2.8 of the Disclosure Guidance and Transparency Rules, being related

party transactions that have taken place in the first six months of the current

financial year and that have materially affected the financial position or

performance of the Company during that period; and any changes in the related

party transactions described in the last Annual Report that could do so.

This Half-Yearly Report was approved by the Board of Directors on 26 March 2020

and the above responsibility statement was signed on its behalf by Richard

Hills, Chairman.

Going Concern

The Company has adequate financial resources to meet its investment commitments

and, as a consequence, the Directors believe that the Company is well placed to

manage its business risks. After making appropriate enquiries and due

consideration of the Company's cash balances, the liquidity of the Company's

investment portfolio and the cost base of the Company, the Directors have a

reasonable expectation that the Company has adequate available financial

resources to continue in operational existence for the foreseeable future and

accordingly have concluded that it is appropriate to continue to adopt the

going concern basis in preparing the Half-Yearly Report, consistent with

previous periods.

Principal Risks and Uncertainties

For the Company, the overriding risks and uncertainties to an investor relate

to the markets on which the Company's shares trade, and the shares of the

companies in which it invests trade, may move outside the control of the Board.

The principal risks and uncertainties are set out on pages 16 and 17 of the

Annual Report for the year ended 30 June 2019, which is available at

www.strategicequitycapital.com.

The Company's principal risks and uncertainties have not changed since the date

of the Annual Report and are not expected to change for the remaining six

months of the Company's financial year.

Statement of Comprehensive Income

for the six month period to 31 December 2019

Six month period ended Year ended Six month period to

31 December 2019 30 June 2019 31 December 2018

unaudited audited unaudited

Note Revenue Capital Total Revenue Capital Total Revenue Capital Total

return return GBP'000 return return GBP'000 return return GBP'000

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Investments

Gains/(losses) on 6 - 13,265 13,265 - 1,448 1,448 - (17,968) (17,968)

investments held at

fair value through

profit or loss

Currency gains - 3 3 - 1 1 - 2 2

- 13,268 13,268 - 1,449 1,449 - (17,966) (17,966)

Income

Dividends 2 1,697 - 1,697 3,116 - 3,116 1,434 - 1,434

Interest 2 33 - 33 73 - 73 32 - 32

Total income 1,730 - 1,730 3,189 - 3,189 1,466 - 1,466

Expenses

Investment 8 (635) - (635) (1,235) - (1,235) (631) - (631)

Manager's fee

Investment 9 - (45) (45) - (484) (484) - - -

Manager's

performance fee

Other expenses 3 (303) - (303) (576) - (576) (304) - (304)

Total expenses (938) (45) (983) (1,811) (484) (2,295) (935) - (935)

Net return before 792 13,223 14,015 1,378 965 2,343 531 (17,966) (17,435)

taxation

Taxation - - - - - - - - -

Net return and 792 13,223 14,015 1,378 965 2,343 531 (17,966) (17,435)

total comprehensive

income for the

period

Return per Ordinary pence pence pence pence pence pence pence pence pence

share

Basic 5 1.25 20.85 22.10 2.11 1.48 3.59 0.80 (27.17) (26.37)

The total column of this statement represents the Statement of Comprehensive

Income. The supplementary revenue and capital columns are both prepared under

guidance published by the AIC.

All items in the above Statement derive from continuing operations. No

operations were acquired or discontinued in the period.

Statement of Changes in Equity

for the six month period to 31 December 2019

Note Share Share Special Capital Capital Revenue Total

capital premium reserve reserve redemption reserve GBP'000

GBP'000 account GBP'000 GBP'000 reserve GBP'000

GBP'000 GBP'000

For the six month period

to 31 December 2019

unaudited

1 July 2019 6,986 31,737 25,595 99,910 2,264 2,545 169,037

Net return and total - - - 13,223 - 792 14,015

comprehensive income for

the period

Dividend paid 4 - - - - - (951) (951)

Shares buy-backs - - (1,028) - - - (1,028)

31 December 2019 6,986 31,737 24,567 113,133 2,264 2,386 181,073

For the year to 30 June

2019 audited

1 July 2018 6,986 31,737 32,521 98,945 2,264 1,828 174,281

Net return and total - - - 965 - 1,378 2,343

comprehensive income for

the year

Dividend paid 4 - - - - - (661) (661)

Share buy-backs - - (6,926) - - - (6,926)

30 June 2019 6,986 31,737 25,595 99,910 2,264 2,545 169,037

For the six month period

to 31 December 2018

unaudited

1 July 2018 6,986 31,737 32,521 98,945 2,264 1,828 174,281

Net return and total - - - (17,966) - 531 (17,435)

comprehensive income for

the period

Dividend paid 4 - - - - - (661) (661)

Shares buy-backs - - (4,163) - - - (4,163)

31 December 2018 6,986 31,737 28,358 80,979 2,264 1,698 152,022

The notes form an integral part of these Half-Yearly financial statements.

