TIDMREDD TIDMNTG

RNS Number : 9296Z

Redde PLC

15 January 2020

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART

IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A

VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

FOR IMMEDIATE RELEASE

15 January 2020

RECOMMED ALL-SHARE MERGER

of

Redde plc

and

Northgate plc

to be effected by means of a scheme of arrangement

under Part 26 of the Companies Act 2006

RESULTS OF THE COURT MEETING AND THE REDDE GENERAL MEETING

Redde plc ("Redde") announces that at the Court Meeting and the

Redde General Meeting held earlier today in connection with the

recommended all-share merger of Northgate plc ("Northgate") and

Redde (the "Merger"), all resolutions were duly passed.

As previously announced, the Merger is to be implemented by

means of a scheme of arrangement under Part 26 of the Companies Act

2006 (the "Scheme") and today:

(i) a majority in number of Scheme Shareholders who voted and

were entitled to vote, either in person or by proxy, who together

represented not less than 75 per cent. in value of the Scheme

Shares voted, voted in favour of the Scheme at the Court Meeting;

and

(ii) the requisite majority of Redde Shareholders voted to pass

the special resolution to approve and implement the Scheme

(including, without limitation, the amendment to the Redde articles

of association) at the Redde General Meeting.

Details of the resolutions passed are set out in the notices to

the Court Meeting and the Redde General Meeting contained in the

scheme document published by Redde on 12 December 2019 in

connection with the Merger (the "Scheme Document").

Redde is also pleased to note that the Merger has been approved

by Northgate shareholders at the Northgate shareholder meeting as

announced by Northgate today.

John Davies, Interim Non-Executive Chairman of Redde commented:

"Redde's board is pleased that shareholders of both Redde and

Northgate today approved the proposed merger of the two companies.

Completion of the proposed merger remains subject to regulatory

approvals and a final court hearing but is still expected to take

place in the first quarter of 2020".

At the Scheme Voting Record Time, Redde had 306,868,351 ordinary

shares in issue. Therefore the total number of voting rights in

Redde at the Scheme Voting Record Time was 306,868,351.

Voting results of the Court Meeting

The table below sets out the results of the poll at the Court

Meeting. Each Scheme Shareholder, present in person or by proxy,

was entitled to one vote per Scheme Share held at the Scheme Voting

Record Time.

Resolution Number of % of the Number of % of Scheme Number of

Scheme Shareholders voting Scheme Scheme Shares Shares which Scheme Shares

who voted Shareholders voted were voted voted as

a % of the

total issued

share capital

For 174 82.08 164,715,331 90.36 53.68

--------------------- --------------- --------------- -------------- ---------------

Against 38 17.92 17,566,420 9.64 5.72

--------------------- --------------- --------------- -------------- ---------------

Total 212 100 182,281,751 100 59.40

--------------------- --------------- --------------- -------------- ---------------

Voting results of the Redde General Meeting

The table below sets out the results of the poll at the Redde

General Meeting. Each Redde Shareholder, present in person or by

proxy, was entitled to one vote per Redde Share held at the Scheme

Voting Record Time.

Redde Special Resolution Number of Redde Shares % of the total Redde

voted* Shares voted*

For 164,317,544 90.30

----------------------- ---------------------

Against 17,641,021 9.70

----------------------- ---------------------

Withheld(*) 178,818 N/A

----------------------- ---------------------

Total 182,137,383 100

----------------------- ---------------------

(*) A vote withheld is not a vote in law and is not counted in

the calculation of the proportion of votes 'For' or 'Against' the

Redde Special Resolution.

Effective Date and Timetable

Completion of the Merger remains subject to the satisfaction,

or, if applicable, the waiver of the other Conditions set out in

the Scheme Document, including the regulatory approvals from the

FCA and the SRA and the Court sanctioning the Scheme at the Court

Hearing.

The Court Hearing is expected to be held after the satisfaction,

or, if applicable, the waiver of the Conditions in respect of the

regulatory approvals. Subject to the Scheme being sanctioned by the

Court at the Court Hearing and the delivery of the Scheme Court

Order to the Registrar of Companies, the Scheme is expected to

become effective on the Business Day following the Court Hearing,

which is expected to occur in the first quarter of 2020. The Merger

is conditional on the Scheme becoming effective by no later than 30

April 2020 or such later date (if any) as Northgate and Redde may

agree, with the consent of the Panel, and as the Court may approve

(if such consent(s)/approval(s) are required).

