TIDMNTBR

RNS Number : 9724G

Northern Bear Plc

12 November 2018

12 November 2018

Northern Bear plc

("Northern Bear" or the "Company")

Interim results for the six month period ended 30 September

2018

The board of directors of Northern Bear (the "Board") is pleased

to announce the unaudited interim results for the Company and its

subsidiaries (together the "Group") for the six months to 30

September 2018.

Highlights

-- Revenue of GBP28.6m (2017: GBP27.2m)

-- Operating profit of GBP1.7m (2017: GBP1.4m)

-- Profit before income tax of GBP1.6m (2017: GBP1.3m)

-- Basic earnings per share of 6.9p (2017: 5.9p)

-- Cash generated from operations of GBP2.0m (2017: GBP0.9m)

-- Net bank debt of GBP0.3 million at 30 September 2018 (31

March 2018: GBP0.8 million; 30 September 2017: GBP0.6m)

Steve Roberts, Executive Chairman of Northern Bear,

commented:

"We have had a very successful first half to the financial year,

with increased revenue, profit before tax and basic earnings per

share.

"Overall the outlook for the second half of the financial year

is currently very good and we hope to report another strong set of

full year results."

For further information please contact:

+44 (0) 166

Northern Bear plc 182 0369

Steve Roberts - Executive Chairman +44 (0) 166

Tom Hayes - Finance Director 182 0369

Strand Hanson Limited (Nominated Adviser

and Broker)

James Harris

James Spinney +44 (0) 20 7409

James Bellman 3494

CHAIRMAN'S STATEMENT

Introduction

I am pleased to report the unaudited interim results for the six

months ended 30 September 2018 (the "Period") for Northern Bear plc

(the "Company" and, together with its subsidiaries, the

"Group").

In our preliminary results for the year to 31 March 2018, we

stated that the Group continued to hold a high level of committed

orders and that trading in the new financial year had started well.

By September 2018, it was apparent that trading for the six month

period to 30 September 2018 had been particularly strong and that

results would be ahead of the prior period, and we issued a trading

update to this effect on 20 September 2018.

Further to that update, I am pleased to confirm the Group has

made further positive progress and produced excellent results for

the Period, generating retained profits of GBP1.3 million (2017:

GBP1.1 million) and basic earnings per share of 6.9p (2017:

5.9p).

Trading

Our Group companies produced outstanding results over the

Period, with continuing high levels of committed orders secured.

Performance was particularly strong in our Roofing and Specialist

Building Services divisions.

Isoler Limited, our fire protection business, secured some major

contracts and traded exceptionally well over the Period. Our

materials handling business, A1 Industrial Trucks Limited, has

found trading conditions more challenging, but we are hopeful that

recent additions to the management team will improve performance

over the second half of the year.

Revenue for the Period was GBP28.6 million (2017: GBP27.2

million) and gross margins improved to 19.7% (2017: 18.4%),

principally through careful contract selection and execution.

Administrative expenses increased to GBP3.9 million (2017:

GBP3.5 million) in order to support the higher activity levels in

the Period. As with results for the prior period, we have presented

transaction costs and amortisation separately within the income

statement, as well as an adjusted earnings per share calculation

(in the notes to this report), in order to provide an indication of

underlying trading performance.

Overall profit before income tax for the Period increased to

GBP1.6 million (2017: GBP1.3 million). We benefited from a full six

months' trading from H. Peel & Sons Limited ("H Peel") in the

Period, which accounted for GBP0.1 million of the increase, as H

Peel was acquired on 25 July 2017 during the comparative

period.

Cash flow

Net bank debt at 30 September 2018 was GBP0.3 million (30

September 2017: GBP0.6 million, 31 March 2018: GBP0.8 million).

Cash generated from operations was GBP2.0 million in the period

(2017: GBP0.9 million) although the overall cash movement was

impacted by the payment of last year's final ordinary and special

dividends, totalling GBP0.7 million (2017: GBP0.7 million), and the

payment of deferred and earn out consideration on H Peel of GBP0.3

million.

The operating cash generation in the period was outstanding,

although I would emphasise that this represents a snapshot at a

particular point in time and our net cash/bank debt position can

move by up to GBP1.5m in a matter of days given the nature, size

and variety of contracts that we work on and the related working

capital balances. For information, the lowest net bank debt

position during the period was GBPnil, the highest was GBP1.8

million, and the average was GBP0.9 million.

