Pan African Resources Plc Update on Operations

May 11 2020 - 3:00AM

UK Regulatory

TIDMPAF

Pan African Resources PLC

(Incorporated and registered in England and Wales under Companies Act 1985 with

registered number 3937466 on 25 February 2000)

Share code on AIM: PAF

Share code on JSE: PAN

ISIN: GB0004300496

("Pan African Resources" or "the Company" or "the Group")

UPDATE ON OPERATIONS AMID COVID-19 NATIONAL LOCKDOWN REGULATIONS, NEW FY2020

PRODUCTION GUIDANCE AND UPDATE ON GROUP DEBT REDUCTION

Update on Group Operations and COVID-19 National Lockdown Regulations

As previously communicated to shareholders, on 9 April 2020, the South African

government announced an extension of the National Lockdown period ("Lockdown

Extension"), enacted in terms of the South African Disaster Management Act

("the Regulations") from 16 April 2020 to 30 April 2020, in an ongoing effort

to curtail the spread of the COVID-19 (coronavirus) pandemic.

The Regulations pertaining to the Lockdown Extension provided for a phased

ramp-up of mining capacity to 50% of normalised production during the lockdown

period, provided that all the preventative and mitigating controls were in

place to curtail the spread of the COVID-19 virus. In response to these

amendments, the Group implemented plans to recall 50% of its employees at the

Company's Barberton Mines and Evander Mines surface and underground operations

("Group Operations").

On 23 April 2020, the South African government announced that the country would

be entering a period of phased lifting of the lockdown restrictions from 1 May

2020, resulting in the previous Level-five hard lockdown, that commenced on 27

March 2020, being reduced to a Level-four lockdown. Level-four lockdown

restrictions require a risk-based and gradual approach to recalling employees.

It enables open cast mines and surface operations to operate at up to 100% of

normal capacity, and all other mines at 50% capacity.

In response to this announcement, the Group commenced the recall of permitted

employees for the phased recommencing of Group Operations in compliance with

legal requirements, with all the required safety protocols and procedures in

place.

The recall of employees at the Group's Operations in terms of these Level-four

lockdown regulations is now well advanced, with the surface operations at the

Elikhulu Tailings Retreatment Plant and the Barberton Tailings Retreatment

Plant producing at close to full capacity from early May 2020.

Revised FY2020 Production Guidance

As announced on 30 March 2020, the Group suspended its original FY2020

production guidance of 185,000oz as a result of the anticipated COVID-19 impact

on the Group's mining operations.

As expected, production at the Group's operations was severely affected during

the lockdown months of March and April 2020. The Group was however able to

mitigate some of the impact through continued mining activities at its surface

operations, which was staffed by a materially reduced employee complement, and

also with limited high-grade underground mining at Barberton Mines.

The Group is now in a position to advise shareholders that it expects the

revised gold production for the 2020 financial year to be approximately

176,000oz, including capitalised production from the #8 Shaft Pillar operation.

The revised production guidance is a decrease of only 5% from the previous

guided production of 185,000oz, due to the Group's ability to increase output

from surface toll treatment and low grade surface stockpile processing

initiatives, in substitution of underground production. The substituted

production was however at a reduced margin, when compared to normal margins

earned on ounces produced from underground.

The revised production guidance is based , inter-alia, on the assumptions that

the Group can continue surface operations at close to maximum capacity for the

remainder of the 2020 financial year and underground operations continuing at

50% of personnel capacity, consistent with current Level-four restrictions.

The approximate split of expected full year gold production between operations

is as follows:

Full Year

Production ounce profile:

Barberton Mines - Underground: 64,000

Barberton Tailings Retreatment 21,000

Plant:

Evander Mines - Underground and 31,000

tolling:

Elikhulu: 59,000

Total ounces produced: 175,000

Statement of Financial Position

The Group remained cashflow positive during the lockdown period. Assuming that

the prevailing ZAR gold price of approximately ZAR1 million/kg (approximately

USD1,680/oz) can be sustained for the remainder of the 2020 financial year, the

Group is expected to reduce its senior interest-bearing debt (including the

outstanding gold loan balance), net of projected available cash, to

approximately ZAR1.3 billion (USD70 million) assuming an exchange rate of ZAR/

USD:18.50 from ZAR1.8 billion (USD129 million) at 30 June 2019. This represents

a reduction in senior interest-bearing debt of 23% and 28% relative to the debt

levels at 31 December 2019 and 30 June 2019, respectively.