Balance Sheet

as at 31 December 2019

As at As at As at

31 December 30 June 31 December

2019 2019 2018

unaudited audited unaudited

GBP'000 GBP'000 GBP'000

Note

Non-current assets

Investments held at fair 6 173,460 154,888 141,698

value through

profit or loss

Current assets

Trade and other receivables 238 1,244 413

Cash and cash equivalents 7,886 16,311 10,399

8,124 17,555 10,812

Total assets 181,584 172,443 152,510

Current liabilities

Trade and other payables (511) (3,406) (488)

Net assets 181,073 169,037 152,022

Capital and reserves:

Share capital 7 6,986 6,986 6,986

Share premium account 31,737 31,737 31,737

Special reserve 24,567 25,595 28,358

Capital reserve 113,133 99,910 80,979

Capital redemption reserve 2,264 2,264 2,264

Revenue reserve 2,386 2,545 1,698

Total shareholders' equity 181,073 169,037 152,022

pence pence pence

Net asset value per share 286.07 265.12 233.72

number number number

Ordinary shares in issue 7 63,296,844 63,759,589 65,045,291

The notes form an integral part of these Half-Yearly financial statements.

Statement of Cash Flows

for the six month period to 31 December 2019

Six month Year ended Six month

period to 30 June period to

31 December 2019 31 December

2019 audited 2018

unaudited GBP'000 unaudited

GBP'000 GBP'000

Operating activities

Net return before taxation 14,015 2,343 (17,435)

Adjustment for (gains)/losses on (13,265) (1,448) 17,968

investments

Currency gains (3) (1) (2)

Operating cash flows before 747 894 531

movements in working capital

Increase in receivables (106) (57) (338)

(Decrease)/increase in payables (401) 433 (40)

Purchases of portfolio investments (34,437) (26,508) (11,088)

Sales of portfolio investments 27,891 34,953 12,117

Net cash flow from operating (6,306) 9,715 1,182

activities

Financing activities

Equity dividend paid (951) (661) (661)

Shares bought back in the period (1,171) (6,838) (4,218)

Net cash flow from financing (2,122) (7,499) (4,879)

activities

(Decrease)/increase in cash and cash (8,428) 2,216 (3,697)

equivalents for period

Cash and cash equivalents at start 16,311 14,094 14,094

of period

Revaluation of foreign currency 3 1 2

balances

Cash and cash equivalents at 7,886 16,311 10,399

end of the period

The notes form an integral part of these Half-Yearly financial statements.

Notes to the Financial Statements

for the six month period to 31 December 2019

1.1 Corporate information

Strategic Equity Capital plc is a public limited company incorporated and

domiciled in the United Kingdom, registered in England and Wales under the

Companies Act 2006 whose shares are publicly traded. The Company is an

investment company as defined by Section 833 of the Companies Act 2006.

The Company carries on business as an investment trust within the meaning of

Sections 1158/1159 of the Corporation Tax Act 2010.

1.2 Basis of preparation/statement of compliance

The condensed interim financial statements of the Company have been prepared on

a going concern basis and in accordance with IAS 34, 'Interim financial

reporting' issued by the International Accounting Standards Board (as adopted

by the EU). They do not include all the information required for a full report

and financial statements and should be read in conjunction with the report and

financial statements of the Company for the year ended 30 June 2019, which have

been prepared in accordance with IFRS as adopted by the EU. Where

presentational guidance set out in the Statement of Recommended Practice

("SORP") for investment trust companies and venture capital trusts issued by

the AIC is consistent with the requirements of IFRS, the Directors have sought

to prepare financial statements on a basis compliant with the recommendations

of the SORP.

