TIDMNTOG

RNS Number : 1878J

Nostra Terra Oil & Gas Company PLC

08 April 2020

8 April 2020

Nostra Terra Oil and Gas Company plc

("Nostra Terra" or the "Company")

Fundraise and Appointment of Joint Broker

Partial Loan Conversion

Corporate Update

Related Party Transactions

Nostra Terra (AIM: NTOG), the oil & gas exploration and

production company with a portfolio of development and production

assets in Texas, USA, is pleased to announce that it has raised

GBP318,055 (the "Fundraise"), before expenses, in order to

strengthen its balance sheet and position the Company for potential

further growth in 2020 despite challenging market conditions.

Highlights:

-- GBP318,055, before expenses, raised via a Placing and Subscription

o Directors have participated in the Subscription, amounting to,

in aggregate, GBP90,000

-- Fundraise completed to strengthen the Company's balance sheet

-- Portfolio of conventional oil assets with relatively low operating cost

-- Significant reduction in CEO's remuneration

-- Additional reductions in overheads being implemented, with cost review ongoing

-- Reduction in corporate debt pursuant to the Partial Loan Conversion

-- Novum appointed as joint broker

Fundraise

The Company has raised, in aggregate, GBP 318,055 , before

expenses, by way of a placing of 20,000,000 new ordinary shares

(the "Placing Shares") (the "Placing") and a subscription of

107,222,000 new ordinary shares (the "Subscription Shares") (the

"Subscription") at a price of 0.25 pence per share (the "Issue

Price"). The net proceeds of the Fundraise will be utilised to

further the Company's strategy and for general short to medium term

working capital purposes. Further fundraises are likely to be

necessary thereafter.

The Issue Price represents a discount of approximately 47% to

the closing middle market price of the Company's ordinary shares on

AIM of 0.47 pence on 7 April 2020, being the latest practicable

date prior to this announcement. The Placing Shares and

Subscription Shares (together, the "Fundraise Shares") represent

approximately 64% of the Company's issued share capital.

The Placing was conducted by Novum Securities Limited ("Novum")

acting as agent for the Company. Novum has been appointed as a

joint broker to the Company with immediate effect.

Issue of Warrants

Participants in the Fundraise will be issued with one warrant

for every two Fundraise Shares subscribed for (the "Warrants"),

resulting in the issue of 63,611,000 Warrants. The Warrants will be

exercisable for a period of two years at a price of 0.60 pence per

share, which equates to a premium of 140% to the Issue Price.

In addition, Novum will be issued with 10,000,000 Warrants in

connection with its services to the Company both with regard to the

Placing and acting as joint broker.

The Company does not currently have the requisite share

authorities to issue new ordinary shares in connection with the

potential future exercise of Warrants. Therefore, the issue of the

Warrants is conditional on shareholder approval at a duly convened

general meeting. Further announcements in this regard will be made

in due course. The receipt of the proceeds from the Fundraise is

conditional only on admission of the Fundraise Shares and the Fee

Shares to trading on AIM.

Directors' Participation in the Subscription

Matthew Lofgran and Stephen Staley, CEO and Non-Executive

Chairman of the Company respectively, have subscribed for

32,000,000 and 4,000,000 Subscription Shares respectively,

amounting to subscriptions of GBP80,000 and GBP10,000 respectively

(the "Directors' Subscriptions"). Accordingly, 16,000,000 Warrants

and 2,000,000 Warrants will be issued to Mr Lofgran and Mr Staley

respectively (the "Director Warrants").

On completion of the Fundraise, Messrs Lofgran and Staley will

be interested in 38,525,976 ordinary shares and 4,000,000 ordinary

shares respectively, representing 10.8% and 1.1% of the Company's

then enlarged issued share capital.

In addition, Ewen Ainsworth, a former Director of Nostra Terra,

has subscribed for 5,000,000 Subscription Shares. As such, Mr

Ainsworth will be issued with 2,500,000 Warrants.

