TIDMPOS

RNS Number : 3244F

Plexus Holdings Plc

21 March 2022

Plexus Holdings PLC / Index: AIM / Epic: POS / Sector: Oil

equipment & services

21 March 2022

Plexus Holdings PLC

('Plexus', 'the Company' or 'the Group')

Interim Results for the 6 months to 31 December 2021

Plexus Holdings plc, the AIM quoted oil and gas engineering

services business and owner of the proprietary POS-GRIP(R) method

of wellhead engineering, announces its interim results for the six

months to 31 December 2021.

Financial Results

-- Continuing operations sales revenue GBP734k (2020: GBP419k)

-- Continuing operations EBITDA loss (GBP1,061k) (2020: GBP1,214k loss)

-- Continuing operations loss before tax (GBP1,953k) (2020: GBP1,995k loss)

-- Basic loss per share from continuing activities (1.94p) (2020: 1.99p loss)

-- Cash of GBP3.38m (2020: GBP3.38m), and GBP3.29m (2020:

GBP2.04m) drawn down from the Lombard banking facility

-- The Group has GBP4.71m in financial assets (2020: GBP3.04m)

-- Total assets of GBP26.3m (2020: GBP29.4m)

-- Total liabilities of GBP5.3m (2020: GBP3.9m)

Operational overview

-- July 2021 - received the London Stock Exchange's Green Economy Mark

o Awarded to companies and funds where 50% or more of their

revenues are attributable to environmental solutions which

contribute to the global green economy

o Recognition of Plexus' 'through the BOP' (Blow-out Preventer)

wellhead designs, as well as its POS-GRIP proprietary HG(R)

metal-to-metal leak proof sealing system

-- August 2021 - diversified future revenue stream by

re-entering the Jack-up Exploration (Adjustable) Rental Wellhead

market, through a collaboration agreement with Cameron

International Corporation ("Cameron"), a Schlumberger company

-- December 2021 - scope of surface production low-cost volume

wellhead licencing agreement with Cameron expanded worldwide

increasing the target market for Plexus' technology and royalty

rates for the expanded activities

o Terms and milestones of the previous agreement with Cameron

announced 10 November 2020 include:

-- Non-Exclusive Agreement enabling Cameron to design, market

and sell Plexus' POS-GRIP and HG metal-to-metal seal method of

wellhead engineering for surface wellheads to its existing

clients

-- Royalty payment in the range of 3% to 6% of the revenues

generated from the sale, lease, or rental of surface wellheads

-- Cameron design, testing and preparation of marketing material

underway and it is anticipated that sales activity will begin in

the first half of the next financial year

-- December 2021 - won a further contract with a leading North

Sea Operator for the provision of a Plexus' POS-GRIP 10,000 psi

leak proof "HG(R)" metal to metal sealing surface production

wellhead, together with associated spares and valve equipment

o Wellhead equipment on schedule for delivery by Q2 2022

-- Global concern about methane emissions continues to gather

momentum as part of the drive towards Net Zero and meeting ESG

goals, and Plexus believes that leak proof equipment with

scientifically proven long-term integrity will over time only

become more relevant to oil and gas exploration and production

activities

-- The war in Ukraine has resulted in the suspension of sales

and marketing activities in Russia with our licencee LLC Gusar

("Gusar") - further updates will follow as the tragic situation

unfolds. The suspension is not expected to have a material impact

on Plexus' financial trading performance in the year ending 30 June

("FY22") which the Board anticipates will remain in line with

market expectations

Chief Executive Ben van Bilderbeek said: "Despite another

challenging six months trading period in which COVID-19 continued

to impact on the global economy, there is now at least a clear sign

that the pandemic is beginning to subside, and although we must

still all be vigilant, the economy is returning to some sort of

normality. However, just as COVID recedes, what the world did not

anticipate post period end, was Russia waging war on Ukraine and

the ensuing tragic consequences that are ongoing; it is not yet

clear what this will mean for the world, the oil and gas industry

or our relationship with our Russian licensee Gusar where we have

suspended business activities for the foreseeable future.

"Notwithstanding these challenging circumstances, we are pleased

with our progress during the period both organically, with the

winning of a further surface production wellhead contract for the

North Sea, and strategically, with the strengthening of our

relationship with Cameron with the signing of two new agreements.