The condensed interim financial statements do not comprise statutory accounts

within the meaning of Section 434 of the Companies Act 2006. The financial

statements for the six month periods to 31 December 2019 and 31 December 2018

have not been either audited or reviewed by the Company's Auditor. Information

for the year ended 30 June 2019 has been extracted from the latest published

Annual Report and financial statements, which have been filed with the

Registrar of Companies. The report of the Auditor on those financial statements

was unqualified, did not contain an emphasis of matter paragraph and did not

contain any statement under Section 498 of the Companies Act 2006.

Convention

The financial statements are presented in Sterling, being the currency of the

Primary Economic Environment in which the Company operates, rounded to the

nearest thousand.

Segmental reporting

The Directors are of the opinion that the Company is engaged in a single

segment of business, being investment business.

1.3 Accounting policies

The accounting policies, presentation and method of computation used in these

condensed financial statements are consistent with those used in the

preparation of the financial statements for the year ended 30 June 2019.

1.4 New standards and interpretations not applied

Implementation of changes and accounting standards in the financial period, as

outlined in the financial statements for the year ended 30 June 2019, had no

significant effect on the accounting or reporting of the Company.

2. Income

Six month period to Year ended 30 June 2019 Six month period to

31 December 2019 (audited) 31 December 2018

(unaudited (unaudited)

Revenue Capital Revenue Capital Revenue Capital

return return Total return return Total return return Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Income from

investments

UK dividend 1,697 - 1,697 3,116 - 3,116 1,434 - 1,434

income

Other

operating

income

Liquidity 33 - 33 73 - 73 32 - 32

interest

Total 1,730 - 1,730 3,189 - 3,189 1,466 - 1,466

income

3. Other expenses

Six month period to Year ended 30 June 2019 Six month period to

31 December 2019 (audited) 31 December 2018

(unaudited) (unaudited)

Revenue Capital Revenue Capital Revenue Capital

return return Total return return Total return return Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Secretarial 74 - 74 117 - 117 57 - 57

services

Auditors'

remuneration

for:

Audit 18 - 18 24 - 24 12 - 12

services

Directors' 71 - 71 131 - 131 67 - 67

remuneration

Other 140 - 140 304 - 304 168 - 168

expenses

303 - 303 576 - 576 304 - 304

4. Dividend

The Company paid a final dividend of 1.50p in respect of the year ended 30 June

2019 (30 June 2018: 1.00p) per Ordinary share on 63,396,844 (30 June 2018:

66,135,700) shares, amounting to GBP950,953 (30 June 2018: GBP661,357). The

dividend was paid on 13 November 2019 to Shareholders on the register at 11

October 2019. In line with previous years, the Board does not intend to propose

an interim dividend.

5. Return per Ordinary share

Six month period to Year ended Six month period to

31 December 2019 30 June 2019 31 December 2018

Revenue Capital Revenue Capital Revenue Capital

return return Total return return Total return return Total

pence pence pence pence pence pence pence pence Pence

Return per 1.25 20.85 22.10 2.11 1.48 3.59 0.80 (27.17) (26.37)

Ordinary

share

Returns per Ordinary share are calculated based on 63,428,216 (30 June 2019:

65,305,594 and 31 December 2018: 66,120,529) being the weighted average number

of Ordinary shares, excluding shares held in treasury, in issue throughout the

period.

6. Investments

31 December 2019

GBP'000

Investment portfolio summary:

Listed investments at fair value through 173,428

profit or loss

Unlisted investments at fair value through 32

profit or loss

173,460

The Company is required to classify its investments using a fair value

hierarchy that reflects the subjectivity of the inputs used in measuring the

fair value of each asset. The fair value hierarchy has the following levels:

Investments whose values are based on quoted market prices in active markets

are classified within level 1 and include active listed equities. The Company

does not adjust the quoted price for these instruments.

The definition of level 1 inputs refers to 'active market' which is a market in

which transactions take place with sufficient frequency and volume for pricing

information to be provided on an ongoing basis. Due to the liquidity levels of

the markets in which the Company trades, whether transactions take place with

sufficient frequency and volume is a matter of judgement, and depends on the

specific facts and circumstances. The Investment Manager has analysed trading

volumes and frequency of the Company's portfolio and has determined these

investments as level 1 of the hierarchy.

Financial instruments that trade in markets that are not considered to be

active but are valued based on quoted market prices, dealer quotations or

alternative pricing sources supported by observable inputs are classified

within level 2. As level 2 investments include positions that are not traded in

active markets and/or are subject to transfer restrictions, valuations may be

adjusted to reflect illiquidity and/or non-transferability, which are generally

based on available market information.