Issue of Fee Shares

8,000,000 new ordinary shares have been issued to Novum as part

of its advisory fees in connection with the Placing and acting as

joint broker to the Company (the "Fee Shares").

Partial Loan Conversion

The Company is also pleased to announce that Discovery Energy

Limited ("Discovery") (a company controlled by Ewen Ainsworth) has

agreed to convert GBP57,500 of the outstanding loan owed to

Discovery (the "Discovery Loan") by the Company into 23,000,000 new

ordinary shares at the Issue Price (the "Conversion Shares") (the

"Partial Loan Conversion"). Following the Partial Loan Conversion,

GBP229,811, being principal and interest, remains outstanding under

the Discovery Loan. The Company is in constructive dialogue with Mr

Ainsworth with regard to restructuring the remaining amounts

outstanding, particularly in the context of the challenging

operating environment.

Corporate Update

At the beginning of the year, the Board designed a 'Low Cost,

High Impact' work plan for 2020, focusing on growing production,

primarily from existing assets, while still seeking additional

opportunities that could be transformational for the Company.

Included in these plans for the year were planned reductions in

overhead costs.

During the oil price volatility of 2015/2016, the Company

repositioned its portfolio for a lower oil price environment and,

in 2017, took the prudent step to begin hedging a significant part

of its production. Low cost production from conventional reservoirs

form the basis of Nostra Terra's cashflow and this is protected by

recently negotiated hedges guaranteeing approximately US$56/bbl for

around half of the Company's production (as announced on 1 April

2020), which provides a level of support in the current depressed

oil price environment.

In the last month, following the significant drop in oil prices

and the severe economic downturn caused by the spread of the

coronavirus, the Board began prioritising certain, highly targeted

work necessary to ensure maintenance of low cost production and the

safety and regulatory requirements of the leases, subject to

satisfying applicable regulations with regard to operating in the

current coronavirus environment. Accordingly, further investment by

the Company into its portfolio will be very limited until such time

that the oil price strengthens.

The goals for the Company at this time are as follows:

1. To carefully manage existing assets and restrict work to that

which improves the economics of each project in the light of the

changing oil price environment.

2. To maintain low overheads and seek to reduce them further.

3. To expand the portfolio, seeking the right opportunities to

grow the asset base, including significant transactions.

Existing Assets

The Company has identified multiple areas across its entire

portfolio to increase production. As mentioned earlier, given the

lower oil price environment, the Company is being very selective on

the work done in order to preserve capital.

Nostra Terra has received multiple unsolicited approaches

regarding additional opportunities around Pine Mills (outside of

the Company's existing production, but acreage which the Company

owns) and the Company is pleased to report that it is in advanced

discussions with an operator regarding a potential farm-in for a

portion of this Pine Mills area acreage, wherein a well would be

drilled at no cost to Nostra Terra and the Company would retain a

carried working interest.

A successful outcome from the potential farm-in partner drilling

this well could provide a further significant increase in

production in addition to the existing Pine Mills production. It

could also open up and de-risk multiple additional well locations

in the Pine Mills acreage to further drilling.

Cost Reductions

Matt Lofgran has agreed to a 60% decrease in annual salary until

such time that the Company completes its next sizeable fundraise.

The Directors of the Company (excluding Mr Lofgran) will have

discretion over whether a fundraise is of sufficient size, at which

point Mr Lofgran's salary will increase to 76% of its original

amount. In addition, at such time of the relevant sizeable

fundraise, the Company will settle the difference between Mr

Lofgran's reduced salary and his increased salary on a monthly pro

rata basis, with the first three months satisfied by the issue of

new ordinary shares at the price associated with such fundraise and

the balance settled in cash. These arrangements together being

defined as the "CEO's Remuneration Arrangements".

In addition, the Non-Executive Directors are currently putting

in place an executive Long Term Incentive Plan that will better

align Mr Lofgran's remuneration with growth in value for

shareholders. A further announcement in this regard will be made in

due course.