Balance sheet

Details of new accounting standards which are being applied for

the Group's current financial year are set out in Note 2 to this

document. As a result of new standards, we have changed the

presentation of trade and other receivables on the balance sheet at

30 September 2018 to split out contract retentions between current

assets and non-current assets based on whether balances are due in

less than or more than one year from the balance sheet date.

Contract retentions are an ongoing feature of the Group's

businesses and the industry in which they operate and are something

that we monitor closely. Retention periods are typically one year

from completion where a Group company is the main contractor on a

project and two years where it is a subcontractor.

Dividend

Our stated policy is to pay only a final dividend. Provided that

the strong trading performance and operating environment continues

for the remainder of the financial year, it is the current

intention of the Board to continue with our progressive dividend

policy.

Strategy

We continue to seek acquisitions of established specialist

building services businesses, either in the same or complementary

sectors to our current operations. Our main criteria are that a

business is well-established in its sector, has a consistent track

record of profitability and cash generation and has a strong

management team who are committed to remaining with the business.

Any potential acquisition would need to meet these criteria and, in

addition, be earnings accretive and provide an acceptable return on

investment.

Our continued preference is to source acquisitions through

direct conversations with business owners or via our industry

contacts rather than through intermediaries. We have generally

found negotiations more productive with entrepreneurs whose

priority is to secure the long-term future of their business and

employees, in addition to realising significant equity value,

rather than seeking to maximise sale value through an auction

process. We are always happy to have such conversations with

business owners and can assure complete confidentiality.

Outlook

The results for the Period were exceptionally strong and we

continue to hold a high level of committed orders. The Board

considers the outlook for trading in the second half of the year to

be very good and we hope to report another strong set of results

for the full financial year.

People

Succession planning remains an ongoing focus for us and a

programme of succession planning is in place for all of our

subsidiary businesses. We have recently included a news feed on our

website, in order to provide updates on operational progress that

would not need to be released via RNS, and any changes to

subsidiary management teams would be included there.

As always our loyal, dedicated and skilled workforce is a key

part of our success and we make every effort to support them

through continued training and health and safety compliance.

Conclusion

I am delighted to be reporting on another excellent trading

period and such an outstanding set of results. I would once more

like to thank all of our employees for their hard work and

contribution.

Steve Roberts

Executive Chairman

12 November 2018

Consolidated statement of comprehensive income

for the six month period ended 30 September 2018

6 months ended 6 months ended Year ended

30 September 30 September

2018 2017 31 March 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Revenue 28,576 27,196 53,573

Cost of sales (22,942) (22,202) (43,067)

--------------- --------------- --------------

Gross profit 5,634 4,994 10,506

Other operating income 12 13 23

Administrative expenses (3,903) (3,453) (7,459)

--------------- --------------- --------------

Operating profit (before

amortisation and transaction

costs) 1,743 1,554 3,070

Transaction costs and adjustments 23 (158) (158)

Amortisation of intangible

assets arising on acquisitions (76) (26) (102)

Operating profit 1,690 1,370 2,810

Finance costs (103) (59) (213)

--------------- --------------

Profit before income tax 1,587 1,311 2,597

Income tax expense (302) (249) (613)

--------------- --------------- --------------

Profit for the period 1,285 1,062 1,984

--------------- --------------- --------------

Total comprehensive income

attributable to equity

holders of the parent 1,285 1,062 1,984

=============== =============== ==============

Earnings per share from

continuing operations

Basic earnings per share 6.9p 5.9p 10.9p

Diluted earnings per share 6.9p 5.9p 10.8p

Consolidated statement of changes in equity

for the six month period ended 30 September 2018

Capital

Share redemption Share Merger Retained Total

capital reserve premium reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2017 184 6 5,169 9,231 5,102 19,692

Total comprehensive income

for the period

Profit for the period - - - - 1,062 1,062

Transactions with owners, recorded

directly in equity

Issue of shares 5 - - - - 5

Exercise of share options - - - - 38 38

Equity dividends paid - - - - (742) (742)

Merger reserve arising on acquisition - - - 374 - 374

--------- ------------ --------- --------- ---------- --------

At 30 September 2017 189 6 5,169 9,605 5,460 20,429

========= ============ ========= ========= ========== ========

At 1 April 2017 184 6 5,169 9,231 5,102 19,692

Total comprehensive income

for the year

Profit for the year - - - - 1,984 1,984

Transactions with owners, recorded

directly in equity

Issue of shares 5 - - - - 5

Exercise of share options - - - - 65 65

Equity dividends paid - - - - (742) (742)