General

Unless otherwise defined, all capitalised terms in this

announcement shall have the same meaning given to them in the

Scheme Document, a copy of which is available on the Redde website

at www.redde.com.

All references in this announcement to times are to times in

London.

Certain figures included in this announcement have been subject

to rounding adjustments. Accordingly, figures shown as totals in

certain tables may not be an arithmetic aggregation of the figures

that precede them.

Enquiries:

Redde +44 (0) 122 532 1134

Martin Ward

Stephen Oakley

J.P. Morgan Cazenove (sole financial

adviser to Redde) +44 (0) 207 742 4000

Charles Harman

James Robinson

Wendy Hohmann

Cenkos Securities plc (nominated advisor

and joint broker to Redde) +44 (0) 207 397 8900

Giles Balleny

Nick Wells

Square1 Consulting Limited +44 (0) 207 929 5599

David Bick

Important notices relating to financial advisers

J.P. Morgan Securities plc, which conducts its UK investment

banking business as J.P. Morgan Cazenove ("J.P. Morgan Cazenove"),

is authorised in the UK by the Prudential Regulation Authority

("PRA") and regulated by the PRA and the Financial Conduct

Authority ("FCA"). J.P. Morgan Cazenove is acting as financial

adviser exclusively for Redde and no one else in connection with

the matters set out in this announcement and will not regard any

other person as its client in relation to the matters set out in

this announcement and will not be responsible to anyone other than

Redde for providing the protections afforded to clients of J.P.

Morgan Cazenove or its affiliates, or for providing advice in

relation to any matter referred to herein.

Cenkos Securities plc ("Cenkos"), which is authorised and

regulated by the FCA, is acting exclusively for Redde and no one

else in connection with the matters set out in this announcement

and will not be acting for any other person or otherwise

responsible to any person other than Redde for providing the

protections afforded to clients of Cenkos or for advising any other

person in respect of the matters set out in this announcement or

any transaction, matter or arrangement referred to in this

announcement.

Further information

This announcement is for information purposes only and is not

intended to and does not constitute, or form part of, an offer,

invitation or the solicitation of an offer to purchase, otherwise

acquire, subscribe for, sell or otherwise dispose of any

securities, or the solicitation of any vote or approval in any

jurisdiction, pursuant to the Merger or otherwise, nor shall there

be any sale, issuance or transfer of securities of Redde in any

jurisdiction in contravention of applicable law.

This announcement has been prepared for the purpose of complying

with English law and the Takeover Code and the information

disclosed may not be the same as that which would have been

disclosed if this announcement had been prepared in accordance with

the laws of jurisdictions outside England and Wales.

This announcement does not constitute a prospectus or prospectus

equivalent document.

Overseas Shareholders

The release, publication or distribution of this announcement in

or into jurisdictions other than the UK or the United States may be

restricted by law and therefore any persons who are subject to the

law of any jurisdiction other than the UK or the United States

should inform themselves about, and observe, any applicable legal

or regulatory requirements. Any failure to comply with the

applicable restrictions may constitute a violation of the

securities laws of any such jurisdiction. To the fullest extent

permitted by applicable law, the companies and persons involved in

the Merger disclaim any responsibility or liability for the

violation of such restrictions by any person.

The Merger relates to the securities of two English companies

and is proposed to be implemented by means of a scheme of

arrangement provided for under, and governed by, English law. A

transaction effected by means of a scheme of arrangement is not

subject to the proxy solicitation nor the tender offer rules under

the United States Securities Exchange Act 1934 (as amended) (the

"US Exchange Act"). Accordingly, the Scheme will be subject to

disclosure requirements and practices applicable in the UK to

schemes of arrangement, which are different from the disclosure

requirements of the US proxy solicitation and tender offer rules.

If Northgate exercises its right to implement the acquisition of

the Redde Shares by way of a Takeover Offer, such offer will be

made in compliance with applicable US securities laws and

regulations.

