TIDMNXT

RNS Number : 5226K

Next PLC

05 January 2021

Date: Embargoed until 07.00hrs, Tuesday 5 January 2021

Contacts: Amanda James, Group Finance Director (analyst calls)

NEXT PLC Tel: 0333 777 8888

Alistair Mackinnon-Musson Email: next@rowbellpr.com

Rowbell PR Tel: 020 7717 5239

Photographs: http://www.nextplc.co.uk/media/image-gallery/campaign-images

NEXT PLC

Trading Statement - 5 January 2021

This document contains page cross-referencing. Please refer to

the PDF version of this statement which is available at

http://www.rns-pdf.londonstockexchange.com/rns/5226K_1-2021-1-4.pdf

HEADLINES

-- Full price sales in the nine weeks to 26 December were down

-1.1% on last year and much better than our central guidance

of -8%, given in our October Trading Statement.

-- After accounting for the benefit of better sales in November

and December and anticipated losses from store closures

in January, full year profit before tax is forecast to be

GBP370m(1) before two additional non-recurring items.

-- A non-recurring profit of +GBP12m from a 53rd week, along

with an additional property provision of -GBP40m (see page

6), mean that total full year profit before tax is forecast

to be GBP342m.

-- Year end net debt is forecast to reduce by GBP487m to GBP625m.

-- For the year ahead (2021/22) our central guidance, which

assumes our Retail stores will be closed in February and

March, is for profit before tax of GBP670m, based on full

price sales being flat versus two years ago (i.e. 2019/20).

(1) Profit before tax is quoted on a 52-week basis. The

financial information presented in this document does not reflect

the impact of IFRS 16 Leases.

FULL PRICE SALES TO 26 DECEMBER

In the nine weeks to 26 December, the sales gained in our Online

business compensated for almost all those lost in Retail stores,

with total product full price sales down just -0.5%. The table

below sets out the full price sales performance by business channel

versus last year for the fourth quarter, second half and year to 26

December.

Fourth quarter Second half Year to

Full price sales (VAT exclusive) to 26 December to 26 December 26 December

================================= =============== =============== ============

Online UK +36% +30% +9%

Online Overseas +43% +31% +13%

=============== =============== ============

Online total +38% +30% +10%

Retail - 43% - 30% - 46%

=============== =============== ============

Product full price sales - 0.5% +1.8% - 16.5%

Finance interest income - 13% - 13% - 8%

=============== =============== ============

Total full price sales including

interest income - 1.1% +0.9% - 15.9%

=============== =============== ============

Full Price Sales by Week

The chart below shows full price sales by week by sales channel.

Retail sales are shown in green, Online product sales are shown in

blue and interest income in grey. The dotted black line shows the

total full price sales for last year.

Click or paste the following link into your web browser to view

the chart titled 'Full Price Sales by Week'. Refer to page 2 for

this chart.

http://www.rns-pdf.londonstockexchange.com/rns/5226K_1-2021-1-4.pdf

Product and Sales Trends

The effect of the pandemic on the shape of our business in the

fourth quarter was very similar to the effect during the rest of

the year. The paragraphs below set out the main points.

Products that did Childrenswear, Home, Loungewear and Sportswear.

well

Products that did Adult clothing for work, parties, events and

badly going out.

Returns rates Returns rates continued to be much lower than

last year (21% compared to 36% last year).

Of the 15% movement, 10% came from the change

in product mix (i.e. the categories that did

well have lower returns rates than those that

did badly). The remaining 5% fall came from

customers being more selective when placing

their initial order.

Retail Parks versus Stores located in out of town Retail Parks

other stores continued to perform around 15% better than

those in city centres and shopping centres.

Online Customers

Total Customers

The number of active customers has grown significantly during

the year and, as at 26 December, our Online customer base was up

24% on last year. The growth was driven by new UK and Overseas cash

customers. Cash customers are customers who do not use a NEXT

credit account.

Active customers as at 26 December

(m) 26 Dec 2020 26 Dec 2019 Var %

=================================== =========== =========== ======

UK credit 2.71 2.65 +2.2%

UK cash 3.58 2.40 +49.3%

=========== =========== ======

Total UK 6.29 5.05 +24.6%

Overseas (all overseas accounts

are cash) 1.91 1.56 +22.4%

=========== =========== ======

Total 8.20 6.61 +24.1%

Credit Customers

We experienced a steep reduction in the number of credit

customers during the first lockdown as a result of (1) the two week

closure of our website, (2) a change in product mix towards

categories that attract lower levels of credit usage and (3)

reduced Sale activity. During the second half, credit customers

recovered and the total number is now slightly ahead of last year

at +2%. The graph below shows the change in credit customer numbers

by month along with the growth of the credit customer base versus

last year (red line, right hand axis).