The first of these, signed in August enables Plexus to re-enter the

exploration rental wellhead market sector where we had built up an

excellent reputation within the industry over many years up until

2018 when the division was sold to TechnipFMC. The second agreement

signed in December, expanded the scope of the existing Cameron

license which now extends worldwide, whilst at the same time

increasing royalty rates for an expanded set of activities.

"The deployment of our proprietary wellhead and associated

equipment designs for surface and subsea applications remains a key

focus, and we are already pursuing a number of new tender

opportunities for exploration rental wellheads. Growing oil and gas

supply constraints, combined with gas being recognised as the

transition fuel of choice suggest that the UKCS and ECS still have

an important role to play over the coming decades. Indeed, the

Chancellor Rishi Sunak recently said that "We have resources in the

North Sea, and we want to encourage investment in that because

we're going to need natural gas as part of our transition to

getting to NetZero". The revitalised recognition of the role

hydrocarbons still have to play in the world economy has been

underlined by Oystein Noreng, professor of petroleum economics at

BI Norwegian School of Management in Oslo who has gone as far to

say We have misled ourselves that we will have windmills and solar

and that will be it. But globally we are not out of the coal age;

we are in the middle of the oil age and just starting the gas

age".

"In addition to these opportunities, we are also confident that

in the longer term our technology can play a crucial role in

supporting emerging industries such as carbon capture, gas storage,

hydrogen and geothermal. The unique combination of leak proof

performance and long-term integrity, which can avoid expensive

intervention and maintenance measures, is particularly important

for such applications.

"Moreover, in the last six months, the importance of aiming for

a net-zero future has never been more apparent, with the November

COP26 summit in Glasgow putting the spotlight on another

opportunity: decommissioning. Left unplugged, oil and gas wells are

at risk of leaking methane into the atmosphere, which currently

accounts for at least 25% of global warming. All of this indicates

that if natural gas is now viewed as a key transitional energy

source in the shift to a sustainable future, then exploration and

production methods must be conducted as responsibly as possible,

and that should mean that leak proof equipment of whatever nature

should be used whenever and wherever possible throughout the supply

chain.

"Despite opportunities finally emerging after an extended

industry downturn, we undoubtedly face obstacles: historically, the

industry has not been the most forward-thinking; project financing

is getting harder; funding in the decommissioning space has been

constrained; and as a small 'disruptive technology provider' we can

sometimes be regarded as an inconvenient and 'riskier' partner.

"However, I believe that the tide is now turning. New oil and

gas exploration and production drilling activities are increasing,

oil is back at record prices and meeting ESG requirements is no

longer optional, with regulation and investor sentiment becoming

ever more rigorous. If they are to survive, companies will also

need to explore alternative options to reach NetZero such as carbon

capture and storage and the use of depleted formations, and

geothermal power where Plexus is assessing ways in which its

technology can be adapted to deliver unique solutions. With

superior, leak-free technology at its core, escalating organic

opportunities, strengthening blue-chip partnerships, dynamic

R&D advances, our re-entering of the Jack-up exploration

wellhead rental business, and with ESG goals on the agenda of

governments worldwide, I am increasingly confident that Plexus has

reached a tipping point that positions us well to rebuild

significant value to shareholders over the next 18 months."

For further information please visit www.posgrip.com or

contact:

Ben van Bilderbeek Plexus Holdings PLC Tel: 020 7795 6890

Graham Stevens Plexus Holdings PLC Tel: 020 7795 6890

Derrick Lee Cenkos Securities PLC Tel: 0131 220 9100

Pete Lynch Cenkos Securities PLC Tel: 0131 220 9100

Max Bennett St Brides Partners Ltd Tel: 020 7236 1177

Isabel de Salis St Brides Partners Ltd Tel: 020 7236 1177

Chairman's Statement

Business Progress and Operating Review

"Plexus remains well-positioned to benefit from the

opportunities being created by the supply-demand deficit facing the

oil and gas industry. There is continued pressure for oil and gas

operators to increase production from existing wells whilst

improving their green credentials, and we believe this will have to

extend to increased exploration activity. A Shell presentation last

month titled "Shell LNG Outlook 2022" supports this view and warned

that an LNG supply-demand gap was set to emerge in the mid-2020s,

especially as many countries rebound from the economic impact of

the coronavirus pandemic. Shell's CEO van Beurden went as far to

say that "We are struggling as an industry to keep up with

supply.