In light of the Group's elevated senior debt levels at inception of the 2020

financial year, a number of short-term zero-cost collar hedges were entered

into during the course of the 2020 financial year to underpin the Group's

cashflows and its ability to redeem its senior debt. The remaining hedges for

the 2020 and 2021 financial year are detailed hereunder:

2 Months 6 Months

1 May 2020 - 30 June 1 July 2020 - 31 Dec

2020 2020

Ounces hedged: 21,820 50,000

Average floor price - R/ 683,226 708,000

Kg:

Average ceiling price - 847,109 925,829

R/Kg:

Importantly, the Group is unhedged post 31 December 2020.

COVID-19 Programme of Relief and Assistance (CPR)

As previously communicated, the Group initiated a CPR programme to assist with

alleviating the adverse impact of the COVID-19 pandemic in its host communites

and for its employees. The programme commenced at the end of April 2020 with

the distribution of food and hygiene hampers to its employees, contractors and

vulnerable families in communities in close proximity to the Group's

operations. The programme's rollout will continue during May 2020 and

approximately 5,400 hampers will be provided with a total value of almost R5

million during the current phase of the programme.

In the light of the ongoing pandemic, the Group will continue its initiatives

to assist some of its most vulnerable stakeholders in the months ahead.

"It is crucial for the country's economy to be restarted and the phased

approach adopted by the government to achieve this is practical in fighting the

pandemic and enabling businesses and communities to survive during this

tumultuous period. We have implemented preventative and precautionary measures

at our operations to ensure the health and well-being of employees as they

return to work, and we look forward to working with all stakeholders in the

operational ramp-up. We expect that we still have a long battle ahead against

COVID-19, however, I wish to commend all of our employees for the manner in

which they have worked together during this period. The strategic repositioning

of our Group some years ago, as a safe and high-margin producer with multiple

operations and the flexibility to withstand short-term external shocks, should

continue to serve all stakeholders well." commented Cobus Loots, CEO of Pan

African Resources.

Pan African Resources will continue to provide shareholders with updates on

progress at its operations as further information becomes available.

Rosebank

11 May 2020

For further information on Pan African Resources, please visit the Company's

website at

www.panafricanresources.com

Contact information

Corporate Office Registered Office

The Firs Office Building Suite 31

2nd Floor, Office 204 Second Floor

Cnr. Cradock and Biermann Avenues 107 Cheapside

Rosebank, Johannesburg London

South Africa EC2V 6DN

Office: + 27 (0)11 243 2900 United Kingdom

info@paf.co.za Office: + 44 (0)20 7796 8644

Cobus Loots Deon Louw

Pan African Resources PLC Pan African Resources PLC

Chief Executive Officer Financial Director

Office: + 27 (0)11 243 Office: + 27 (0)11 243 2900

2900

Phil Dexter/Jane Kirton John Prior

St James's Corporate Services Limited Numis Securities Limited

Company Secretary Nominated Adviser and Joint Broker

Office: + 44 (0)20 7796 8644 Office: +44 (0)20 7260 1000

Ciska Kloppers Ross Allister/David McKeown

Questco Corporate Advisory Proprietary Peel Hunt LLP

Limited Joint Broker

JSE Sponsor Office: +44 (0)20 7418 8900

Office: + 27 (0)11 011 9200

Hethen Hira Thomas Rider/Neil Elliot

Pan African Resources PLC BMO Capital Markets Limited

Head : Investor Relations Joint Broker

Tel: + 27 (0)11 243 2900 Office: +44 (0)20 7236 1010

E-mail: hhira@paf.co.za

Website: www.panafricanresources.com

END

(END) Dow Jones Newswires

May 11, 2020 03:00 ET (07:00 GMT)

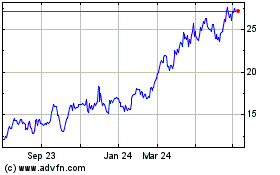

Pan African Resources (LSE:PAF)

Historical Stock Chart

From Mar 2024 to Apr 2024

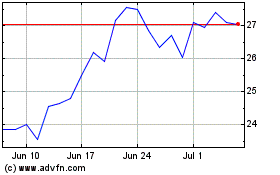

Pan African Resources (LSE:PAF)

Historical Stock Chart

From Apr 2023 to Apr 2024