Level 3 instruments include private equity, as observable prices are not

available for these securities the Company has used valuation techniques to

derive the fair value. In respect of unquoted instruments, or where the market

for a financial instrument is not active, fair value is established by using

recognised valuation methodologies, in accordance with International Private

Equity and Venture Capital ("IPEV") Valuation Guidelines.

The underlying funds primarily invest in private companies which are recorded

at cost or Fair Value derived from private equity valuation models and

techniques. The main inputs into the valuation models of the underlying funds

include industry performance, company performance, quality of management, the

price of the most recent financing round or prospects for the next financing

round, exit opportunities which are available, liquidity preference and net

present value analysis.

The level in the fair value hierarchy within which the fair value measurement

is categorised is determined on the basis of the lowest level input that is

significant to the fair value of the investment.

Financial instruments at fair value through profit or loss as at 31 December

2019

Level 1 Level Level 3 Total

GBP'000 2 GBP'000 GBP'000

GBP'000

Equity investments and limited 173,428 - 32 173,460

partnership interests

Liquidity funds - 6,352 - 6,352

Total 173,428 6,352 32 179,812

The below table presents the movement in level 3 instruments for the period

ended 31 December 2019.

GBP'000

Opening balance at 30 June 2019 628

Proceeds from disposals during the period (545)

Gains on disposals during the period 519

Decrease in unrealised profit for the (570)

period included in the Statement of

Comprehensive Income

Closing balance at 31 December 2019 32

Investments in unquoted investment funds are generally held at the valuations

provided by the managers of those funds. The valuation for Vintage I is as at

31 December 2019.

There were no transfers between levels for the period ended 31 December 2019.

A list of the portfolio holdings by their aggregate market values is given in

the Investment Manager's report above.

31 December 2019

Total

Analysis of capital gains:

Gains on sale of investments 6,385

Movement in investment holding gains 6,880

13,265

7. Share capital

31 December

2019

Number GBP'000

Allotted, called up and fully paid Ordinary

shares of 10p each:

At 30 June 2019 69,858,891 6,986

Ordinary shares of 10p each held in treasury (6,099,302) (610)

Ordinary shares in circulation at 30 June 63,759,589 6,376

2019

Share buy-backs during the period to be held (462,745) (46)

in treasury

Ordinary shares in issue per Balance Sheet 63,296,844 6,330

Shares held in treasury 6,562,047 656

Ordinary shares in circulation at 31 69,858,891 6,986

December 2019

During the period to 31 December 2019 462,745 Ordinary shares were bought back

by the Company and held in treasury.

8. Investment Manager's fee

A basic management fee is payable to the Investment Manager at the annual rate

of 0.75% of the NAV of the Company. The basic management fee accrues daily and

is payable quarterly in arrears.

The Investment Manager is also entitled to a performance fee, details of which

are set out below.

9. Performance fee arrangements

The Company's performance is measured over rolling three-year periods ending on

30 June each year, by comparing the NAV total return per share over a

performance period against the total return performance of the FTSE Small Cap

(ex Investment Companies) Index. A performance fee is payable if the NAV total

return per share (calculated before any accrual for any performance fee to be

paid in respect of the relevant performance period) at the end of the relevant

performance period exceeds both:

(i) the NAV per share at the beginning of the relevant performance period as

adjusted by the aggregate amount of (a) the total return on the FTSE Small Cap

(ex Investment Companies) Index (expressed as a percentage) and (b) 2.0% per

annum over the relevant performance period ("Benchmark NAV"); and

(ii) the high watermark (which is the highest NAV per share by reference to

which a performance fee was previously paid).

The Investment Manager is entitled to 10% of any excess of the NAV total return

over the higher of the Benchmark NAV per share and the high watermark. The

aggregate amount of the Management Fee and the Performance Fee in respect of

each financial year of the Company shall not exceed an amount equal to 1.4% per

annum of the NAV of the Company as at the end of the relevant financial period.

A performance fee of GBP45,000 has been accrued in respect of the six months

ended 31 December 2019 (30 June 2019: GBP484,000; 31 December 2018: GBPnil).

10. Taxation

The tax charge for the half year is GBPnil (30 June 2019: GBPnil; 31 December 2018:

GBPnil). The estimated effective corporation tax rate for the year ended 30 June

2020 is 0%. This is because investment gains are exempt from tax owing to the

Company's status as an investment company and there is expected to be an excess

of management expenses over taxable income.

