Brent Oil Set to Disappear as Crude-Price Benchmark Lives On

December 02 2019 - 6:36AM

Dow Jones News

By Sarah McFarlane

The world's most famous oil and gas field -- and the backbone of

global crude pricing -- has dried up. Soon the Brent benchmark will

have no Brent oil.

Royal Dutch Shell PLC is expected next year to plug the last

remaining Brent oil wells, located in the North Sea's East Shetland

Basin, about 115 miles northeast of Scotland's Shetland Islands.

The closures mark the end of an era, as the industry shifts its

focus to smaller oil finds near existing infrastructure.

Many companies are shutting down platforms above massive fields

discovered in the 1970s, but Brent stands apart as one of the first

and most significant of these finds. The field has generated

billions of dollars for Shell, its partner in the field, Exxon

Mobil Corp. and the U.K. government.

In the late 1980s, Brent crude became the benchmark on which

most of the world's oil is priced and is still used to set the

price of the multi-trillion dollar Intercontinental Exchange Brent

futures market.

"The role it has played is a cornerstone for this industry now

for 40 plus years," said Steve Phimister, vice president of

upstream and director of U.K. operations at Shell.

The Brent benchmark will keep its name and increasingly

represents a blend of North Sea crudes, with the potential to

include oil from other locations in the future.

Shell discovered the field in 1971 and named it after the brent

goose, keeping with the seabird theme the company used for naming

its discoveries at the time. Developing it was a huge and expensive

undertaking. Standing as tall as the Eiffel tower, Brent Charlie,

the last active platform of Brent's original four, was built to

withstand some of the most hostile conditions on earth.

The North Sea's wave heights of up to 12 meters and gale-force

winds of up to 100 miles an hour make it a place for "hardy

individuals," said Aberdeen-based Alan Lawrie, who joined Shell in

1984 when he was 16 years old. Now 51 and manager of Shell's

Charlie platform, he said Brent was the field everyone vied to work

on.

Like all of the approximately 180 workers on the platform, Mr.

Lawrie is on a fly-in fly-out rotation, spending two weeks offshore

at a time and working 12-hour shifts while there. The Charlie

platform can house up to 192 people in what is like a miniature

village on an island in the middle of nowhere. It has restaurants,

games rooms and a gym -- where Mr. Lawrie has spent much of his

downtime on a rowing machine.

One of his fondest memories is celebrating his 21st birthday on

Charlie with his colleagues, who teased him with a gift of an

18-inch model wooden oar that one of them had whittled between

shifts on the platform.

The North Sea oil rush was helped by higher oil prices after the

Arab Oil Embargo in the early 1970s, when crude prices quadrupled.

Oil got another jolt from shortages caused by the Iranian

Revolution in 1979.

"We were importing all our oil and the main emphasis from the

U.K. government, and oil companies was to get to first oil as

quickly as possible, to help our balance of payments, which was

suffering badly because of a huge bill for paying for oil imports,"

says Alex Kemp, professor of petroleum economics at the University

of Aberdeen Business School.

The project was risky and had massive cost overruns, as the

North Sea was a frontier region, and the effort used new

technologies to go deeper underwater than ever before and drill

more than 4 miles beneath the seabed.

North Sea oil production has been in decline since the turn of

the century, partly because it was too expensive to compete with

other regions. At its peak in 1982 Brent produced more than 500,000

barrels a day, enough to meet the annual energy needs of around

half of all U.K. homes at the time. The U.K. region of the North

Sea produced around 1.8 million barrels a day of oil and gas last

year, less than half the peak hit in 1999.

As Brent production declined, several other oil grades were

added to what is now a basket of North Sea crudes used to set the

Brent price. Still, production of the grades used to price Brent is

expected to drop by half -- to 500,000 barrels a day -- by 2025

because of a lack of investment and fields winding down.

The Brent benchmark's main competitor, U.S. West Texas

Intermediate, is backed by much higher volumes of crude. Around 4

million barrels a day of U.S. crude, which represents around 4% of

global production, meets the quality requirements needed for

delivery against WTI futures.

Some researchers, including the Oxford Institute for Energy

Studies, believe that the Brent benchmark could eventually include

U.S. crude to set the price.

Meanwhile, Shell is set to decommission the Charlie platform

sometime next year. "There's a tear in your eye when we're removing

the big ones, " says Shell's Mr. Lawrie, referring to the

platforms. "But it's a natural part of the life-cycle of the

industry we work in."

Write to Sarah McFarlane at sarah.mcfarlane@wsj.com

(END) Dow Jones Newswires

December 02, 2019 06:21 ET (11:21 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

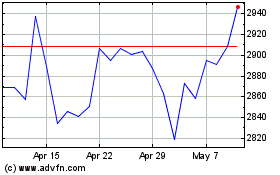

Shell (LSE:SHEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

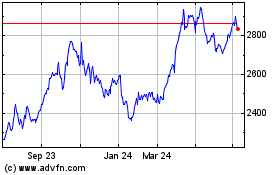

Shell (LSE:SHEL)

Historical Stock Chart

From Apr 2023 to Apr 2024