Click or paste the following link into your web browser to view

the graph titled 'Credit Customer Changes by Month'. Refer to page

3 for this graph.

http://www.rns-pdf.londonstockexchange.com/rns/5226K_1-2021-1-4.pdf

Interest Income, Credit Sales, Payment Rates and Receivables

Balance

Finance interest income fell by -13% in the nine weeks to 26

December, driven by lower average customer balances, which were

down -15% on the previous year. The paragraphs below explain the

changes in credit sales, payments and receivables throughout the

course of the year.

Credit The initial lockdown significantly reduced credit

sales sales but they recovered through the second half,

as shown in the following graph.

Click or paste the following link into your web browser to view

the graph titled 'Credit Sales versus last year'. Refer to page 4

for this graph.

http://www.rns-pdf.londonstockexchange.com/rns/5226K_1-2021-1-4.pdf

Payments Payment rates reduced during the first lockdown but

recovered by June and have remained significantly

ahead of last year throughout the second half. The

following graph shows the change in monthly customer

payments as a proportion of their outstanding balances,

versus the previous year(2) . For example, in December

last year customers paid off 12.2% of their balance,

this year they paid 15.5%, so the proportion of balance

paid increased by +28%.

Click or paste the following link into your web browser to view

the graph titled 'Payments as a % of balance versus last year'.

Refer to page 4 for this chart.

http://www.rns-pdf.londonstockexchange.com/rns/5226K_1-2021-1-4.pdf

Receivable Receivable balances fell significantly in the first

balances half as credit sales declined. In the second half,

the effect of increasing credit sales was partially

offset by increasing payment rates.

Click or paste the following link into your web browser to view

the chart titled 'Receivable balances'. Refer to page 4 for this

graph.

http://www.rns-pdf.londonstockexchange.com/rns/5226K_1-2021-1-4.pdf

Default Default rates continue to remain below last year

rates and as yet, we have not seen any deterioration in

the quality of our consumer debt. However, with current

levels of economic uncertainty, we are maintaining

the additional GBP20m bad debt provision that we

charged in the first half.

(2) In calculating this measure we compare payments as a

percentage of the opening receivables balance.

End of Season Sale

Stock was well managed and surplus stock going into our

end-of-season Sale was down -12% on last year. We expect clearance

rates to be down -4.8%, in line with the guidance we gave in

October, which anticipated lower footfall in our Retail Sale.

The closure of around 50% (by sales value) of our Retail stores

limited our capacity to clear Sale stock in our traditional Boxing

Day Retail Sale. To mitigate these closures, we significantly

increased the amount of Retail Sale stock available to order in our

Online Sale. We now estimate that we will clear around 25% of our

Retail Sale stock through Online sales. However, the cost of

clearing stock will be GBP5m higher than anticipated as the

marginal cost of clearing stock Online is higher than in Retail

stores.

FULL PRICE SALES, PROFIT AND CASH GUIDANCE FOR THE CURRENT

FINANCIAL YEAR

Profit gained from the overperformance in November and December

has been almost entirely offset by:

-- The anticipated loss of full price Retail sales in January

due to the lockdown closure of 90% of our stores (by value).

-- The additional costs we have incurred clearing more of our

Retail end-of-season Sale stock Online.

For the purposes of this estimate we have assumed that 50% of

the lost Retail sales in January are recouped Online. This would

result in total full price sales in January being down -14%. We now

expect total full price sales (including interest income), for the

full year (2020/21), to be down -16%.

There are two additional non-recurring items that need to be

accounted for. This year is a 53-week year which will add an

estimated GBP12m to profit. In addition, we have decided to take

further property provisions of GBP40m (see explanatory paragraph

below). So overall our new central guidance for full year profit

before tax is GBP342m.

The table below walks profit forward from our October central

scenario and demonstrates how we have arrived at our latest

guidance.

Full year estimate to January 2021 Profit walk forward

================================================== ===================

Previous guidance given in October central

scenario GBP365m

Additional profit from full price sales beat

(-1% vs -8%) +GBP28m

===================

Profit before tax before effects of post-Christmas

lockdown GBP393m

Additional costs of end-of-season Sale - GBP5m

Loss of profit from lost January sales - GBP18m

===================

52-week profit before tax GBP370m

Profit from 53rd week +GBP12m

Estimated increase in Retail property provisions - GBP40m

===================

53-week profit before tax GBP342m

===================

Reduction in year end net debt GBP487m

Year end net debt GBP625m

===================

Estimated Increase in Retail Property Provisions

We have reviewed the level of provisions that we hold for store

impairment and onerous leases. In previous years, we assumed that

store sales would decline for one more year and remain flat

thereafter. We now believe this is overly optimistic and we are

forecasting annual like-for-like sales declines for the foreseeable

future. So we are now providing for store-level losses in shops

that we believe will become unprofitable at any point up to the end

of their leases.