"Evidence is building that the supply-demand deficit is

awakening investment activity by the large oil and gas exploration

and production companies, even before the war in Ukraine. Rystad

Energy analysts have reported that global oil and gas investment

will increase by $26bn this year to $628bn, and in the meantime

drilling rig use is climbing with some recent reports indicating a

circa 50% increase in North America and internationally. Eni head

Claudio Descalzi said the imbalance predated the pandemic and was a

result of falling investment since 2015, and it is now clear that

this needs to be addressed, especially for natural gas where Plexus

wellhead equipment and products excel.

"Plexus' wellheads, which have been used in over 400 gas wells

globally, are leakproof, deliver operational time savings, have

lower maintenance costs, and importantly, can significantly reduce

the escape of methane gas - increasing safety for personnel, and

limiting the negative impact on the environment. In recognition of

the Company's ongoing commitment to improving standards in the oil

and gas industry through the development and implementation of

innovative green technologies, on 21 July 2021, Plexus received the

London Stock Exchange's Green Economy Mark, an accolade awarded to

companies and funds where 50% or more of their revenues are

attributable to environmental solutions.

"On 9 August 2021, the Company announced that it was to re-enter

the Jack-up Exploration (Adjustable) Rental Wellhead market,

through a Co-operation Agreement with Cameron. Under the terms of

the Agreement, Cameron will licence and transfer Plexus' original

designed Exact-15 ("Exact") system rental wellhead inventory and

Centric-15 ("Centric") mudline system equipment, as well as provide

manufacturing support. Cameron will also assist Plexus with sales

leads generation and market insight through a formal Sales Advisory

Board. Plexus will contract directly with customers, manage the

full job execution cycle using its in-house field technicians and

infrastructure, and will assume responsibility for the maintenance,

repairs, and logistics of the equipment provided. Plexus will pay

Cameron a licence royalty fee based on revenue generated from the

sale and rental of the licenced equipment. This is an important

strategic move for Plexus and returns the Company to a business

sector it understands very well and in which it has a proven track

record.

"During the reporting period, the Company announced that it had

won a contract with a leading North Sea operator for the provision

of Plexus' POS-GRIP 10,000 psi leak-proof "HG" metal to metal

sealing surface production wellhead, together with associated

spares, and valve equipment. This is a cash generative, short-term

contract of 120 days, with a tiered payment structure, and

deliverable by Q2 2022. Plexus is pleased to report that this

contract will be delivered on time and with revenues as

anticipated."

Key functions that support our operations are Human Resources

('HR'), Quality Health and Safety ('QHSE'), Information Technology

('IT') and Intellectual Property (IP').

The Company maintains its Competency Management System through

an internally developed system 'Competency@Plexus' ('C@P'). This is

monitored and accredited by OPITO, the training and qualifications

standards board. The annual monitoring audit was successfully

conducted in September 2021, full accreditation was maintained with

no findings raised by the auditor.

QHSE is an important function of the Company and Plexus' strong

track record enables it to demonstrate a high degree of compliance

and credibility in the oil and gas industry. Without the

appropriate certifications, it would not be possible for Plexus to

be considered for certain contract awards by operators. With this

in mind, and with a commitment to provide a safe, practical, and

competent workplace for our employees, management has developed and

adopted very rigorous QHSE procedures in this field. In September

2021 the Company achieved six consecutive years of zero lost time

incidents ('LTIs') and, following successful audits, Plexus has

retained its API Q1 and ISO 45001 certifications.

The Group has continued to follow Government COVID-19

guidelines, with a gradual transition from working from home during

the pandemic towards a full time return to the office. Plexus has

been able to rely on robust IT and security systems to ensure that

neither work performance nor data security has been compromised

during this period.

We continue to develop our suite of IP both through patent

protection and ongoing research and development. Capitalised

R&D salary costs for the 6 months ended 31 December 2021 was

GBP223k.

Interim Results

Plexus' results for the six months to December 2021, and the

activities carried out during this period, reflect the Group's

ongoing strategy of moving towards the development of new revenue

streams and new markets.

Continuing operations revenue for the six-month period ended 31

December 2021 increased to GBP734k, compared to the previous year's

figure of GBP419k following an increase in operational

activity.

