TIDMNXT

RNS Number : 6318J

Next PLC

14 April 2020

Contacts: Alistair Mackinnon-Musson

Rowbell PR

Email: next@rowbellpr.com Tel: 020 7717 5239

Photographs: Photographs available at:

http://press.next.co.uk/media/company-images/campaignimages.aspx

Next plc

Annual Financial Report for year ended January 2020

including the Notice of Annual General Meeting ("AGM") -

convened for

14 May 2020

The Company announces that the Annual Financial Report for the

year ended January 2020 is today being posted or otherwise made

available to shareholders and published on its website,

www.nextplc.co.uk .

In accordance with Listing Rule 9.6.1 a copy of this Report

together with a Form of Proxy for the 2020 Annual General Meeting

has been uploaded to the National Storage Mechanism and will be

available for viewing shortly at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

Update subsequent to the signing of the Annual Financial

Report

Since the Board approved the Annual Financial Report, the scale

of the Coronavirus pandemic and its impact on the business has

become clearer. During this challenging period, all directors have

agreed to waive 20% of their salaries and fees. In addition, the

payment to the executive directors of bonuses due for performance

in respect of 2019/20 will be deferred for the period of the crisis

.

AGM

The Company has been closely monitoring developments relating to

the Coronavirus pandemic, including the related public health

guidance and legislation issued by the UK Government. At the time

of writing, the UK Government has prohibited public gatherings of

more than two people and non-essential travel, save in certain

limited circumstances.

In light of these measures, the 2020 AGM will be run as a closed

meeting and shareholders will not be able to attend in person. The

Company will make arrangements such that the legal requirements to

hold the meeting can be satisfied through the attendance of a

minimum number of people and the format of the meeting will be

purely functional.

Shareholders are therefore strongly encouraged to submit a proxy

vote in advance of the meeting. Shareholders are encouraged to

appoint the Chairman of the Meeting as their proxy rather than a

named person who will not be permitted to attend the meeting.

This situation is constantly evolving, and the UK Government may

change current restrictions or implement further measures relating

to the holding of general meetings during the affected period. Any

changes to the AGM (including any change to the location of the

AGM) will be communicated to shareholders before the meeting

through our website at

nextplc.co.uk/investors/shareholder-information/company-meetings

and, where appropriate, by RIS announcement.

S L Anderson

Company Secretary

Next plc

The Appendix to this announcement is a supplement to our

preliminary statement of financial results made on 19 March 2020

(the "Final Results Announcement"). It contains the information

required pursuant to DTR 6.3.5 that is in addition to the

information communicated in the Final Results Announcement, and

should be read together with the Final Results Announcement.

APPIX

The Chief Executive's Review in the preliminary statement of the

Financial Results Announcement issued on 19 March 2020 includes a

commentary on the primary uncertainties affecting the Group's

businesses for 2020/21.

Further details of other key risks and uncertainties relating to

NEXT group are set out on pages 59 to 64 of the 2020 Annual Report.

The directors' responsibilities statement can be found on page 82

of the 2020 Annual Report. The following is extracted in full

unedited text from the 2020 Annual Report. Accordingly, page

references in the text below refer to page numbers in the 2020

Annual Report.

Risk trend: Limited increase Unchanged

Principal risk and description

Business strategy development and How we manage or mitigate the risk

implementation * The Board reviews business strategy on a regular

If the Board adopts the wrong business basis to determine how sales and profit can be

strategy or does not implement its maximised, and business operations made more

strategies effectively, our business efficient

may suffer. The Board therefore

needs to understand and properly

manage strategic risk, taking into * The Chief Executive provides regular updates at Board

account specific retail sector risk meetings regarding key opportunities and progress of

factors, in order to deliver long major initiatives.

term growth for the benefit of NEXT's

stakeholders.

* Our International Online business and our third-party

label business provide geographic and product

diversity

* Our disciplined approach to sales, budgeting,

investment returns and cost control ensures the

Company continues to generate strong profits and cash

flows

* The Board and senior management consider strategic

risk factors, wider economic and industry specific

trends that affect the Group's businesses, the

competitive position of its product and the financial

structure of the Group

* A detailed plan to manage the business going forward

and its longer term direction of travel exists and is

clearly articulated to our stakeholders in our annual

and half yearly reports

* Longer term financial scenarios for our Retail

business have been prepared and stress tested. This

process provides a mechanism for ensuring that

business profitability is maximised through efficient

allocation of resources and management of costs

------------------------------------------------------------------------

Product design and selection How we manage or mitigate the risk

* Executive directors and senior management continually

Our success depends on designing review the design, selection and performance of NEXT