In accordance with normal UK practice, Northgate, certain

affiliated companies and its nominees, or its brokers (acting as

agents), may from time to time make certain purchases of, or

arrangements to purchase, Redde Shares outside of the US, other

than pursuant to the Merger, until the date on which the Merger

and/or Scheme becomes effective, lapses or is otherwise withdrawn.

These purchases may occur either in the open market at prevailing

prices or in private transactions at negotiated prices and would

comply with applicable law, including the US Exchange Act. Any

information about such purchases will be disclosed as required in

the UK, will be reported to a Regulatory Information Service and

will be available on the London Stock Exchange website at

www.londonstockexchange.com.

Unless otherwise determined by Northgate or required by the

Takeover Code, and permitted by applicable law and regulation, the

Merger shall not be made available, directly or indirectly, in,

into or from a Restricted Jurisdiction where to do so would violate

the laws in that jurisdiction and no person may vote in favour of

the Merger by any such use, means, instrumentality or form within a

Restricted Jurisdiction or any other jurisdiction if to do so would

constitute a violation of the laws of that jurisdiction.

Accordingly, copies of this announcement and all documents relating

to the Merger are not being, and must not be, directly or

indirectly, mailed or otherwise forwarded, distributed or sent in,

into or from a Restricted Jurisdiction where to do so would violate

the laws in that jurisdiction, and persons receiving this

announcement and all documents relating to the Merger (including

custodians, nominees and trustees) must not mail or otherwise

distribute or send them in, into or from such jurisdictions where

to do so would violate the laws in that jurisdiction. To the

fullest extent permitted by applicable law, the companies and

persons involved in the Merger disclaim any responsibility or

liability for violation of such restrictions by any person.

The availability of New Northgate Shares under the Merger to

persons who are not resident in the UK or the ability of those

persons to hold such shares may be affected by the laws or

regulatory requirements of the relevant jurisdictions in which they

are resident. Persons who are not resident in the UK should inform

themselves of, and observe, any applicable legal or regulatory

requirements. Redde Shareholders who are in any doubt regarding

such matters should consult an appropriate independent financial

adviser in their relevant jurisdiction without delay. Any failure

to comply with such restrictions may constitute a violation of the

securities laws of any such jurisdiction.

The Merger shall be subject to the applicable requirements of

the Takeover Code, the Panel, the London Stock Exchange and the

Financial Conduct Authority.

Forward Looking Statements

This announcement contains statements which are, or may be

deemed to be, "forward-looking statements" and which are

prospective in nature. All statements other than statements of

historical fact included in this announcement may be

forward-looking statements. They are based on current expectations

and projections about future events, and are therefore subject to

risks and uncertainties which could cause actual results to differ

materially from the future results expressed or implied by the

forward-looking statements. Often, but not always, forward-looking

statements can be identified by the use of forward-looking words

such as "plans", "expects", "is expected", "is subject to",

"budget", "scheduled", "estimates", "forecasts", "predicts",

"intends", "anticipates", "believes", "targets", "aims",

"projects", "future-proofing" or words or terms of similar

substance or the negative of such words or terms, as well as

variations of such words and phrases or statements that certain

actions, events or results "may", "could", "should", "would",

"might" or "will" be taken, occur or be achieved. Such statements

are qualified in their entirety by the inherent risks and

uncertainties surrounding future expectations. Forward-looking

statements may include statements relating to the following: (i)

future capital expenditures, expenses, revenues, earnings,

synergies, economic performance, indebtedness, financial condition,

dividend policy, losses and future prospects; (ii) business and

management strategies and the expansion and growth of Northgate's

or any member of the Wider Northgate Group's, Redde's or any member

of the Wider Redde Group's operations and the Combined Group; and

(iii) the effects of global economic conditions and governmental

regulation on Northgate's, any member of the Wider Northgate

Group's, Redde's or any member of the Wider Redde Group's and

Combined Group's business.

Such forward-looking statements involve risks and uncertainties

that could significantly affect expected results and are based on

certain key assumptions. Many factors could cause actual results to

differ materially from those projected or implied in any

forward-looking statements. Due to such uncertainties and risks,

readers are cautioned not to place undue reliance on such

forward-looking statements, which speak only as of the date

hereof.