Subject to final confirmation with our auditors, we estimate

that our property provisions will increase by circa GBP40m compared

with our October central scenario. This will bring our total

property provisions in the year to just under GBP100m. This

provision will be a non-recurring, non-cash cost. For the full

effect of all non-recurring costs in the year please see Appendix

1.

OUTLOOK FOR SALES AND PROFIT IN THE YEAR AHEAD

The continued uncertainty caused by the COVID pandemic, and its

potential economic impact, mean that it is harder than ever to

predict sales and profits for the year ahead. So the guidance

ranges we are giving for the coming year are wider than usual, but

at least give shareholders an understanding of how the profits of

the business would respond to different levels of sales growth.

In addition to the closure of shops, the pandemic has adversely

affected the flow of container traffic from the Far East. At

present many of our deliveries are running two to three weeks late

and we expect this level of disruption to continue into the new

year. Our stock levels are currently down

-10% versus two years ago (January 2019). We expect stock levels

to steadily improve and return to more normal levels by the end of

March.

Full Price Sales and Profit Guidance for the Year Ahead

The table below sets out three full price sales and profit

scenarios for the year ahead. The central scenario assumes that all

our stores will remain closed for the first eight weeks of the

financial year (i.e. until the last week of March). We have assumed

that 50% of the lost Retail sales will be recouped Online. Within

our central scenario, we believe that the loss of sales from the

closure of stores in February and March (net of the gain in our

Online business) will reduce profit by around GBP40m.

Please note that next year's guidance is given relative to two

years ago (2019/20), providing a more meaningful comparison than

the current, COVID stricken, financial year.

Upside Central scenario Downside

Versus year ended Sales exceed our Some disruption Significant disruption

January 2020 expectations throughout in the 1st half, in 1st half and

the year recovering in subdued sales

the 2nd half throughout the

year

==================== ========================== =================== =========================

First half sales +2% - 3% - 7%

Second half sales +6% +3% +0%

========================== =================== =========================

Full year sales +4% + 0% - 3.5%

Profit before

tax GBP735m GBP670m GBP600m

BREXIT

We have not experienced any disruption as a result of Brexit and

all our new systems required for Brexit have been implemented and

are now operational. We do not anticipate that Brexit will have a

material impact on our ability to import and export stock in the

year ahead.

Following the announcement of the free trade deal between the UK

and EU, we do not anticipate any increase in customs duty costs in

the year ahead.

FULL YEAR RESULTS ANNOUNCEMENT

We are scheduled to announce our results for the full year

ending January 2021 on Thursday 1 April 2021.

Forward Looking Statements

Certain statements in this Trading Update are forward looking

statements. These statements may contain the words "anticipate",

"believe", "intend", "aim", "expects", "will", or words of similar

meaning. By their nature, forward looking statements involve risks,

uncertainties or assumptions that could cause actual results or

events to differ materially from those expressed or implied by

those statements. As such, undue reliance should not be placed on

forward looking statements. Except as required by applicable law or

regulation, NEXT plc disclaims any obligation or undertaking to

update these statements to reflect events occurring after the date

these statements were published.

Appendix 1: Non-Recurring Profit and Loss Items

In the table below we have set out the significant,

non-recurring profit and loss items that are included within this

year's profit forecast.

In total, on a 52-week basis, non-recurring items are expected

to reduce profit by -GBP22m. After accounting for the additional

profit generated from the 53rd week, profit is expected to reduce

by -GBP10m.

Full year profit impact GBPm (e) New central guidance

============================================= ====================

Business rates reduction +80

Property profit from the sale and leaseback

of properties +44

====================

Subtotal: Benefits to profit +124

Property provisions for store impairment

and onerous leases - 97

Stock and fabric provisions - 29

Bad debt provisions - 20

====================

Subtotal: Costs to profit - 146

====================

Total profit impact from non-recurring items

(52 weeks) - 22

Profit from 53rd week +12

====================

Total profit impact from non-recurring items

(53 weeks) - 10

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDBGDBBBGDGBS

(END) Dow Jones Newswires

January 05, 2021 02:00 ET (07:00 GMT)

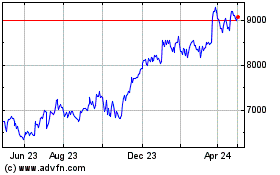

Next (LSE:NXT)

Historical Stock Chart

From Mar 2024 to Apr 2024

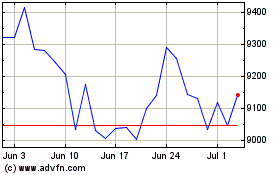

Next (LSE:NXT)

Historical Stock Chart

From Apr 2023 to Apr 2024