During the period Plexus continued to focus on preserving Group

cash by minimising spending, and controlling investment on capex,

opex and non-essential R&D, without compromising

operations.

Continuing activities administrative expenses have decreased for

the six months to December 2021 to GBP2.51m (2020: GBP2.64m).

Personnel numbers, including non-executive board members are

broadly in line with the prior year at 38 (2020: 36). This staff

structure has balanced the anticipation of ongoing and future

organic operational opportunities, particularly with the move back

into the rental wellhead exploration market, and development and

support for our POS-GRIP IP-led strategy involving external

partners and licensees, against the need to carefully manage the

Group's costs and cash resources. The current staff levels are

around the minimum required to maintain the operational

infrastructure that has been developed to date, including

maintaining the Group's Business Management System, and retaining

all relevant and necessary accreditations, in addition to meeting

operational requirements.

For continuing operations, the Group has reported a loss of

GBP2.0m in the period which is in line with the prior year. The

loss comes after absorbing depreciation and amortisation costs of

circa GBP0.8m.

The Group has not provided for a charge to UK Corporation Tax at

the prevailing rate of 19%. This is consistent with the prior

year.

Basic loss per share for continuing operations was 1.94p per

share which compares to a 1.99p loss per share for the same period

last year.

The balance sheet continues to remain strong, with the current

level of intangible and tangible property, plant and equipment

asset values at GBP9.4m and GBP2.8m respectively illustrating the

amount of cumulative investment that has been made in the business.

Total asset values at the end of the period stood at GBP26.3m.

As at 31 December 2021, the Group had cash and cash equivalents

of GBP3.4m, financial assets with a value of GBP4.7m and had drawn

down GBP3.3m on a Lombard banking facility provided by EFG.

Outlook

"It is now widely accepted that the transition to clean energies

will take several decades, with natural gas being recognised as the

key transitional hydrocarbon energy source. It is hard to believe

that mid-pandemic in 2020, demand for oil plummeted and traders

were paying buyers to take storage of oil, and that Brent crude was

trading at US$23, a historical low. At the same time global oil and

gas investments fell from US$780 billion in 2019 to US$680 billion.

Moving to the present, as economies recover post pandemic, global

energy demand together with uncertainties surrounding established

supply sources has resulted in huge price increases particularly in

relation to gas. In the UK gas prices have for practically two

decades traded around 50p per therm and lower, and this month,

magnified by the Ukraine crisis gas briefly hit over 550p per

therm.

"At the same time, the oil price shot up earlier this month to

circa US$139 a barrel before settling closer to $100. In response

to this growing demand, and the need for the West to diversify its

strategic supply sources, both oil and gas investments are showing

signs of a strong recovery for example in terms of growing rig

utilisation, and this will translate into more activity for oil

services companies. Importantly, natural gas is likely to be used

for a longer period as a transition fuel while renewable energies

mature technologically and economically. This endorsement was

underlined by the BBC in a report in early February, confirming

that the European Commission had decided to classify gas as a

'sustainable investment' if it meets certain targets.

"Perhaps none of this should be such a surprise in a world where

fossil fuels combined make up 83% of the energy mix, and oil and

gas alone account for 56%. These are fast declining assets once

they are producing, and our industry needs to invest enough to

offset the 5m to 6m barrels per day ('b/d') normal rate of decline.

Hardly a surprise therefore that Opec said earlier in the year that

demand for its oil in 2022 will be about 1mn b/d higher than last

year, and that longer term Opec sees current global demand of 100m

b/d rising to 108m b/d, or 28 per cent of energy requirements by

2045. It would appear that a combination of an over assumption that

a COVID 'shackled' global economy was pointing to ongoing lower

energy use, combined with an 'overshoot' of green initiatives

resulting in a sharp pivot away from hydrocarbons has all conspired

to create energy supply constraints that perhaps should have been

better anticipated.

"The upshot of all this is that despite current aspirations,

hydrocarbons have a role to play in the transition to NetZero and

are likely to remain an important part of the world's energy mix

for much longer than some pundits had predicted. These challenges

have of course been sadly magnified by the war in Ukraine, and the

realisation that Europe's dependence on Russian oil and gas is not

strategically sensible or acceptable. For oil services companies

such developments point to a better future than many would liked to

have believed, and is evidenced by a recent green light given by

the Government for six North Sea oil and gas projects to proceed

later this year. Further, the Prime Minister has just announced the

setting up of an energy task force headed up by two industry

experts to boost the UK's oil and gas supplies which will include

the North Sea.