Merger reserve arising on acquisition - - - 374 - 374

At 31 March 2018 189 6 5,169 9,605 6,409 21,378

========= ============ ========= ========= ========== ========

At 1 April 2018 189 6 5,169 9,605 6,409 21,378

Total comprehensive income

for the period

Profit for the period - - - - 1,285 1,285

Transactions with owners, recorded

directly in equity

Exercise of share options - - - - 14 14

Equity dividends paid - - - - (740) (740)

At 30 September 2018 189 6 5,169 9,605 6,968 21,937

========= ============ ========= ========= ========== ========

Consolidated balance sheet

at 30 September 2018

30 September 30 September 31 March

2018 2017 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Assets

Property, plant and equipment 3,122 3,007 3,050

Intangible assets 20,552 20,661 20,628

Trade and other receivables 1,420 - -

Total non-current assets 25,094 23,668 23,678

Inventories 724 1,033 952

Trade and other receivables 9,224 8,881 9,833

Prepayments 536 503 265

Cash and cash equivalents 1,746 2,923 1,731

Total current assets 12,230 13,340 12,781

------------- ------------- ---------

Total assets 37,324 37,008 36,459

============= ============= =========

Equity

Share capital 189 189 189

Capital redemption reserve 6 6 6

Share premium 5,169 5,169 5,169

Merger reserve 9,605 9,605 9,605

Retained earnings 6,968 5,460 6,409

Total equity attributable to

equity holders of the Company 21,937 20,429 21,378

============= ============= =========

Liabilities

Loans and borrowings 2,173 3,630 2,672

Deferred consideration 206 474 510

Deferred tax liabilities 316 307 316

Total non-current liabilities 2,695 4,411 3,498

------------- ------------- ---------

Loans and borrowings 194 180 227

Deferred consideration 417 365 425

Trade and other payables 11,181 10,898 10,333

Current tax payable 900 725 598

Total current liabilities 12,692 12,168 11,583

------------- ------------- ---------

Total liabilities 15,387 16,579 15,081

============= ============= =========

Total equity and liabilities 37,324 37,008 36,459

============= ============= =========

Consolidated statement of cash flows

for the six month period ended 30 September 2018

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2018 2017 2018

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Operating profit for the period 1,690 1,370 2,810

Adjustments for:

Depreciation 264 265 559

Amortisation 76 26 103

(Profit)/loss on sale of property,

plant and equipment 14 (3) (7)

Non-cash transaction adjustments (23) - -

2,021 1,658 3,465

Change in inventories 228 (70) 11

Change in trade and other

receivables (811) (52) (1,004)

Change in prepayments (271) (205) 33

Change in trade and other

payables 846 (461) (1,103)

--------------- --------------- -----------

Cash generated from operations 2,013 870 1,402

Interest received - - -

Interest paid (65) (59) (139)

Tax paid - (106) (483)

--------------- --------------- -----------

Net cash flow from operating

activities 1,948 705 780

--------------- --------------- -----------

Cash flows from investing

activities

Proceeds from sale of property,

plant and equipment 119 94 186

Acquisition of property, plant

and equipment (333) (313) (569)

Acquisition of subsidiary

(net of cash acquired) (327) (817) (866)

--------------- --------------- -----------

Net cash from investing activities (541) (1,036) (1,249)

--------------- --------------- -----------

Cash flows from financing

activities

Issue / (repayment) of borrowings (498) 1,504 511

Repayment of finance lease

liabilities (168) (129) (216)

Proceeds from the exercise

of share options 14 38 64

Equity dividends paid (740) (742) (742)

Net cash from financing activities (1,392) 671 (383)

--------------- --------------- -----------

Net increase in cash and cash

equivalents 15 340 (852)

Cash and cash equivalents

at start of period 1,731 2,583 2,583

Cash and cash equivalents

at end of period 1,746 2,923 1,731

=============== =============== ===========

1. Basis of preparation

These interim consolidated financial statements have been

prepared using accounting policies based on International Financial

Reporting Standards (IFRS and IFRIC Interpretations) issued by the

International Accounting Standards Board ("IASB") as adopted for

use in the EU. They do not include all disclosures that would

otherwise be required in a complete set of financial statements and

should be read in conjunction with the 31 March 2018 Annual Report

and Financial Statements. The financial information for the half

years ended 30 September 2018 and 30 September 2017 does not

constitute statutory accounts within the meaning of Section 434 (3)

of the Companies Act 2006 and both periods are unaudited. The

financial information has not been prepared (and is not required to

be prepared) in accordance with IAS 34 Interim Financial

Reporting.

