TIDMSAFE

RNS Number : 6157S

Safestore Holdings plc

17 March 2021

17 March 2021

Safestore Holdings plc

("Safestore", "the Company" or "the Group")

Result of Annual General Meeting

Annual General Meeting

The 2021 Annual General Meeting of Safestore Holdings plc was

held at midday today at the Company's registered office in

Borehamwood, Hertfordshire.

The Annual General Meeting was a closed meeting in accordance

with the Corporate Insolvency and Governance Act 2020 and

shareholders, other than those required for a quorum, were not

permitted to attend. Voting was conducted by way of a poll so that

all shareholders were fairly represented.

All resolutions were passed by the requisite majority by way of

a poll.

The following votes were cast in respect of the AGM

resolutions:

% of

Issued

Total Votes Share

Votes (excluding Capital Votes

Resolution Votes For % Against % withheld) Voted Withheld

To receive

the Annual

Report and

1 Accounts 163,598,427 99.99% 16,429 0.01% 163,614,856 77.61% 456,503

--------------------- ------------ -------- ----------- ------- ------------ --------- ----------

To approve

the Directors'

Remuneration

2 Report 158,436,298 96.58% 5,615,966 3.42% 164,052,264 77.82% 19,095

--------------------- ------------ -------- ----------- ------- ------------ --------- ----------

To appoint

Deloitte LLP

3 as auditor 162,595,038 99.40% 985,061 0.60% 163,580,099 77.60% 491,260

--------------------- ------------ -------- ----------- ------- ------------ --------- ----------

To authorise

the Directors

to determine

the auditors'

4 remuneration 163,071,111 99.40% 984,998 0.60% 164,056,109 77.82% 15,250

--------------------- ------------ -------- ----------- ------- ------------ --------- ----------

To declare

a final dividend

of 12.7 pence

per ordinary

5 share 164,056,713 100.00% 0 0.00% 164,056,713 77.82% 14,646

--------------------- ------------ -------- ----------- ------- ------------ --------- ----------

To elect Gert

van de Weerdhof

6 as a Director 133,244,757 81.22% 30,808,293 18.78% 164,053,050 77.82% 18,309

--------------------- ------------ -------- ----------- ------- ------------ --------- ----------

To re-elect

David Hearn

7 as a Director 142,965,799 90.33% 15,309,690 9.67% 158,275,489 75.08% 5,795,870

--------------------- ------------ -------- ----------- ------- ------------ --------- ----------

To re-elect

Frederic Vecchioli

8 as a Director 164,053,679 99.99% 1,471 0.01% 164,055,150 77.82% 16,209

--------------------- ------------ -------- ----------- ------- ------------ --------- ----------

To re-elect

Andy Jones

9 as a Director 162,554,043 99.09% 1,500,507 0.91% 164,054,550 77.82% 16,809

--------------------- ------------ -------- ----------- ------- ------------ --------- ----------

To re-elect

Ian Krieger

10 as a Director 158,796,776 96.80% 5,257,774 3.20% 164,054,550 77.82% 16,809

--------------------- ------------ -------- ----------- ------- ------------ --------- ----------

To re-elect

Joanne Kenrick

11 as a Director 163,794,826 99.84% 258,287 0.16% 164,053,113 77.82% 18,246

--------------------- ------------ -------- ----------- ------- ------------ --------- ----------

To r e-elect

Claire Balmforth

12 as a Director 164,021,468 99.98% 33,745 0.02% 164,055,213 77.82% 16,146

--------------------- ------------ -------- ----------- ------- ------------ --------- ----------

To r e-elect

Bill Oliver

13 as a Director 164,051,579 99.99% 1,471 0.01% 164,053,050 77.82% 18,309

--------------------- ------------ -------- ----------- ------- ------------ --------- ----------

To authorise

political donations

and political

14 expenditure 158,096,144 96.37% 5,957,557 3.63% 164,053,701 77.82% 17,658

--------------------- ------------ -------- ----------- ------- ------------ --------- ----------

To authorise

the directors

to allot relevant

15 securities 153,985,467 93.86% 10,068,433 6.14% 164,053,900 77.82% 17,459

--------------------- ------------ -------- ----------- ------- ------------ --------- ----------