No member of the Wider Northgate Group, nor the Wider Redde

Group, nor any of their respective associates, directors, officers,

employees or advisers provides any representation, assurance or

guarantee that the occurrence of the events expressed or implied in

any forward-looking statements in this announcement will actually

occur.

All forward looking statements contained in this announcement

are expressly qualified in their entirety by the cautionary

statements contained or referred to in this section.

No profit forecasts or estimates

No statement in this announcement is intended as a profit

forecast or estimate for any period and no statement in this

announcement should be interpreted to mean that earnings, earnings

per share or dividend per share for Northgate or Redde, as

appropriate, for the current or future financial years would

necessarily match or exceed the historical published earnings,

earnings per share or dividend per share for Northgate or Redde, as

appropriate.

Publication on website and availability of hard copies

A copy of this announcement shall be made available subject to

certain restrictions relating to persons resident in Restricted

Jurisdictions on Northgate's and Redde's websites at

www.northgateplc.com and www.redde.com respectively by no later

than 12 noon (London time) on 16 January 2020. For the avoidance of

doubt, the contents of these websites are not incorporated into and

do not form part of this announcement.

Any person who is required to be sent a copy of this

announcement under the Takeover Code may request a hard copy of

this announcement by contacting Link Asset Services at The

Registry, 34 Beckenham Road, Beckenham, Kent, BR3 4TU or on +44 (0)

371 664 0321. You may also request that all future documents,

announcements and information to be sent to you in relation to the

Merger should be in hard copy form. A hard copy of this

announcement will not be sent to you unless requested.

Disclosure requirements of the Takeover Code

Under Rule 8.3(a) of the Takeover Code, any person who is

interested in 1 per cent. or more of any class of relevant

securities of an offeree company or of any securities exchange

offeror (being any offeror other than an offeror in respect of

which it has been announced that its offer is, or is likely to be,

solely in cash) must make an Opening Position Disclosure following

the commencement of the Offer Period and, if later, following the

announcement in which any securities exchange offeror is first

identified. An Opening Position Disclosure must contain details of

the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror(s). An Opening

Position Disclosure by a person to whom Rule 8.3(a) applies must be

made by no later than 3.30 pm (London time) on the 10th business

day following the commencement of the Offer Period and, if

appropriate, by no later than 3.30 pm (London time) on the 10th

business day following the announcement in which any securities

exchange offeror is first identified. Relevant persons who deal in

the relevant securities of the offeree company or of a securities

exchange offeror prior to the deadline for making an Opening

Position Disclosure must instead make a Dealing Disclosure.

Under Rule 8.3(b) of the Takeover Code, any person who is, or

becomes, interested in 1 per cent. or more of any class of relevant

securities of the offeree company or of any securities exchange

offeror must make a Dealing Disclosure if the person deals in any

relevant securities of the offeree company or of any securities

exchange offeror. A Dealing Disclosure must contain details of the

dealing concerned and of the person's interests and short positions

in, and rights to subscribe for, any relevant securities of each of

(i) the offeree company and (ii) any securities exchange offeror,

save to the extent that these details have previously been

disclosed under Rule 8. A Dealing Disclosure by a person to whom

Rule 8.3(b) applies must be made by no later than 3.30 pm (London

time) on the business day following the date of the relevant

dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they shall be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Panel's website at http://www.thetakeoverpanel.org.uk/,

including details of the number of relevant securities in issue,

when the Offer Period commenced and when any offeror was first

identified. If you are in any doubt as to whether you are required

to make an Opening Position Disclosure or a Dealing Disclosure, you

should contact the Panel's Market Surveillance Unit on +44 (0)20

7638 0129.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ROMBSGDBDSBDGGU

(END) Dow Jones Newswires

January 15, 2020 09:47 ET (14:47 GMT)

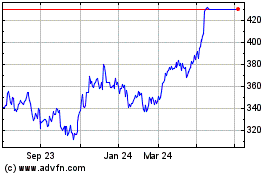

Redde Northgate (LSE:REDD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Redde Northgate (LSE:REDD)

Historical Stock Chart

From Apr 2023 to Apr 2024