TIDMOBC

RNS Number : 0281I

Online Blockchain PLC

16 March 2018

16 March 2018

For immediate release

Online Blockchain PLC

("Online" or the "Company", formerly On-Line PLC)

Unaudited Interim Results for the Six Months Ended 31 December

2017

Online today announces unaudited interim results for the six

months ended 31 December 2017 (the "Period").

Chairman's Statement

On 20 December 2017, we changed Online's corporate name to

Online Blockchain to reflect the projects we had been working on

for some time and our activity in this emerging technology. When we

had first started our research and development on Blockchain

projects, general market interest in Blockchain technology was at a

low level, but that changed during 2017. We believe that Blockchain

development is a complimentary extension of the Company's

activities and experience in the online sector.

Our first Blockchain project we announced in the Period was the

first phase of our Plus 1 Coin cryptocurrency project, which we had

developed in conjunction with ADVFN PLC ("ADVFN"). Following

testing within the ADVFN community, ADVFN offered its customers and

members a Plus 1 coin wallet, which had been built on software

developed by Online. Plus 1 coin is designed as a social media

cryptocurrency to enable social media users to interact and "up

vote" content of other social media. As previously announced,

Online and ADVFN are each bearing their own costs in respect of the

Plus 1 Coin cryptocurrency cooperation project and while there are

currently no financial arrangements between the two companies in

respect of this project, we anticipate that Online will in due

course charge publishers like ADVFN a license fee for its software

which supports the wallet, on terms to be agreed.

In addition to our development activities, Online has a 17.98

percent interest in ADVFN, which has also released its interim

results for the six months ended 31 December and which are

summarised further below.

Following the Period end, we raised GBP1m through an issue of

new shares to provide general working capital for the Company and

to provide additional resources to invest further in the

development of Blockchain projects as and when they arise. This

development work dovetails with our efforts with ADVFN, which is

broadening its own information service on cryptocurrencies whilst

implementing our Plus1 Coin product for its international

community.

We are excited about the potential opportunities for Blockchain

technology. Shareholders should note that the Company's own

development of additional Blockchain products are still at an early

stage but we look forward to reporting further progress this

year.

Following the Period end on 23 February 2018, we were also

particularly pleased to announce the appointment of Bill Louden to

the Board as a non-executive director, and the following provides

some additional background and context to his appointment. Bill is

considered one of the early pioneers of the online industry,

joining CompuServe in 1979, which played a key role in the

commercial development of the internet at that time. Between 1979

and 1984 at Compuserve, Bill was responsible for personal computing

and communication product lines, including InfoPlex, a CompuServe

commercial store and forward system, which was re-designed and

developed under Bill as a consumer product, renamed as "EMAIL" and

launched in 1981 (and subsequently trademarked by Compuserve

between 1983 and 1984). Bill is particularly recognised for his

role in leading the development and commercialisation of

multi-player games at Compuserve (and thereafter as founder of the

GEnie online service at General Electric), including MegaWars, the

first commercial multi-player online game. Bill's reputation within

the online industry and experience will be of great value to

us.

Change of name

On 20 December 2017 the name of the Company was changed from

On-Line PLC to Online Blockchain PLC.

More information about Online Blockchain PLC can be found at:

www.onlineblockchain.io

ADVFN PLC

2017 was a year of consolidation at ADVFN. As reported by ADVFN

in its unaudited interim accounts for the six months ended 31

December 2017, ADVFN was profitable, as set out in the table of

financial performance further below.

ADVFN's sales in the 6-month interim period have shown a top

line growth of GBP456,000, an increase of 12% on the comparable

period last year, from approximately GBP3.8m to GBP4.3m. Reported

operating profit for the 6-month interim period was GBP24,000

(2016: operating loss, GBP66,000).

ADVFN Financial performance for the six months ended 31 December

2017

Key financial performance for the period has been summarised as

follows:

Six Months ended Six Months ended

31 December 2017 31 December 2016

------------------------- ----------------- -----------------

GBP'000 GBP'000

------------------------- ----------------- -----------------

Turnover 4,282 3,826

------------------------- ----------------- -----------------

Profit for the period 24 18

------------------------- ----------------- -----------------

Operating profit/(loss) 24 (66)

------------------------- ----------------- -----------------

Profit per share

(see note 3) 0.09 p 0.07 p

------------------------- ----------------- -----------------

Michael Hodges

Chairman

16 March 2018

A copy of this announcement is available on the Company's

website, at www.onlineblockchain.io

Enquiries:

For further information please contact:

Online Blockchain PLC +44 (0) 207 070

Michael Hodges 0909

Beaumont Cornish Limited

(Nominated Adviser)

www.beaumontcornish.com

+44 (0) 207 628

Roland Cornish/Michael Cornish 3396

Smaller Company Capital +44 (0) 203 651

Limited (Broker) 2910

Jeremy Woodgate

Cassiopeia Ltd (Investor stefania@cassiopeia-ltd.com

Relations)

Stefania Barbaglio

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. The person who arranged for the

release of this announcement on behalf of the Company was Michael

Hodges, Director.