and selecting products that customers product ranges and those of other brands sold by

want to buy, at appropriate price NEXT. To some extent, product risk is mitigated by

points and stocked in the right the diversity of our ranges and our third-party label

quantities. product ranges

In the short term, a failure to

manage this risk may result in surplus * Executive directors and senior management regularly

stocks that cannot be sold and may review product range trends to assess and correct any

have to be disposed of at a loss. key selection or product issues. Corrections to

significant missed trends or poorer performing ranges

Over the longer term a failure to are targeted for amendment, with alternative products

meet the design, quality and value being sourced within six months where necessary

expectations of our customers will

adversely affect the reputation

of the NEXT Brand. * Senior product management approves quality standards,

with in-house quality control and testing teams in

place across all product areas

* Senior management regularly reviews product recalls

and product safety related issues

------------------------------------------------------------------------

Key suppliers and supply chain How we manage or mitigate the risk

management * Stock availability is reviewed on an ongoing basis

and appropriate action taken where service or

Reliance on our supplier base to delivery to customers may be negatively impacted

deliver products on time and to

quality standards is essential.

Failure to do so may result in an * Management continually seeks ways to develop our

inability to service customer demand supplier base to reduce over-reliance on individual

or adversely affect NEXT's reputation. suppliers and to maintain the quality and

competitiveness of our offer. The Group's supplier

Changes in global manufacturing risk assessment procedures establish contingency

capacity and costs may impact on plans in the event of key supplier failure

profit margins.

Non-compliance by suppliers with * Existing and new sources of product supply are

the NEXT Code of Practice may increase developed in conjunction with NEXT Sourcing, external

reputational risk or undermine our agents and/or direct suppliers

reputation as a responsible retailer.

* Our in-house global Code of Practice team carry out

regular audits of our product-related suppliers'

operations to ensure compliance with the standards

set out in our Code. These standards cover supplier

production methods, employee working conditions,

quality control and inspection processes. Further

details are set out on page 67

* We train relevant employees and communicate with

suppliers regarding our expectations in relation to

responsible sourcing, anti-bribery, human rights and

modern slavery

* The Audit Committee receives Code of Practice and

modern slavery updates from senior management during

the year

* The Audit Committee receives modern slavery and

anti-bribery training progress updates together with

whistleblowing reports at each meeting. Significant

matters are reported to the Board

------------------------------------------------------------------------

Warehousing distribution How we manage or mitigate the risk

* Planning processes are in place to ensure there is

Our warehousing and distribution sufficient warehouse handling capacity for expected

operations provide fundamental support future business volumes over the short and longer

to the running of the business. terms

Risks include business interruption

due to physical damage, access

restrictions, * Service levels, warehouse handling, inbound logistics

breakdowns, capacity and resourcing and delivery costs are continually monitored to

shortages, IT systems failure, ensure goods are delivered to our warehouses, Retail

inefficient stores and Online customers in a timely and

and slow processes and third-party cost-efficient manner

failures.

Increasing choice in the products * Our Warehouse Leadership Team meets regularly to

NEXT sells has been central to the assess the opportunities and risks in our warehouse

development of our Online Platform and logistics network

but the proliferation of unique

items has presented our warehouse

operation with significant challenges. * Business continuity plans and insurance are in place

to mitigate the impact of business interruption

* The Board has approved and keeps under regular review

a

warehouse investment proposal to accommodate

further Online growth and transfer

in customer demand from Retail to

Online (see page 20 for further details)

* During the year, the Audit Committee requested and

received updates of key warehouse fire risks and

mitigation plans from our Warehousing and Logistics

directors. Following a detailed review of the risk of

business interruption arising from a catastrophic

event in one of our key warehouses, the Board

approved an increase in the value of risk covered by

insurance

------------------------------------------------------------------------

Customer-facing systems How we manage or mitigate the risk

* Continued investment in technology which supports the

NEXT's performance depends on the various component parts of the NEXT Online Platform

recruitment and retention of customers,

and on its ability to drive and

service customer demand. This includes * Continual development and monitoring of performance

having an attractive, functional of NEXT's UK and overseas websites, with a particular

and reliable website, a well organised focus on improving the online customer experience

and attractive store environment,

effective call centres, operating

successful marketing strategies, * A range of key trade and operational meetings keep

and providing both Retail and Online under review the performance, evolution, risks and

customers with service levels that opportunities of the NEXT customer facing systems.