"There will still however rightly be a push for operators to be

greener, safer and to use technology to optimise wells and reduce

harmful emissions. Perhaps, it is unsurprising that the USA has led

the clean agenda by pledging US$1.15 billion to clean up orphaned

oil and gas wells, and we are hopeful that other countries will

follow suit, although Plexus has always maintained that the

prevention of such environmental issues is far better than supposed

cures which are not guaranteed, especially for the long term. A key

backdrop to these developments is that Plexus owns an extensive IP

suite which has and will continue to deliver innovative solutions

for the oil and gas industry, and which can also involve

retrofitting of bespoke equipment. This has been recognised by our

licensees, and we will be doing everything we can to capitalise on

this important asset.

"In summary, Plexus believes it will benefit from strong market

drivers across the oil and gas industry, including the demand for

oil and gas being likely to outstrip supply for some time. This,

coupled with the recognition that gas will continue to play a key

transitional role in the provision of sustainable green energy

makes us optimistic about the future as drilling activities gain a

new momentum."

J Jeffrey Thrall

Non-Executive Chairman

18 March 2022

Plexus Holdings Plc

Unaudited Interim Consolidated Statement of Comprehensive

Income

For the Six Months Ended 31 December 2021

Six months Six months Year to

to to 30 June

31 December 31 December 2021

2021 2020

GBP'000 GBP'000 GBP'000

Revenue 734 419 2,017

Cost of sales (130) (36) (1,062)

------- ------- -------

Gross profit 604 383 955

Administrative expenses (2,512) (2,641) (5,501)

Operating loss (1,908) (2,258) (4,546)

Finance income 81 106 143

Finance costs (159) (40) (103)

Other income 11 180 211

Share in profit of associate 22 17 (77)

------- ------- -------

Loss before taxation (1,953) (1,995) (4,372)

Income tax credit (note 6) - - 262

------- ------- -------

Loss after taxation from continuing

operations (1,953) (1,995) (4,110)

Loss after taxation from discontinued

operations - - (392)

------- ------- -------

Loss for Year (1,953) (1,995) (4,502)

Other comprehensive income - - -

------- ------- -------

Total comprehensive income (1,953) (1,995) (4,502)

------- ------- -------

Loss per share (note 7)

Basic from continuing operations (1.94p) (1.99p) (4.09p)

Diluted from continuing operations (1.94p) (1.99p) (4.09p)

Basic from discontinued operations - - (0.39p)

Diluted from discontinued operations - - (0.39p)

Plexus Holdings PLC

Unaudited Interim Consolidated Statement of Financial

Position

As at 31 December 2021

31 December 31 December 30 June

2021 2020 2021

GBP'000 GBP'000 GBP'000

ASSETS

Goodwill 767 767 767

Intangible assets 9,435 9,920 9,644

Property, plant and equipment

(note 9) 2,798 3,076 2,961

Non-current financial asset 4,705 3,044 3,042

Investment in associate 743 865 721

Deferred tax asset 1,899 2,130 1,899

Other Receivables - - -

Right of use asset 1,093 1,397 1,245

------- ------- -------

Total non-current assets 21,440 21,199 20,279

------- ------- -------

Inventories 663 1,385 575

Trade and other receivables 852 3,396 1,051

Current income tax asset - - -

Cash and cash equivalents 3,379 3,384 5,175

------- ------- -------

Total current assets 4,894 8,165 6,801

------- ------- -------

TOTAL ASSETS 26,334 29,364 27,080

------- ------- -------

EQUITY AND LIABILITIES

Called up share capital (note

12) 1,054 1,054 1,054

Shares held in treasury (2,500) (2,500) (2,500)