To authorise

the dis-application

of pre-emption

16 rights 163,729,740 99.80% 324,060 0.20% 164,053,800 77.82% 17,559

--------------------- ------------ -------- ----------- ------- ------------ --------- ----------

To authorise

market purchases

of ordinary

17 shares 162,847,653 99.54% 748,529 0.46% 163,596,182 77.60% 475,177

--------------------- ------------ -------- ----------- ------- ------------ --------- ----------

To authorise

general meetings

(other than

annual general

meetings) to

be called on

not less than

14 clear days'

18 notice meetings 151,716,106 92.48% 12,339,072 7.52% 164,055,178 77.82% 16,181

--------------------- ------------ -------- ----------- ------- ------------ --------- ----------

Resolutions 1 to 15 were ordinary resolutions, requiring more

than 50 per cent. of shareholders' votes to be cast in favour of

the resolutions. Resolutions 16 to 18 were special resolutions,

requiring at least 75 per cent. of shareholders' votes to be cast

in favour of the resolutions.

Where shareholders appointed the Chairman of the meeting as

their proxy with discretion as to voting, their votes were cast in

favour of the resolutions and their shares have been included in

the "votes for" column.

A "vote withheld" is not a vote in law and is not counted in the

calculation of the percentages of votes cast for and against a

resolution.

The current issued capital of Safestore Holdings plc is 210,811,175 ordinary shares.

In accordance with LR 9.6.2, copies of the resolutions passed as

special business have been submitted to the Financial Conduct

Authority's National Storage Mechanism and will shortly be

available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

For further information, please contact:

Safestore Holdings plc

Helen Bramall,

Company Secretary 020 8732 1500

www.safestore.com

Instinctif Partners

Guy Scarborough

Catherine Wickman 020 7457 2020

Notes to editors:

-- Safestore is the UK's largest self-storage group with 159

stores at 31 January 2021 comprising 127 wholly owned stores in the

UK (including 71 in London and the South East with the remainder in

key metropolitan areas such as Manchester, Birmingham, Glasgow,

Edinburgh, Liverpool, Sheffield, Leeds, Newcastle and Bristol) and

28 wholly owned stores in the Paris region and 4 stores in

Barcelona. In addition, the Group operates 9 stores in the

Netherlands and 6 stores in Belgium under a joint venture agreement

with Carlyle.

-- Safestore operates more self-storage sites inside the M25 and

in central Paris than any competitor providing more proximity to

customers in the wealthiest and densest UK and French markets.

-- Safestore was founded in the UK in 1998. It acquired the

French business "Une Pièce en Plus" ("UPP") in 2004 which was

founded in 1998 by the current Safestore Group CEO Frederic

Vecchioli.

-- Safestore has been listed on the London Stock Exchange since

2007. It entered the FTSE 250 index in October 2015.

-- The Group provides storage to around 75,000 personal and business customers.

-- As at 31 January 2021, Safestore had a maximum lettable area

("MLA") of 6.871 million sq ft (excluding the expansion pipeline

stores, and the Carlyle Joint Venture) of which 5.506 million sq ft

was occupied.

-- Safestore employs around 660 people in the UK, Paris, and Barcelona.

-- Following a recent assessment by Investors in People,

Safestore has been awarded the prestigious We invest in people,

platinum accreditation. Platinum is the highest level of

accreditation achievable through the We invest in people

accreditation, with only 2% of organisations achieving this

standard.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGUBVVRASUOAAR

(END) Dow Jones Newswires

March 17, 2021 12:00 ET (16:00 GMT)

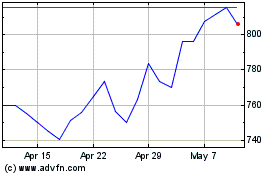

Safestore (LSE:SAFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

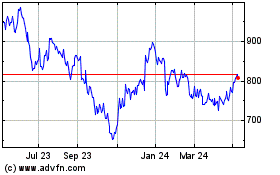

Safestore (LSE:SAFE)

Historical Stock Chart

From Apr 2023 to Apr 2024