meet or exceed their expectations. Executive directors are in attendance at each of

these key meetings

* Market research and customer feedback is used to

assess customer opinions and satisfaction levels to

help to ensure that we remain focused on delivering

excellent customer service

* Ongoing monitoring of KPIs and feedback from website

and call centre support operations

------------------------------------------------------------------------

Management of long term liabilities How we manage or mitigate the risk

and capital expenditure * Our predominantly leased store portfolio is actively

managed by senior management, with openings, refits

Poor management of NEXT's longer and closures based on strict store profitability and

term liabilities and capital expenditure cash payback criteria

could jeopardise the long term

sustainability

of the business. It is important * We undertake regular reviews of lease expiry and

to ensure that the business continues break clauses to identify opportunities for exit or

to be responsive and flexible to renegotiation of commitments. Leases will not be

meet the challenges of a rapidly automatically renewed if acceptable terms are not

changing Retail sector. agreed

* The Board regularly reviews our lease commitments,

new store openings and potential store closures

* We ensure that we make healthy returns on capital

employed, commensurate with the risks involved in our

sector (in practical terms this means a return of no

less than 15% on capital invested).

* Appropriate amortisation accounting policies reduce

the risk of unexpected significant write-off

------------------------------------------------------------------------

Information security, business continuity How we manage or mitigate the risk

and cyber risk * We operate an Information Security and Data

Protection Steering Committee. Its main activities

The continued availability and integrity include agreement and monitoring of related key risks,

of our IT systems is critical to activities and incidents. The Committee comprises two

successful trading. Our systems executive directors and relevant senior management

must record and process substantial

volumes of data and conduct inventory

management accurately and quickly. * Significant investment in systems' development and

Continuous enhancement and investment security programmes has continued during the year,

is required to prevent obsolescence complemented by in- house dedicated information and

and maintain responsiveness. physical security resources

The threat of unauthorised or malicious

attack is an ongoing risk, the nature * Systems vulnerability and penetration testing is

of which is constantly evolving carried out regularly by both internal and external

and becoming increasingly sophisticated. resources to ensure that data is protected from

Our brand reputation could be negatively corruption or unauthorised access or use

impacted by cyber security breaches.

The Group could inadvertently process * Critical systems backup facilities and business

customer or employee data in a manner continuity plans are reviewed and updated regularly

deemed unethical or unlawful, resulting

in significant financial penalties,

remediation costs, reputational * Major incident simulations and business continuity

damage and/or restrictions on our tests are carried out periodically

ability to operate. This is against

a backdrop of:

The changing attitude of UK consumers * IT risks are managed through the application of

toward their data and how it is internal policies and change management procedures,

used imposing contractual security requirements and

Increasingly complex and fast-evolving service level agreements on third-party suppliers,

data protection law and regulation and IT capacity management

Rapid technological advances delivering

an enhanced ability to gather, draw

insight from and monetise personal * All staff and contractors are required to read,

data accept and comply with the Group's data protection

and information security policies, which are kept

under regular review and supported by training

* Information security and data protection risk

exposure was reviewed during the year by both the

Audit Committee and the Board, target risk appetites

were agreed and the controls necessary to achieve

target were documented. A roadmap was prepared and

approved to address gaps between current and target

risk exposures

------------------------------------------------------------------------

Financial, treasury, liquidity and How we manage or mitigate the risk

credit risks * NEXT operates a centralised treasury function which

is responsible for managing liquidity, interest and

NEXT's ability to meet its financial foreign currency risks. It operates under a Board

obligations and to support the operations approved Treasury policy. Approved counterparty and

of the business is dependent on other limits are in place to mitigate NEXT's exposure

having sufficient funding over the to counterparty failure. Further details of the

short, medium and long term. Group's treasury operations are given in Note 28 to

the financial statements

NEXT is reliant on the availability

of adequate financing from banks

and capital markets to meet its * The Group's debt position, available funding and cash

liquidity needs. flow projections are regularly monitored and reported

to the Board. The Board will agree funding for the

NEXT is exposed to foreign exchange Group in advance of its requirement to mitigate

risk and profits may be adversely exposure to illiquid market conditions

affected by unforeseen moves in

foreign exchange rates.