11. Capital commitments and contingent liabilities

The Company has a commitment to invest EURnil in Vintage I (30 June 2019: EUR

1,560,000; 31 December 2018: EUR1,560,000).

12. Related party transactions and transactions with the Investment Manager

The Investment Manager is regarded as a related party of the Company.

The amounts payable to the Investment Manager, in respect of management fees,

during the period to 31 December 2019 was GBP635,000 (30 June 2019: GBP1,235,000;

31 December 2018: GBP631,000), of which GBP322,000 (30 June 2019: GBP318,000; 31

December 2018: GBP302,500) was outstanding at 31 December 2019. The amount due to

the Investment Manager for performance fees at 31 December 2019 was GBP45,000 (30

June 2019: GBP484,000; 31 December 2018: GBPnil).

Directors and Advisors

Directors

Richard Hills (Chairman)

Richard Locke (Deputy Chairman)

William Barlow

Josephine Dixon

David Morrison

Auditor

KPMG LLP

Saltire Court

20 Castle Terrace

Edinburgh EH1 2EG

Broker

Investec Bank plc

30 Gresham Street

London EC2V 7QP

Custodian

J.P. Morgan Chase Bank N.A.

25 Bank Street

Canary Wharf

London E14 5JP

Depositary

J.P. Morgan Europe Limited

25 Bank Street

Canary Wharf

London E14 5JP

Investment Manager

GVQ Investment Management Limited

16 Berkeley Street

London W1J 8DZ

Tel: 020 3907 4190

Registrar

Computershare Investor Services plc

The Pavilions

Bridgwater Road

Bristol BS99 6ZY

Tel: 0370 707 1285

Website: www.computershare.com

Solicitor

Stephenson Harwood LLP

1 Finsbury Circus

London EC2M 7SH

Company Secretary and Administrator

PATAC Limited

21 Walker Street

Edinburgh EH3 7HX

Tel: 0131 538 6610

Registered Office

c/o Stephenson Harwood LLP

1 Finsbury Circus

London EC2M 7SH

Shareholder Information

Financial calendar

Company's year-end 30 June

Annual results announced October

Annual General Meeting November

Company's half-year 31 December

Half-yearly results announced February

Share price

The Company's Ordinary shares are premium listed on the main market of the

London Stock Exchange plc (the "London Stock Exchange"). The share price is

quoted daily in the Financial Times under 'Investment Companies'.

Share dealing

Shares can be traded through your usual stockbroker.

Share register enquiries

The register for the Ordinary shares is maintained by Computershare Investor

Services plc ("Registrar"). In the event of queries regarding your holding,

please contact the Registrar, on 0370 707 1285. Changes of name and/or address

must be notified in writing to the Registrar, whose address is shown above.

NAV

The Company's NAV is announced daily to the London Stock Exchange.

Website

Further information on the Company can be accessed via the Company's website:

www.strategicequitycapital.com

An investment company as defined under Sections 833 of the Companies Act 2006

REGISTERED IN ENGLAND AND WALES No 5448627

A member of the Association of Investment Companies

The Half Yearly Financial Report will be posted to shareholders shortly. The

Report will also be available for download from the following website:

www.strategicequitycapital.com or on request from the Company Secretary.

National Storage Mechanism

A copy of the Half Yearly Report will be submitted shortly to the National

Storage Mechanism ("NSM") and will be available for inspection at the NSM,

which is situated at: http://www.morningstar.co.uk/uk/nsm

Neither the contents of the Company's website nor the contents of any website

accessible from hyperlinks on the Company's website (or any other website) is

incorporated into, or forms part of this announcement.

END

(END) Dow Jones Newswires

March 27, 2020 03:00 ET (07:00 GMT)

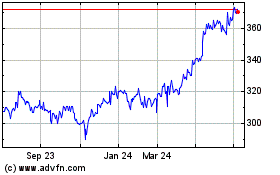

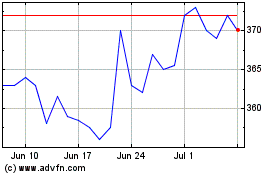

Strategic Equity Capital (LSE:SEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Strategic Equity Capital (LSE:SEC)

Historical Stock Chart

From Apr 2023 to Apr 2024