Jackson National's Profitable U.K. Divorce -- Heard on the Street

August 27 2020 - 8:01AM

Dow Jones News

By Rochelle Toplensky

Breakups are never easy, but taking time to do it properly can

be better for everyone.

Earlier this month insurer Prudential PLC confirmed plans to

split from its U.S. business Jackson National. Activist investor

Third Point has pushed for a quick breakup, but the London-listed

company is taking its time. That gives investors the chance to buy

in before the shares rerate.

The 172-year old insurer has two main businesses: Jackson

National, which specializes in retirement annuities for Americans;

and a Hong Kong-based business selling health and life insurance

and investments to the growing middle classes in Asia and

eventually Africa. Both are profitable, but incongruously grouped

together as Prudential they appear to fetch a lower valuation than

they might if assessed on their individual merits.

To address this so-called sum-of-the-parts problem, Third Point

pushed for a spinoff of Jackson directly to shareholders.

Prudential instead plans to list the U.S. business through an

initial public offering some time before next summer. It will

retain a stake that can then be sold down gradually.

Low interest rates and regulatory changes have prompted many

insurance companies to split into more focused businesses in recent

years. Prudential has already been through the separation ringer,

having spun off its U.K. investment business M&G last

October.

Jackson specializes in variable annuities, a stock-linked

retirement product that is "extremely complex to analyze,"

according to Third Point. It isn't the only investor to believe the

unit's value isn't reflected in Prudential's share price.

In June, Athene agreed to buy an 11% stake in Jackson for $500

million, which implies a $4.5 billion valuation. Apollo-backed

Athene is an annuities specialist and seen by many as a shrewd

investor. The number also is broadly in line with the valuation

multiple of rivals such as Equitable Holdings and Lincoln National.

That offers reassurance that Jackson is indeed worth more than

Prudential's stock price implies, but the shares haven't rerated

since the news.

Jackson isn't expected to need additional capital: Its

regulatory risk-based capital solvency ratio was within the IPO

target range at the end of June. It is likely to issue debt up to

Pru's target leverage range of 20% to 25%, but won't pay dividends

until after the listing.

The breakup could prompt a re-evaluation of Prudential's

Asia-based insurance business too. According to Chief Executive

Mike Wells, "every dollar of capital invested organically in Asia

new business created nearly six dollars of value." Third Point

argued the business is "materially undervalued" and UBS sees upside

of about 15%. Shares in AIA, a similar business, trade for 19 times

prospective earnings, compared with just nine times for

Prudential's stock.

To be sure, the IPO plan could be delayed by a second wave of

the pandemic or other market disruption. Pru's Asian growth

prospects, which are mainly focused on emerging markets like India

and Indonesia as well as mainland China and the troubled city of

Hong Kong, could also stall.

Yet a better valuation for Jackson doesn't depend on Asia, and

the IPO plans are in place. Reassuringly, Mr. Wells has done this

before. Divorces usually only make lawyers richer, but Prudential's

is one from which investors could also benefit.

Write to Rochelle Toplensky at rochelle.toplensky@wsj.com

(END) Dow Jones Newswires

August 27, 2020 07:46 ET (11:46 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

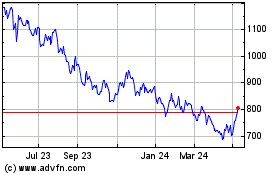

Prudential (LSE:PRU)

Historical Stock Chart

From Mar 2024 to Apr 2024

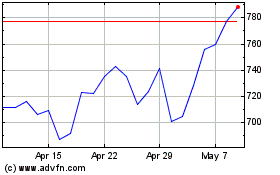

Prudential (LSE:PRU)

Historical Stock Chart

From Apr 2023 to Apr 2024