NB Private Equity Partners Limited Nb Private Equity: First 2019 Semi-annual Dividend And Update On Strategic Actions

January 08 2019 - 2:00AM

UK Regulatory

TIDMNBPE

THE INFORMATION CONTAINED HEREIN IS NOT FOR RELEASE, PUBLICATION OR

DISTRIBUTION IN OR INTO AUSTRALIA, CANADA, ITALY, DENMARK, JAPAN, THE

UNITED STATES, OR TO ANY NATIONAL OF SUCH JURISDICTIONS

NBPE Announces the First 2019 Semi-annual Dividend and Update on

Strategic Actions

8 January 2019

NB Private Equity Partners Limited ("NBPE" or the "Company") today

announces:

-- A first 2019 dividend of $0.28 per share

-- Entry into new share buyback agreement, to be managed by Jefferies

International

-- The sale of 14 of its legacy third-party private equity funds totalling

$19.4 million of proceeds, taking ongoing fund investments to below 5% of

private equity fair value

First 2019 Dividend

NBPE today declares its first 2019 semi-annual dividend payment on the

Company's Ordinary Shares of $0.28 per Ordinary Share, to be paid on 28

February 2019. On an annualised basis, this dividend payment represents

a dividend yield of 4.3% based on the London Stock Exchange closing

price of GBP10.20 ($12.98 at GBP/USD exchange rate of $1.273) on 4

January 2019. In line with its long term dividend policy of targeting an

annualised dividend yield of 3.0% or greater on NAV, this payment

represents a yield on 30 November 2018 estimated NAV, of 3.1%.

While the Company declares dividends in US Dollars, Shareholders will

receive Sterling at the prevailing rate at the time of currency

conversion, unless an election to receive dividends in US Dollars is

made on forms which are available on NBPE's website prior to the

currency election date listed below. If an investor has previously

elected to receive US Dollars, that election will be used unless

changed. Investors may also participate in a dividend re-investment plan

(forms for which are available on NBPE's website) if they wish to

increase their shareholdings as against receiving dividends.

Distribution amount: $0.28 cents per Share

=================================================== =====================

Ex-dividend date: 31 January 2019

=================================================== =====================

Dividend record date: 1 February 2019

=================================================== =====================

Final day for Currency Election: 1 February 2019

=================================================== =====================

Final day for Dividend Re-investment Plan Election: 8 February 2019

=================================================== =====================

Payment date: 28 February 2019

=================================================== =====================

Entry into New Share Buyback Agreement

NBPE has a long history of returning capital to shareholders. Since it

began paying dividends in 2013, NBPE has returned $140 million to

shareholders (not including the first 2019 dividend detailed above). In

addition, between November 2010 and October 2012, NBPE repurchased

2,269,028 Class A Shares. These Class A Shares were repurchased at a

weighted average discount to NAV of 32% and a total cost of $16.5

million. From July 2008 to May 2009, under the liquidity enhancement

program, NBPE repurchased 3,150,408 Class A Shares at a weighted average

discount to NAV of 69% and a total cost of $9.2 million. Class A Shares

repurchased under the liquidity enhancement program are held in

treasury. Over the course of the buybacks, total NAV per share accretion

was $0.71 per share.

Continuing this principle, the board of directors of NBPE has approved a

new share buyback policy. In addition, a new share buyback agreement

with Jefferies International Limited ("Jefferies") has been finalised

and signed. These actions will allow Jefferies at its discretion to

repurchase NBPE Class A Shares on behalf of NBPE based on multiple

factors in the buyback policy, including the absolute level of discount,

NBPE's discount compared with peers and broader equity market movements,

among other factors. The board believes that under the criteria it has

set, any share buybacks will be an optimal use of NBPE's capital for the

benefit of shareholders, as well as being immediately accretive to net

asset value.

Purchases of Class A Shares may be made only in accordance with Guernsey

law, the Disclosure Guidance and Transparency Rules and the authority

granted by Shareholders at the Company's Annual General Meeting on 5

November 2018. Under the FCA Listing Rules, the maximum price that may

be paid by the Company on the repurchase of any Class A Shares pursuant

to a general authority is 105 per cent. of the average of the middle

market quotations for the Class A Shares for the five business days

immediately preceding the date of purchase or, if higher, that

stipulated by regulatory technical standards adopted by the European

Commission pursuant to Article 5(6) of the Market Abuse Regulation (EU)

No. 596/2014.

A buy-back of Class A Shares pursuant to the buyback policy on any

trading day may represent a significant proportion of the daily trading

volume in the Class A Shares on the Main Market of the London Stock

Exchange plc (and could exceed the 25% limit of the average daily

trading volume of the preceding 20 business days as referred to in the

Commission Delegated Regulation (EU) No. 2016/1052 on buy-back

programmes).

Any purchase of Class A Shares by the Company will be notified by an

announcement through a Regulatory Information Service by no later than

7.30 a.m. on the following business day. Class A Shares repurchased by

the Company will be cancelled.

Shareholders should note that the purchase of Class A Shares by the

Company is based on a number of factors and subject to the satisfaction

of certain conditions set out in the buyback policy. Accordingly, no

expectation or reliance should be placed on the Directors exercising

such discretion on any one or more occasions.