Online Blockchain PLC (formerly On-Line PLC)

Statement of comprehensive income

for the six months ended 31 December 2017

Six months Six months

ended ended Year ended

31 December 31 December 30 June

2017 2016 2017

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Note

Turnover 32 44 98

Share based payment (3)

Administrative expenses (21) (31) (78)

----------- ----------- ----------

Operating profit 8 13 20

Interest payable (15) (1) (2)

----------- ----------- ----------

(Loss)/profit on ordinary

activities before taxation (7) 12 18

Tax on profit on ordinary

activities - - -

----------- ----------- ----------

(Loss)/profit and total

comprehensive income

for the period attributable

to shareholders of the

parent (7) 12 18

=========== =========== ==========

(Loss)/earnings per

share

Basic (loss)/earnings (0.09)

per ordinary share 2 p 0.16 p 0.24 p

Diluted (loss)/earnings (0.09)

per ordinary share 2 p 0.16 p 0.24 p

=========== =========== ==========

.

Online Blockchain PLC (formerly On-Line PLC)

Balance sheet

at 31 December 2017

31 December 31 December 30 June

2017 2016 2017

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Note

Non-current assets

Investments 3 868 868 868

---------------- ---------------- ----------------

Current assets

Trade and other receivables 159 170 125

Cash at bank and in

hand - - 2

---------------- ---------------- ----------------

159 170 127

Total assets 1,027 1,038 995

================ ================ ================

Equity and liabilities

Equity

Called up share capital 3,242 3,242 3,242

Share premium account 2,205 2,205 2,205

Share based payment

reserve 39 38 36

Profit and loss account (4,532) (4,531) (4,525)

---------------- ---------------- ----------------

954 954 958

Current liabilities

Trade and other payables 24 35 37

Borrowings (bank overdraft) 49 49 -

---------------- ---------------- ----------------

73 84 37

Total equity and liabilities 1,027 1,038 995

================ ================ ================

Online Blockchain PLC (formerly On-Line PLC)

Statement of changes in equity

at 31 December 2017

Share Share Share Retained Total

capital premium based earnings equity

payment

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2016 3,242 2,205 36 (4,543) 940

Equity settled share

options - - 2 - 2

--------- --------- --------- ---------- --------

Transactions with owners - - 2 - 2

Profit for the period

after tax - - - 12 12

Total comprehensive

income - - - 12 12

At 31 December 2016 3,242 2,205 38 (4,531) 954

Equity settled share

options - - (2) - (2)

--------- --------- --------- ---------- --------

Transactions with owners - - (2) - (2)

Profit for the period

after tax - - - 6 6

Total comprehensive

income - - - 6 6

At 30 June 2017 3,242 2,205 36 (4,525) 958

Equity settled share

options - - 3 - 3

Transactions with owners - - 3 - 3

Loss for the period

after tax - - - (7) (7)

Total comprehensive

loss - - - (7) (7)

--------- --------- --------- ---------- --------

At 31 December 2017 3,242 2,205 39 (4,532) 954

========= ========= ========= ========== ========

Online Blockchain PLC (formerly On-Line PLC)

Cash flow statements

for the six months ended 31 December 2017

Six months Six months

ended ended Year ended

31 December 31 December 30 June

2017 2016 2017

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

(Loss)/profit for the period (7) 12 18

Share based payments 3 2 -

(Increase)/decrease in

trade and other receivables (34) (11) 34

(Decrease)/increase in

trade and other payables (13) 3 5

------------- ------------- -------------------

Net cash used by operating

activities (51) 6 57

------------- ------------- -------------------

(Decrease)/increase in

cash and cash equivalents (51) 6 57

Cash and cash equivalents

at the start of the period 2 (55) (55)