Share based payments reserve 674 674 674

Retained earnings 21,811 26,271 23,764

To tal equity attributable ------- ------- -------

to equity holders

of the parent 21,039 25,499 22,992

Lease liabilities 1,015 1,220 1,085

------- ------- -------

Total non-current liabilities 1,015 1,220 1,085

Trade and other payables 670 1,239 643

Bank Lombard facility 3,294 1,094 2,044

Current income tax liability - - -

Lease liabilities 316 312 316

------- ------- -------

Total current liabilities 4,280 2,645 3,003

------- ------- -------

Total liabilities 5,295 3,865 4,085

------- ------- -------

TOTAL EQUITY AND LIABILITIES 26,334 29,364 27,080

------- ------- -------

Plexus Holdings Plc

Unaudited Interim Statement of Change in Equity

For the Six Months Ended 31 December 2021

Called Shares Share Based Retained Total

Up Held in Payments Earnings

Share Capital Treasury Reserve

Balance as at 30 June

2020 1,054 (2,500) 674 28,266 27,494

Total comprehensive

income for the year - - - (4,502) (4,502)

------- ------- ------- ------ ------

Balance as at 30 June

2021 1,054 (2,500) 674 23,764 22,992

Total comprehensive

income for the period - - - (1,953) (1,953)

------- ------- ------- ------- -------

Balance as at 31 December

2021 1,054 (2,500) 674 21,811 21,039

------- ------- ------- ------- -------

Plexus Holdings Plc

Unaudited Interim Statement of Cash Flows

For the Six months ended 31 December 2021

Six months

to 31 December Six months Year to

2021 to 31 December 30 June

2020 2021

GBP 000's GBP 000's GBP 000's

Cash flows from operating activities

Loss before taxation from continuing

activities (1,953) (1,995) (4,372)

Loss before taxation from discontinued

activities - - 20

------- ------- -------

Loss before tax (1,953) (1,995) (4,352)

Adjustments for:

Depreciation, amortisation and

impairment charges 838 864 1,701

Gain on disposal of property,

plant and equipment (1) (1) (1)

Fair value adjustment of on financial

assets 112 (41) 19

Lease liability re-assessment - - 25

Share in (profit) / loss of associate (22) (17) 77

Other income (11) (180) (123)

Investment income (81) (65) (143)

Interest expense 47 40 84

Changes in working capital:

(Increase) / decrease in inventories (88) (515) 295

Decrease / (increase) in trade

and other receivables 199 (414) (255)

Increase / (decrease) in trade

and other payables 27 461 (135)

------- ------- -------

Cash used in operating activities (933) (1,863) (2,808)

Net income taxes received - 76 157

------- ------- -------

Net cash used in operating activities (933) (1,787) (2,651)

------- ------- -------

Cash flows from investing activities

Funds invested in financial instruments (1,775) (8) (66)

Other income 11 180 123

Dividend received from associate - 50 100

Purchase of intangible assets (252) (53) (235)

Deferred proceeds from sale of

discontinued operation - - 2,186

Interest and investment income

received 81 65 143

Purchase of property, plant and

equipment (62) (58) (170)

Net proceeds from of sale of property,

plant and equipment 2 1 1

------- ------- -------

Net cash (used) / generated from

investing activities (1,995) 177 2,082

------- ------- -------

Plexus Holdings Plc

Unaudited Interim Statement of Cash Flows (continued)

For the Six months ended 31 December 2021

Cash flows from financing activities

Drawdown of banking facility 1,250 1,094 2,044

Repayments of lease liability (87) (147) (342)

Interest paid (31) (40) (45)

------- ------- -------

Net cash inflow / (outflow) from

financing activities 1,132 907 1,657

------- ------- -------

Net decrease in cash and cash

equivalents (1,796) (703) 1,088

Cash and cash equivalents at

brought forward 5,175 4,087 4,087

------- ------- -------

Cash and cash equivalents carried

forward 3,379 3,384 5,175

------- ------- -------

Notes to the Interim Report December 2021

1. This interim financial information does not constitute

statutory accounts as defined in section 435 of the Companies Act

2006 and is unaudited.

The comparative figures for the financial year ended 30 June

2021 are not the Company's statutory accounts for that financial

year. Those accounts have been reported on by the company's

auditors, Crowe U.K. LLP, and delivered to the registrar of

companies. The report of the auditors was (i) unqualified, (ii) did

not include a reference to any matters to which the auditors drew

attention by way of emphasis without qualifying their report and

(iii) did not contain a statement under section 498(2) or (3) of

the Companies Act 2006.

The interim financial information is compliant with IAS 34 -

Interim Financial Reporting.