* NEXT has a Treasury Committee which includes the

NEXT might suffer financial loss Group Finance Director. The Treasury Committee

if a counterparty with which it usually meets weekly to review the Group's treasury

has transacted fails and is unable and liquidity risks including foreign exchange

to fulfil its contract. exposures

NEXT is also exposed to credit risk,

particularly in respect of our Online * Rigorous procedures are in place with regards to our

customer receivables, which at GBP1.4bn credit account customers, including the use of

represents the largest item on the external credit reference agencies and applying set

Group Balance Sheet. risk criteria before acceptance. These procedures are

regularly reviewed and updated

* Continual monitoring of our credit customers' payment

behaviours and credit take up levels is in place

* The Board and Audit Committee receives regular

updates throughout the year regarding the customer

credit business

------------------------------------------------------------------------

Regulatory compliance in relation How we manage or mitigate the risk

to our consumer credit business * Policies and training are in place for those

employees and contractors working in the business

Failure to continuously adapt to areas that are subject to financial regulation. These

the increasingly broad, stringent are kept under review and updated.

and fast-evolving regulatory framework

applicable to the operation of the

Group's customer credit business * A dedicated financial regulatory compliance and

could result in significant financial quality assurance team monitors compliance and any

penalties and remediation costs, changing requirements, working with external advisers

reputational damage and/ or restrictions as required.

on our ability to operate.

* NEXT has identified a set of Conduct and Compliance

risks, documented in an operational risk register,

with owners and associated controls.

* Key risk and control performance indicators are

managed through a series of operational meetings and

reported quarterly to the Retail Credit Board.

------------------------------------------------------------------------

Directors' Responsibilities statement

Directors' Responsibilities

The directors are responsible for preparing the Annual Report

and the financial statements in accordance with applicable law and

regulation.

Company law requires the directors to prepare financial

statements for each financial 52 week period. Under that law the

directors have prepared the Group financial statements in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the European Union and Parent Company financial

statements in accordance with United Kingdom Generally Accepted

Accounting Practice (United Kingdom Accounting Standards,

comprising FRS 101 "Reduced Disclosure Framework", and applicable

law).

Under company law the directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Group and Parent Company and of

the profit or loss of the Group and Parent Company for that period.

In preparing the financial statements, the directors are required

to:

-- select suitable accounting policies and then apply them

consistently

-- state whether applicable IFRSs as adopted by the European

Union have been followed for the group financial statements and

United Kingdom Accounting Standards, comprising FRS 101, have been

followed for the Company financial statements, subject to any

material departures disclosed and explained in the financial

statements

-- make judgements and accounting estimates that are reasonable

and prudent and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Group and Parent

Company will continue in business.

The directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Group and

Parent Company's transactions and disclose with reasonable accuracy

at any time the financial position of the Group and Parent Company

and enable them to ensure that the financial statements and the

Directors' Remuneration Report comply with the Companies Act 2006

and, as regards the Group financial statements, Article 4 of the

IAS Regulation.

The directors are also responsible for safeguarding the assets

of the Group and Parent Company and hence for taking reasonable

steps for

the prevention and detection of fraud and other

irregularities.

Legislation in the United Kingdom governing the preparation and

dissemination of financial statements may differ from legislation

in other jurisdictions.

Directors' confirmations

The directors consider that the Annual Report and Accounts,

taken as a whole, is fair, balanced and understandable and provides

the

information necessary for shareholders to assess the Group and

Parent Company's position and performance, business model and

strategy.

Each of the directors, whose names and functions are listed on

pages 80 and 81, confirm that to the best of their knowledge:

-- the Parent Company financial statements, which have been

prepared in accordance with United Kingdom Generally Accepted

Accounting Practice (United Kingdom Accounting Standards,

comprising FRS 101 "Reduced Disclosure Framework", and applicable

law), give a true and fair view of the assets, liabilities,

financial position and profit of the company

-- the Group financial statements, which have been prepared in

accordance with IFRSs as adopted by the European Union, give a true

and fair view of the assets, liabilities, financial position and

profit of the group and

-- the Strategic Report includes a fair review of the

development and performance of the business and the position of the

Group and Parent Company, together with a description of the

principal risks and uncertainties that it faces.

On behalf of the Board

Lord Wolfson of Aspley Amanda James

Guise Group Finance Director

Chief Executive

14 April 2020

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACSUSOVRRUUSAAR

(END) Dow Jones Newswires

April 14, 2020 11:40 ET (15:40 GMT)

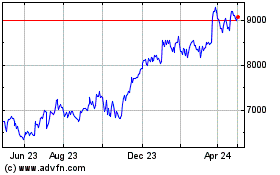

Next (LSE:NXT)

Historical Stock Chart

From Mar 2024 to Apr 2024

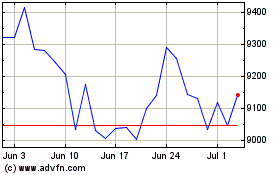

Next (LSE:NXT)

Historical Stock Chart

From Apr 2023 to Apr 2024