------------- ------------- -------------------

Cash and cash equivalents

at the end of the period (49) (49) 2

============= ============= ===================

Cash and cash equivalents

Six months Six months

ended ended Year ended

31 December 31 December 30 June

2017 2016 2017

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Cash at bank - - 2

Borrowings (bank overdraft) (49) (49) -

------------- ------------- ----------

(49) (49) 2

============= ============= ==========

Online Blockchain PLC (formerly On-Line PLC)

Notes to the interim statement

for the six months ended 31 December 2017

1. Basis of preparation

The financial statements have been prepared in accordance with

applicable United Kingdom accounting standards, including Financial

Reporting Standard 102 - 'The Financial Reporting Standard

applicable in the United Kingdom and Republic of Ireland' (FRS 102)

and with the Companies Act 2006. The financial statements have been

prepared under the historical cost convention.

The financial statements are presented in Sterling (GBP) rounded

to the nearest thousand except where specified.

The unaudited interim financial information is for the six month

period ended 31 December 2017. The financial information does not

include all the information required for full annual financial

statements and should be read in conjunction with the financial

statements of the company for the year ended 30 June 2017.

The interim financial information has been prepared on the going

concern basis which assumes the company will continue in existence

for the foreseeable future. No material uncertainties that cast

significant doubt about the ability of the company to continue as a

going concern have been identified by the directors. Accordingly,

the directors, believe it is appropriate for the interim financial

statement to be prepared on the going concern basis.

The interim financial information has not been audited nor has

it been reviewed under ISRE 2410 of the Auditing Practices Board.

The financial information presented does not constitute statutory

accounts as defined by section 434 of the Companies Act 2006. The

company statutory accounts for the year to 30 June 2017 have been

filed with the Registrar of Companies. The auditors, Grant Thornton

UK LLP reported on these accounts and their report was unqualified

and did not contain a statement under section 498(2) or Section

498(3) of the Companies Act 2006.

2. (Loss)/earnings per ordinary share

Six months Six months Year

ended ended ended

31 December 31 December 30 June

2017 2016 2017

GBP'000 GBP'000 GBP'000

(Loss)/profit for the

period (7) 12 18

Shares Shares Shares

Weighted average number

of Ordinary shares 7,662,348 7,662,348 7,662,348

Dilutive effect of options 142,860 - -

----------- ----------- -----------------

Weighted average Ordinary

shares for diluted earnings

per share 7,805,208 7,662,348 7,662,348

=========== =========== =================

(Loss)/earnings per

share

(0.09)

Basic earnings per share p 0.16 p 0.24 p

Diluted earnings per (0.09)

share p 0.16 p 0.24 p

=========== =========== =================

Where a loss occurs the diluted loss per share does not differ

from the basic loss per share as the exercise of share options

would have the effect of reducing the loss per share and is

therefore not dilutive.

In addition, where a profit has been recorded but the average

share price for the period remains under the exercise price the

existence of options is not dilutive.

Online Blockchain PLC (formerly On-Line PLC)

Notes to the interim statement

for the six months ended 31 December 2017

3. Fixed asset investments

Six months Six months Year

ended ended ended

31 December 31 December 30 June

2017 2016 2017

GBP'000 GBP'000 GBP'000

At historical cost 868 868 868

Percentage ownership 17.98% 18.05% 17.98%

The Company owns 17.98% (2016: 18.05%) of ADVFN plc (ADVFN)

which is incorporated in England and Wales and whose principal

activity is the development and provision of financial information,

primarily via the internet, research services and the development

and exploitation of ancillary internet sites.

The investment in ADVFN plc is treated for the purposes of

financial reporting as an associate due to the common directorships

held between ADVFN plc and On-line plc and the resulting level of

significant influence over the associate.

4. Dividends

The directors do not recommend the payment of a dividend.

5. Accounts

Copies of this statement are being posted to shareholders

shortly and will be available from the company's registered office

at Suite 27, Essex Technology Centre, The Gables, Fyfield Road,

Ongar, Essex, CM5 0GA and in electronic form from the Company's

website, www.onlineblockchain.io

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SFAFLMFASESD

(END) Dow Jones Newswires

March 16, 2018 10:12 ET (14:12 GMT)

Online Blockchain (LSE:OBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

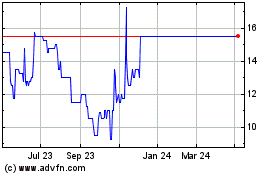

Online Blockchain (LSE:OBC)

Historical Stock Chart

From Apr 2023 to Apr 2024