The accounting policies are based on current International

Financial Reporting Standards ("IFRS"), International Financial

Reporting Interpretation Committee ("IFRIC") interpretations and

current International Accounting Standards Board ("IASB") exposure

drafts that are expected to be issued as final standards and

adopted by the EU such that they are effective for the year ending

30 June 2022. These standards are subject to on-going review and

endorsement by the EU and further IFRIC interpretations and may

therefore be subject to change.

2. Except as described below the accounting policies applied in

these interim financial statements are the same as those applied in

the Group's consolidated financial statements as at and for the

year ended 30 June 2021 and which are also expected to apply for 30

June 2022.

The changes in accounting policy set out below will also be

reflected in the Group's consolidated financial statements for the

year ending 30 June 2022.

Interest Rate Benchmark Reform - Phase 2 (Amendments to IFRS 9,

IAS 39, IFRS 7, IFRS 4 and IFRS 16

A number of other amendments to standards not yet endorsed

include:

-- Classification of liabilities as current or non-current (Amendments to IAS 1)

-- Disclosure of Accounting Policies (Amendments to IAS 1 and IFRS Practice Statement 2)

-- Definition of Accounting Estimate (Amendments to IAS 8)

-- Sale or Contribution of Assets between an Investor and its

Associate or Joint Venture (Amendments to IFRS 10 and IAS 28)

The Directors have considered those standards, amendments and

interpretations, which have not been applied in the financial

statements but are relevant to the Group's operations, that are in

issue but not yet effective and do not consider that they will have

a material impact on the future results of the Group.

3. This interim report was approved by the board of directors on

18 March 2022.

4. The directors do not recommend payment of an interim dividend

in relation to this reporting period.

5. There were no other gains or losses to be recognised in the

financial period other than those reflected in the Statement of

Comprehensive Income.

6. No corporation tax provision has been provided for the six

months ended 31 December 2021 (2020: nil). As a result, there is no

effective rate of tax for the six months ended 31 December 2021

(2020: 0%).

7. Basic earnings per share are based on the weighted average of

ordinary shares in issue during the half-year of 100,435,744 (2020:

100,435,744).

8. The Group derives revenue from the sale of its POS-GRIP

friction-grip technology and associated products, and licence

income derived from its various licensing agreements. These income

streams are all derived from the utilisation of the technology

which the Group believes is its only segment. Business activity is

not subject to seasonal fluctuations.

9. Property plant and equipment

Buildings Tenant Equipment Assets Motor Total

GBP000 Improvements GBP000 under construction vehicles GBP000

GBP000 GBP000 GBP000

Cost

As at 30 June

2020 3,740 714 5,393 - 17 9,864

Additions - - 42 128 - 170

Transfers - - 128 (128) - -

Disposals - - (2) - - (2)

----- ----- ----- ----- ----- -----

As at 30 June

2021 3,740 714 5,561 - 17 10,032

Additions - - 43 19 - 62

Transfers - - 19 (19) - -

Disposals - - - - - -

----- ----- ----- ----- ----- -----

As at 31 December

2021 3,740 714 5,623 - 17 10,094

----- ----- ----- ----- ----- -----

Depreciation

As at 30 June

2020 1,490 525 4,569 - 7 6,591

Charge for

the year 153 41 284 - 4 482

On disposals - - (2) - - (2)

----- ----- ----- ----- ----- -----

As at 30 June

2021 1,643 566 4,851 - 11 7,071

Charge for

the year 76 17 130 - 2 225

On disposals - - - - - -

----- ----- ----- ----- ----- -----

As at 31 December

2021 1,719 583 4,981 - 13 7,296

----- ----- ----- ----- ----- -----

Net book value

As at 31 December

2021 2,021 131 642 - 4 2,798

----- ----- ----- ----- ----- -----

As at 30 June

2021 2,097 148 710 - 6 2,961

----- ----- ----- ----- ----- -----

10. Investments

GBP'000

Investment in associate at 30 June

2020 898

Share of profit for the period (77)

Dividends received (100)

-----

Investment in associate at 30 June

2021 721

Share of profit for the period 22

-----

Investment in associate at 31 December

2021 743

-----

On 14 December 2018 Plexus Ocean Systems Limited acquired a 49%

interest in Kincardine Manufacturing Services Limited ('KMS') for a

consideration of GBP735k plus associated legal fees. KMS is a

precision engineering company which serves the oil and gas

industry. This is viewed as a long-term strategic investment by

Plexus. KMS is based at Sky House, Spurryhillock Industrial Estate,

Stonehaven, Aberdeenshire AB39 2NH.