Moreover, the Non-Executive Directors of the Company, being

Stephen Staley and John Stafford, intend to accept short term

reductions to their remuneration arrangements and a further

announcement in relation to this will be made in due course.

Additional reductions have been made in overheads, with review

ongoing as the Directors identify additional savings.

Potential Acquisitions

The Board continues to seek additional assets to expand the

Company's portfolio, with the aim of adding to production, thereby

increasing revenue and net cash flow, and increasing the Company's

oil reserves, whilst also diversifying the portfolio. The Board has

a wide range of exploration and operational experience in diverse

areas around the world, and as such a number of potentially

transformative opportunities are under consideration both inside

and outside the USA. The current low oil price environment may

provide opportunities for acquisitions at attractive

valuations.

Related Party Transactions

Matt Lofgran and Steve Staley, as Directors of the Company, and

Ewen Ainsworth, as a Director of the Company in the last 12 months,

are considered to be related parties of the Company under the AIM

Rules for Companies ("AIM Rules"). Accordingly, the CEO's

Remuneration Arrangements, the Directors' Subscriptions and the

issue of the Director Warrants, and the issue of the Conversion

Shares, Subscription Shares and Warrants to Mr Ainsworth are

considered to be related party transactions pursuant to Rule 13 of

the AIM Rules. John Stafford, independent Director, having

consulted with the Company's Nominated Adviser, Strand Hanson

Limited, considers that the terms of the CEO's Remuneration

Arrangements, Directors' Subscriptions and the issue of the

Director Warrants, and the issue of the Conversion Shares,

Subscription Shares and Warrants to Mr Ainsworth are fair and

reasonable in so far as the Company's shareholders are

concerned.

Admission and Total Voting Rights

The Fundraise is conditional only on the admission of the

Fundraise Shares and the Fee Shares to trading on AIM

("Admission").

Application will be made for Admission of the Fundraise Shares,

Fee Shares and Conversion Shares, which is expected to occur at

8.00 a.m. on or around 20 April 2020.

Following Admission, the Company will have 356,828,226 ordinary

shares in issue, none of which will be held in treasury.

Accordingly, the total number of voting rights in the Company will

be 356,828,226 and shareholders may use this figure as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company under the FCA's Disclosure Guidance and

Transparency Rules.

Matt Lofgran , Nostra Terra's Chief Executive Officer, said:

" Considering the macroeconomic challenges we're pleased to

raise additional equity to help Nostra Terra to progress in this

adverse market. We look forward to building on the foundation in

place throughout the year.

"I also want to take the time to welcome Dr Staley as the new

Chairman of Nostra Terra. Stephen brings over 35 years of

experience from working with smaller companies such as Predator Oil

& Gas to larger companies like Conoco and Cove, the latter

where they went from early-stage to a very successful exit within a

few years. We're excited to be working with him and the leadership

he'll bring to the Board."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014

For further information, contact:

Nostra Terra Oil and Gas Company

plc

Matt Lofgran, CEO Email: +1 480 993 8933

Strand Hanson Limited

(Nominated & Financial Adviser

and Joint Broker)

Rory Murphy / Ritchie Balmer /

Jack Botros Tel: +44 (0) 20 7409 3494

Shard Capital Stockbrokers (Joint

Broker)

Damon Heath / Erik Woolgar

Novum Securities Limited (Joint Tel: +44 (0) 207 186 9952

Broker)

Jon Belliss

Tel: +44 (0) 207 399 9425

Lionsgate Communications (Public

Relations)

Jonathan Charles Tel: +44 (0) 7791 892509

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDUPUUWCUPUUQR

(END) Dow Jones Newswires

April 08, 2020 02:45 ET (06:45 GMT)

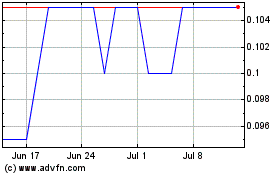

Nostra Terra Oil And Gas (LSE:NTOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nostra Terra Oil And Gas (LSE:NTOG)

Historical Stock Chart

From Apr 2023 to Apr 2024