Sale of Legacy Fund Positions

As announced on 3 September 2018, NBPE has been engaged in a review and

sales process of its legacy fund interests. The sales process was

focused on maximising value to NBPE shareholders measured through both

absolute value and the opportunity cost of holding vs. selling. All fund

investments were analysed and a decision was made on a case by case

basis as to the best way to maximise value. Following this process, NBPE

formally engaged a leading secondary private equity broker to explore

the sale of the portion of its third party legacy fund positions which

it is believed were most favourable to divest. Today we are pleased to

announce the sale of 14 of NBPE's legacy fund interests. In aggregate,

the 14 fund interests were sold at 86% of their reported 30 June 2018

net asset value, and the sale will generate a total of approximately

$19.4 million of proceeds on a cash flow adjusted basis. At closing,

NBPE received proceeds of approximately $9.7 million, with the remaining

50% of the proceeds subject to a 12 month deferral. The sales value of

these funds is reflected in the most recent NAV update, as of 30

November 2018 and hence there is not expected to be any further NAV

adjustment from these sales in the 31 December NAV statements.

We are pleased with the outcome of this process, the continuing

reduction in the size of the funds portfolio and the fact that over 95%

of the portfolio is now in direct investments. Based on the November

monthly NAV update, adjusted for the sale of the 14 legacy funds, NBPE's

reported fair value in remaining funds was $49.7 million, representing

approximately 5% of the adjusted total private equity fair value. This

compares to the 31st December 2017 reported fair value in legacy funds

of $107.6 million (11% of private equity fair value).

Following the sale, NBPE has 19 remaining legacy fund interests (of

which the largest five represent 73% of the total legacy fund fair

value) which we expect to continue to liquidate over the next 12 -- 24

months.

For further information, please contact:

NBPE Investor Relations +1 214 647 9593

KL Communications +44 (0) 20 3603 2803

Charles Gorman nbpe@kl-communications.com

https://www.globenewswire.com/Tracker?data=QRqnsfGgftANsQ1XyhQrWLlqE8rUbvBPCkxV1avXEJuvS-vEHBJmCxfT7P37wmLyKo8Hca42Opavj-Jr3uoL3y1nOr6uiAnWw91JiV0tun_ZpcMRjrB3dLMXrAVqJULH

ABOUT NB PRIVATE EQUITY PARTNERS LIMITED

NBPE is a closed-end private equity investment company with class A

ordinary shares admitted to trading on the Premium Segment of the Main

Market of the London Stock Exchange. NBPE has 2022 and 2024 ZDP Shares

admitted to trading on the Specialist Fund Segment of the Main Market of

the London Stock Exchange. NBPE holds a diversified portfolio of direct

equity investments, direct income investments and fund investments

selected by the NB Alternatives group of Neuberger Berman, diversified

across private equity asset class, geography, industry, vintage year,

and sponsor.

LEI number: 213800UJH93NH8IOFQ77

ABOUT NEUBERGER BERMAN

Neuberger Berman, founded in 1939, is a private, independent,

employee-owned investment manager. The firm manages a range of

strategies--including equity, fixed income, quantitative and multi-asset

class, private equity and hedge funds--on behalf of institutions,

advisors and individual investors globally. With offices in 20 countries,

Neuberger Berman's team is more than 2,000 professionals. For four

consecutive years, the company has been named first or second in

Pensions & Investments Best Places to Work in Money Management survey

(among those with 1,000 employees or more). Tenured, stable and

long-term in focus, the firm fosters an investment culture of

fundamental research and independent thinking. It manages $315 billion

in client assets as of September 30, 2018. For more information, please

visit our website at

https://www.globenewswire.com/Tracker?data=KzxHt2b1L4tnZvfHtySvsn-06CfStJmkEiH32vMaM4SgnISJw-PIHY3dVjjyp_YM4cWKaF5Q8CtL3GbqHzxzlw==

www.nb.com.

This press release appears as a matter of record only and does not

constitute an offer to sell or a solicitation of an offer to purchase

any security.

NBPE is established as a closed-end investment company domiciled in

Guernsey. NBPE has received the necessary consent of the Guernsey

Financial Services Commission. All investments are subject to risk. Past

performance is no guarantee of future returns. The value of investments

may fluctuate. Results achieved in the past are no guarantee of future

results. This document is not intended to constitute legal, tax or

accounting advice or investment recommendations. Prospective investors

are advised to seek expert legal, financial, tax and other professional

advice before making any investment decision. Statements contained in

this document that are not historical facts are based on current

expectations, estimates, projections, opinions and beliefs of NBPE's

investment manager. Such statements involve known and unknown risks,

uncertainties and other factors, and undue reliance should not be placed

thereon. Additionally, this document contains "forward-looking

statements." Actual events or results or the actual performance of NBPE

may differ materially from those reflected or contemplated in such

targets or forward-looking statements.

(END) Dow Jones Newswires

January 08, 2019 02:00 ET (07:00 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

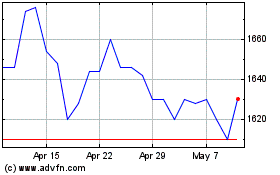

Nb Private Equity Partners (LSE:NBPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nb Private Equity Partners (LSE:NBPE)

Historical Stock Chart

From Apr 2023 to Apr 2024