Following the investment Graham Stevens, Plexus' Finance

Director was appointed to the board of KMS. The company remains

under the control and influence of the 51% majority

shareholders.

The summary financial information of KMS, extracted on a 100%

basis from the accounts for the year to 31 December 2021 is as

follows:

2021

GBP'000

Assets 2,747

Liabilities 1,802

Revenue 2,819

Loss after tax (143)

11. Discontinued operations

Six months Six months Year to

to 31 December to 31 December 30 June

2021 2020 2021

GBP'000 GBP'000 GBP'000

Revenue - - -

Expenses - - 20

(Loss)/Profit before tax of discontinued

operations - - 20

I ncome tax credit - - (412)

(Loss)/Profit after tax of discontinued

operations - - (392)

12. Share Capital

Six months Six months Year to

to 31 December to 30 June

2021 31 December 2021

2020

GBP'000 GBP'000 GBP'000

Authorised:

Equity: 110,000,000 (June 2021

& Dec 2020: 110,000,000) Ordinary

shares of 1p each 1,100 1,100 1,100

Allotted, called up and fully ----- ----- -----

paid:

Equity: 105,386,239 (June 2021

& Dec 2020: 105,386,239) 1,054 1,054 1,054

----- ----- -----

Notes

Plexus Holdings plc (AIM: POS) is an IP led company focussed on

establishing its patented leak-proof POS-GRIP(R) wellhead and

associated equipment as the go-to technology for energy markets

whilst making a genuine contribution to the oil and gas industry's

ESG and NetZero goals by championing "through the BOP" (Blow-out

Preventer) designs, and lifetime leak-proof HG(R) metal-to-metal

sealing systems. Having protected the environment for many years

through these technological innovations, the Company was awarded

the London Stock Exchange's Green Economy Mark in July 2021 and

continues to place emphasis on its ability to reduce harmful

methane emissions and unnecessary maintenance and intervention

costs.

Headquartered in Aberdeen, the Company has provided leak-free

wellhead performance in over 400 wells worldwide and worked with an

array of blue-chip oil and gas company clients. As well as

generating direct revenues from securing orders for surface

production wellheads particularly in the UK and European North Sea

regions, the Company has several licencing/collaboration agreements

with major partners including FMC Technologies, which is a

subsidiary of TechnipFMC, and LLC Gusar in Russia. Furthermore, it

works closely with Cameron, a Schlumberger Group company Cameron

has a non-exclusive licence to use the POS-GRIP and HG(R)

metal-to-metal seal method of wellhead engineering for the

development of conventional and unconventional oil and gas surface

wellheads, and Plexus entered into a Cooperation Agreement, which

enabled Plexus to return to the Jack-up Exploration (Adjustable)

Wellhead rental business for 'through the BOP' jack-up

applications, where Cameron will help to provide Plexus with sales

leads and market insight through a formal Sales Advisory Board.

Plexus' current suite of products and applications include: "HG"

wellheads, which combine POS-GRIP technology with gas tight leak

free metal-to-metal sealing; the Python(R) subsea wellhead,

developed in a Joint Industry Project with several industry

leaders; the POS-SET(TM) Connector for the de-commissioning and

abandonment market; and Tersus-PCT, an innovative HP/HT tie back

connector product. Having proved the superior uniquely enabling

qualities of POS-GRIP Technology, Plexus is now also focused on

establishing its technology and equipment in other markets such as

Plug and Abandonment de-commissioning, carbon capture, gas storage,

hydrogen and geothermal where it can play an important role in

reducing harmful methane emission risks as operators strive to

deliver on ESG commitments and NetZero goals in a safe and

cost-effective way.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR ZVLFFLXLLBBV

(END) Dow Jones Newswires

March 21, 2022 03:00 ET (07:00 GMT)

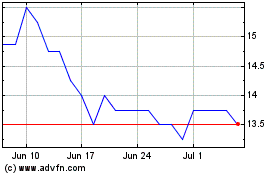

Plexus (LSE:POS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Plexus (LSE:POS)

Historical Stock Chart

From Apr 2023 to Apr 2024