The annual consolidated financial statements of Northern Bear

plc (the "Company", or, together with its subsidiaries, the

"Group") are prepared in accordance with IFRS as adopted by the

European Union. The comparative financial information for the year

ended 31 March 2018 included within this report does not constitute

the full statutory Annual Report for that period. The statutory

Annual Report and Financial Statements for the year ended 31 March

2018 have been filed with the Registrar of Companies. The

Independent Auditors' Report on the Annual Report and Financial

Statements for the year ended 31 March 2018 was i) unqualified, ii)

did not draw attention to any matters by way of emphasis, and iii)

and did not contain a statement under 498(2) - (3) of the Companies

Act 2006.

2. Accounting policies

The Group has applied the same accounting policies and methods

of computation in its interim consolidated financial statements as

in its 2018 annual financial statements, as set out in Notes 2 and

3 of that document, except for those that relate to new standards

and interpretations effective for the first time for periods

beginning on (or after) 1 April 2018, and will be adopted in the

2019 financial statements. The accounting policies applied are

based on the recognition and measurement principles of IFRS in

issue as adopted by the European Union (EU) and are effective at 31

March 2019 or are expected to be adopted and effective at 31 March

2019.

New standards impacting the Group that will be adopted in the

annual financial statements for the year ending 31 March 2019, and

which have given rise to changes in the Group's accounting policies

are:

-- IFRS 9 Financial Instruments; and

-- IFRS 15 Revenue from Contracts with Customers

Details of the impact of these two standards are given below.

Other new and amended standards and interpretations issued by the

IASB that will apply for the first time in the next annual

financial statements are not expected to have a material impact on

the Group.

IFRS 9 Financial Instruments

IFRS 9 has replaced IAS 39 Financial Instruments: Recognition

and Measurement, and has had an effect on the Group in the

following areas:

-- The impairment provision on financial assets measured at

amortised cost (such as trade and other receivables) have been

calculated in accordance with IFRS 9's expected credit loss model,

which differs from the incurred loss model previously required by

IAS 39. This has not resulted in a change to the impairment

provision at 1 April 2018.

IFRS 15 Revenue from Contracts with Customers

IFRS 15 has replaced IAS 18 Revenue and IAS 11 Construction

Contracts as well as various Interpretations previously issued by

the IFRS Interpretations Committee, noting the Company has adopted

the modified retrospective approach. There is no material impact on

any revenue stream for the Group, noting the following as it

relates to the Group's revenue streams from its operating segments

as set out in Note 4 of the Annual Report and Financial Statements

for the year ended 31 March 2018:

2. Accounting policies (continued)

-- Roofing activities - revenue is recognised over time based on

allocation of the customer contract price to distinct performance

obligations and recognising revenue when those performance

obligations are satisfied;

-- Building services activities - revenue is recognised over

time based on allocation of the customer contract price to distinct

performance obligations and recognising revenue when those

performance obligations are satisfied;

-- Materials handling activities

o Product sales - revenue is recognised on delivery to the

customer

o Assets leased to customers - revenue is recognised on a

straight line basis over the lease term

On application of IFRS 15 the Group has changed the basis of

presentation of its consolidated balance sheet such that contract

retentions due in more than one year are shown in non-current

assets. The amount due in more than one year is presented on an

undiscounted basis as the impact of discounting is not considered

to be material. The Group has not restated the consolidated balance

sheet at 31 March 2018 or 30 September 2017 in this report on an

equivalent basis.

The adoption of the above standards has not had a significant

impact on the Group's profit for the period or equity.

Standards and interpretations effective in subsequent financial

periods

There are a number of standards and interpretations which have

been issued by the International Accounting Standards Board that

are effective for periods beginning subsequent to 31 March 2019

(the date on which the company's next annual financial statements

will be prepared up to) that the Group has decided not to adopt

early. The most significant of these is IFRS 16 Leases (mandatorily

effective for periods beginning on or after 1 January 2019). It is

currently anticipated that substantially the whole of the Group's

leases that are currently accounted for as operating leases off the

Group's balance sheet would come on to the balance sheet with the

associated lease debt.

3. Taxation

The taxation charge for the six months ended 30 September 2018

is calculated by applying the Directors' best estimate of the

annual effective tax rate to the profit for the period.

