Shell Shares Rise as It Weathers Coronavirus Headwinds

March 31 2020 - 10:21AM

Dow Jones News

By Sarah McFarlane

Royal Dutch Shell PLC's shares jumped 7.4% Tuesday after it said

the coronavirus outbreak had a relatively minor impact on the first

two months of the first quarter.

In its quarterly trading update on Tuesday, Shell said it

expects the sharp fall in oil prices to result in a "material

working capital release" but the company said its liquidity remains

strong with a new $12 billion revolving credit facility.

Shell has $40 billion available liquidity and access to

extensive paper programs.

The energy giant's results for the January-March quarter are

likely to reflect two months of normal activity and one month of

extreme volatility, said RBC Capital Markets in a note. Aside from

an impairment charge of up to $800 million, headline cash flow

should be "flattered" by a working-capital release, which RBC

estimated at $10 billion.

"We think Shell has the balance-sheet capacity and ability to

cut capex to survive in the current environment without a

significant cut to dividends, but if this outlook was to last for

more than 9-12 months, we would expect a cut," said RBC.

Write to Sarah McFarlane at sarah.mcfarlane@wsj.com

(END) Dow Jones Newswires

March 31, 2020 10:06 ET (14:06 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

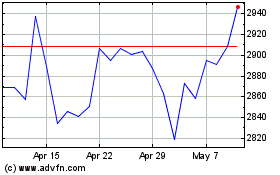

Shell (LSE:SHEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

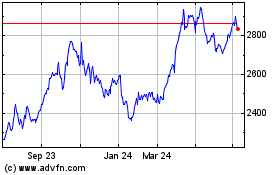

Shell (LSE:SHEL)

Historical Stock Chart

From Apr 2023 to Apr 2024