4. Earnings per share

Basic earnings per share is the profit or loss for the period

divided by the weighted average number of ordinary shares

outstanding, excluding those held in treasury, calculated as

follows::

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2018 2017 2018

Unaudited Unaudited Audited

Profit for the period (GBP'000) 1,285 1,062 1,984

------------- ------------- -----------

Weighted average number of ordinary

shares excluding shares held

in treasury for the proportion

of the year held in treasury

('000) 18,510 17,920 18,270

Basic earnings per share 6.9p 5.9p 10.9p

------------- ------------- -----------

The calculation of diluted earnings per share is the profit or

loss for the period divided by the weighted average number of

ordinary shares outstanding, after adjustment for the effects of

all potential dilutive ordinary shares, excluding those in

treasury, calculated as follows:

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2018 2017 2018

Unaudited Unaudited Audited

Profit for the period (GBP'000) 1,285 1,062 1,984

------------- ------------- -----------

Weighted average number of

ordinary shares excluding shares

held in treasury for the proportion

of the year held in treasury

('000) 18,510 17,920 18,270

Effect of potential dilutive

ordinary shares ('000) 64 188 113

Diluted weighted average number

of ordinary shares excluding

shares held in treasury for

the proportion of the year

held in treasury ('000) 18,574 18,108 18,383

============= ============= ===========

Diluted earnings per share 6.9p 5.9p 10.8p

------------- ------------- -----------

The following additional earnings per share figures are

presented as the directors believe they provide a better

understanding of the trading performance of the Group.

Adjusted basic and diluted earnings per share is the profit for

the period, adjusted for acquisition related costs, divided by the

weighted average number of ordinary shares outstanding as presented

above.

Adjusted earnings per share is calculated as follows:

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2018 2017 2018

Unaudited Unaudited Audited

Profit for the period (GBP'000) 1,285 1,062 1,984

Transaction costs and adjustments (23) 158 158

Amortisation of intangible assets

arising on acquisitions 76 26 102

Unwinding of discount on deferred

consideration liabilities 38 - 74

Corporation tax effect of above

items - (30) (30)

------------- ------------- -----------

Adjusted profit for the period

(GBP'000) 1,376 1,216 2,288

------------- ------------- -----------

Weighted average number of ordinary

shares excluding shares held in

treasury for the proportion of

the year held in treasury ('000) 18,510 17,920 18,270

Adjusted basic earnings per

share 7.4p 6.8p 12.5p

------------- ------------- -----------

Adjusted diluted earnings per

share 7.4p 6.7p 12.4p

------------- ------------- -----------

On 25 July 2017 the Group acquired the entire issued share

capital of H Peel & Sons (Holdings) Limited and its subsidiary

H. Peel & Sons Limited.

The consideration was satisfied through a combination of cash,

equity instruments, and deferred and contingent consideration. The

amount recognised on the Group's balance sheet for deferred and

contingent consideration at the date of acquisition was based on

the discounted present value of estimated future payments to be

made.

Transaction costs and adjustments for the period ended 30

September 2018 relate to the difference between the amount provided

for deferred and contingent consideration due in the period and the

actual amount paid. In the period ended 30 September 2017

transaction costs relate to acquisition related costs incurred.

As deferred and contingent consideration is presented at

discounted present value the unwinding of this discount is recorded

in finance costs in the income statement.

5. Finance costs

6 months 6 months

ended ended Year ended

30 September 30 September 31 March

2018 2017 2018

Unaudited Unaudited Audited

On bank loans and overdrafts 60 49 128

Finance charges payable in respect

of finance leases and hire purchase

contracts 5 10 11

Unwinding of discount on deferred

consideration liabilities 38 - 74

------------- ------------- -----------

Total finance costs 103 59 213

------------- ------------- -----------

6. Principal risks and uncertainties

The directors consider that the principal risks and

uncertainties which could have a material impact on the Group's

performance in the remaining six months of the financial year

remain the same as those stated on page 7 to 10, and 60 to 64 of

our Annual Report and Financial Statements for the year ended 31

March 2018, which are available on the Company's website,

www.northernbearplc.com.

7. Half year report

The condensed financial statements were approved by the Board of

Directors on 12 November 2018 and are available on the Company's

website, www.northernbearplc.com. Copies will be sent to

shareholders and are available on application to the Company's

registered office.

For and on behalf of the Board of Directors

Thomas Hayes

Finance Director

12 November 2018

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR FKCDBFBDDNDK

(END) Dow Jones Newswires

November 12, 2018 02:00 ET (07:00 GMT)

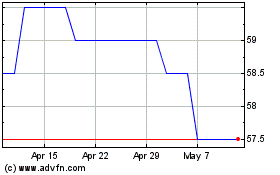

Northern Bear (LSE:NTBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Northern Bear (LSE:NTBR)

Historical Stock Chart

From Apr 2023 to Apr 2024